Real Estate Investors Plc

TRADING & STRATEGIC UPDATE

Real Estate Investors Plc (AIM: RLE), the UK’s only Midlands-focused Real Estate Investment Trust (REIT) with a portfolio of commercial property across all sectors, is pleased to provide the following update as at 31 December 2023:

DISPOSALS – ACCELERATED SALES PROGRAMME

· Sales in 2023 of £17.97 million at an aggregate uplift of 2.93% (pre-costs) to 31 December 2022 book value

· Further pipeline sales in legals, with focus on reducing portfolio debt further

DEBT REDUCTION & REFINANCING

· Receipts from sales during 2023 have been used to repay £17.1 million of debt

· Total drawn debt reduced to £54.3 million (FY 2022: £71.4 million / FY 2021: £89.4 million)

· Aviva facility fully paid – lenders are now National Westminster Bank Plc, Barclays plc and Lloyds Bank plc

· Average cost of debt maintained at 3.7% (H1 2023: 3.7%)

· Discussions well advanced with lenders to renew facilities due to expire in May, June, and December 2024

PORTFOLIO SUMMARY

· Occupancy levels at 83.03% (FY 2022: 84.54%)

· Contracted rental income of £10.9 million p.a. (FY 2022: £12.6 million p.a.)

· Major letting contracted to complete in April 2024. This will improve existing occupancy to 85.91% and boost contracted rental income to £11.2 million p.a. (subject to sales and other lease activity)

· Portfolio WAULT improved to 5.24 years to break and 6.01 years to expiry (FY 2022: 4.98 years & 6.29 years)

· Continued robust rent collection levels with overall rent collection for 2023 of 99.82%

STRATEGIC UPDATE

The Board has previously stated an intention to accelerate its sales programme, through the sale of assets either on an individual or collective basis, on terms that represent value for shareholders. Given the ongoing substantial discount between the share price and NAV, combined with a lack of liquidity in its shares, the Board has concluded that it will conduct an orderly strategic sale of the Company’s portfolio over the next 3 years with the objective of maximising the return of capital to shareholders (the “Disposal Strategy”). To achieve this outcome, assets will be sold individually, as smaller portfolios or as a whole portfolio sale, with the initial priority to repay the Company’s debt.

Over the last 3 years, the Company has sold £56.4 million of assets, on an aggregate basis, at or above book value, and significantly reduced drawn debt from £101 million to £54.3 million (as at 31 December 2023).

The ongoing pace of the disposals will depend on market conditions however, it is the Company’s intention to secure disposals at book value or higher, maximising returns to shareholders.

To support the Disposal Strategy and the return of capital to shareholders, the Company is implementing a new Shorter Term Incentive Plan (“STIP”). The STIP will replace the existing Long Term Incentive Plan (“LTIP”), help to retain Paul Bassi, Chief Executive Officer and Marcus Daly, Finance Director (the “Executives”), and the wider management team and incentivise them to achieve an orderly and timely disposal of the Company’s assets to maximise the capital return to shareholders.

In addition, the Company’s Remuneration Committee has approved changes to the Executives’ remuneration to align the policy with the wider Company strategy.

REVISED REMUNERATION POLICY (EFFECTIVE 1 JANUARY 2024)

1. Basic salary: Executive salaries to be reduced by one third. New salaries – Paul Bassi, CEO reduced to £367k (previously £550k) and Marcus Daly, CFO reduced to £229k (previously £344k) amounting to a cost saving of approximately £330k (including National Insurance contributions). In addition, Non-Executive Directors’ fees also to be reduced by one third

2. Annual discretionary bonus: The Executives’ bonus is reduced from up to a maximum of 100% of basic salary to a maximum of 50% of the new reduced basic salary

3. Executives’ service contracts: If contracts are to be paid up following a corporate transaction or equivalent, then compensation under the Executives’ service contracts reverts to old salary levels

4. LTIP Awards: The Executives’ entitlement to awards under the Company’s existing LTIP scheme have been amended as follows:

· Unvested awards granted re: FY2020 – to be reduced by one third

· Unvested awards granted re: FY2021 – to be reduced by two thirds

· Unvested awards granted re: FY2022 – to be cancelled

· No further awards under the LTIP going forward

· The approximate value in the reduction in the awards equates to approximately 4 million Ordinary Shares, which at a share price of 30p equates to £1.2 million

5. Shorter Term Incentive Plan (“STIP”): To compensate the Executives (albeit not to the same extent) for the retrospective reduction in LTIPs in relation to FY2020 and FY2021, the cancelling of awards relating to FY2022 and no further issuing of awards under the LTIP in relation to FY2023 or going forward, the Executives will be entitled to participate in the STIP.

SHORTER TERM INCENTIVE PLAN

The STIP is being implemented to compensate the Executives for the retrospective reduction in awards and cancellation of future awards under the LTIP.

1. Under the STIP, the participants will receive a proportion of a notional cash pool (the “Pool”) which will be created from the excess (“Gain”) of Total Shareholder Return (“TSR”) over the market value of the Company as at 31 December 2023.

2. TSR is cash per Ordinary Share returned to shareholders, excluding ordinary dividends.

3. To ensure the timely disposal of assets, the Gain attributable to the Pool will be reduced over time.

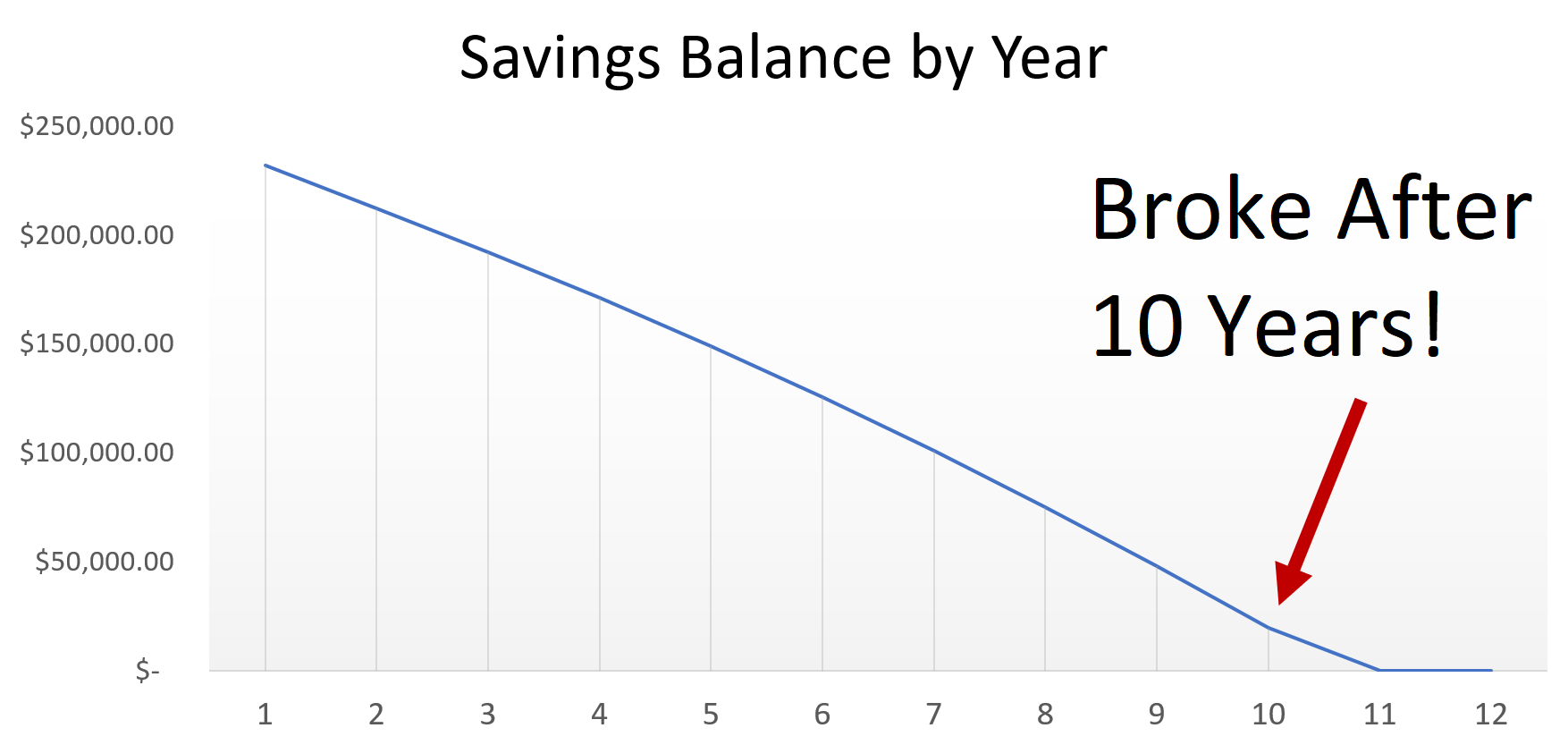

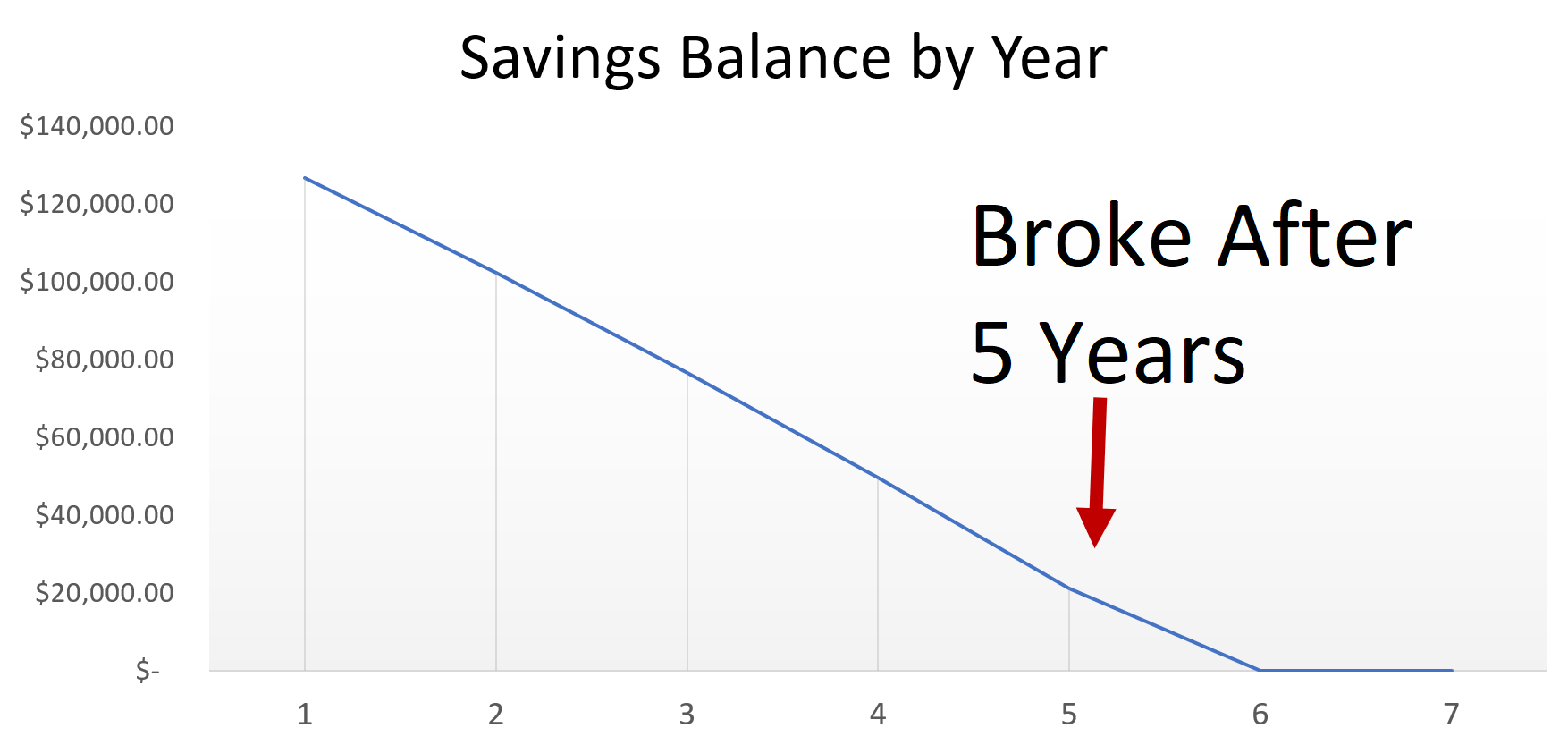

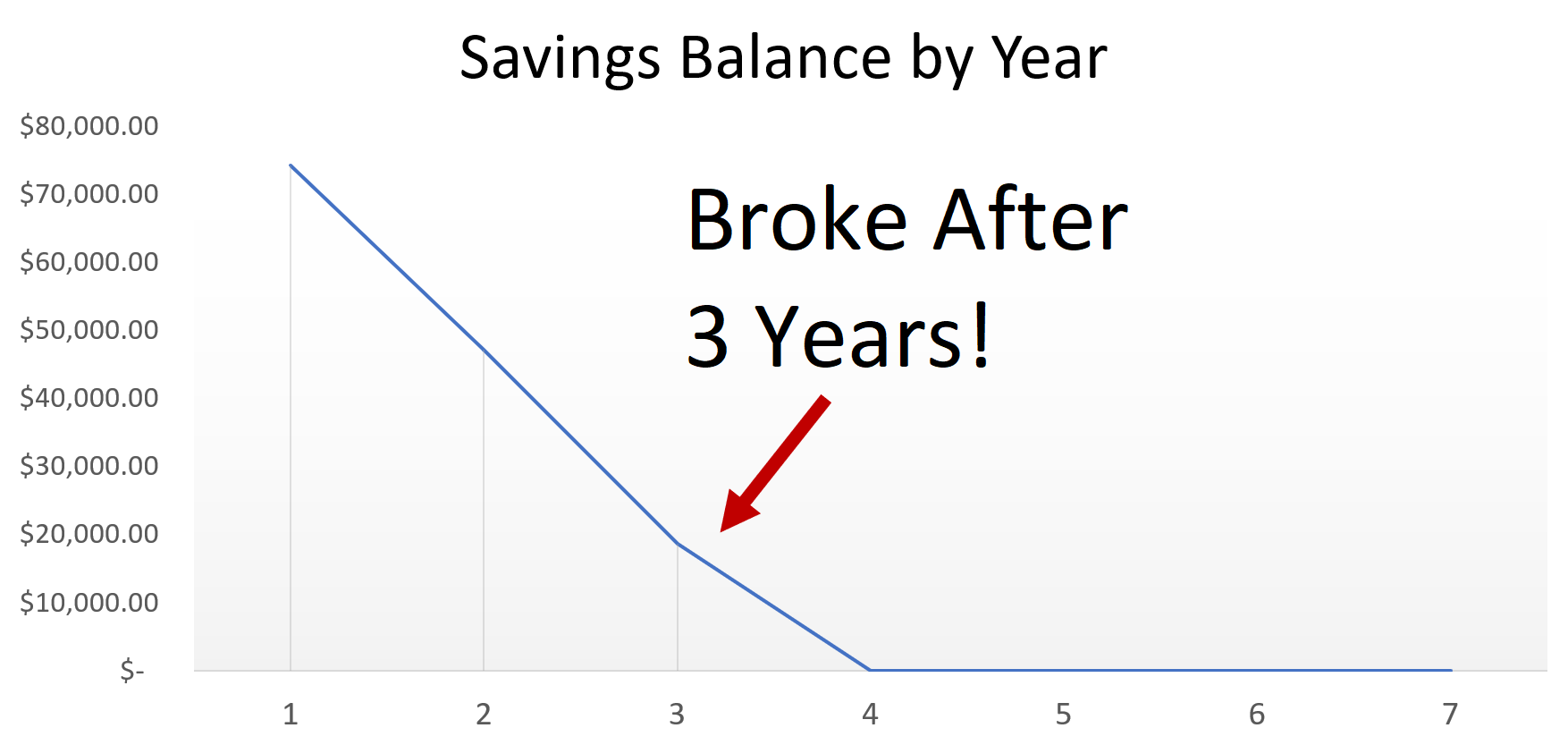

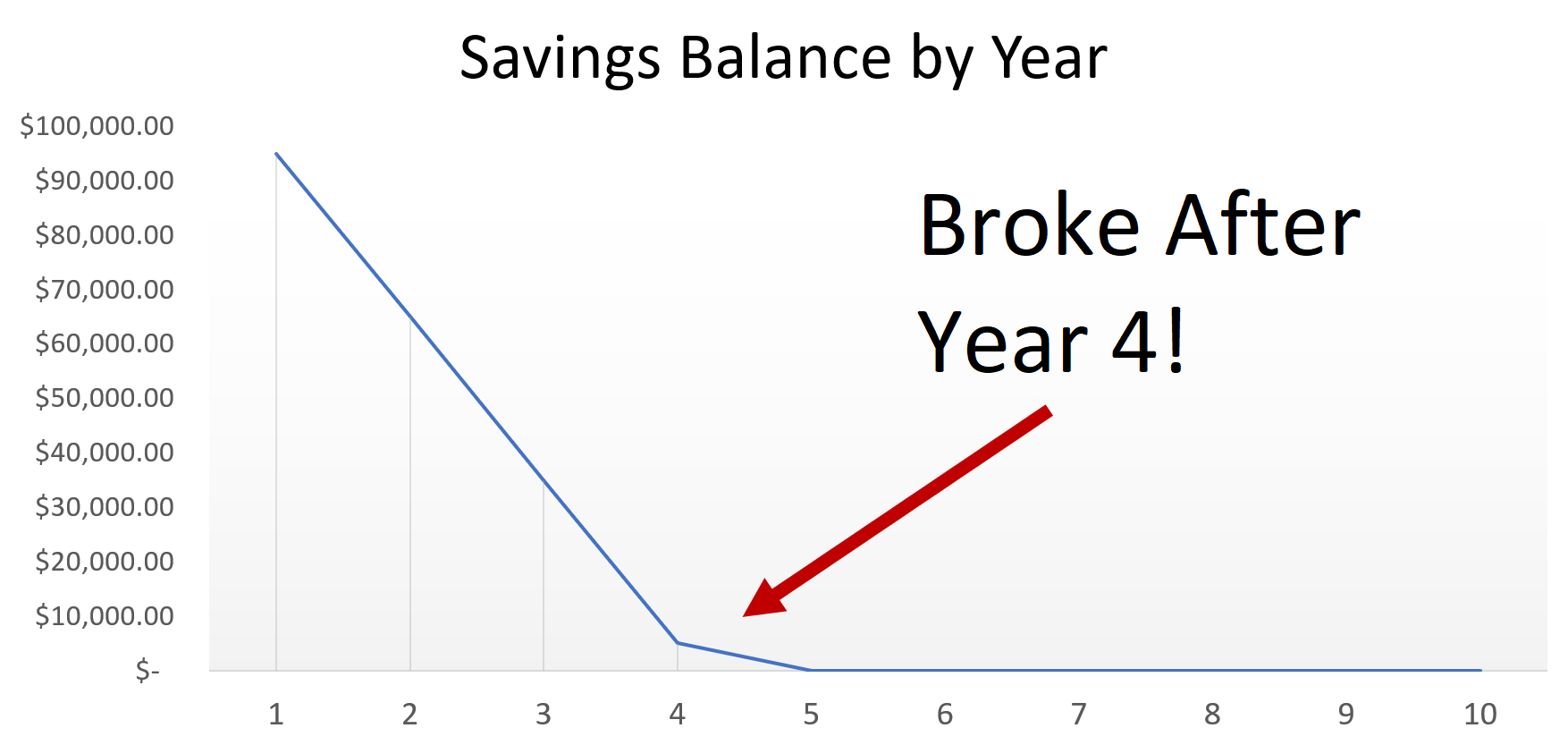

4. If the Company’s sell down strategy is completed in 2024 then the Pool is calculated as 10% of the Gain. If the strategy is completed in 2025 the Pool reduces to 7.5% and if by 2026, the Pool reduces to 5%.

5. Of the Pool, a minimum figure of £410k is ringfenced for the management team (excluding the Executives) equivalent to a bonus of 100% salary.

6. The STIP will pay out as soon as reasonably practicable after the earliest of (1) the sale of all the assets, (2) a takeover of the Company or (3) when the Remuneration Committee determine that a sufficient proportion of the assets have been sold and that the STIP has achieved its original purpose.

In determining the revised remuneration policy and STIP, the Company’s Remuneration Committee has consulted with REI’s largest institutional shareholders.

NOTICE OF FINAL RESULTS

The Company will release its results for the year ended 31 December 2023 on 26 March 2024.

PAUL BASSI, CHIEF EXECUTIVE, COMMENTED:

“Against a backdrop of high interest rates and stubborn inflation, political instability and unrest in Ukraine and the Middle East, the REI portfolio remains stable, with robust rent collection levels. The portfolio is well managed and remains sheltered from wider economic pressures due to its diverse nature and lack of exposure to large office schemes and other challenging sectors.

Having finalised our strategic plan, our priority is to continue disposing of assets at or above book value, maximising returns to shareholders. During 2023, despite an inactive property market, we made sales of £17.97 million (predominantly to private investors) and receipts from these disposals were utilised to reduce debt by £17.1 million. We currently have a further healthy pipeline of sales in legals, which we anticipate to complete in H1 2024.

With the benefit of our unique market insight, we will continue to capitalise on ongoing buyer demand for our smaller lot sizes from private investors and special purchasers. We have identified other larger assets that are ready for disposal, some of which we will hold for income until corporate and institutional buyer demand returns. In the meantime, the business is operationally robust and we will continue intensively managing assets to maximise income and reduce vacancy levels, supporting our fully covered dividend.

Despite a strong year of sales to private investors and special purchasers, market sentiment remains weak and we anticipate valuation decline across the industry. This is due to the lowest level of transactions since the financial crisis of 2008, high interest rates and the political uncertainty in an election year. However, we are confident that our diversification will outperform market benchmarks.

The Board is committed to maximising shareholder returns, whilst remaining open to a corporate transaction that is in the best interest of the shareholders. In the meantime, it is the Board’s intention to continue paying a fully covered quarterly dividend payment, subject to the pace of disposals.”