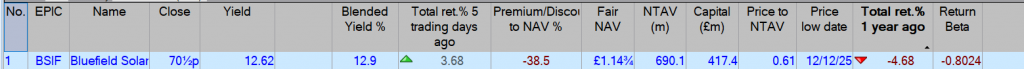

LSE:BSIF

Bluefield Solar Income Fund: dividends whatever the weather

Last updated: 08:01 29 Jan 2026 GMT

Snapshot

- Bluefield Solar Income confirms impact from govt indexation change

- Bluefield Solar Income Fund: The sun is shining on this dividend play

- Bluefield Solar Income pivot to IPP model ‘short-term pain’ for long-term gain

- Bluefield Solar Income Fund hits dividend target amid market headwinds

About the company

Bluefield Solar Income Fund is a pioneer in the renewable energy space.

The company primarily targets utility-scale solar, wind and energy storage assets and portfolios on greenfield, industrial and/or commercial sites. It aims to deliver long-term stable dividends and has one of the most successful track records in the sector.

How it is doing

29 Jan 2026

Bluefield Solar Income Fund Ltd (LSE:BSIF) said the announcement this week from the government about indexation of subsidies will result in around a 2% or 2p per share reduction in its net asset value.

On Wednesday, 28 January 2026, the Department for Energy Security and Net Zero published its response to the consultation and confirmed the intention to proceed with a switch from RPI to CPI-based indexation for both Renewable Obligation Certificates (ROCs) and Feed-in Tariffs (FiTs).

The switch will be made in the next annual adjustment scheduled in April 2026, rather than in 2030 as originally planned.

This was anticipated by the investment trust in November, shortly after DESNZ first announced it was launching the indexation consultation.

23 Jan 2026

Bluefield Solar Income Fund Ltd (LSE:BSIF, FRA:5B3) said more than 90% of its 1.34GW development pipeline has received confirmed grid connection offers under the National Energy System Operator’s (NESO) reformed connection process.

The company secured Gate 2, Phase 1 offers on 660MW of projects, meaning they will be connected between 2026 and 2030, including around 540MW of solar PV and 120MW of battery storage.

08 Nov 2025

Bluefield Solar Income Fund (LSE:BSIF) managing partner James Armstrong talked with Proactive about the company’s decision to initiate a strategic review and formal sale process.

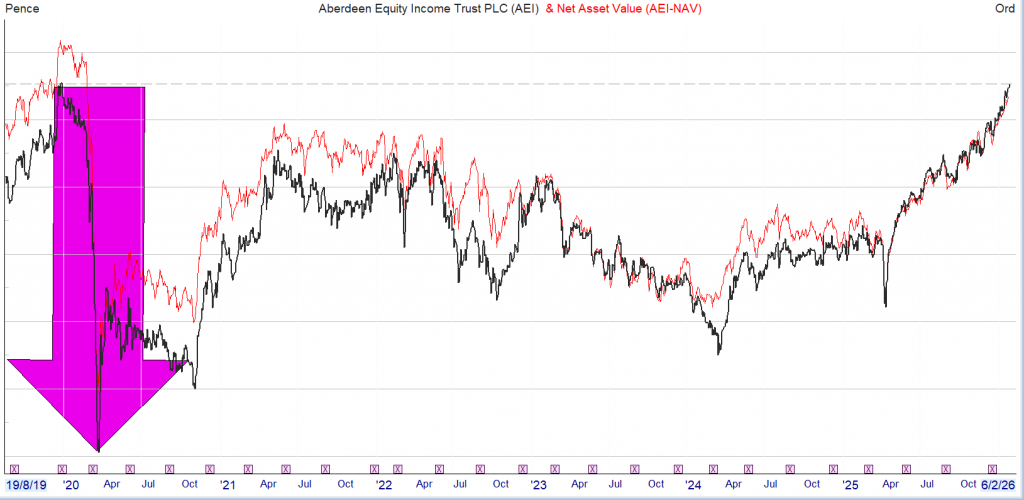

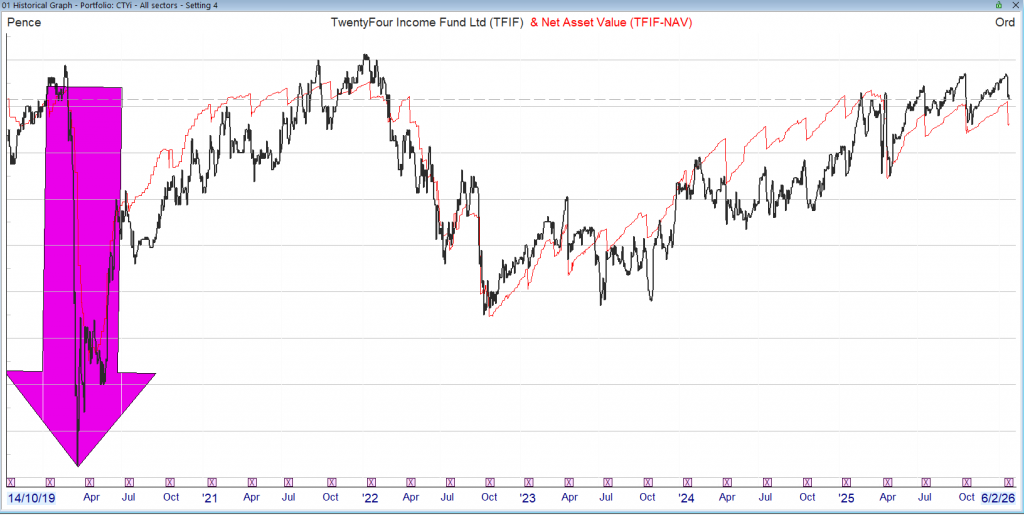

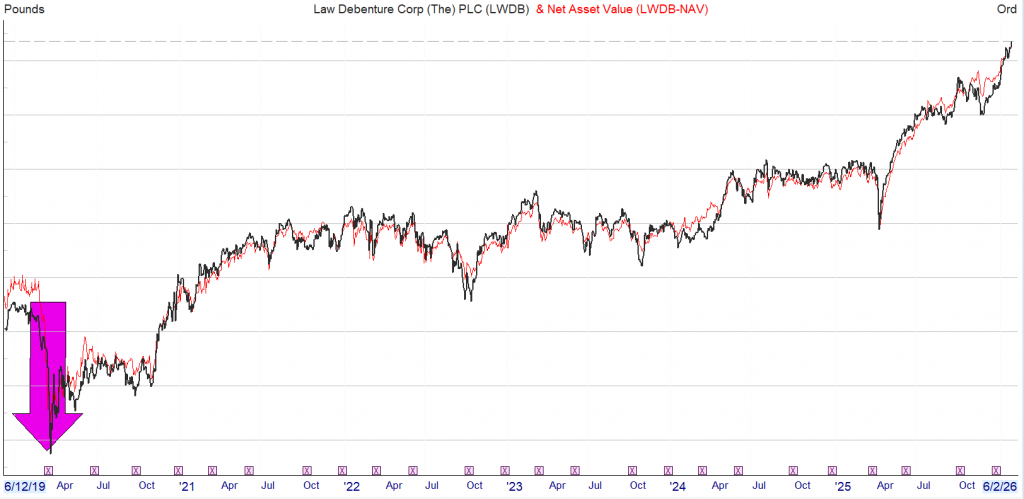

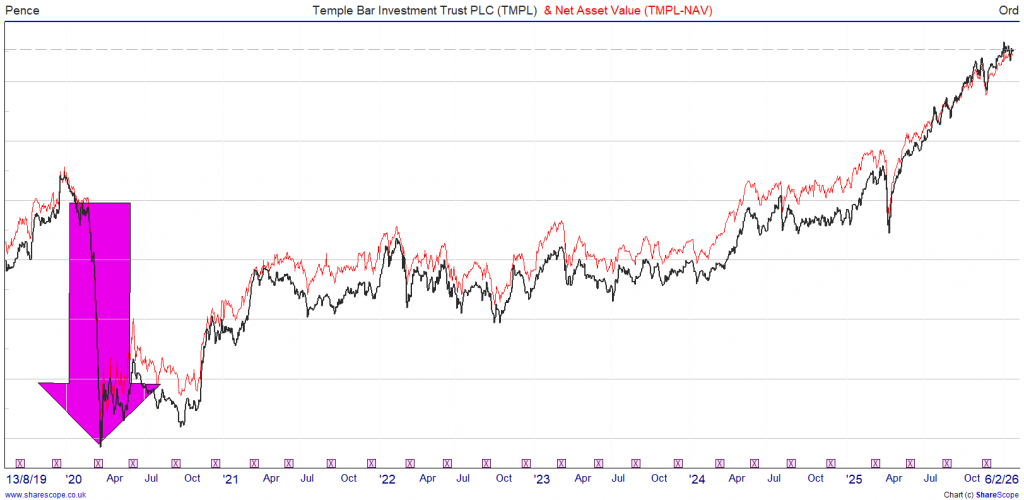

Armstrong explained the move follows extended consultation with shareholders and stems from Bluefield Solar’s continued share price discount to net asset value (NAV), which has persisted for over three years. Despite the fund’s strong performance since its IPO, the board concluded that “doing nothing is not an option”, citing the lack of a clear market catalyst for a re-rating.

Insight: Bluefield Solar Income Fund: The sun is shining on this dividend play

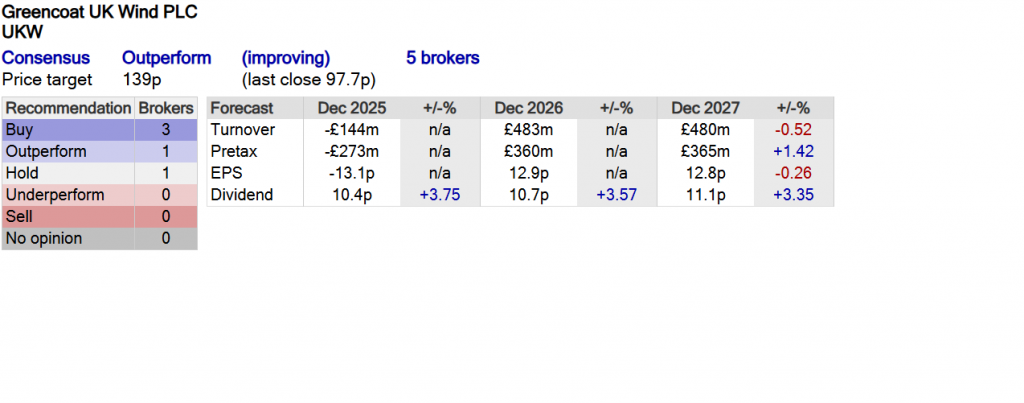

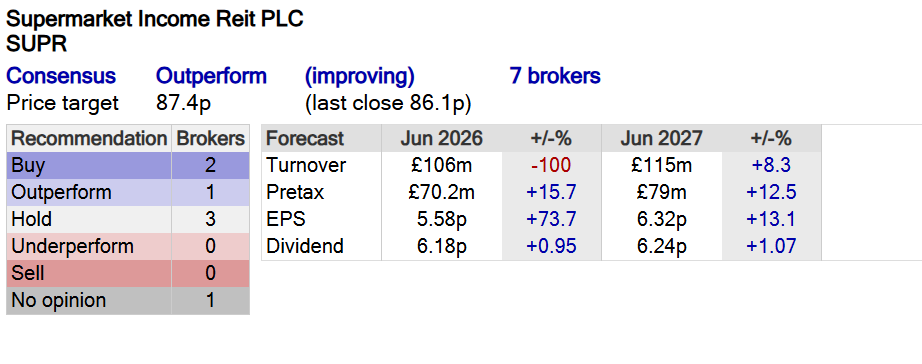

What the brokers say

22 Oct 2025

Bluefield Solar Income Fund’s (LSE:BSIF) proposed transition to an independent power producer (IPP) model would involve significant structural changes, RBC Capital Markets said, but more precise details on the pivot are still awaited.

The new strategy, which follows the collapse of a recent sale process, was unveiled alongside the company’s full-year results yesterday and would include internalising investment manager Bluefield Partners and removing investment trust status

At this stage, with no details confirmed, the analysts supposed that a dividend cut and a capital raise to fund photovoltaic and battery energy storage system (BESS) developments would both be likely.

What management says

30 Sep 2024

Bluefield Partners managing partner James Armstrong

Releasing results for the year to 30 June, 2024, Armstrong highlighted that despite facing some headwinds, including lower radiation levels and a slight dip in production, the fund successfully delivered an 8.8 pence per share dividend, which is one of the highest in the infrastructure sector. This translates to a dividend yield of around 8.3%, a highly attractive return for shareholders.