Their research says even 5% returns are “slim.”

Not very encouraging if you expect to retire on your IRA balance + capital gains.

It’s downright scary actually.

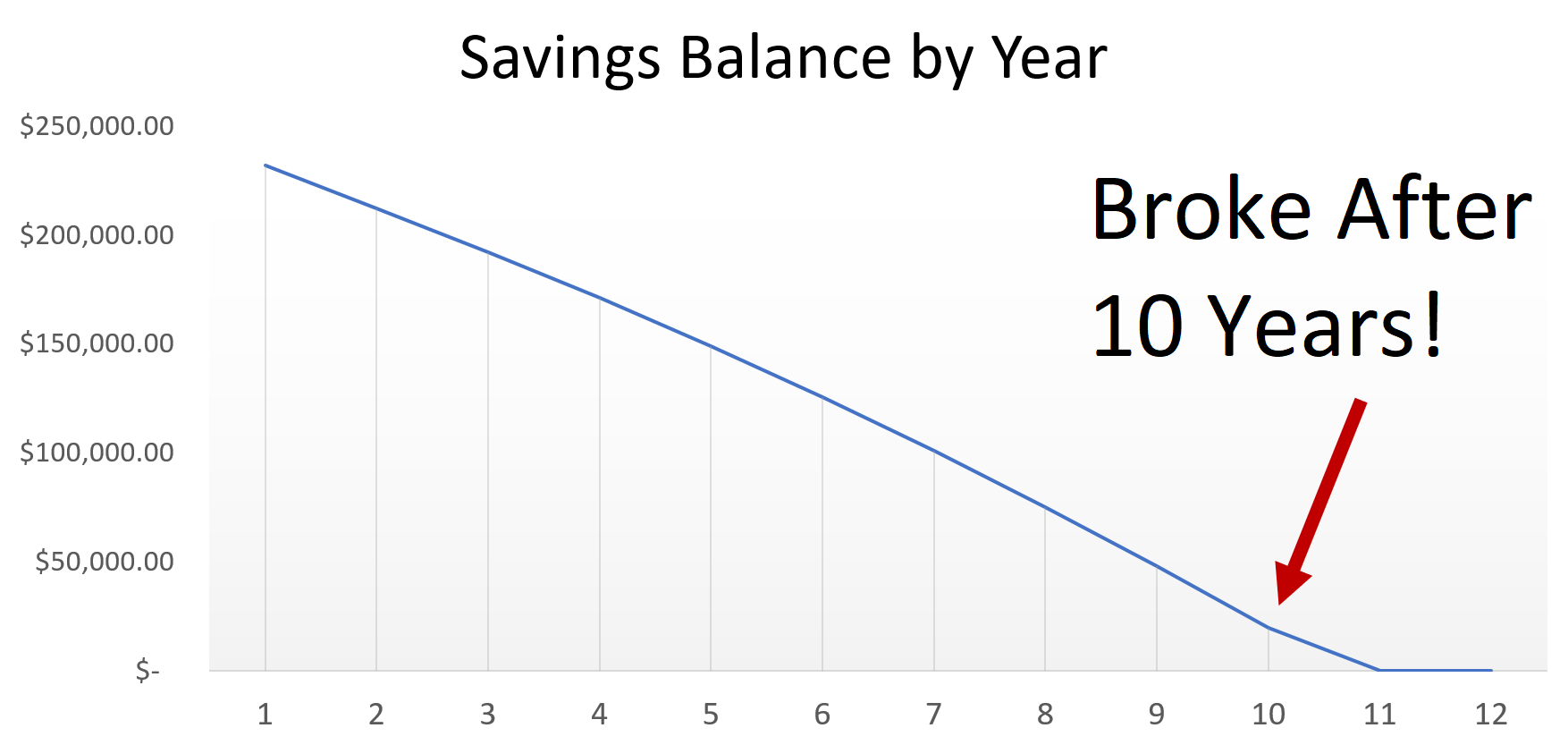

If you have $250,000 now, at 5% growth, but withdrawing your $2,500 per month to use for bills…

You’re out of money in 10 years.

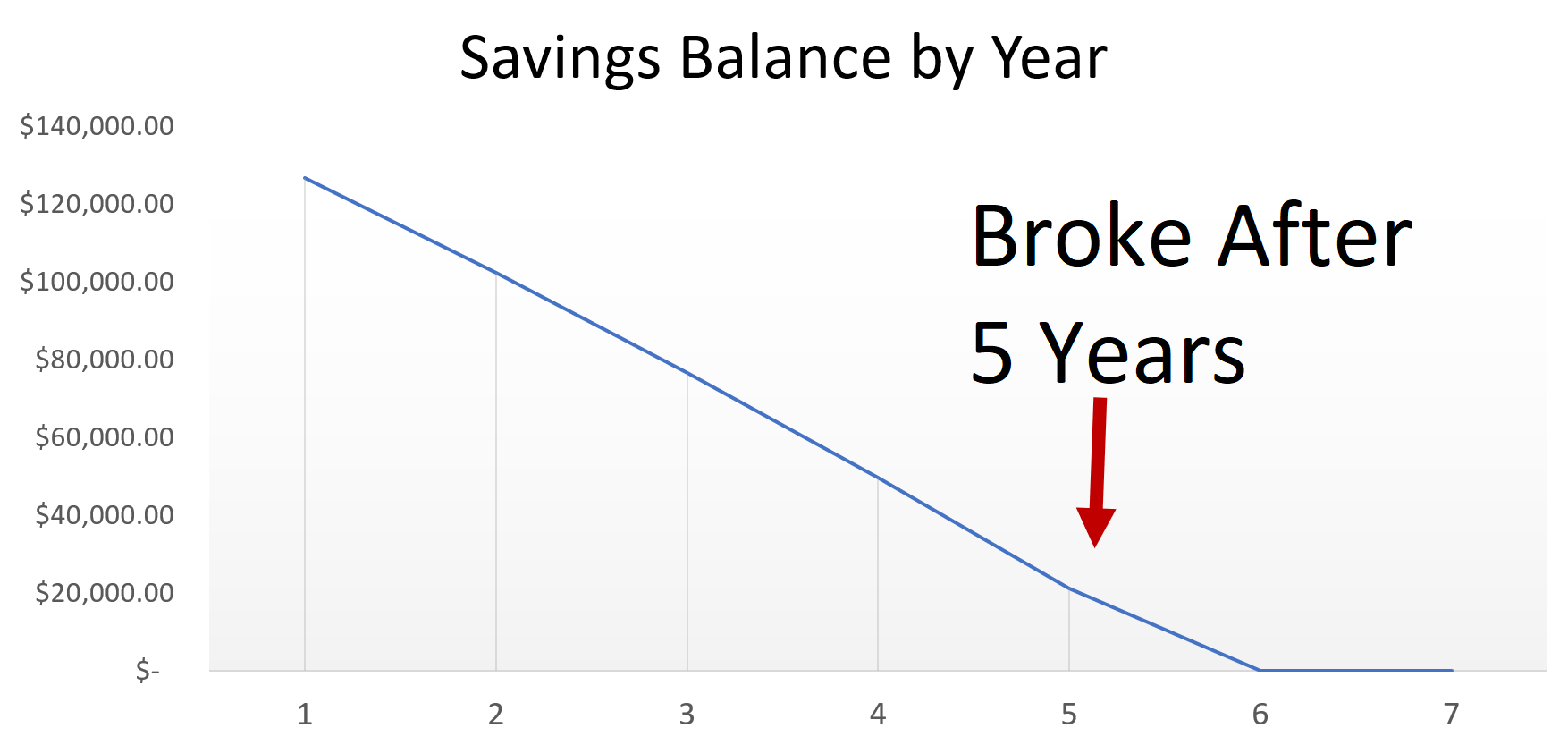

Have $150,000?

Out of money in 5 years.

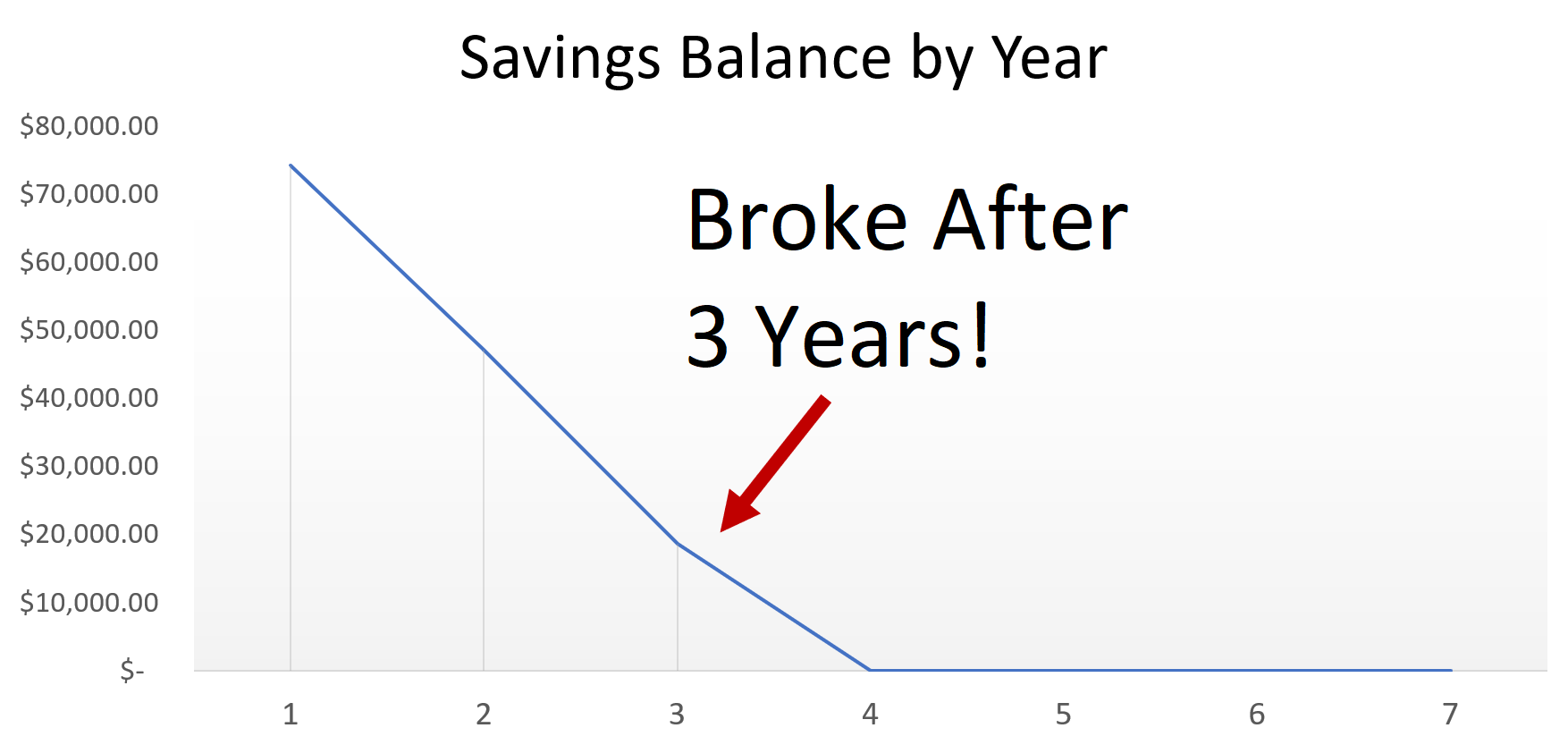

$100,000?

Broke in the middle of Year 3:

Clearly, hoping for endless bull markets won’t get you where you need to be.

At some point, leaning on capital gains is the surefire way to get blindsided.

I mentioned how I’ve surveyed thousands of readers. Their No 1 fear is “running out of money and going broke.”

I didn’t mention their second fear: “a stock market crash.”

I just showed you why. Because when you rely on capital gains to fund your retirement, the only way to win is if stocks keeping going up.

If stocks go down, you’re in dire straits.

Welcome to our platform, your top source for all the freshest updates and developments on the media landscape in the United Kingdom. Whether you’re curious in telecasts, broadcast radio, press, or digital media, we provide thorough coverage that keeps you knowledgeable about the key developments and trends. From breaking articles to thorough analyses, our team of veteran journalists and industry specialists work relentlessly to bring you the most correct and latest news – https://ukeventnews.uk/electronic-music-has-evolved-dramatically-since/

In addition to to updates, we provide thought-provoking features and opinion essays that delve into the intricacies of the media industry. Our stories cover a broad spectrum of topics, including regulatory shifts, media possession, and the impact of new developments. We also emphasize the achievements and obstacles faced by media professionals, providing a platform for voices from through the industry to be noticed and acknowledged.

Stay linked with the pulse of the UK media scene through our consistently updated content. Whether you’re a media professional, a student, or simply a media enthusiast, our website is designed to accommodate to your needs and demands. Become part of our growing community of readers and confirm you’re always in the know about the dynamic and continually progressing world of media in the United Kingdom.