You would like to start to earn some passive income (dividends) but are concerned u might pick the wrong share and they stop paying dividends.

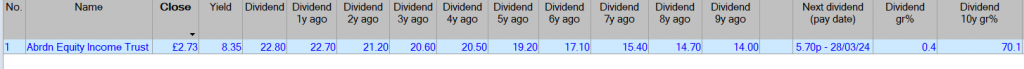

Below is an Investment Trust – Abdrn Equity Income 8.35% AEI

Trading at a discount to NAV of 6.7%

Currently yielding 8.4%

The yield is above what is available in the market as the UK stock market has been out of favour for several years. This may continue for a long time but u will still receive your dividends which could be invested back into AEI or shares, the world’s your onion.

If one of the shares in the portfolio stops paying a dividend, for whatever reason, it will be barely noticeable in the yield paid out.

Investment Trusts have reserves that they can use to maintain dividends such as the Covid crash where the investment world was coming to an end, apparently.

U don’t have to do anything whilst the dividends keep rolling in, from the list above the dividends have increased by 70%, so in 10 years time a yield of around 14%. GRS

If the UK market finally catches up with the rest of the world’s markets and print a new high, u should be able to sell some of the shares for a profit.

If not u will still have the dividends to keep u warm.

ACTIVITY BREAKDOWN

Top 10 Holdings

BP PLC 5.1%

National Grid PLC 4.9%

DS Smith PLC 4.9%

Shell PLC 4.8%

Imperial Brands PLC 4.5%

SSE PLC 4.3%

Barclays PLC 4.1%

NatWest Group PLC 3.8%

Conduit Holdings Ltd 3.5%

BHP Group Ltd 3.2%

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.