Passive vs Active: a slightly stale debate

Why passive and actively managed funds both have their uses. Its not an either/or debate because markets aren’t always that efficient

ByDavid Stevenson

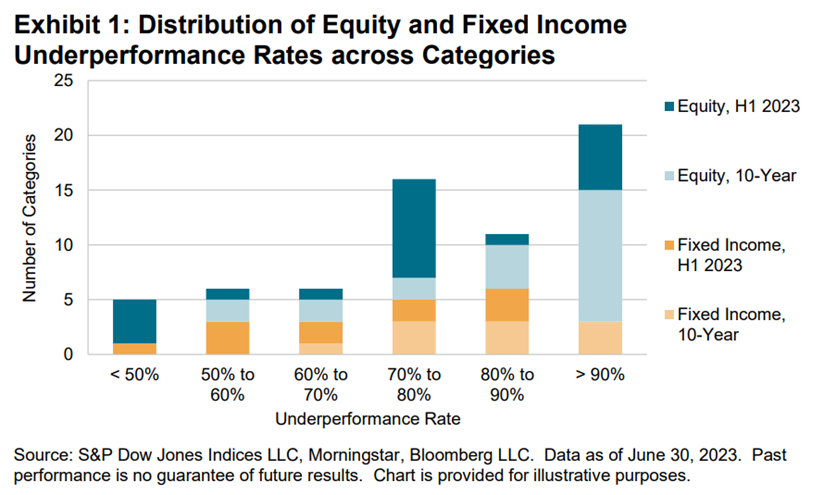

Every year around this time there’s a surfeit of surveys that pose the annual question – have active funds outperformed their passive (ETF and index) fund peers. And every year the answer in aggregate is roughly the same: passive is massive and most active fund managers underperform. One of the biggest data sets comes from S&P Dow Jones, the index firm via their SPIVA reports. Typical of their analysis is the most recent report from the middle of last year – the mid year European score card. Here’s a quick summary of their findings :

“It was a challenging first half of 2023 for active managers in European equities, with over one-quarter of 22 categories recording underperformance rates of 90% or higher. Fixed income managers had a better start to the year in relative terms, with no categories registering underperformance rates of over 90%. Across both asset classes, however, underperformance rates increased to a similarly high average over a 10-year horizon. In H1 2023, 72% of British pound sterling-denominated and 76% of euro-denominated actively managed Europe Equity funds underperformed the S&P Europe 350®, while 77% of Eurozone Equity funds underperformed the S&P Eurozone BMI.”

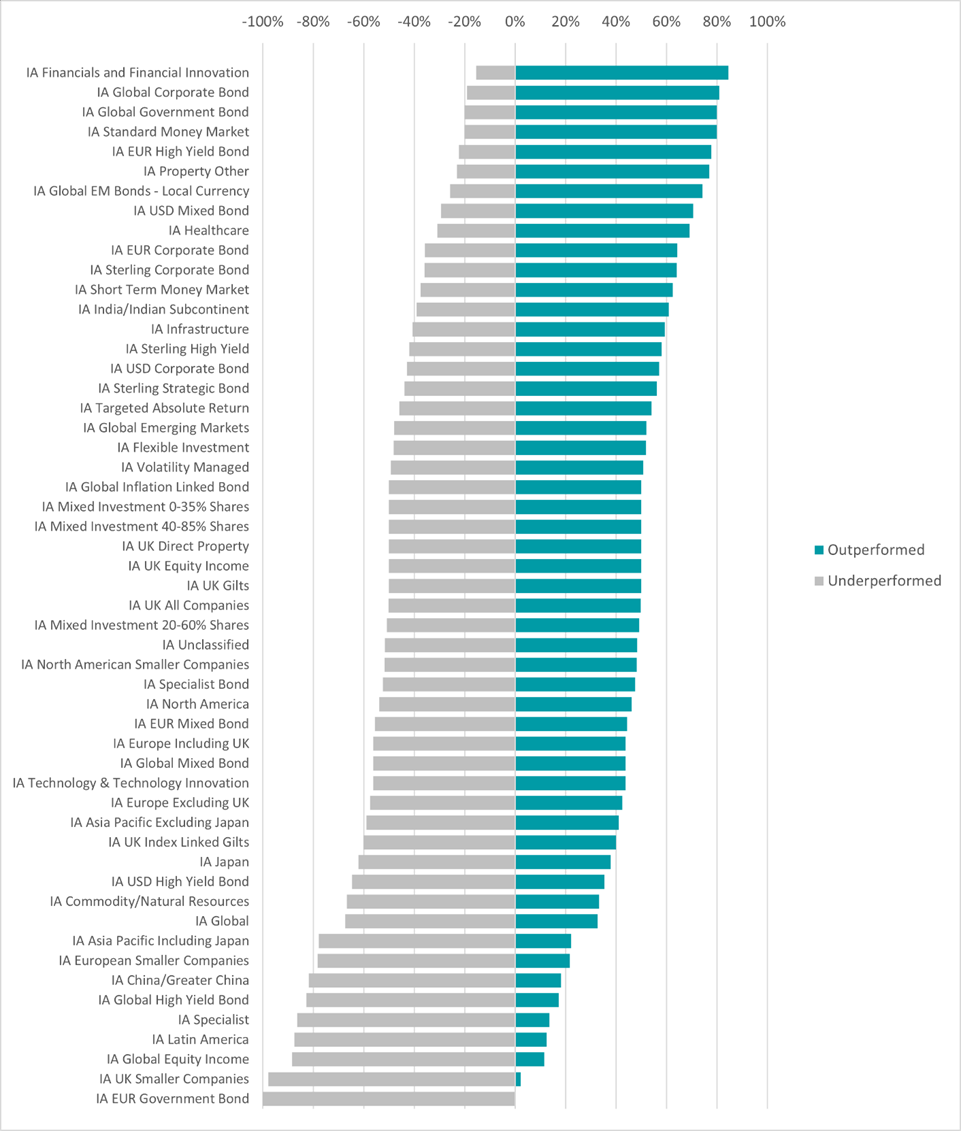

A more recent update on the same theme comes courtesy of a recent article from Trustnet which looks at data from FinXL. It compares returns in 2023 by Investment Association sectors (this is unit trust-focused data) for actively managed funds versus index benchmarks. Headline reveal ? Active management had the upper hand in 22 Investment Association (IA) sectors out of 54 in 2023. As always there are some headline grabbers in here. For example, the Trustnet article says “the chances of picking an outperforming active fund were slim – of the 343 funds that failed to beat the benchmark (the MSCI ACWI index), 289 (84%) were actively managed”.

To understand the chart below look at the preferred actively managed portfolios (on the upper side of the chart below) versus those asset classes where cheaper, passive alternatives (on the lower side of the diagram) would have outperformed. The most successful active managers – versus their benchmark – were in niches such as the IA Financials and Financial Innovation sector, where 84.6% of active funds managed to beat the MSCI ACWI/Financials index. Of the 12 funds that did, 11 were actively managed. Source: FinXL

Source: FinXL

The report also suggests that active funds work well in focused bond sectors as well – passive funds tend to end up buying the biggest, most liquid, most indebted issues not the safest. In the more mainstream, liquid strategies and markets it was a ‘coin toss’ between active and passive : IA UK Equity Income, IA UK All Companies and IA North America, where the chance of active portfolios outperforming passives was approximately 50%. The most revealing data point though are returns for tech funds, notably the IA Technology and Technology Innovation sector. Here the index funds captured nearly all the gains any active manager would have targeted.

Active fund management RIP? Not so fast, especially if you invest in investment trusts which by their nature tend to be very specialist and highly focused. There are a number of important caveats to add to these big data sets. First with the SPIVA data you are looking at big aggregate numbers which conceals significant variation around the average. This comes through clearly in the Trustnet FinXL analysis which shows that many alternative sectors and spaces see sustained active outperformance – these include many alternatives, and very specialist markets where smaller cap companies dominate. There’s also some academic debate about the SPIVA numbers in particular : one analysis highlighted a list of concerns including (all very technical this): survivorship bias, Equal weighted performance measurement bias, Incorrect comparison to index/style bias, single index comparison bias, Index funds, ETF and others inclusion bias, Fund fees bias, Indices and index funds comparison bias and finally, different timeframes comparability bias.

A more general criticism of the passive is massive argument is that it relies on the idea that markets – equity markets, bond markets – are efficient. According to academics this posits that markets behave in a rational fashion and are largely efficient in processing stock specific information. There’s always been weak and strong versions of this theory and much of it underlines modern portfolio theory. Personally I’ve always bought the weak version – overall, in aggregate terms, markets do get prices right in the short to medium term, but I would add many caveats, most of which are based around the power of momentum and crowds. Liberum’s chief strategist Joachim Klement highlights a recent paper which suggests that most financial professionals – and investors – don’t believe in that theory.

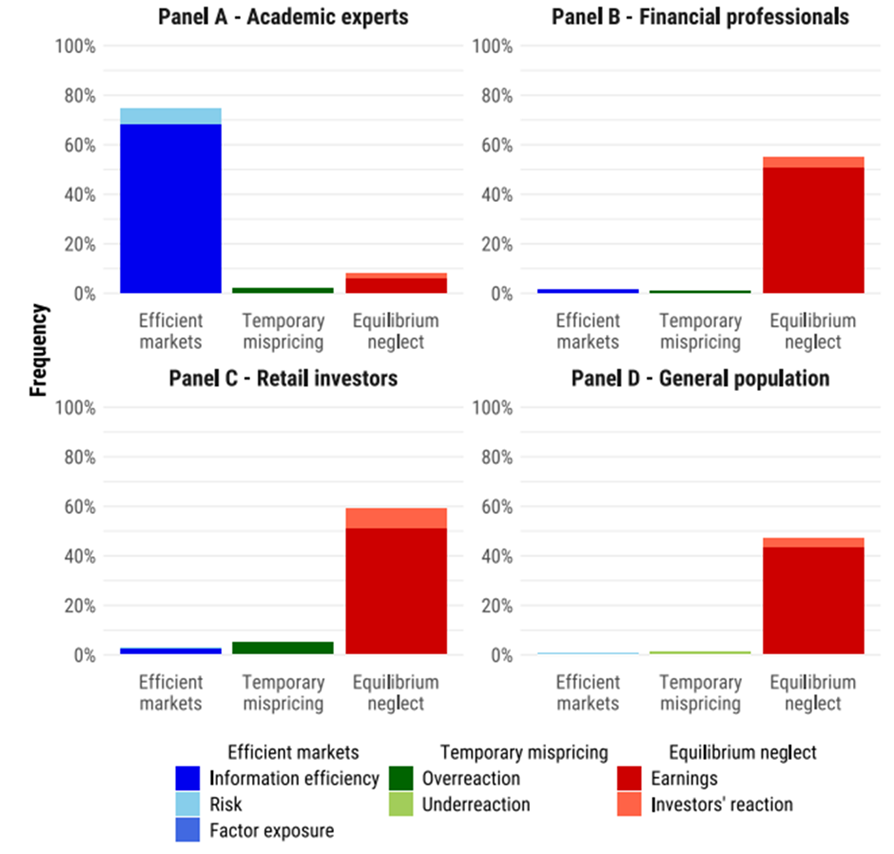

“Peter Andre and his colleagues conducted lab experiments where academics, financial professionals, retail investors, and members of the general public were invited to invest in different stocks or the stock market overall. The setup was quite simple. Investors were provided with good or bad news about a company that had been released four weeks ago. Then they were asked to predict the future return of that stock and interviewed about their reasons for making that forecast. The results are summarised in the chart below. Essentially, the vast majority of academics followed the prescriptions of the efficient market hypothesis and did not change their forecasts in response to old news, good or bad. They argued that this information was fully reflected in the share price and hence has no impact on future returns. Financial professionals, retail investors, and members of the public alike changed their return expectations in response to this news. If the news is good, they increase their return expectations even if that news item was released four weeks ago. If the news is bad, they reduce their return forecasts. The main argument for doing so is the persistent impact of the news on future earnings and dividends. They argue that because of the good news, earnings growth should be stronger, which should result in higher share prices going forward, etc.”

Source: Andre et al. (2023) I’ve quoted this at length because like Klement I suspect that if enough finance professionals and investors think and act as if markets are inefficient, then they are probably inefficient i.e there will be a feedback loop which reinforces crowd like behaviour. A good example of this is the way that analysts produce upgrades and downgrades in waves – the big Ai wave for instance – which in turn produces big momentum trends.

So, what to conclude ? It isn’t simply a case of passive vs active. Both have their place. Passive funds and thus benchmark indices are hard to beat in mainstream, liquid asset classes. Impossible no, difficult yes. As Warren Buffett once put it : “The problem simply is that the great majority of managers who attempt to over-perform will fail. The probability is also very high that the person soliciting your funds will not be the exception who does well.” But that doesn’t mean that active managers in specialist markets and niches – especially the alternatives sector – will fail. In fact I’d suggest the complete opposite – the more opaque the market the better the likelihood of outperformance. And one last fact to consider – a large part of the listed funds universe comprises investments in private assets such as private equity and private credit. Indices and benchmarks that efficiently track all major players are almost non existent and thus you have no other choice than to invest in an actively managed investment trust.

I believe that is among the such a lot vital info what does vpn stand for me.

And i’m happy reading your article. However should statement on few general issues,

The website taste is wonderful, the articles is really great : D.

Just right job, cheers

Now I am going away to do my breakfast, later than having my breakfast coming again to

read further news.

my webpage; vpn special coupon code

Howdy! This article could not be written much better! Looking through this article reminds me of my previous roommate!

He continually kept preaching about this. I am going to send this

information to him. Pretty sure he’ll have a great

read. I appreciate you for sharing!

Review my web blog vpn ucecf

I was suggested this blog by my cousin. I am not sure whether

this post is written by him as nobody else know such detailed about my trouble.

You are wonderful! Thanks!

Here is my blog :: facebook vs eharmony to find love online

Does your website have a contact page? I’m having a tough time locating it but,

I’d like to send you an e-mail. I’ve got some creative

ideas for your blog you might be interested in hearing.

Either way, great blog and I look forward to seeing it develop over time.

Here is my web page :: eharmony special coupon code 2024

Hey there I am so happy I found your blog, I really found you by mistake, while I was looking on Digg for something else, Nonetheless

I am here now and would just like to say kudos for a

marvelous post and a all round enjoyable blog (I also love the

theme/design), I don’t have time to browse it all at the minute

but I have saved it and also added your RSS feeds, so when I have time I will be back to read a lot more,

Please do keep up the superb b.

Review my blog post; nordvpn special coupon code 2024