What next for investors? A more dynamic approach to markets can pay off

Trying to time markets and dynamically allocate between assets like equities and bonds is tough, and most managers fail. However, Charles Ekins of boutique firm Ekins Guinness has a solid record of being active and dynamic in calling market highs and lows. With US equities at record levels and most equity investors bullish, what does Ekins think we should do now?

By David Stevenson

Charles Ekins of Ekins Guinness has been operating as a fund manager for nearly 7 years with a very distinctive approach. The two small funds in his stable are run systematically, with a rules-based model, starting with a top-down asset allocation and then investing in different asset classes, geographies and sectors through low-cost ETFs. The firm’s value and momentum approach avoids style bias, as the investment focus changes according to market conditions and opportunity.

The Ekins Guinness approach seems especially appealing to investors looking to participate in the upside from rising equity markets but seeking a fund that can go very defensive if a bear market is expected. Ekins says the main reason why investors might adopt a dynamic asset allocation strategy is that their funds aim to have significant allocations to equities in a bull market but do not want to leave investors stuck with high equity exposure in a bear market. Since launch, it has also been ahead of all four IA Mixed Asset Sectors (Flexible, Mixed Investment 0-35%, 20-60% & 40-85% Shares) and in the first quartile over 1,3,5 years of all 624 funds in these four IA Mixed Asset Sectors.

In sum, Ekins is perfectly positioned to give investors a big picture of asset allocation, market bubbles, and the risks and opportunities of investing in risky assets such as US equities. I caught up with Ekins earlier this week, and what follows is Ekins take on bullish equities, all with a strong data driven, charts heavy approach.

Fundamental value determines the potential over the medium/long term but can be a poor indicator of price movements in the short term. Market trends (including momentum and overbought signals) can be a good leading indicator of future price movements but can be dangerous if fundamental value is ignored. Neither analytic should be used in isolation, but it is logical to select investments based objectively according to a combination of fundamental value and market trends, which are independent of opinion, forecasts and emotion.

You have a data-driven approach that combines a technical viewpoint with financial factors — what does this actually involve?

Fundamental value determines the potential over the medium/long term but can be a poor indicator of price movements in the short term. Market trends (including momentum and overbought signals) can be a good leading indicator of future price movements but can be dangerous if fundamental value is ignored. Neither analytic should be used in isolation but it is logical to select investments based objectively according to a combination of fundamental value and market trends which are independent of opinion, forecasts and emotion.

Can investors and fund managers ever hope to time markets?

Of course, but one needs a method. Most people say you can’t do market timing: they say it can’t be done with a portfolio of stocks because the trading costs are too high). Or it can’t be done using bottom-up company research (which is the main focus for most managers). It’s also tricky using econometric models or geopolitics. It can be done all the time using trend-following metrics. CTAs, or commodity trading advisors, are the largest subset of hedge funds and successfully use Trend Following to go long/short. CTA is effectively market timing. To make it work, it needs to be simple and systematic, not based on opinion, emotion, or forecasts. In our view, its better to add Value scores – risk measures – as it’s dangerous to follow trends (like CTAs do) without a Value check. Welcome to the world of Ekins Guinness!

What’s your attitude towards US equities? Are they overpriced? Should investors be internationally diversifying away from heavy US exposure in global indices?

The US has become relatively expensive but has the best momentum – which is more important. US Value Yield – our measure of the fundamental value of a market – has not become so extreme that it is an immediate concern. But we are in the danger zone so we might reduce that exposure as soon as momentum deteriorates. Most other regions have poor relative momentum. Then again, the US has been relatively expensive for a while, mainly because the Cash Earnings Yield is very low. But following momentum in the US has paid off.

Are tech stocks generally in a bubble in valuation terms, or is positive momentum still strong?

The Technology sector displays strong positive momentum versus World Equities and it is not overbought. On one of our preferred measures, called the Relative Value Yield, the tech sector is negative (growth sector) but is in the middle of its 20-year range.

Is the UK market cheap? And Japan?

The UK is strong in absolute terms but disappointing in relative terms whereas Japan has been strong in relative terms but is possibly flagging (and not to have hedged Yen is a disaster). The UK is relatively cheap versus World Equities and within the context of its history. But it’s been cheap for a while and has underperformed significantly over the last 7 years

Have you been increasing or decreasing your exposure to equities vs bonds?

Our Asset Allocation model started to reduce the Equity weighting from 100% in late March largely because of one of the measures, the Equity Value Yield. We had similar valuation risk concerns in late 2021 (ahead of the 2022 bear market). As for other asset classes, Gold and Commodities are more attractive than Bond markets. Our view is that bonds are not attractive. Valuations are perhaps stabilizing but there is no clear uptrend yet. In our view, nominal yields do not have an attractive premium over inflation. By contrast, Gold and Commodities are in an uptrend, although the precious metal might have paused for breath but it is still in an uptrend As for the wider commodities markets, they have a weaker trend due to the weaker oil price but overall commodities are still in an uptrend.

If you are an investor at the moment, what is the one warning signal you should focus on?

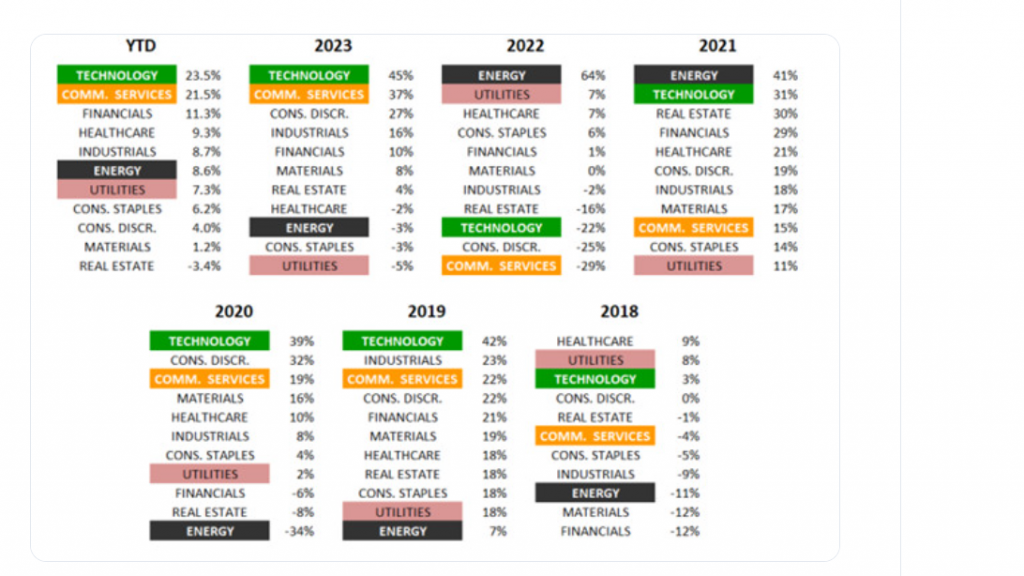

Sector rotation! You always get significant differences in Sector returns and leadership rotation over a sufficient period of time. Our view is that a major Sector rotation is likely at some point this year. Consumer Staples for instance have been a major underperformer so far. There could be a major opportunity to buy back in, but we would wait for confirmation. One of our measures, the Relative Value Yield for Consumer Staples, is at a 30-year high, so strategically, they are very attractive –that said we would wait for sentiment to improve.

Leave a Reply