Cash Will Be King Soon, 4 Out Of 5 Market Top Signs Are Here

Aug. 15, 2025

Summary

- I’m selling into market strength, as underlying weakness and red flags suggest we’re near a market top, despite record index highs.

- Key sectors like transportation, consumer discretionary, and real estate are showing signs of strain, while jobs data is weakening.

- Market breadth is dangerously narrow, margin debt is at record highs, and speculative trading is rampant—classic signals of a topping market.

- I’m raising cash now, believing caution is wise; cash will be king when the next market pullback offers better opportunities.

The stock market is doing great and it has been making new record highs. The momentum could carry it higher for a while, but I am using this as an opportunity to sell into strength, because not all is well when you dig deeper and beyond the major indexes. I am not a huge bear, and I am keeping my core holdings for the long term, but I am skeptical and I believe cash will be king as soon as this Fall. Let’s take a closer look below at some points of concern and also at 5 of the indicators that often signal a market top.

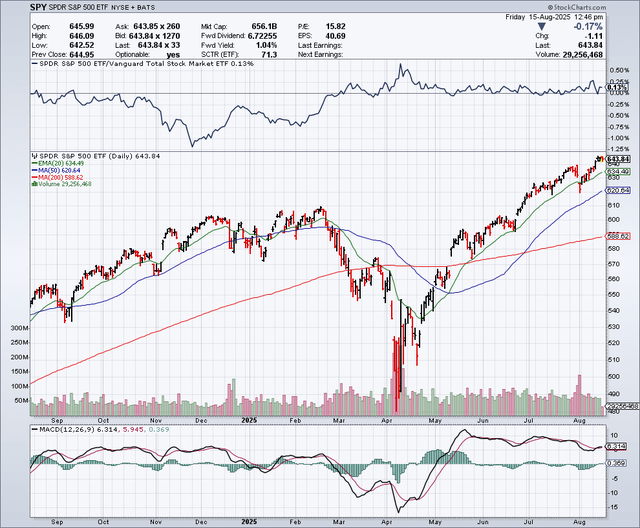

The Chart

When I look at the chart of the S&P 500 Index (NYSEARCA:SPY) below, it looks like we are potentially at or near the blow-off top stage of this bull market. I certainly do not look at this chart and say that this is when I want to be adding more money and risk to my portfolio.

Why Things Are Not So Great Under The Surface

The market strength in terms of the indexes looks great but there is underlying weakness in some important segments of the market such as the transportation stocks and consumer discretionary. For example, UPS (UPS) is trading near 52-week lows. FedEx (FDX) is way below the 52-week high. A major European container shipping company recently warned that high global tariffs could slow down volumes in the coming months. When things aren’t being shipped, it means they aren’t being sold and this weakness in shipping volumes is a major concern.

The real estate market appears to be in correction mode in many parts of the country. I am seeing price cuts where I live in California that I have not seen in years. I am also seeing homes sit on the market for months in many cases. Companies like Whirlpool (WHR) recently reported challenges with tariffs and weaker than expected results. Lower home prices could lead to weaker consumer sentiment as a potential negative wealth effect from real estate takes its toll.

The jobs market seems to be shifting rapidly and this could be the start of a new and very negative trend. On August 1, the Bureau of Labor Statistics released the jobs report which showed July non-farm payroll growth was just 73,000. This was much lower than the expectations for 110,000. But it gets worse, because payrolls for May and June were revised down by a total of 258,000. This means the job market weakness really started earlier this year and we are only starting to recognize the start of this potentially new trend now.

A Tariff 2.0 Growth Scare Could Be Coming

The stock market recovered from a brutal decline in April after President Trump announced the Liberation Day tariffs. The stock market is back at new highs, and consumers have not seemingly been hit with big price increases. So, it now seems like we can have a huge increase in tariffs that brings billions of dollars in new revenues to the U.S. Government and there is really no impact or downside.

However, this could be false hope, and we could be in the “quiet before the storm” period. That’s because there is a major lag time for tariffs to take effect and to hit with full impact. We have to realize that many countries were able to defer tariffs during the negotiation period and many companies stockpiled raw materials and other items. Many businesses have also held back on raising prices because there has been uncertainty as to whether or not tariffs would remain high or be negotiated away. A recent CNBC article says that higher prices might be coming in September, according to some analysts and this is based on seasonal inventory patterns and products that are working their way through the supply chain system. I believe it is way too early to suggest that we are in the clear when it comes to tariffs and the potential inflationary impact.

A Number Of Indicators Of Market Tops Are At Red Flag Levels Now

They often say that no one rings a bell at the market top, but there are multiple indicators that seem to be ringing a bell, for anyone who is willing to listen:

1) Narrowing Market Breadth: A healthy bull market has broad participation, but this bull market has been very dependent on mega-cap tech stocks which could be a warning sign of trouble ahead. A recent Goldman Sachs (GS) article points out that market breadth has been too narrow and it states:

“Although the S&P 500 has reached record highs, the median stock within the index is more than 10% below its 52-week high. This has lowered market breadth—a measure of how widely a market’s performance is reflected by its constituents—to its lowest level since 2023, according to Goldman Sachs Research’s market breadth indicator.

In the past, sharp declines in market breadth have often signalled below-average returns and larger-than-average drawdowns ahead.”

2) Excessive Euphoria And Margin Debt: We are hearing things that suggest we are in a new “Golden Age” and we are in a new era with AI and humanoid robots coming, all of which can seem limitless in terms of potential. Past market tops also had concepts that were touted as having incredible potential, such as the Internet/dotcom bubble. I believe there is excessive euphoria now and this often leads to investors believing that buying stocks is a no-can-lose proposition over the long run, even to the point where they are borrowing money to buy stocks. According to the latest statistics from FINRA, margin debt levels just went over $1 trillion in June 2025 and this is a new record. Since margin debt levels often hit record levels at or near market tops, I view this as another bell or warning signal that is going off right now.

3) Rising Interest Rates: This is often a problem for the stock market, but we are not seeing rising rates now, so this is the one indicator that is neutral and not ringing a bell. However, there is a case to be made that interest rates have been held up high for too long and that the damage might already be done. I think some of this damage is starting to show up in the jobs data.

4) Declining Economic Indicators: Earlier in this article, the weakening labor market was discussed, and this could be a major indicator of economic weakness, but there are others as well. New factory orders and durable goods orders fell in June and the ISM Manufacturing PMI showed in July that manufacturing is in a state of contraction. The ISM services index also declined in July, which is yet another potential warning sign. Lumber prices have plunged in recent weeks and this could be another sign of looming weakness in the economy.

5) A Surge In Speculative Trading: In the past couple of weeks we have seen a renewed meme stock rally whereby investors are buying into highly speculative stocks, which in some cases have very poor fundamentals. This is yet another potential red flag warning sign as this type of behavior is often seen at or near the market top. The record levels at which many cryptocurrencies trade is another sign of speculation. The stock market and other assets classes have clear signs of froth in certain areas and that will likely need to be flushed out.

In Summary

There are multiple signs that seem to suggest we could be at or near a market top. I definitely think it makes sense to be cautious when others are being greedy, and even using record levels of margin debt to buy stocks. I also believe that new stock market highs are being fuelled by a narrow part of the market and that this is masking some of the underlying weakness that has just started to appear in some of the manufacturing and services data as well as the jobs data. I think this is a great time to raise cash, and that cash will be king again and much smarter to deploy in the next big market pullback.

Leave a Reply