Investment Trust Dividends

I’ve added to the Snowball by buying 2855 shares in AEI

for 8k

xd next week for £162.00 payable in March.

Currently £112,628.00 invested in the market.

This is not the value of the portfolio as it will take a while

for markets to improve and more dividends earned.

It makes no difference because as the price of a Trust rises

the yield falls, so when u are re-investing lower for longer

is best.

Stick to your plan until it sticks to u.

I am going to buy a position in AEI as the shares they hold

are of interest to me and looking well ahead for when the FTSE100

trades higher.

ACTIVITY BREAKDOWN

Top 10 Holdings

Name Holdings

BP PLC 4.8%

Shell PLC 4.3%

National Grid PLC 4.3%

Imperial Brands PLC 3.8%

SSE PLC 3.8%

DS Smith PLC 3.7%

Barclays PLC 3.1%

NatWest Group PLC 3.1%

BHP Group Ltd 3.0%

OSB Group PLC 3.0%

Currently yielding 8.2% trading at a discount to NAV of 5.9%

There are only two.

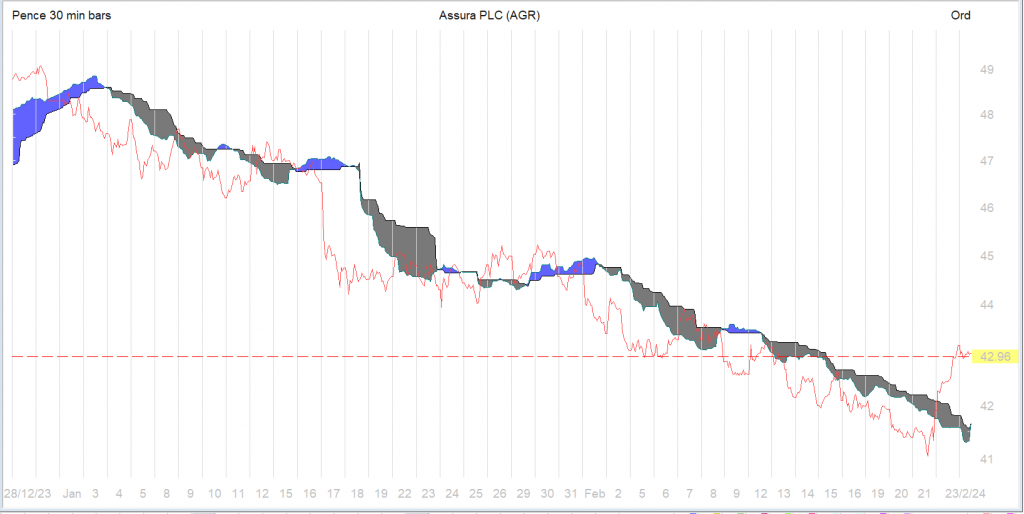

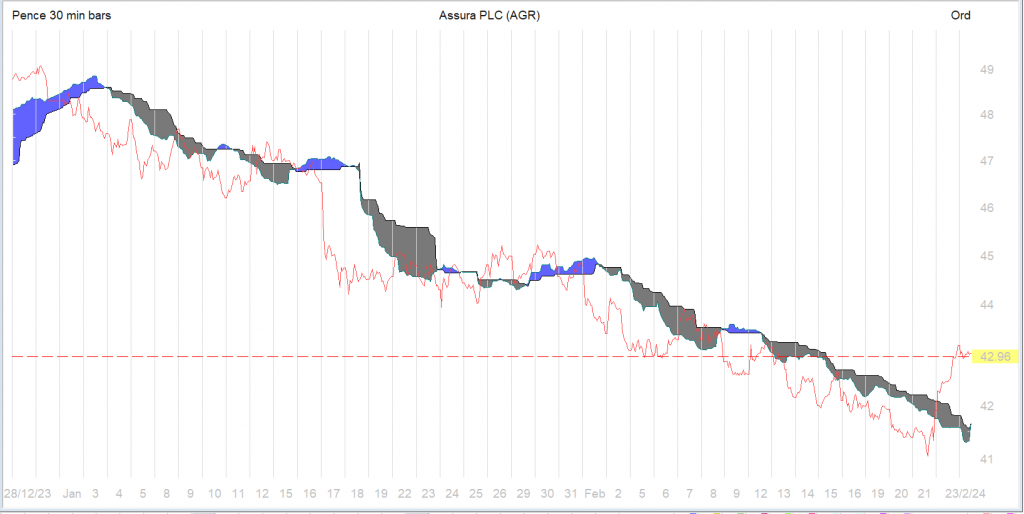

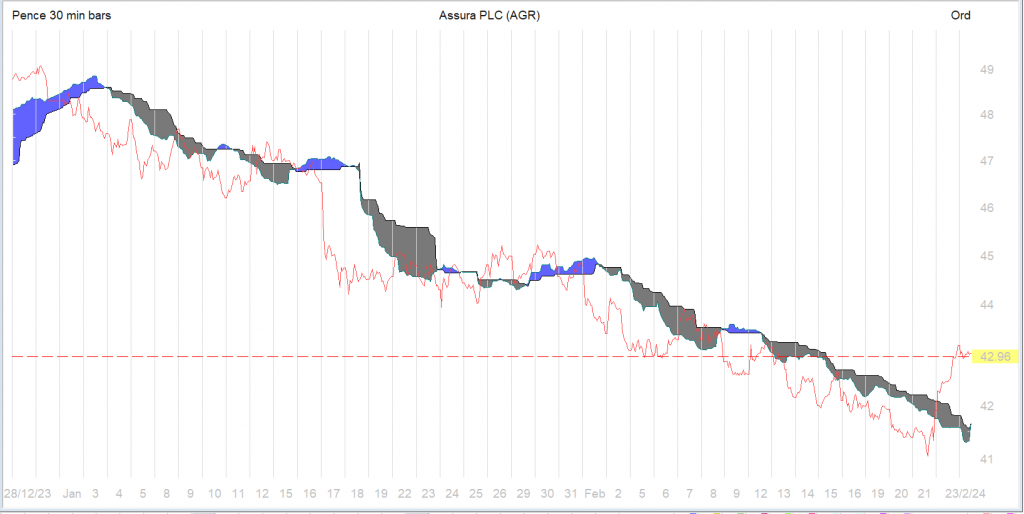

I’ve sold 12264 shares in GRID for a loss of £1,175.00

after they cancelled their next dividend.

Cash to re-invest £8,139.00

Gresham House Energy Storage Fund plc

(“GRID” or the “Company“)

Capacity Market (CM) auction results

Gresham House Energy Storage Fund plc (LSE: GRID), the UK’s largest fund investing in utility-scale battery energy storage systems (BESS), is pleased to provide shareholders with an update on the 2023 Capacity Market auction results for the portfolio.

The latest T-1 CM auction concluded on 20 February 2024, clearing slightly higher than expected at a price of £35.79/kW. The Company has secured additional 1-year contracts across 13 of its Projects with a total derated capacity of 90.491MW. In total, the additional contracts are expected to generate £3.2mn of additional revenue from October 2024 to September 2025.

In the valuation process for the Company’s assets, CM revenues are only included where contracts are held at the date of valuation, therefore these new contracts are in addition to current revenue assumptions and are accretive to NAV. The NAV benefit from these contracts will be recognised at the next valuation date of 31 March 2024.

Ben Guest, Fund Manager of Gresham House Energy Storage Fund plc, said: “We’re pleased with these results from the latest annual Capacity Market auction, as well as their expected positive contribution to our NAV from 31 March 2024.

“One of the great attributes of battery energy storage systems is their flexibility. We can swiftly and remotely configure our software to tap a wide range of potential revenues available to BESS without needing to make any physical changes to hardware. These revenues include both contracted income such as the Capacity Market auction results we’re announcing today, as well as merchant, or trading, revenues

2024 dividends received £1,903.00

Dividends announced for March £933.00

1st Quarter fcast £2,836 (Fcast £2,000.00)

Dividends announced for April £538.00 with

a further £300.00 expected.

In only year 2 of the portfolio the 2024 target of 9k already

exceeds the current annuity available in the market and u get

to keep all your hard earned capital.

Real Estate Credit Investments Limited (the “Company”)

Ordinary Dividend for RECI LN (Ordinary shares)

Real Estate Credit Investments Limited announces today that it has declared a third interim dividend of 3.0 pence per Ordinary Share for the year ending 31 March 2024. The dividend is to be paid on 5 April 2024 to Ordinary Shareholders on the register at the close of business on 15 March 2024. The ex-dividend date is 14 March 2024.

Positive Update on Office Active Occupancy

The Company is pleased to provide an update on active office occupancy based on a survey of the Group’s tenants across 122 buildings in the Company’s portfolio. The survey’s results are based on the Company’s office tenants across a wide geographic spectrum of the main regional centres of the UK and in aggregate account for over 29,000 employees. The survey showed that employees have returned to the office for an average of 4.1 days per week.

The survey also showed 71.4% active office occupation across the portfolio, which compares favourably to the 65.4% announced in June 2023. Pre-pandemic active occupation is estimated at 70.0% The Asset Manager’s study of the office portfolio shows that current active occupation is 102% of the pre-pandemic occupancy levels and is expected to grow further.

GRID has cancelled it’s expected dividend.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑