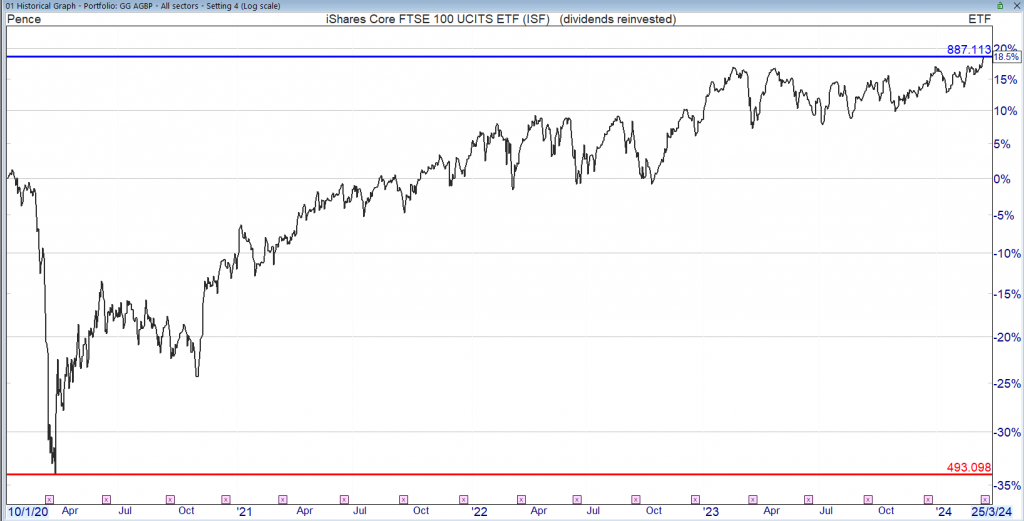

The previous ISF chart has gone xd, so this messes with the chart in the short term.

If we look at the FTSE P&F chart, it includes price targets, with an index if u are patient, they are normally met. Here the target is 8100.

Investment Trust Dividends

The previous ISF chart has gone xd, so this messes with the chart in the short term.

If we look at the FTSE P&F chart, it includes price targets, with an index if u are patient, they are normally met. Here the target is 8100.

NextEnergy Solar Fund Limited

(“NESF” or the “Company”)

260MW International Solar Co-Investments Energised

NextEnergy Solar Fund, a leading specialist investor in solar energy and energy storage, is pleased to announce the energisation of its first two international solar co-investments alongside NextPower III ESG (“NPIII ESG”), bringing an additional 260MW online in Europe and increasing NESF’s total installed net capacity to 979MW.

The two assets consist of a 210MW solar project located in Santarém, Portugal, known as Santarém, and a 50MW solar asset located in Cadiz, Spain, known as Agenor. The combined assets are expected to produce 445GWh of renewable electricity every year, the equivalent of powering approximately 126,700 homes.

NESF directly owns 13.6% of Santarém, 24.5% of Agenor, and 6.21% of NPIII ESG. The energisation of these assets adds 46MW to NESF’s total installed net capacity on a look-through basis.

Both Santarém and Agenor benefit from long-term contracted revenues through Power Purchase Agreements (“PPAs”) with Statkraft, a high-quality corporate off-taker in Europe’s energy market. The PPA covering Santarém is notable, being the largest PPA in the history of Portugal to date, showing the continued demand for high-quality corporate PPAs across the European market.

NPIII ESG, into which NESF invested $50m in June 2021, is a private fund exclusively focused on the international solar infrastructure sector, principally targeting projects in carefully selected OECD countries, including the US, Portugal, Spain, Poland, Greece, and Italy. NPIII ESG has 173 solar and storage assets, totalling 1.8GW.

Helen Mahy, Chair of NextEnergy Solar Fund Limited, commented:

“Energisation of 50MW at Agenor in Spain and 210MW at Santarém in Portugal marks a significant milestone in NESF’s expansion and international diversification of our operational solar asset base. These projects will generate electricity for the equivalent of more than 126,700 homes and demonstrate our commitment to providing reliable, renewable energy solutions. Both projects also benefit from a 100% PPA with Statkraft which ensures long-term contracted revenue and visibility of cash flow.”

Ross Grier, COO & Head of UK Investment, NextEnergy Capital, commented:

“With Agenor and Santarém now operational, we’ve completed our first direct international co-investments made by NESF through NextPower III ESG. The co-investment structure provides attractive exposure to international solar assets alongside other institutional investors and allows us to realise an uplift in installed capacity on a no-fee, no-carry basis. This enables us to target utility-scale solar assets across developed global markets and contributes to our long-term growth objectives.”

Subject to the passing of the Resolutions at the General meeting, the Board intends to announce the details of an initial Return of Capital under the B Share Scheme shortly after the General Meeting.

The adoption of a B Share Scheme will not limit the ability of the Company to return cash to Shareholders by using other mechanisms and, if the B Share Scheme is adopted, the Board will continue to review its efficacy over time. Details of the Board’s intention to implement the B Share Scheme are set out in the Circular (as defined below).

The Board’s proposal to adopt a B Share Scheme now should not be taken as any indication as to the likely timing or quantum of any future returns of cash to Shareholders.

General Meeting

The introduction of the B Share Scheme requires Shareholder approval, which will be sought at a General Meeting of the Company to held at the offices of Stephenson Harwood LLP, 1 Finsbury Circus, London EC2M 7SH on 5 April at 10.00 a.m. Resolution 1 is proposed as a special resolution and Resolutions 2 and 3, as ordinary resolutions. Together they seek approval for the B Share Scheme. A special resolution requires at least 75 per cent. of the vote cast to be in favour in order for the resolution to be passed. An ordinary resolution requires a majority of members entitled to vote and present in person or by proxy to vote in favour in order for it to be passed.

This Fool explains why real estate investment trusts (REITs) are a great way to earn dividends, and details two picks she likes.

Sumayya Mansoor

I own a few real estate investment trusts (REITs) purely for passive income. REITs are income-producing property stocks that must return 90% of profits to shareholders.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

With that in mind, two more I’m looking to snap up when I can are Empiric Student Property (LSE: ESP) and Supermarket Income (LSE: SUPR).

Here’s why I’ve taken a liking to both stocks!

Student accommodation

Similar to the UK housing market, demand for student beds across the UK is outstripping supply. This could be good news for Empiric, and its shareholders. Performance and returns could grow in the future.

The pandemic hurt Empiric, as many students retreated home, and then deferred studies. Since then, the business has rebounded, in my view. This is perfectly signified by today’s preliminary results for the year ended 31 December 2023.

Revenue and earnings per share jumped by 10% and 17% compared to the same period last year. Gross margin levels have increased too and 99% revenue occupancy was achieved for 2023/24. The dividend has been hiked by a mammoth 27%. A yield of 3.8% is in line with the FTSE 100 average. However, I’m conscious dividends are never guaranteed.

One issue I’ll keep an eye on moving forward is the foreign student visa demand. These students often take up a big chunk of student beds, which is good news for Empiric. However, a recent government investigation found fraudulent visas were being applied for and obtained. If these numbers were to drop due to any new rules, Empiric’s performance and returns could drop.

Supermarket Income

As the name suggests, the business provides supermarket-related properties and facilities for our favourite stores to operate smoothly. I reckon there’s a sense of defensive ability for Supermarket Income. This is because groceries are essential for day-to-day living.

I must admit I’m buoyed by Supermarket’s impressive client list to date. At present, major players including Aldi, Tesco, Morrisons, and Sainsbury’s all rent property from it. Ties with the biggest players in the market that all possess a sprawling presence can only boost performance and returns. If it can leverage these relationships into further rentals and contracts, there could be good times ahead.

In addition to this, as the population increases and more infrastructure and facilities are needed, Supermarket Income could find more of its properties rented by grocery businesses to keep up with rising demand.

A dividend yield of just under 8% is very enticing, and the main reason the shares caught my eye.

From a bearish view, a difficult property market driven by higher interest rates and inflation could make growth trickier. New assets could be costly, or Supermarket Income could overpay for any new properties. This could hurt performance levels, and returns in the future. I’ll keep an eye on this issue.

I reckon Supermarket Income is one of a number of REITs that should flourish when turbulence subsides.

Sumayya Mansoor has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mention

Get Rich Slow.

Low risk trade for a dividend re-investment plan.

The Motley Fool

Story by Zaven Boyrazian, MSc

Income shares are one of the best ways to generate a passive income, in my opinion. While they come with some risks, investors with modest sums of capital can leverage the power of compounding to achieve some lucrative results. And in the long run, it’s possible to create the equivalent of a second salary without having to lift a finger.

The power of compounding

On average, households across the country are saving around £180 a month. It’s generally a good idea to use these savings to build a solid emergency fund within an interest-bearing savings account. However, for those fortunate enough to already have a large cash cushion, it may be smarter to start drip-feeding this capital into income shares instead.

Looking at the FTSE 100, the index has historically generated an average annual return of around 8%. That’s both ahead of inflation and average savings interest rates offered by banks. At this level of return, drip-feeding £180 each month can build up to a substantial pile of wealth in the long run.

After 30 years of regular investing, a total of £64,800 would have been poured into a stock portfolio. But thanks to compounding, the actual value of this portfolio would be just under £270,000. And for those able to wait another decade, the snowball effect becomes clear since the valuation would reach as high as £628,400

Following the 4% withdrawal rule, that’s the difference between a passive income of £10,800 and £25,136 per year. That’s why so many financial advisors recommend to start investing as soon as possible

Risk versus return

Waiting three to four decades to hit a five-figure passive income target is a big ask. Even more so, considering a poorly-timed crash or correction could easily extend the waiting time. While a few investors may have this level of patience, others likely want to get rich quicker.

When it comes to investing, becoming a millionaire overnight is near impossible. The few extremely rare occurrences give novice investors a false sense of hope. However, that doesn’t mean there aren’t strategies investors can deploy to accelerate the wealth-building process.

The first and simplest is to allocate more money to investments each month. Getting a promotion, switching jobs, and cutting spending are all viable strategies to increase the amount of spare capital available at the end of each month.

Investors can also strive to build more wealth with higher returns through stock picking. Instead of following an index, a hand-crafted portfolio of individual top-notch companies can potentially deliver market-beating returns.

This does carry significantly more risk and demands a far more hands-on approach. But even achieving an extra 2% gain can have a significant impact. In fact, doubling monthly contributions to £360 and hitting a 10% annualised return is enough to cut almost 12 years from the waiting time to reach £600k.

You would like to start to earn some passive income (dividends) but are concerned u might pick the wrong share and they stop paying dividends.

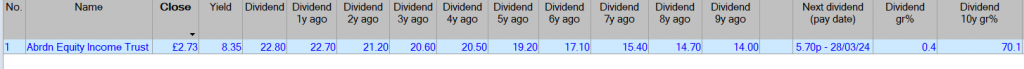

Below is an Investment Trust – Abdrn Equity Income 8.35% AEI

Trading at a discount to NAV of 6.7%

Currently yielding 8.4%

The yield is above what is available in the market as the UK stock market has been out of favour for several years. This may continue for a long time but u will still receive your dividends which could be invested back into AEI or shares, the world’s your onion.

If one of the shares in the portfolio stops paying a dividend, for whatever reason, it will be barely noticeable in the yield paid out.

Investment Trusts have reserves that they can use to maintain dividends such as the Covid crash where the investment world was coming to an end, apparently.

U don’t have to do anything whilst the dividends keep rolling in, from the list above the dividends have increased by 70%, so in 10 years time a yield of around 14%. GRS

If the UK market finally catches up with the rest of the world’s markets and print a new high, u should be able to sell some of the shares for a profit.

If not u will still have the dividends to keep u warm.

ACTIVITY BREAKDOWN

Top 10 Holdings

BP PLC 5.1%

National Grid PLC 4.9%

DS Smith PLC 4.9%

Shell PLC 4.8%

Imperial Brands PLC 4.5%

SSE PLC 4.3%

Barclays PLC 4.1%

NatWest Group PLC 3.8%

Conduit Holdings Ltd 3.5%

BHP Group Ltd 3.2%

The Motley Fool

With that in mind, let’s go through the five main steps to building a diversified passive income portfolio.

As with any financial venture, the first step is to raise some cash. After all, shares aren’t free, and investors need money to make money.

Finding capital for investments can be tough. This cash will likely be invested for several years. And while it’s always possible to pull money out early, this can significantly harm a portfolio’s performance.

The good news is with some trading fees and commissions dropping to near-free, investors don’t actually need much to get going. And setting aside as little as a few pounds a day is enough to start accumulating a decent lump sum to invest in dividend shares.

For a passive income portfolio, the most likely strategy is to focus on dividend stocks. However, just because a company offers a high payout today doesn’t mean it will stay that way.

Unlikely the interest income from bonds dividends are not mandatory for companies to pay. They exist purely as a mechanism to return excess capital back to the owners of the business (the shareholders).

However, if there are no excess earnings, then dividends are likely to be cut, suspended, or even outright cancelled. And suddenly, a promising source of passive income runs dry, with the share price usually dropping sharply thereafter.

Investors need to investigate a company’s free cash flow generation capabilities to see whether dividends are sustainable, or heading for the chopping block.

There are obviously plenty of other factors that go into making an investment decision. But by filtering out companies with tight margins, the search for lucrative passive income opportunities can be greatly narrowed.

After isolating the most promising passive income stocks, it’s time to start putting capital to work. Investors should strive to build a dividend portfolio containing a variety of companies operating in different industries. This is called diversification, and it can significantly reduce risk exposure.

There is a lot of debate, but the ideal number of stocks to own usually lies between 15 and 25. However, be aware that owning too many stocks can dilute investment returns. So investors need to find the balance between risk and reward that works for them.

With a portfolio in place, there’s not much else to do but hopefully watch the money roll in. If I aim for £1,000 a month at an average 5% yield (which, of course, isn’t guaranteed), I’ll need a portfolio worth £240,000. Obviously, that’s not pocket change.

But steadily investing capital each month, reinvesting any dividends received, and hitting this milestone, long term it’s truly possible.

Story by John Fieldsend

The MotleyFool

• 1mo

Let’s say I had no savings, no experience with stocks, and was starting at 40 years old. Still worth investing? Without a doubt, if you ask me. And even putting away £200 a month could hand me a yearly second income of £10,653. Here’s how.

My first step is to carve out £200 a month. Not to say this is easy. Anyone who can save cash in this day and age should be applauded.

But if I can find room in my budget, I’d rather direct it to building a lifelong second income than a couple of takeaways and some that I found online.

Where to invest

Even still, £200 isn’t going to do a whole lot by itself. One decade of diligently saving that only brings me £24,000. What I’ll need is a powerful wealth-building method that pays out a big multiplier on the amount I put in.

Buy-to-lets are one option. Rental yields of 3%-5% aren’t too shabby, but taxes and the work required make it a no for me. Savings accounts offer up to 6% now. Although, I’d avoid these too as the rates will come down as interest rates are cut.

The best place? Well, Vanguard released a report recently spelling out what many of us already know. The report found UK stocks returned 9.18% from 1902 to 2022. The upshot? Stocks are the best place to grow wealth and build a second income.

Hang on a minute, the stock market? Won’t I be up against algorithms making trades in fractions of a second? Or City of London bankers with inside connections and data-filled terminals?

Get rich fast?

Well, the answer is no, not really. I don’t intend to watch lines zip up and down on a chart. And I don’t plan to work a second job processing hundreds of trades a day. The way I invest is, to be honest, quite boring.

I follow the Warren Buffett approach. Buy good companies and don’t overpay. Sound exciting? It shouldn’t. But it’s a proven recipe for long-term wealth building and one of the simplest ways to start investing in stocks – even for someone who’s never done it before.

If I follow this approach with my £200 a month, I won’t get rich fast. After the first year, I’ve saved £2,400 and my extra 9% (assuming the average UK stocks return) would give me £216. Sounds okay, I suppose. But where’s my juicy second income?

Well, the funny thing about investing in stocks is how little happens early on. In the first year, two years, or even five years, the growth is minimal. It looks like nothing is happening. Even 10 years in, my 9% would only get around £3,000.

Reposition

But if I let my wealth grow from the age of 40 to 65 – with a cool 25 years of compounding – then the total deposits of £60,000 would grow to £230,061.

A 9% return or any other is not guaranteed of course, and I can lose money investing like this.

But if I achieve my goal, I may reposition my portfolio to focus on dividends. By buying the shares in companies that pay a consistent income, a 5% withdrawal isn’t overly challenging. I could then receive £10,653 each year and I’d hope to receive that for the rest of my days.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑