If u know the reference without googling it u are showing your age.

Investment Trust Dividends

If u know the reference without googling it u are showing your age.

Because of the high yield AEI often trades around its NAV sometimes at a premium, if it continues up I will book some more profit. If it doesn’t I am more than content with the current yield. Mr. market is always right but sometimes not that bright.

I’ve sold another 53 shares in AEI for a ‘profit’ of £150.00.**

Now there are 3 options.

The price continues up and I can book more ‘profit’ (see earlier post)

The price flatlines so it’s the right decision to book ‘profits’

The price falls and u may be able to buyback the shares that were sold at a better price.

** I sold earlier today because I wanted to make a general comment about ‘profit taking. It’s a loss of profit of around ten pounds so no problem but a profit is a profit is a profit but I would have sold as the price rose.

Story by Jon Smith

The new Stocks and Shares ISA year kicked off last week, meaning I now have a new £20k allowance to make use of for the next year.

Even though I’ve held an ISA for a long time, some will be starting from scratch right now. So if I was in that position and wanted to target passive income as my investment goal, here’s what I’d do.

Principles to remember

To begin with, I wouldn’t invest everything all in one go. The beauty of the ISA is that the allowance is over the course of a year. I’m not penalised if I invest in regular chunks each month.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

This helps when I’m trying to build up good options for passive income. Stocks that pay out dividends do so at different points during the year. So for a company that only delivers one payment annually, it might make sense to buy it at a certain point during the year.

Further, a stock’s dividend yield fluctuates due to the moving share price. This means opportunities to buy will present themselves during the year. So by investing regularly instead of all in one go, I can capture more opportunities.

My final note would be to diversify my exposure around different sectors. This will help me to build a robust portfolio that can withstand a shock. This could occur to one specific company, or to an underperforming sector. My income will take a hit from this, but it won’t be anywhere near as hard as if I just held that one stock (or one sector).

A banking idea

A good example of a stock I’d include in a fresh ISA is Barclays (LSE:BARC). With a dividend yield of 4.14%, it’s above the FTSE 100 average of 3.66%. Granted, this isn’t what I’d classify as an ultra-high yield option.

Yet for my ISA, I want solid stocks I believe will pay out dividends and grow them in years to come. That’s the position I believe Barclays is in. The bank has benefitted from higher interest rates over the past couple of years. In 2023, it recorded the highest revenue in over five years. The dividend per share payments also grew from 6p in 2021 to 7.25p in 2022 and 8p last year.

Granted, cuts to interest rates this year could negatively impact earnings. Yet I’m not sure that we’ll see as many cuts as people think, given the fact that inflation is remaining a bit sticky.

Let’s not forget that the share price is up 27% over the past year. Any gains here further help to boost my overall profits.

Building up income

I’d happily include Barclays in the ISA portfolio. From there, I’d then be more confident to buy a high-yield option that carries more risk to help raise the overall yield.

If I included options from other sectors including Imperial Brands (8.47%), Greencoat UK Wind (7.48%) and Bakkavor Group (6.56%), I think I could get an average yield of around 6.5%. If I invested a starting sum of £5k and then put £500 a month in my ISA, my income would start to build. By year 15, I could be making just over £10k a year from dividends.

Remember they are realised profit and losses, some of the Trusts are in the current portfolio so hopefully some of the losses can be clawed back, alternatively the profit could be lost before any Trust is finally sold.

The plan remains the same.

To own Investment Trusts to earn dividends to buy more Investment Trusts that pay a dividend. Stick to your task until it sticks to u.

Hopefully more profits to come subject to jam down.

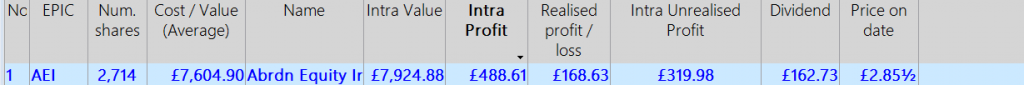

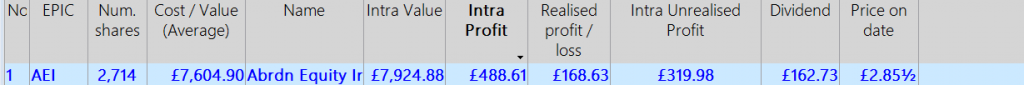

I’ve sold 88 shares in AEI for a profit of £250.00 as I want to explain an important point.

Prior to the sale

Intra profit of £448.00

(Unrealised profit of £254.15 Realised profit of £193.85 dividend )

After the sale

Unrealised profit of £187.87

Realised profit of £328.88 (dividend plus sale profits)

Unfortunately u can’t decide to sell x number of shares and take the profit. The buying price was 280p and the selling price 290p, the 10p profit per share, less trading costs is spread over all the shares including the remaining shares, where the profit can disappear as fast as snow on a summer’s day.

Simpler to understand is a profit is not a profit until it sits in your account as cash. I know of one trader who has a very successful trading history often buys two equal positions so he can sell one position and book all the profit for his blog.

One final point the AnnualRateofReturn ARR, which u often seen quoted on the trade was 35% which is meaningless.

No guarantees but whilst the NAV is rising the price should follow and hopefully start to close the discount to NAV. If not u still have the 8% yield to keep u warm.

I made a dummy trade with AEI, which is not the same as a trade for dummies, and I was offered a sell price of 285p, which I declined. At that price the thread position was a profit of £310.00, which includes a dividend of £162.00. This gives me the following options.

Sell the whole position and re-invest in a higher yielder.

Take out the profit of £148.00 and hope to make more, with trading costs having fallen it would be an option. For me, remember u are not me as your portfolio may be at a different stage, it’s a strong hold with a target of crystallising the profit only, very roughly £300 of profit plus the dividend.

All subject to the well known investing cliche of jam down (where the worst outcome is if u drop your toast/jam it will land jam down, where if it landed jam up and no one was watching u could still eat it.

GL

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑