The Results Round-Up – The Week’s Investment Trust Results

Third Point’s second half performance in 2023 and Menhaden Resource Efficiency’s consistent outperformance are just two of the highlights of this week’s Results Round-Up.

By Frank Buhagiar

Third Point Investors’ (TPOU) year of two halves

TPOU’s +4% NAV return for 2023 may well have fallen short of the MSCI World’s +24.4% and the S&P 500’s +26.3%, but at least the fund outperformed both indices in the second half. And the improved performance has continued into the new year – NAV is up +17.6% for the six months to 31 March. Chairman Rupert Dorey puts the turnaround down to a portfolio repositioning which “entailed a move towards more high conviction and concentrated investment exposures, focussed on core areas of competency such as deep value, event driven and activist strategies.”

Despite this, and in response to a hard-to-shift discount, the fund is launching a full review to consider how the Company may best deliver value to Shareholders.

JPMorgan: “TPOU is one of three companies in the AIC Hedge Funds sector although in our view it is more comparable to the companies in the AIC North America conventional trust sector as a majority of its portfolio is listed equities.” Because of this “a significantly narrower discount probably requires better relative NAV performance compared to global equity indices, as is usually the case for funds invested principally invested in listed securities.”

Menhaden Resource Efficiency’s (MHN) number one ranking

MHN reported a +23.8% NAV per share total return for 2023, which, according to Chairman Howard Pearce, represents “a 15.6% outperformance over the Company’s performance benchmark”. The outperformance is no one-off either, “the Company’s NAV performance has been ranked 1st in the AIC environmental sector over the last 1, 3, and 5 years.” A thumbs up then for the fund’s strategy which is centred around investing in “a concentrated portfolio of high quality largely global businesses, the majority of which have a key role in enabling the transition to a lower-carbon future”.

Numis: “Recent performance has been influenced by significant exposure to mega cap tech companies, which are held based on them using a significant amount of renewable power. This fuelled strong returns in 2023, and ytd, after a more challenging period since late 2021.”

Asia Dragon’s (DGN) New Dawn

DGN took on c.£214.7m of net assets during the half year when it combined with abrdn New Dawn. In terms of the half-year performance, the fund generated a NAV and share price total return (sterling) of +1.5% and +2% respectively (dividends reinvested), a little off the MSCI All-Country Asia’s (ex-Japan) +3.7%. According to the half-year report, the underperformance is due to macro factors, “rather than stock fundamentals, dominated market focus and sentiment over the period and Chinese market exposure remained the biggest detractor.”

Chairman James Will sounds confident though: “There are multiple themes that reinforce the attractiveness of Asia. The Manager’s committed focus on quality companies with solid balance sheets and sustainable earnings prospects should position the Company to deliver attractive returns.”

Winterflood: “Chinese exposure was reduced materially over the period, with an emphasis on earnings visibility and cash flow generation. However, the managers retain high conviction in the holdings that remain and continue to believe that China remains an attractive investment proposition for the longer term.”

Martin Currie Global Portfolio’s (MNP) high conviction calls pay off

MNP had a good year. As Chair Christopher Metcalfe explains: “NAV total return was +11.2%, which compares favourably with the return of the benchmark index of +10.9% and was ahead of the average return of our peer group.” The portfolio managers put the strong showing down to their high conviction holdings, “with many of them coming through strongly during the period.” And because of the focus on companies “with resilient earnings growth that are exposed to long-term structural growth themes, have pricing power and solid balance sheets”, the fund “should be well placed to produce superior returns for shareholders.”

Winterflood: “The strongest performing sectors in the portfolio were Technology (+36.4%), Telecoms (+21.2%) and Industrials (+10.8%)”.

NB Private Equity (NBPE), ready whatever the economic weather

NBPE’s NAV Total Return came in at +2.3% for the year. Neuberger Berman MD Paul Daggett had this to say: “Overall the portfolio reported a weighted average LTM revenue and EBITDA growth of 11% and 15%, respectively, during 2023. EBITDA growth outpaced revenue growth, a function of the active ownership of the investments, with operational improvements, operational leverage and synergies from M&A being reflected in the bottom line. The portfolio remains well diversified and we believe is well positioned for a range of economic environments and that it should continue to generate growth over the long term.”

Jefferies: “the very limited investment activity across both 2022 and 2023 has skewed the portfolio’s maturity profile older, highlighting the potential for a material increase in realisations once the exit market improves.”

Numis: “NBPE is currently trading at a 24% discount to NAV and we believe it is one of several attractive options in the LPE sector.”

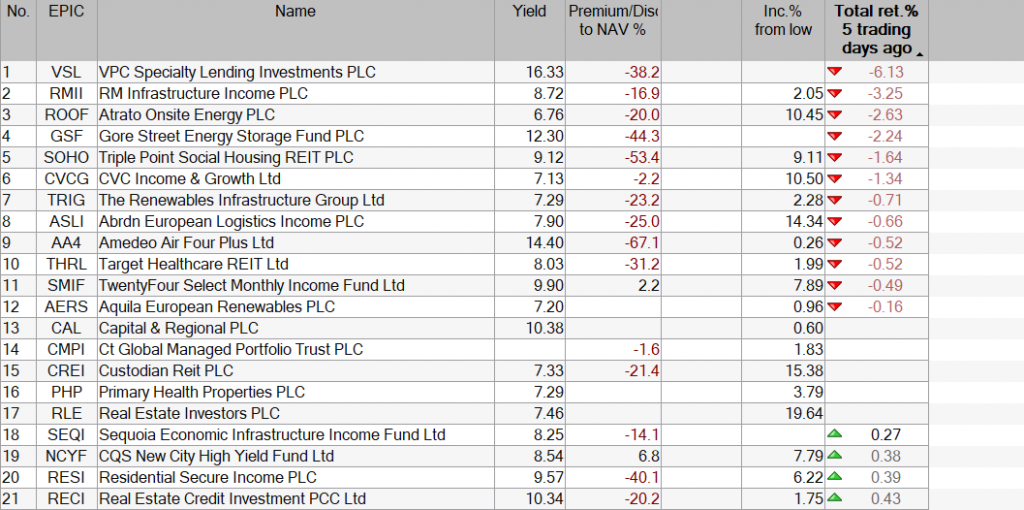

Aquila European Renewables (AERI) is listening

AERI reported a -6% NAV return per share for the year. According to Chairman Ian Nolan, this was “primarily the result of a combination of the development of power price curves, buybacks and the introduction of the resource rent tax in Norway.” Nolan says the Board is listening to its shareholders, particularly with regards to that stubbornly high discount and action taken to date includes returning capital to shareholders. “The dividend paid in 2023 amounted to EUR 21.2 million and was fully covered at 1.1x. When combined with the EUR 27.8 million1 share buyback, the Company has returned EUR 49.0 million to shareholders over 2023.”

Winterflood: “As previously announced, AERI is considering a broad range of strategic options including a potential combination with another listed investment company.”

Liberum: “In our opinion, the potential merger with ORIT makes sense”.

Fidelity Special Values (FSV) not compromising on quality

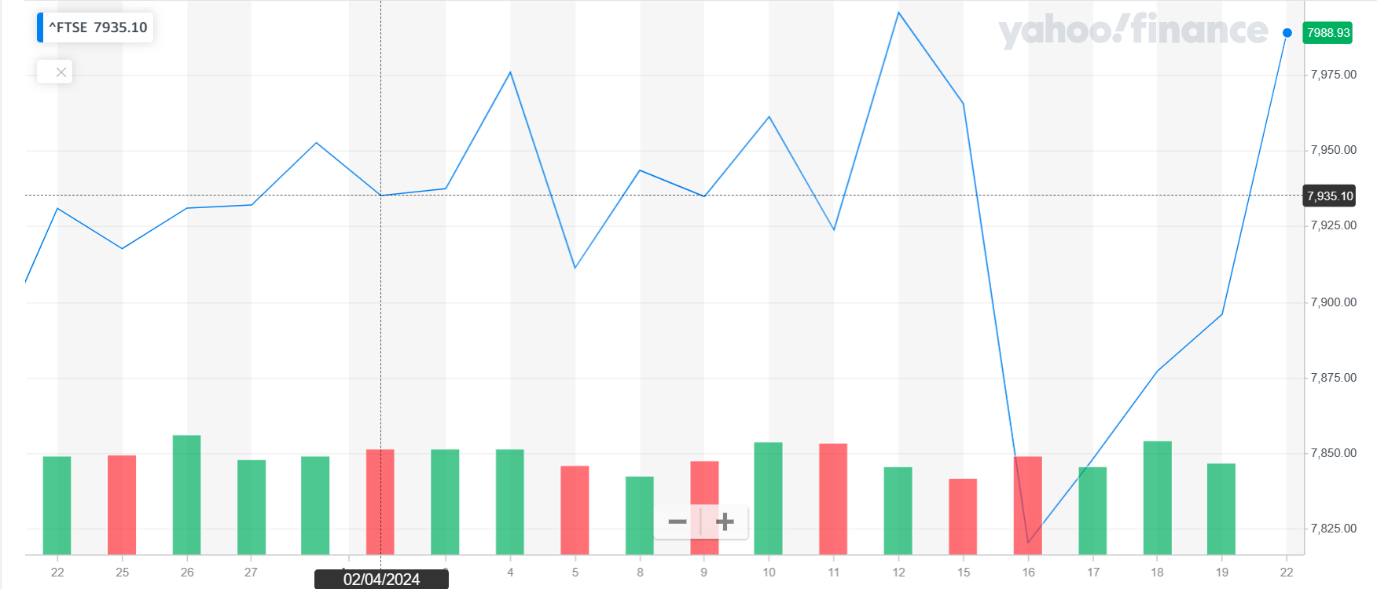

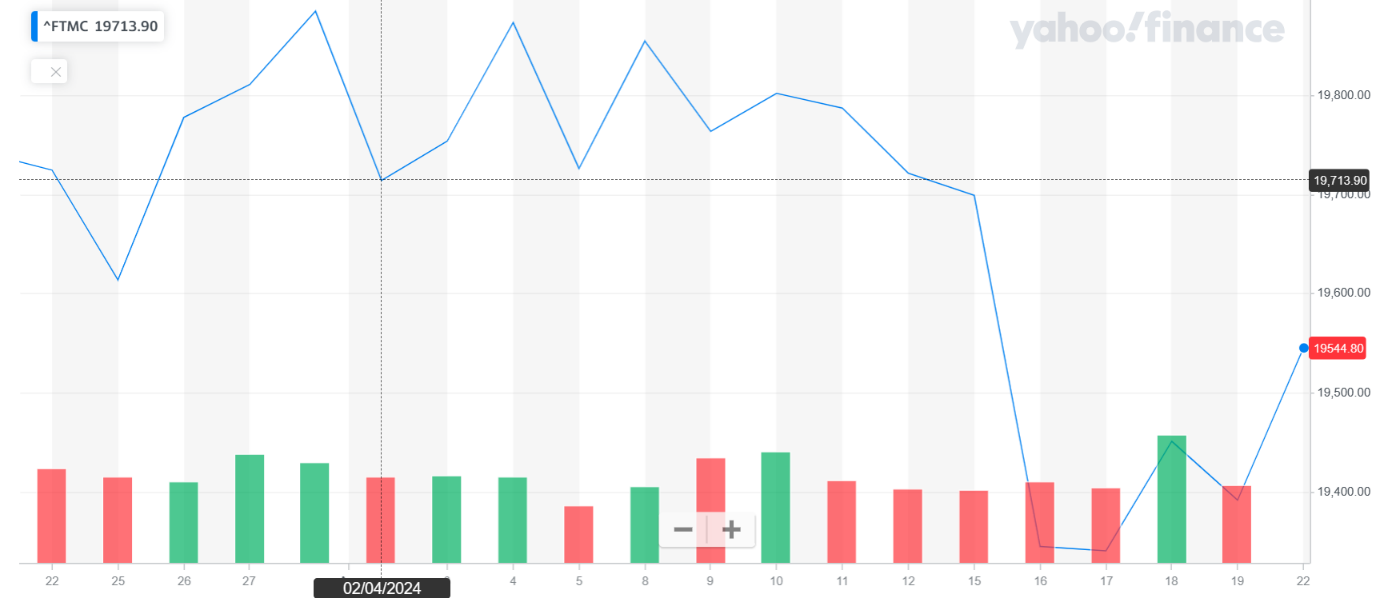

FSV outperformed by the slimmest of margins at the half-year stage: +4% NAV per share return compared to the FTSE All-Share’s 3.9%. Portfolio Manager Alex Wright reckons it’s a target-rich environment out there, “the attractiveness of UK valuations versus history and compared to other markets, as well as the large divergence in performance between different parts of the market, continue to create good opportunities for attractive returns from UK stocks on a three-to-five-year view. Their unloved status means we continue to find overlooked companies with good upside potential across industries and the market cap spectrum. What is more, the lack of interest from other investors means that, despite our focus on attractive valuations, we do not have to compromise on quality.”

Numis: “We rate the manager highly and admire his investment approach which has a strong contrarian flavour, looking for unloved stocks where the downside is limited and there is a catalyst for change. We believe that the c.8% discount is an attractive entry point.”

Henderson Far East Income’s (HFEL) changes pay off

HFEL’s +8.2% NAV Total Return for the half year beat the +4.2% sector average and the FTSE World Asia Pacific’s (ex-Japan) +5.1%, although the MSCI AC Asia Pacific High Dividend Yield Index was up +10%. Chairman Ronald Gould is encouraged “to see substantially better investment returns in response to previous restructuring and the planned changes intended to improve capital returns.” The changes were made to reflect “key themes such as corporate reform in Korea, strong macro-economic data in India and Indonesia and the technology sector which has been a beneficiary of artificial intelligence. The Fund Manager has made a number of changes to the Company’s country and sector positioning to take advantage of these investment themes.”

Winterflood “Outperformance attributed to stock selection. The portfolio benefitted from Indian holdings. Key detractors came from China exposure.”

abrdn European Logistics Income (ASLI) considering all options

ASLI’s NAV per share for the year may have experienced a 21.4% decrease due to “continued sector-wide asset re-pricing” but operationally the fund continues to make progress – annualised passing rent on held assets increased 5% to €32.2 million for example. Nevertheless, as Chairman Tony Roper writes, “while the market looks set to improve in the second half of 2024 and into 2025, and the post period transactions and letting activity achieved by the Investment Manager supports this, challenges will remain for the real estate sector, primarily as a result of higher for longer interest rates. The Board is continuing with its Strategic Review, as it considers all options available that offer maximum value for shareholders.”

Winterflood “ASLI will face continuation vote at AGM in June; Board recommends shareholders to vote in favour of continuation to ensure strategic review can be completed properly. Board currently expects that result of the strategic review will be announced ahead of AGM.”