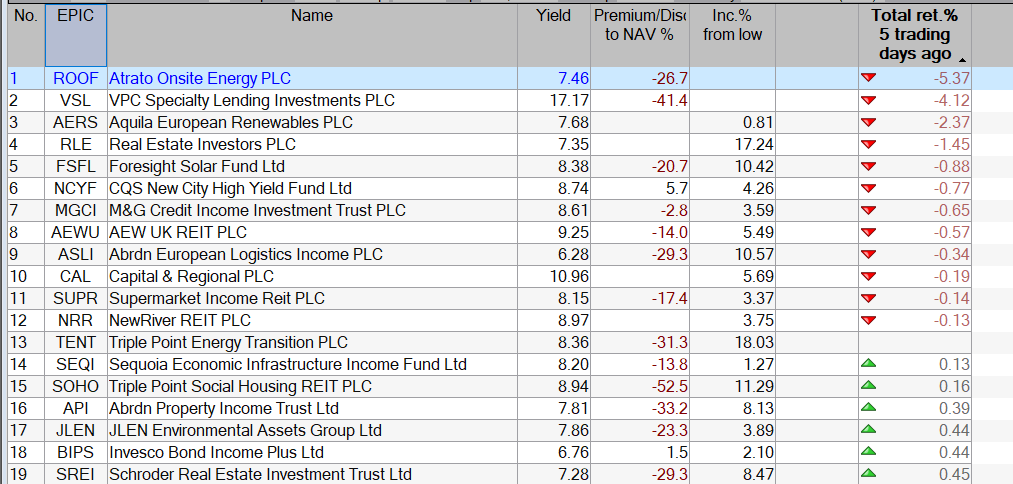

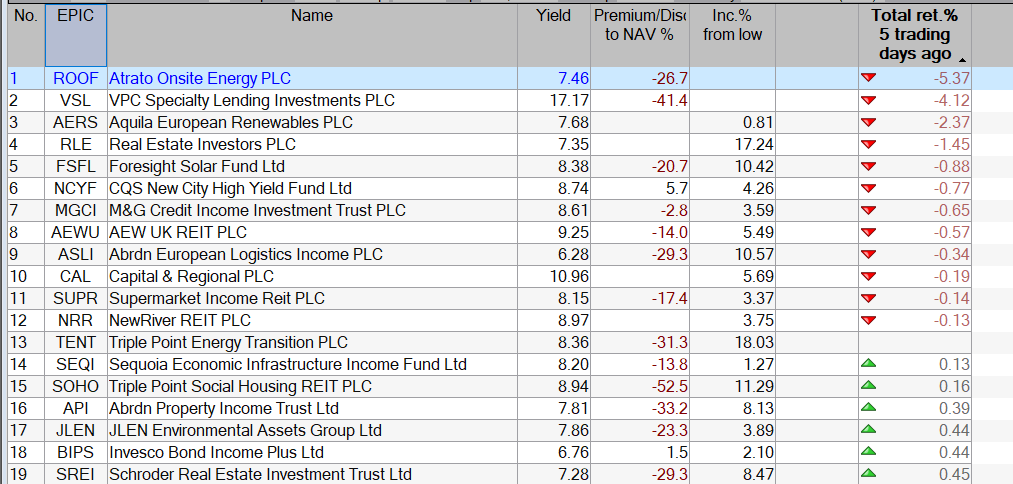

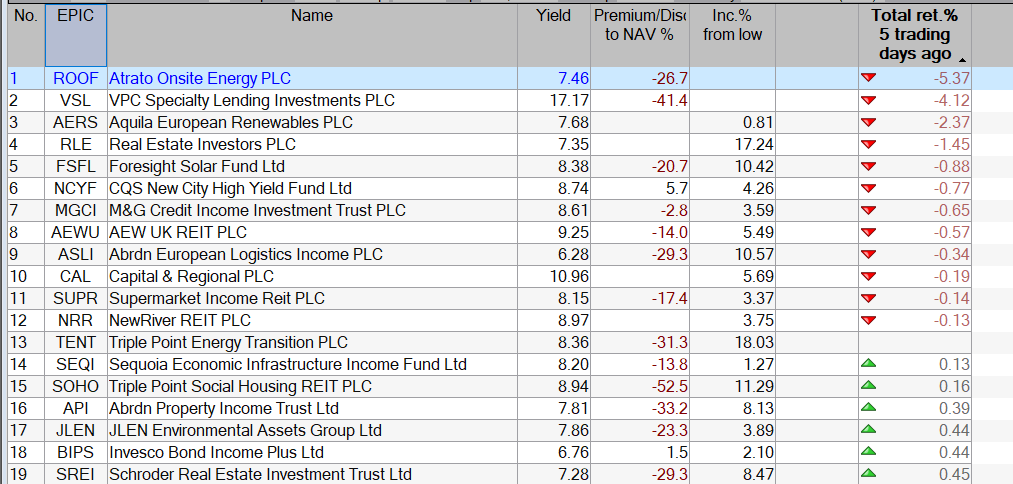

Investment Trust Dividends

Investing has become more perilous as Trusts move away from their lows.

Some takeaways from the table.

Most Asset classes have their day in the sunshine and Trends can stay longer than the mother-in-law.

Last year’s weaker Trusts can be the next winners, timing is not guaranteed.

Last year’s winners may not be this year’s losers.

Some years (2022) u are not going to make any money, great if u have a dividend re-investment plan as u get more shares and a better yield for your hard earned.

On 2 May 2024, Close Brothers Asset Management sold 45,000 shares in ICG-LONGBOW SNR SCD UK PROPERTY DEBT INV CO . This brought our shareholding to 16.99% of the shares in issue. This is based on the shares in issue figure of 121,302,779 as at 2 May 2024.

This is the required notification that the holding has crossed below 17% of the shares in issue.

MoneyWeek

PERSONAL FINANCE

PENSIONS

The 4% pension rule to retire comfortably

Ever wondered when the best time is to retire and access your pension pot? Here is how the 4% pension rule could help you retire comfortably.

BY MARC SHOFFMAN

CONTRIBUTIONS FROM

RUTH EMERY

Accessing your hard-earned pension pot when you are ready to retire is a major milestone.

But deciding how and when to start taking money from your pension savings can influence how long the money lasts and ultimately the lifestyle you will be able to enjoy during your golden years.

As well as hopefully enjoying the returns from your retirement savings, money still needs to be available for bills and possibly your own long-term care.

Understanding when to retire, and how much money to take out of your pension to give you a reliable stream of income, is crucial.

That is especially important as the cost of retirement is rising.

The latest research from the Pensions and Lifetime Savings Association suggests retirees need an income of £43,100 per year for a ‘comfortable retirement.’

Can applying the 4% pension rule help? We explain what it is and how it works.

What is the 4% pension rule?

A popular rule for pension savers is to take 4% of the value of their fund in the first year of withdrawals and increase that by the rate of inflation each year. This is supposed to last a typical retiree 30 years.

Academics at the American Association of Individual Investors devised the 4% rule in 1998 after researching a sustainable withdrawal rate for a retirement pot that wouldn’t deplete the savings.

It looked at data from 1926 to 1995 and found that a rate of 3-4% is “extremely unlikely to exhaust any portfolio of stocks and bonds”.

Can I rely solely on the 4% rule?

Like all rules of thumb, says John Corbyn, pensions specialist at the wealth manager Quilter, the 4% concept is based on certain assumptions.

“It needs to be overlaid with someone’s state of health and propensity to spend which is likely to be higher for younger clients and lower for older clients,” he says.

“Care needs to be taken to ensure the attitude to risk and propensity for loss is also built into these assumptions.

“Depending on your risk tolerance, investment strategy, and the actual returns you get, you might consider a slightly more conservative withdrawal rate.

Corbyn says it is crucial to continuously review and adjust your strategy based on your actual investment returns, spending needs, and the broader economic landscape.

“Ultimately, pensions are a long-term savings vehicle and potentially may need to pay for someone’s income for up to 30-40 years, and care needs to be taken if the fund is accessed early as short-term gain may lead to long-term pain so getting advice is key,” he adds.

Joshua Gerstler, chartered financial planner for The Orchard Practice, says that while the 4% rule is a good guide, in reality our spending patterns are not linear.

“We might want to spend more in the early years of retirement, for example, to travel around the world,” he says.

“Our spending may slow down as we get older and are less able to get out and about. Albeit this could be offset by an increase in care fees. If you have a financial plan then you will have a good idea of how much you can access without ever running out of money.”

It’s important to note that this strategy may not work for everyone and is just one of many factors to consider when retiring.

Make a retirement plan

What you plan to do with your retirement will also have a huge impact on when you should start accessing your pension pot, so it’s a good idea to know what you want to do and the costs of doing it.

“If you have dreams of travelling the world then you might need much more retirement income than if you are content with a quiet life at home,” says Corbyn.

“It’s essential to have a realistic projection of your monthly and yearly expenses, including contingencies for unexpected costs.

“Financial planners can help produce cashflow models that look at your holistic finances and show you how much you can expect to have and what kind of retirement lifestyle that will buy you.”

The importance of timing when retiring

You can’t help when you were born but it is worth thinking about when you start accessing your pension pot as market returns will have an influence on the success of the 4% rule.

Investment firm Fidelity recently attempted to see if the 4% rule had stood the test of time.

One major factor was timing.

It looked at the value of two £100,000 funds after 15 years – one starting in 2000 and one in 2003.

Despite there being just three years between their start points, the pot beginning in 2003 grew to be more than two-and-a-half times bigger than the pot beginning in 2000.

This is because the pot being accessed in 2000 was hit by the dotcom boom, so there wasn’t an opportunity to make up for these losses, while the 2003 pot benefited from the post-crash recovery.

Ed Monk of Fidelity suggests building flexibility into the strategy so you can avoid the worst time to sell your investments.

“Another tactic is to tweak your withdrawals in periods of falling markets so that you take just the income that is produced naturally from investments,” he says.

“This might include the dividends from company shares, income from funds or the interest from bonds. This might mean a lower level of income overall, but it means you won’t need to sell assets when their price has fallen.”

If you’re retiring in a period of economic downturn, adds Corbyn, it may be wise to be more conservative with withdrawals, at least initially.

Gerstler suggests it is also important to consider other savings and investments held outside of pensions as part of your whole retirement strategy.

Don’t forget about tax

Whatever rule you use, experts say it is always important to consider the tax implications.

This is because beyond the 25% tax-free lump sum, you will need to pay income tax on withdrawals if you are earning above the personal allowance.

It may not take much to go above the £12,570 allowance, given the state pension is currently at £10,600 a year and set to rise to £11,500 from April 2024.

“Tax planning is a crucial aspect of accessing a pension, and those who are thinking for instance of buying an annuity or accessing a pension flexibly by withdrawing taxable amounts should take note if they are earning or taking taxable income from elsewhere, including the state pension,” says Alice Haine, personal finance analyst at the investment platform Bestinvest.

“For someone drawing the full flat-rate state pension at the moment, additional income – whether from work or a private pension – of more than £1,970 a year will take them over the personal allowance and into basic-rate tax.

“For those with larger pensions or higher incomes, there will be the potential risk of being taken into the higher or even additional-rate tax brackets, and some savers in drawdown should moderate their pension income to avoid this.”

Exceptional post but I was wondering if you could write a little more on this topic? I’d be very grateful if you could elaborate a little bit more. Cheers!

£££££££££££

I can’t add anything, if anyone has more info I will copy their post.

Update to the previous posted chart, the market goes lower and then reverses. Anyone who never closed their position would now be printing a big loss.

Trading is simple but not easy.

Warren Buffett

I’ve bought for the portfolio 1589 shares in SUPR for £1,200.00

Cash for re-investment £316.00

Story by Charlie Carman

Aiming for £50,000 in annual passive income is a challenging goal. Although it’s not risk-free, I think stock market investing is the best way to achieve this when it comes to my own money.

Here’s how I’d aim to build a passive income empire today.

A sizeable £30,000 savings pot would be the perfect head start, but it’s important to put that money to work as soon as possible in a Stocks and Shares ISA over two tax years.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Over time, inflation erodes the purchasing power of cash since interest rates on traditional savings accounts often don’t keep pace with rising prices.

To target higher returns and benefit from compound returns, I’ll need to embrace volatility by investing in shares.

Shares can fall in value as well as rise — that’s an inescapable possibility with stock market investing. As such, a risk appetite and the ability to keep emotions in check are essential qualities for a good investor.

After all, the potential reward for accepting the risk of capital losses is that well-chosen equities can sometimes turbocharge investors’ returns in a way that cash never could.

I’m aiming for a 4% dividend yield across my final stock market holdings. So, when the time arrives to start spending my passive income, I’d need a portfolio worth £1.25m.

Achieving returns of this nature — or even higher — is hard, but isn’t impossible. Just ask long-term Nvidia shareholders or look at Warren Buffett’s track record.

Nonetheless, it would in all likelihood require me to beat the market by a considerable margin. No mean feat.

Accordingly, I’d want to maximise my chances of reaching my portfolio target by making additional contributions along the way. In doing so, I could still succeed with less spectacular returns.

If I invested an additional £5,000 annually for the next 20 years until I was 50, I could bring my required compound annual growth rate down to 8%. This figure’s broadly in line with the historical returns of leading indexes like the FTSE 100 and S&P 500.

Consequently, if I started with £30,000 at 30 and invested an additional £5,000 a year for much of my working lifetime, I’d have a good chance of securing a retirement funded by £50,000 in annual tax-free passive income from dividend distributions.

Time to start investing !

How much can a £250,000 pension pot get you in your retirement?

© GB News

Increases in food, energy and motoring costs will see those approaching retirement having to save more to afford the lifestyle they want.

Savers typically aim for a pension pot of £250,000 on average but end up with just over half of that in reality, new research reveals.

This is a massive shortfall in the amount they hoped to have available (£250,000) to buy an annuity or invest to generate an income.

A £250,000 pot can buy an annuity – which provides a guaranteed income for life – worth £12,091 a year at today’s rates, according to Standard Life.

A £131,000 fund can currently get someone an annuity of £6,332 a year.

With many people ending up with just over half of their pension saving goal, Britons are urged to carefully consider their retirement plans so they can ensure they have enough to live off in retirement.

With many people ending up with just over half of their pension saving goal, Britons are urged to carefully consider their retirement plans so they can ensure they have enough to live off in retirement.

The Pension and Lifetime Savings Association (PLSA) regularly puts out figures showing how much it costs to fund a minimum, moderate and comfortable level of retirement.

This provides a useful guide to calculate how much someone may need to retire and how much to put into their pension.

The PLSA shows that a couple now needs an income of £59,000 a year to be “comfortable” in old age, whereas a single person needs to save even harder and achieve a £43,100 income to cover this standard of living – covering meals out, holidays, theatre trips, and a car, in addition to everyday essentials.

The figures presented assume that savers qualify for the full new state pension – which is currently £11,500.

Standard Life found half of retirees have regrets about their financial preparation, with 53 per cent wishing they had started saving earlier, and 42 per cent that they had got financial advice or guidance.

Dean Butler, managing director for retail direct at the firm, said: “It can be hard to work out how much you need to save to achieve your desired standard of living in retirement, particularly earlier on in your career.

“Clearly there’s a big gap between what people hope to save, and what they actually do – this is unsurprising, particularly when looking at it during a cost-of-living crisis, however the result can be a significantly reduced standard of living in retirement.

“Ultimately, contributing as much as possible, as early as possible is the key to a good retirement outcome.”

A good way to contribute more if to round up any pension savings.

Rounding up monthly pension contributions to the nearest £100 could generate thousands more in retirement savings, the analysis found.

Those who begin working on a salary of £25,000 per year and pay the minimum monthly auto-enrolment contributions (five percent employee, three percent employer) from the age of 22, could have a total retirement fund of £434,000 by the age of 66, not adjusted for inflation.

£££££££££££££££££

A £131,000 fund can currently get someone an annuity of £6,332 a year and u have to surrender all your capital, at least Dick Turpin had the decency to wear a mask.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑