Investment Trust Dividends

| eharmony special coupon code 2024 robertelmore.org lyndonlukis@yahoo.com 191.96.67.227 | I know this site presents quality dependent posts and extra stuff, is there any other site which presents these things in quality?Here is my site eharmony special coupon code 2024 |

There are many bboards (forums as they are now called).

ADVFN and LSE are popular but are mainly posts about posters buys and then defending their buys against all opposition.

Citywire forum has some decent posters, with the usual mix of idiots.

U can read the forum but have to join to post comments.

DECLARATION OF INTERIM DISTRIBUTION

23 May 2024 – abrdn European Logistics Income plc (LSE: ASLI), the Company which invests in a diversified portfolio of European logistics properties, announces an interim distribution for the year ending 31 December 2024.

The Board has declared an interim distribution of 1.41 euro cents (equivalent to 1.21 pence) per Ordinary share, in respect of the year ending 31 December 2024 (2023: 1.41 euro cents), payable in sterling on 5 July 2024 to Ordinary shareholders on the register on 7 June 2024 (ex-dividend date of 6 June 2024).

Following the announcement of the conclusion of the Strategic Review on 20 May 2024, the Board intends to put forward proposals to shareholders for a managed wind-down of the Company (the “Managed Wind-Down”). Accordingly, the Company expects to publish a circular in June 2024 to convene a general meeting at which it will seek approval from shareholders for the proposed new investment policy by way of ordinary resolution. Should shareholders vote to approve the Managed Wind-Down, as the portfolio asset disposal programme commences, the income generated by the Company will diminish. As a result, the Company’s ability to maintain the current level and frequency of distributions will also decrease.

VH Global Sustainable Energy Opportunities plc

23 May 2024

Dividend declaration

The Board of directors of VH Global Sustainable Energy Opportunities plc (the “Company”) announces an interim dividend of 1.42p per Ordinary Share with respect to the period 1 January 2024 to 31 March 2024, as scheduled below:

| Ex-Dividend date | 6 June 2024 |

| Record date | 7 June 2024 |

| Payment date | 28 June 2024 |

The Company reaffirms the annual dividend target of 5.68p per Ordinary Share for the year beginning 1 January 2024.

The Motley Fool

By Charlie Keough

A quick Google search of the phrase ‘passive income’ returns a staggering 151m results. But there’s one definition that stands out.

It comes from fabled investor Warren Buffett. He said: “If you don’t find a way to make money while you sleep, you will work until you die.” It’s a quote that’s stuck with me.

Making passive income has become incredibly important over the last few years with racing inflation eating away at pockets. As such, I can see why investors are keen to start making some extra cash alongside their main source of income.

If I were starting today, here’s how I’d go about it.

Buying stocks

There are plenty of ways to make additional income. But arguably the simplest is buying shares that pay a high dividend yield.

I could start a side hustle or try and enter the property game. But I’m targeting companies that share profits with shareholders via dividend payments.

What constitutes a high yield is subjective. For me, I tend to largely target companies that pay a yield over 5%. For context, the FTSE 100 average is 3.9%.

Finding the right businesses

Investors also need to do their due diligence. While some yields may look attractive, they may not be sustainable. We saw this most recently with Vodafone’s 11.4% payout, which is now being halved in 2025.

I target businesses that operate in mature industries with proven business models and stable cash flows. Given that dividends are never guaranteed, a strong track record of paying investors is also key.

Let time do its thing

It’s taken investors like Buffett decades to build the large passive income streams they receive today. And there’s a lesson in that. Building these streams doesn’t happen overnight.

It’s a long-term process. Take his investment in Coca-Cola. He bought the stock back in 1988 and added to his position over a couple of decades. Last year, he received a dividend cheque worth more than $736m from the company.

Coupled with adopting a long-term approach, I’d use compounding. By reinvesting my dividends, I can earn interest on my interest. Over time, that can super-boost my wealth.

An example

That’s all well and good, but I’m not going to leave here without giving an example that ticks the above boxes. That’s where Legal & General (LSE: LGEN) enters the frame.

It’s an insurance and asset management company and a stalwart in its field. There are a few more reasons why I hold the stock. Let me briefly explain.

Firstly, it has an 8.6% yield. That’s comfortably above the 5% benchmark I look for. Secondly, it has increased its payout by 80.8% over the last decade.

Of course, like all investments, there will be volatility. Right now, the business is facing headwinds as high interest rates impact deposit levels. But given its position as an industry leader, it’s stocks like Legal & General I’d target.

£15,000 invested in the stock today with an 8.6% yield will give me an investment pot of £196,144 after 30 years, assuming I reinvest my dividends. By year 30, this would pay me £16,108 a year, or £1,342 a month, in passive income.

That’s a healthy amount of cash that would no doubt go a long way in allowing me to live a more comfortable retirement.

22 May 2024

One global fund has been cutting back on its US tech exposure and adding to this UK company.

By Matteo Anelli

Senior reporter, Trustnet

US dominance and the relative bottoming out of the UK market over the past decade may have left some global investors wondering whether there is a need to look to the domestic market at all.

Murmurs have begun about a potential poor run for the US, with Temple Bar manager Ian Lance telling Trustnet yesterday that investors should expect to make a loss from American stocks over the long term from here.

Chris Rossbach and Katerina Kosmopoulou, who are in charge of the $252.4m J. Stern & Co. World Stars Global Equity portfolio, are bullish still on the prospects of the US titans, recently stating that “we are in not a tech bubble of any kind”.

They have stuck with their exposure to digital through tough times before – most notably in 2000 – and did so again in 2021-2022 when they added to stocks such as Nvidia, the leading chip manufacturer. This has rewarded the managers, with the stock rising to be the top holding in the fund, making up 8.3% of the total assets under management (AUM).

Yet even they have begun to look elsewhere, trimming some of their tech allocation as they weigh up the continued strong growth from the US giants versus the prospects of better returns from elsewhere in the future.

Thanks to successful calls on these US names and the returns they have brought in, Kosmopoulou explained that the fund is now in a strong position to take some profit and allocate to other areas.

One such area has been the UK, where, however, only one business convinced the managing duo – spirits company Diageo.

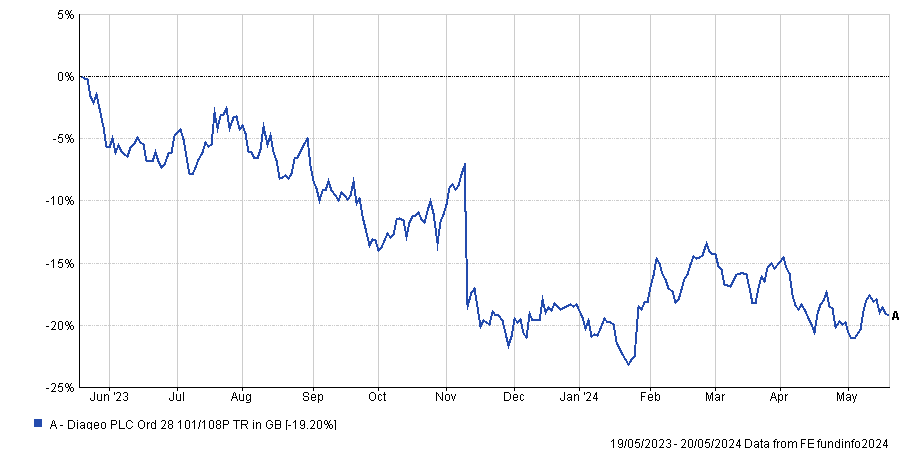

The company has been through a turbulent time in recent years, marked by a profit warning and its chief financial officer stepping down. Unsurprisingly, therefore, it has been a terrible performer of late, losing almost 20% over the past 12 months, 12% over the past three years and 6% over five months.

Performance of stock over 1yr

Source: FE Analytics

But the company is a good recovery play to Kosmopoulou, who said that Diageo is “a screaming buy”.

“Covid massively disrupted consumption and generated excess inventory throughout the supply chain. This is in the process of being corrected now, but the market hates that, so the stock is trading at more than 10% discount to its historical levels,” she said.

“Now if you could tell me that you and I will never drink again, I’m going to sell my Diageo position. But if you tell me that tonight we are likely to have a nice glass of whiskey, then to me that is that is basically a screaming buy.”

This is currently the only UK-listed company owned by the fund, Rossbach noted, with the overall country exposure adding up to 2% of the total AUM.

“We look at a global universe of companies, and the listing matters only in regards to the history of the company, the governance and the liquidity of its shares, with the UK being very strong on all of those points,” he said.

“There are a number of world-leading businesses that are here that we keep on analysing, especially in consumer products, healthcare and the intellectual property (IP) and payments-related areas of financial services, which we think are very interesting.”

Historically, Shell had been a holding in the J. Stern & Co. World Stars Global Equity fund. It was bought in 2012 at inception and sold later in 2014, when the managing team decided energy stocks weren’t for them. Since then, Diageo has been the only UK stock in the portfolio.

It is not alone in owning Diageo, with IFSL Evenlode Global Equity and Lindsell Train Global Equity among six funds in the IA Global sector also placing the stock in their respective top 10 holdings.

Nick Train also has a big position in the stock through his investment trust Finsbury Growth & Income. In the trust’s latest factsheet, the manager noted that it is “well-established” that the stock is out of favour and warned “it is still possible the next set of results will disappoint already low expectations”.

“Nonetheless, Diageo’s shares have now fallen over 30% from their peak in 2021 and we are sure it is right to be looking ahead to better trading for the company. In our view, Diageo shares will likely recover before those better conditions are confirmed,” he said.

SSE declared a final dividend of 40.0p for a full-year payout of 60.0p, down 40% from 96.7p the year before, in line with the plan the company had set out back in November. SSE repeated its commitment for annual dividend increases from the lowered base of between 5% and 10% until financial 2027.

Impact Healthcare REIT plc acquires, renovates, extends and redevelops high quality healthcare real estate assets in the UK and lets these assets on long-term full repairing and insuring leases to high-quality established healthcare operators which offer good quality care, under leases which provide the Company with attractive levels of rent cover.

The Company aims to provide shareholders with an attractive sustainable return, principally in the form of quarterly income distributions and with the potential for capital and income growth, through exposure to a diversified and resilient portfolio of UK healthcare real estate assets, in particular care homes for the elderly.

The Company’s dividend policy is to maintain a progressive dividend that is covered by adjusted earnings.

On this basis, the target total dividend for the year ending 31 December 2024 is 6.95 pence per share, a 0.18 pence increase over the 6.77 pence in dividends paid or declared per ordinary share for the year ended 31 December 2023.

BARCLAYS RAISES JLEN ENVIRONMENTAL ASSETS TO ‘OVERWEIGHT’ (E-W) – PRICE TARGET 110 PENCE

BARCLAYS CUTS NEXTENERGY SOLAR FUND TO ‘EQUAL WEIGHT’ (OW) – PRICE TARGET 87 (100) PENCE

RBC CUTS HICL INFRASTRUCTURE PRICE TARGET TO 165 (175) PENCE – ‘OUTPERFORM’

BARCLAYS RAISES VH Global Sustainable Energy Opp target to 89 (88) p – ‘EQUAL WEIGHT’

BARCLAYS RAISES FORESIGHT SOLAR FUND TARGET TO 102 (99) PENCE – ‘EQUAL WEIGHT’

BARCLAYS CUTS OCTOPUS RENEWABLES INFRASTRUCTURE TRUST TARGET TO 88 (98)P – ‘OVER WEIGHT’

BARCLAYS CUTS BLUEFIELD SOLAR INCOME FUND TARGET TO 128 (132) P – ‘OVERWEIGHT’

JEFFERIES CUTS ASSURA TO ‘HOLD’ (BUY) – PRICE TARGET 45 (52) PENCE

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑