Investment Trust Dividends

I’ve bought for the Snowball 4981 shares in SEQI

Sequoia Economic Infrastructure Income (SEQI)

27/06/2024

Results analysis from Kepler Trust Intelligence

Sequoia Economic Infrastructure Income (SEQI) has released its financial results for the year ending 31/03/2024. Over the year, the trust saw its NAV increase by 8.1% on a total return basis, in excess of its target return of 7-8%.

SEQI paid a total dividend of 6.875p per ordinary share which represents a yield of 8.7% on the share price at the time of writing. The trust delivered a total share price return of 9.6%, helped by a modest narrowing in its discount from 13.8% to 13.5%. The discount has since widened to 16.2%.

The managers have been active in portfolio management, increasing the proportion of fixed rate investments from 42% to 58% over the financial year to position the portfolio to take advantage of the expected fall in interest rates.

The managers and board also continue to take a proactive approach to capital allocation, repaying the revolving credit facility to reduce net debt to zero and returning £88 million to shareholders via a share buyback programme.

Chair James Stewart commented: “I am pleased to announce another resilient year of performance, despite ongoing challenges in the macroeconomic backdrop.”

Kepler View

Sequoia Economic Infrastructure Income (SEQI) generates a high yield for investors by lending against infrastructure projects backed by the security of tangible physical assets. The infrastructure sector is forecast to enjoy strong growth from mega-trends such as digitalisation and decarbonisation, which require trillions of pounds of investment.

This has led to a significant growth in private sector financing as a means of plugging the gap from government spending. We think SEQI is well-positioned to take advantage of this opportunity as the only listed economic infrastructure debt vehicle in the UK. One of SEQI’s strengths is the diversification of its portfolio, with around 55 investments across 30 sub-sectors.

Against a challenging backdrop for alternatives, SEQI has delivered a strong set of results with a NAV and share price total return of 8.1% and 9.6% respectively. This was primarily due to its focus on credit quality through the year.

In our view, SEQI could be an attractive proposition for investors seeking exposure to the infrastructure sector, which offers defensive qualities in addition to strong secular growth themes. While there would be some negative impact on income from falling interest rates, the managers’ decision to build up fixed rate exposure has counteracted some of this. We think the dividend looks sustainable over the coming year, thanks to the high amount of liquidity available and the current outlook for rates. Given the likely positive impact of falling rates on the valuation of the portfolio, we think there is the potential for strong total returns in such an environment from the 8.7% dividend yield plus capital upside from pull to par and a possible narrowing of the discount.

RGL

I have subscribed for the Snowball 59,100 10p shares at a cost of

£5,910.00

cash to re-invest £4,333.09

11 July 2024

Only a handful of equity income trusts have delivered sector-beating returns as well as yields over 4%.

By Emma Wallis

News editor, Trustnet

Now that UK government bonds offer a yield above 4%, equity income strategies have to work harder to justify their existence.

The argument for an equity income strategy is clear: dividend payouts plus the prospect of capital growth and higher total returns than those available from the bond markets. And with many investment trusts trading on a discount, investors can gain access to a portfolio of shares for less than they are intrinsically worth and potentially make additional gains if the discount narrows.

In practice, however, the holy grail of yields plus capital gains has been hard to achieve, with only a handful of investment trusts delivering top-quartile returns over three years with a yield payout in excess of 10-year gilts (4.2% as of 10 July 2024).

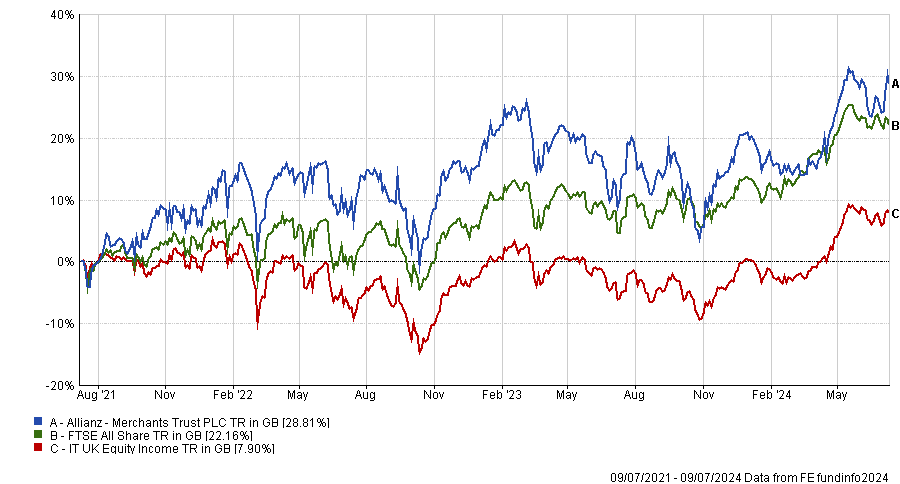

Within the Association of Investment Companies’ (AIC) UK Equity Income sector, Merchants Trust is the only one to make the mark with a yield of 4.9%. It is one of the AIC’s dividend heroes, having increased its dividend for 42 consecutive years.

Peter Hewitt, who manages the CT Global Managed Portfolio Trust and invests in Merchants Trust, said it can be relied upon to keep growing its dividend. “They will not drop the ball” he said.

The £859m trust is the third-best performer in its sector on a total return basis over three and five years. It is trading almost at par, with a very slight discount of 1.4% as of 31 May 2024.

Performance of trust vs sector and benchmark over 3yrs

Source: FE Analytics

Simon Gergel, chief investment officer for UK equities at Allianz Global Investors and head of the value and income team, helms the trust. RSMR analysts described its investment style as contrarian and value-orientated, with an income bias.

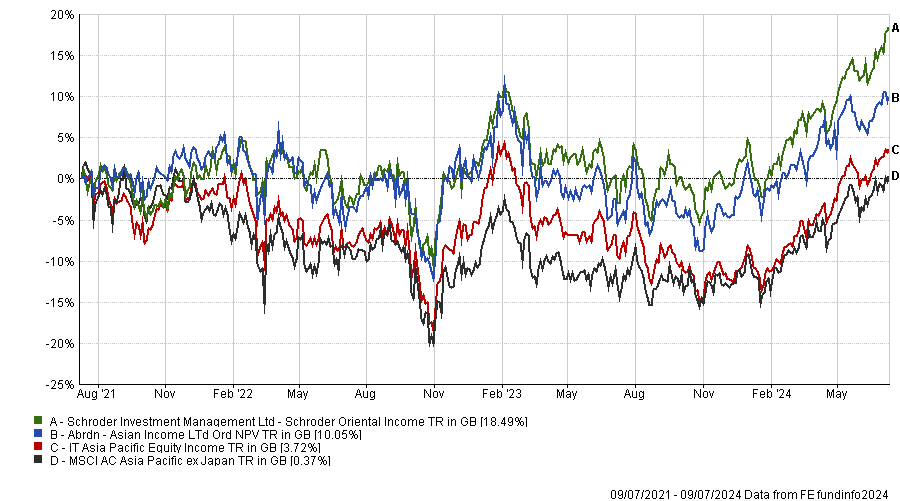

Two Asia Pacific equity income trusts achieved top-quartile returns over three years with a yield above gilts: abrdn Asian Income with a 5.7% yield and Schroder Oriental Income paying out 4.5%. The two trusts have grown their dividends for 15 and 17 consecutive years, respectively.

The abrdn Asian Income trust was trading on a 12.4% discount by 31 May and has a £348m market capitalisation. Richard Sennitt’s £690m Schroder Oriental Income trust sits at a 4.2% discount.

Performance of trusts vs sector and benchmark over 3yrs

Source: FE Analytics

Other equity trusts making the grade included BlackRock Latin America (a 6.4% net yield and a 12.9% discount), BlackRock Frontiers (a 4.4% yield and a 5.9% discount) and Schroders’ International Biotechnology Trust (a 4.5% yield and a 8.7% discount). The latter has committed to paying a 4% dividend from capital reserves.

Meanwhile, the Henderson High Income Trust is a top-quartile performer in the UK Equity & Bond Income sector and has a 6.4% yield. It is trading at a 9.7% discount.

For investors who prioritise income payouts, Henderson Far East Income has a 10.5% yield while the British & American Investment Trust boasts an 9% yield.

Two UK equity trusts paid an income over 7%: Chelverton UK Dividend Trust (7.8%) and abrdn Equity Income Trust (7.4%).

However, all four trusts underperformed their peer groups from a total return perspective over three years, which illustrates the difficulty of achieving both income and growth.

Henderson Far East Income’s performance has struggled, lagging its sector average over three and five years, but it changed hands last autumn when Mike Kerley retired and his colleague Sat Duhra stepped up to become lead manager. Since then, “it’s really picked up”, Hewitt said. “He’s sorted things out and I’m very impressed.”

Performance of trust vs sector over 1yr

Source: FE Analytics

The £376m trust has been consistently boosting its income by writing call options for a decade or more, Hewitt added.

I’ve sold WHR for a profit of £132.00 including the earned dividend.

Mark Peden, Investment Manager, Aegon Asset Management

04 July 2024

Back in 2020, I penned an article titled ‘The Dividend Dilemma’. It was the depths of the Covid-induced market selloff; companies were cutting or suspending dividends left, right and centre; and analysts were predicting big cuts to global dividends from which they would take years to recover. I anticipated a fall of around 30%.

Yet for all the cataclysmic predictions, payouts took just one year to bounce back. 2021 was a record-setting year for global dividends at $1.47 trillion, a mark that was subsequently bettered in 2022 and again in 2023. We have now gone from the dividend dilemma to the dividend deluge and, with 2024 predicted to set yet another record at $1.72 trillion, there are no signs of the momentum fading. In addition, share buyback authorizations are also at all-time highs, meaning the picture is clear – companies are returning record amounts of capital to shareholders.

Exhibit 1: Global total annual dividends are climbing (USD, billions)

Source: Janus Henderson Global Dividend Index Report, as of February 29, 2024

The past few years have seen financial markets affected by bouts of volatility caused by factors such as Covid lockdowns, spiking inflation, historically steep interest rate rises and geopolitical tensions. Through all of this, dividends have reinforced that they are typically much less variable than earnings and can provide an important source of total return, regardless of the market environment. They also have a solid track record of keeping pace with inflation, meaning there was less erosion in real terms than we saw in payouts from most other asset classes during the inflationary spike in 2022 and 2023. All in all, the importance of dividends should not be overlooked.

A focus on quality dividend-paying companies

So where does this leave us now? Deep value areas of the market, characterized by companies with lower-quality earnings and high debt levels had their day in the sun in 2022. Such rallies tend to be sharp but also short-lived, as was illustrated by the strong comeback in growth stocks through 2023. That said, the growth rally has been very narrowly driven by a handful of US-listed, mega-cap, tech-related names known as the ‘Magnificent 7′. We do not see another sharp value rally on the horizon and would question whether the narrow market leadership seen recently can continue over the longer term.

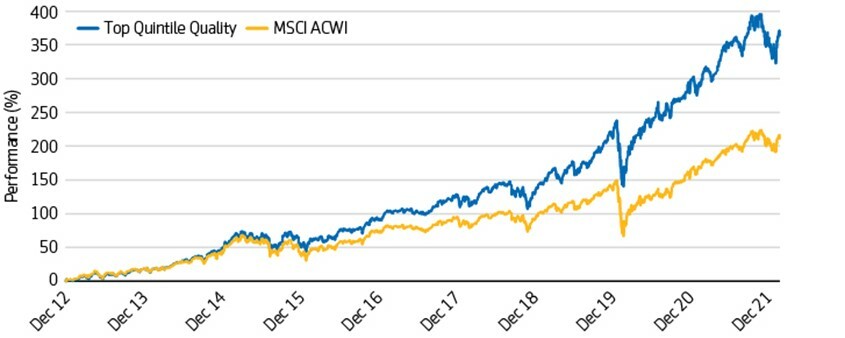

Instead, we believe a focus on ‘quality’ dividend paying companies with strong balance sheets and high returns on equity can be a powerful factor over time. As shown in Exhibit 2, the top quintile of companies, based on quality within the MSCI All Country World Index, has significantly outperformed the wider market over time.

Exhibit 2: Higher-quality companies have historically outperformed

Source: Bloomberg, Aegon AM as of March 31, 2022. Quality is defined by low net debt to EBITDA and high return on equity.

This quality approach will, we believe, be as important as ever in the coming months. Economic growth remains healthy in the US but is more sluggish elsewhere. Inflation has fallen back from recent peaks but the final leg of the journey back to target is proving difficult. Consequently, investors have scaled back their expectations for both the timing and scale of interest rate cuts this year. Add in geopolitical tensions and the looming US presidential election and clearly there is uncertainty out there. We believe well established companies with strong balance sheets, good returns on equity and well covered dividends have the potential to fare well, whichever path the market takes.

Indeed, despite the uncertainty in the market right now, more than 10 companies in a representative global equity income portfolio have increased their dividends by double digit percentages so far this year – well above the rate of inflation. These increases suggest companies are generating plentiful free cash flow and returning it to shareholders, signalling what we believe is a healthy confidence in their financial situation.

A golden period for dividend investing

All of this suggests we may be in a golden period for dividend investing. Companies are returning record amounts of capital to shareholders and are doing so while recording payout ratios that are below long-term averages, meaning these dividends should remain even in the face of slowing growth. In the past several months, we have even seen some members of the Magnificent 7 initiate their first-ever dividends, suggesting dividends are in fashion, even for high-growth companies. While the yields on these companies remain relatively low compared to the wider market, we will monitor developments very closely to see how they progress over time.

Dividend strategies themselves tend to come into their own in more uncertain market environments, where income streams become an even more crucial part of total returns and a lower beta approach may offer some protection from volatility. With equity markets close to all-time highs in many countries and valuations looking fairly full, investors may look to incorporate these characteristics in their portfolios through a dividend focused approach. If nothing else, the shape of global dividends today should provide investors with opportunities going forward.

Passive income text with pin graph chart on business table Provided by The Motley Fool

by Charlie Keough

I’m always looking for ways to generate passive income. And as Warren Buffett once said: “If you don’t find a way to make money while you sleep, you will work until you die.”

Here are some things to consider.

The first thing is to work out where to put my money. And I think the best place to start is the stock market. With rampant inflation leading to base rates around the world reaching attractive levels, including 5.25% in the UK, some investors may opt to leave their money in savings accounts. However, what these savings accounts fail to offer is growth opportunities.

So, if the stock market is where I decide to put my money, what’s next? Well, it’s about selecting the right companies.

For this, I’d use the FTSE 100. The index is the home to high-quality stocks. On top of that, the average dividend yield is around 4%. This year, it’s predicted that it will return £78.7bn to shareholders via dividends.

How To Invest Your Money Effectively

Within the Footsie, I’d also do my due diligence and find stocks that I see providing stable growth in the years ahead. Additionally, finding companies with a solid track record of paying out to such as Dividend Aristocrats, a step I’d take.

Dividend payments can be unstable. And major events such as the global financial crash of 2008, or more recently the pandemic, can lead to these payouts being reduced or stopped altogether. However, selecting businesses with a stable history would provide me with more confidence.

As well as the above, there are a few further factors I’d consider.

On top of that, I’d also think about the bigger picture. When I buy a stock, I don’t think in weeks or months. Instead, I plan to hold it for the years and decades ahead.

So, let’s put this into practice. If I invested £1,000 with an average 7% return, after one year I’d have earned £70 in passive income. While that’s not much, after 30 years, I’d be making closer to £250 a year.

On top of that, by investing an additional £150 a month, by year 30 I’d be making nearly £13,000 a year in passive income. What’s more, my pot would be worth nearly £195,000.

Of course, a 7% return isn’t always guaranteed. However, by doing my research and selecting the right companies, while also topping up my pot and thinking long-term, I’m confident over time I could see some healthy returns.

Royston Wild

by The Motley Fool

The London stock market is a great place to discover top dividend shares. It’s packed with companies with strong records of dividend growth. What’s more, years of share price underperformance also mean many of these offer some staggeringly high dividend yields.

Dividends are never guaranteed. But if broker forecasts are correct, a £25,000 lump sum invested equally across them would provide me with a £1,750 second income over the next 12 months.

I’m confident too these high-yield shares will steadily increase shareholder payouts over the long term. Here’s why I think they might be great buys for dividend investors.

Renewable energy stocks like Greencoat UK Wind have significant earnings potential for long-term investors.

Adverse weather conditions can impact power generation from time to time, putting a drag on revenues. But over an extended time horizon, wind farm operators could enjoy exceptional growth as the world switches from fossil fuels to cleaner energy sources.

Source: Greencoat UK Wind Provided by The Motley Fool

Real estate investment trusts (REITs) can also be a great way to source an income over the long term. They are required to pay a minimum of 90% of their annual rental profits out to shareholders.

Urban Logistics REIT is one I expect to thrive as e-commerce steadily grows. As an operator of storage and distribution hubs, it provides an essential service that allows manufacturers, retailers and delivery companies to get product to online consumers.

In fact, this part of the property market is experiencing a huge shortage. And so like-for-like rents (which grew 19% here last year) look set to continue growing strongly.

High interest rates pose an ongoing problem for its net asset values (NAVs). But on balance, I think Urban Logistics is worth a close look.

Growing political and social turbulence in Georgia threatens to derail the country’s banks like TBC Bank Group.

Financial product penetration’s low in the Eurasian country. And it’s been soaring in recent years as the economy there has boomed.

TBC’s own profits have jumped 111% over the past five years. But it’s performance could slow sharply if turbulence in Georgia continues.

The current cash, after the capital return from ADIG of £3,7333 is £5,855.17. The return has not been included in the Snowball as it’s not a repeatable payment.

The funds are going to be re-invested in the RGL share subscription

59,100 shares at 10p

Now, u don’t need to use a calculator to realise that is short of the entitlement amount but the dividend tomorrow of £331 from RGL will take the Snowball over the line.

The closing date for subscription is the 14th of July.

The Snowball will be overweight with RGL but the intention is still to pay a reduced dividend, so the position will be sold into, overtime.

The subscription shares are trading around 13p but this price may fall after the share consolidation as the newly issued shares find a new home. One option is to sell some shares in the market and replace them with the subscription shares, when issued.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑