Investment Trust Dividends

The 2025 fcast for the Snowball is income of £9,170 and a target of £10,000.

If the fcast is achieved that will be the plan’s fcast for the year ending 2027.

If the target is achieved that would equate to a future income stream in ten years of 20k pa. a yield of 20% on seed capital, if the dividends are re-invested at 7% or above.

RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2024

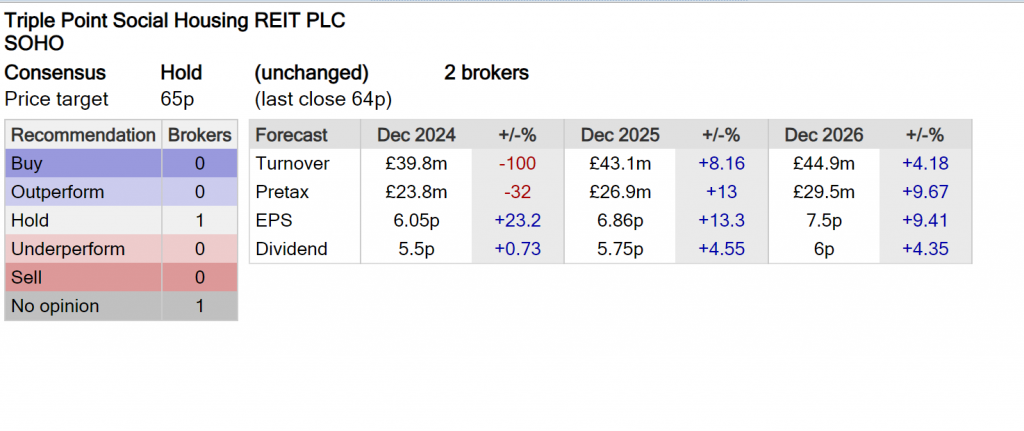

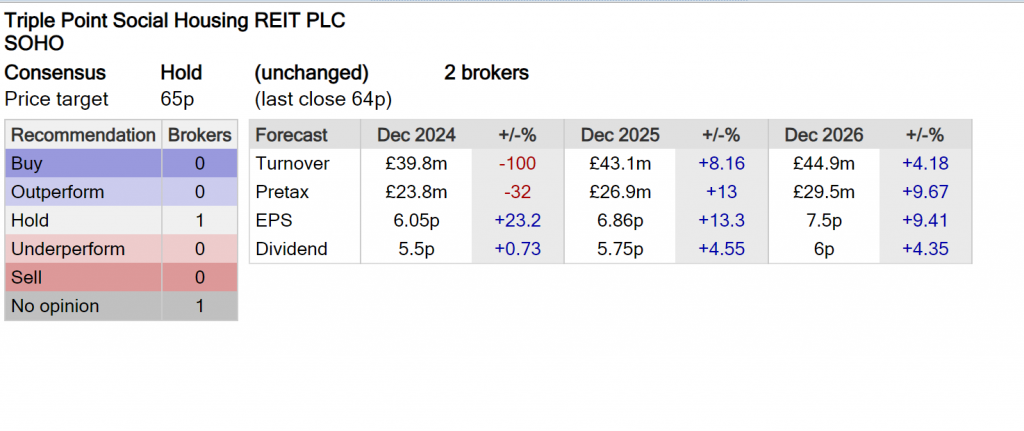

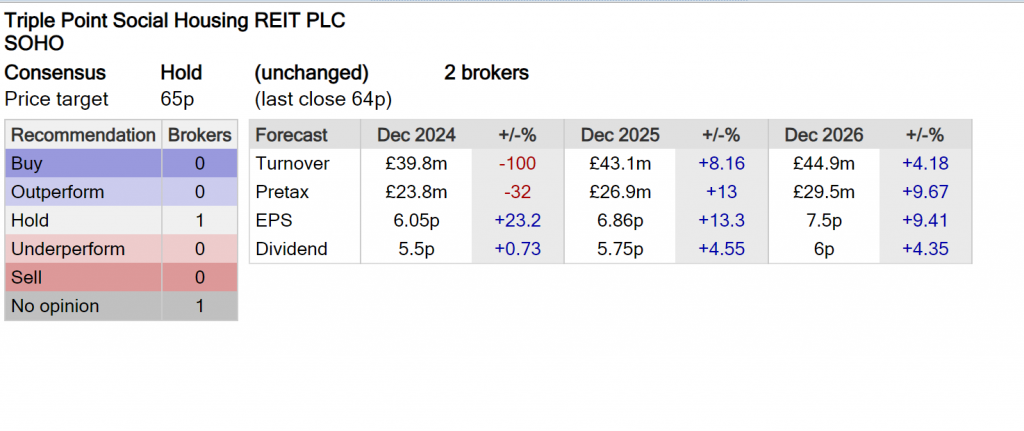

The Board of Triple Point Social Housing REIT plc (ticker: SOHO) is pleased to announce its unaudited results for the six months ended 30 June 2024.

Chris Phillips, Chair of Triple Point Social Housing REIT plc, commented:

“The Company’s portfolio has continued to demonstrate operational and financial resilience and the Group has benefited from strong rental growth that has increased income.

The Group will continue to benefit from having exclusively long term fixed priced debt and we look forward to building on the progress made in the first half of the year particularly in relation to the increase in rent collection and the corresponding increase in dividend cover, which ensured that the dividend was fully covered on an adjusted earnings basis for the six months ending 30 June 2024.”

Triple Point Social Housing REIT plc

(the “Company” or, together with its subsidiaries, the “Group“)

DIVIDEND DECLARATION

The Board of Directors of Triple Point Social Housing REIT plc (ticker: SOHO) has declared an interim dividend in respect of the period from 1 April 2024 to 30 June 2024 of 1.365 pence per Ordinary Share, payable on or around 4 October 2024 to holders of Ordinary Shares on the register on 20 September 2024. The ex-dividend date will be 19 September 2024.

The dividend will be paid as a Property Income Distribution (“PID”).

The Company is targeting an aggregate dividend of 5.46 pence per Ordinary Share for the financial year ending 31 December 2024.

First graph showing dividends earned but not re-invested.

Second graph if the dividends were re-invested thru thick and thin, there will always be plenty of thin.

Note the yield on the FTSE100 is a variable 4%.

The snowball currently has £1,145 xd.

The next dividend payments aren’t until another 2 weeks.

The Snowball is still waiting for SOHO to declare their next dividend, after which the fcast and the target for 2025 can be announced.

GL

ANNOUNCEMENT OF NAV AND QUARTERLY DIVIDEND

Portfolio valuation increase and asset management initiatives underpin positive total return and fully covered dividend

Schroder European Real Estate Investment Trust plc, the company investing in European growth cities and regions, provides a business update and announces its unaudited quarterly dividend and net asset value (“NAV”) as at 30 June 2024.

– Third quarterly interim dividend of 1.48 euro cps declared, fully covered by EPRA earnings, reflecting an annualised dividend yield of c.7.6% based on the current share price1;

– Underlying adjusted quarterly earnings from operational activities (“EPRA earnings”) of €2.0m (quarter ended 30 June 2023: €2.1 million)

– Total interim dividends declared relating to the nine months of the current financial year of 4.44 euro cps, 106% covered by EPRA earnings;

– The direct property portfolio was independently valued at €208.3 million2, reflecting a marginal like-for-like increase over the quarter of 0.1% (31 March 2024: -1.0%), or €0.2 million, demonstrating valuation resilience and signalling improving sentiment as a result of falling interest rates;

– Unaudited NAV of €164.0 million, or 122.6 euro cents per share (“cps”) as at 30 June 2024 (31 March 2024: €165.3 million, or 123.6 euro cps), driven primarily by a small property valuation increase, offset by capital expenditure and deferred taxes;

– NAV total return of 0.4% for the quarter and -0.9% over the nine months of the current financial year;

– The Company remains well positioned with a strong balance sheet, an available cash balance of approximately €26 million, and a loan to value ratio (“LTV”) of 25% net of cash and 33% gross of cash;

– Two lease re-gears, totalling 2,242 sqm, completed at the Frankfurt grocery investment, securing long-term income from high profile tenants and increasing the unexpired lease term to break by over eight years:

o a 1,641 sqm 15-year lease extension (from 2027 to 2042) with anchor tenant Lidl; and

o an 8-year lease extension (from 2029 to 2037) with pet specialist, Fressnapf, for 601 sqm

The net-zero transition using renewable energy is proving counterproductive for Britain. Is the sector still worth investing in?

(Image credit: Getty Images)

By Max King

last updated 10 September 2024

While the government seeks to accelerate Britain’s drive to “net zero” through the increased adoption of renewable energy, the private sector is going in the opposite direction. Since the middle of 2023, The Renewables Infrastructure Group (TRIG) has sold £210m of assets at an average premium to book value of 11%.

Admittedly, most of these assets were in Ireland and Germany but it is notable that the proceeds are not being reinvested in the UK but used to reduce borrowings and initiate a £50m share buyback programme. With TRIG’s shares trading at a 21% discount to net asset value (NAV), this makes sense.

Greencoat UK Wind, trading at a 9% discount, is also prioritising buybacks over investment. It launched a £100m buyback programme last autumn and expects to have £1bn of surplus cash flow in the next five years, based on its current power price forecasts. With borrowings of £2.3bn, it is likely to focus on debt reduction over buybacks.

Try 6 free issues, then save an extra 10% on a Print + Digital subscription. Plus get a free financial eBook (worth £18.75).

Foresight Solar, whose shares trade at a discount of 23%, is also buying back shares, though with borrowings equivalent to 65% of net assets, debt reduction is the priority. It has stopped making new investments and announced a disposal programme. Bluefield Solar, trading on a 19% discount, has also been selling assets to reduce debt and finance new projects.

With combined assets of more than £10bn, these are not small companies. The story in the rest of the sector is the same – shares trade at significant discounts to NAV, making the raising of new capital impossible. Share buybacks and the reduction of debt are a priority, as are asset sales to speed the strategy along.

No wonder the UK Offshore Wind auction last September failed, securing no bids at all – the previous government set an ambitious price cap of £44 per megawatt-hour (MWh). This was similar to the price set in the previous auction but, since then, inflation has increasedcosts significantly. Industry experts estimated a price of £60 per MWh would be necessary for any bid to be viable, and the government responded with an increase in the maximum price at the next auction to £73.

That, though, is above the current wholesale price of electricity and takes no account of the cost of the intermittency of renewable generation. If the new government conducted an auction on this basis the cost of electricity would rise, yet the Labour Party is committed to “cutting household energy bills by up to £1,400 a year and saving businesses £53bn by 2030”. So where will “the clean and cheap power” it has promised come from?

Not from onshore wind generation – the turbines are too small and onshore arrays lack the huge scale of offshore. The new National Wealth Fund and GB Energy, funded with borrowed money, are supposed to “unlock critical investment in key UK infrastructure” by “co-investing with the private sector in larger projects such as onshore wind and solar farms”. Presumably, the government is looking to the big pension funds for this investment but they are unlikely to find economies the listed funds can’t. And a liberal sprinkling of honours is unlikely to tempt them into investments with low returns.

Even if the additional investment was forthcoming, whether from the private sector or the new public bodies, the result would be a glut of electricity when weather conditions were favourable – and hence very low prices – while shortages and very high prices would persist at other times.

This would undermine existing providers of renewable energy, added to which the government’s wary tolerance of the private sector, while it is hoping for investment, could be replaced by hostility if, as is likely, investment is not forthcoming.

On attractive discounts to NAV and with dividend yields above 7%, the investment funds specialising in renewables in the UK are superficially attractive, especially now they are focused on efficient operation, cash generation and enhancing shareholder value rather than expansion. Still, the political risks are significant, so investors should hold off.

by Christopher Ruane

I’d build passive income streams the same way Warren Buffett does.

Buffett looks for passive income in obvious places.

Most of his shareholdings are in large, well-known and long-established companies.

A lot of far less successful investors spend ages trying to find little-known firms they think could yet take the world by storm. Buffett, by contrast, is happy to buy shares in businesses that have already proven their business model and staying power over the course of decades.

Take his holding in Coca-Cola (NYSE: KO) as an example. Buffett started buying into the company back in 1987 and completed his stake-building in 1994.

When he started buying those shares, Coca-Cola had been listed on the New York Stock Exchange for 68 years. It had already raised its dividend annually for over two d (and has continued to do so ever since Buffett invested).

So the Sage of Omaha was not looking for ‘the next big thing’. He was buying into an existing big thing. Today his company, Berkshire Hathaway, earns over $700m annually in Coca-Cola dividends. That is over half of what it paid in total for the entire stake.

With a large customer base, proprietary brands and strong pricing power, Coca-Cola is a classic Buffett pick. It faces risks, such as increasing concern about sugary drinks leading many consumers to prefer healthier alternatives. But, for now at least, the sweetest thing about Buffett’s long-term Coca-Cola stake is its incredible financial rewards.

Is it an accident that those rewards have built over the course of decades? No.

Warren Buffett is the epitome of a long-term investor. He s that if someone would not be willing to own a share for 10 years, they should not even consider owning it for 10 minutes.

As the old saying goes, over the long term, “quality in, quality out”

Although Warren Buffett has not bought more Coca-Cola shares since 1994, he has not used the massive dividend streams to pay dividends to his own Berkshire shareholders.

Instead, like all of Berkshire’s earnings, he has retained them to use in other ways, from buying different shares to taking over whole businesses.

Reinvesting dividends is known as compounding.

From a passive income perspective, it has pros and cons. If I want passive income now, compounding my dividends might not be a good idea.

But if I am willing to forego some or all passive income from my portfolio now, compounding could be a smart way to try and build even bigger income streams in future – just like Warren Buffett!

| Best performing funds in price terms | (%) |

|---|---|

| PRS REIT | 15.4 |

| Triple Point Social Housing REIT | 8.4 |

| Safestore Holdings | 7.2 |

| Residential Secure Income | 6.4 |

| Capital & Regional | 5.8 |

| Primary Health Properties | 4.8 |

| CLS Holdings | 4.5 |

| Big Yellow Group | 4.3 |

| IWG | 4.2 |

| Sirius Real Estate | 3.9 |

Source: Bloomberg, Marten & Co

The customary summer lull in activity in the real estate sector was evident during August, with news flow at a trickle. This was mirrored in share prices, with the average movement over the month of +0.3%. Once again corporate activity was the main driver behind the largest share price outlier, this month PRS REIT. Its share price bounced at the end of the month as shareholders requisitioned the board calling for two directors, including the chairman, to be replaced (see page 3 for more details). The share price of Triple Point Social Housing REIT responded positively to its board’s announcement that it was making progress with its investment manager review and the news that the fund had replaced a struggling tenant in rental arrears. Residential Secure Income was perhaps boosted by the new Labour government’s ambitious house building target, which is set to provide a substantial tailwind for the affordable housing sector in which it operates. Capital & Regional continues to be the subject of takeover talks, with two parties running the numbers on the company. Meanwhile, Primary Health Properties saw an uptick in its share price perhaps on hopes that a new health secretary will ease the bottleneck in primary health centre development.

| Worst performing funds in price terms | (%) |

|---|---|

| Grit Real Estate Income Group | (8.8) |

| NewRiver REIT | (5.4) |

| SEGRO | (4.9) |

| Ground Rent Income Fund | (4.5) |

| Great Portland Estates | (3.9) |

| Helical | (3.8) |

| Shaftesbury Capital | (3.5) |

| Urban Logistics REIT | (3.2) |

| Panther Securities | (3.2) |

| Real Estate Investors | (2.9) |

Source: Bloomberg, Marten & Co

Some real estate heavyweights suffered share price losses in August despite the interest rate cut at the start of the month. The largest negative share price movers in the month, however, was led by pan-African investor and developer Grit Real Estate, with shareholders yet to get behind its renewed strategy focused on diplomatic housing development. With takeover negotiations for Capital & Regional seemingly progressing well, NewRiver REIT’s share price fell perhaps due to the effects of merger arbitrage trades. SEGRO, the largest UK listed real estate company by some margin with a market cap of around £12bn, saw its share price fall almost 5% and it is now negative in the year to date. London office developer

Great Portland Estates and West End landlord

Shaftesbury Capital – both stalwarts of the FTSE 250 index – also suffered share price erosion during the month as positive momentum over interest rate cuts was not maintained. Ground Rents Income Fund continued its run of share price losses as it stumbles towards a difficult wind down. The value of its portfolio continues to be negatively impacted by reforms in the leasehold sector. Another FTSE 250 constituent, Urban Logistics REIT, suffered a 3.2% fall as the market awaits positive updates on earnings growth.

| Company | Sector | NAV move (%) | Period | Comments |

|---|---|---|---|---|

| Target Healthcare REIT | Healthcare | 1.6 | Quarter to 30 June 24 | Portfolio valued at £908.5m, up 0.8% like-for-like |

| Alternative Income REIT | Diversified | 0.4 | Quarter to 30 June 24 | Property values increased 0.1% to £102.7m |

| Custodian Property Income REIT | Diversified | (0.3) | Quarter to 30 June 24 | Portfolio value of £579.6m remained flat on a like-for-like basis |

| Residential Secure Income | Residential | (0.6) | Quarter to 30 June 24 | 0.4% decrease in like-for-like investment property values to £315m |

| abrdn Property Income Trust | Diversified | (4.1) | Quarter to 30 June 24 | Portfolio value down 0.5% to £405.5m. NAV impacted by estimated costs of wind down |

| abrdn European Logistics Income | Europe | (4.3) | Quarter to 30 June 24 | Portfolio valuation increased 0.2% to €607.4m. NAV impacted by cost of managed wind down |

| Impact Healthcare REIT | Healthcare | 2.6 | Half year to 30 June 24 | Like-for-like property values increased 2.9% to £670.1m |

| Empiric Student Property | Student accommodation | 1.7 | Half year to 30 June 24 | Portfolio valuation increased to £1,134.9m reflecting a 1.3% net like-for-like increase |

| Tritax Big Box REIT | Logistics | 1.2 | Half year to 30 June 24 | Portfolio now valued at £6.4bn following M&A activity. Up 0.7% on like-for-like basis |

| Derwent London | Offices | (2.7) | Half year to 30 June 24 | Portfolio valued at £4.8bn, an underlying decrease in value of 1.7% |

| Capital & Regional | Retail | (3.4) | Half year to 30 June 24 | 0.8% increase in like-for-like valuations over to £374.9 m |

| CLS Holdings | Offices | (10.1) | Half year to 30 June 24 | Portfolio valuation down 4.1% to £1,910.4m |

Source: Marten & C

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑