US equity fund pairings for bull and bear markets

10 September 2024

Fund selectors pair up offensive and defensive managers investing in the US.

Emma Wallis

News editor, Trustnet

The US equity market has grown increasingly volatile, especially in the past couple of months. Questions have been raised over the likelihood of a recession and whether the ‘Magnificent Seven’ US stocks are coming off the boil, while the forthcoming presidential election augurs badly for investors who prefer certainty.

Yet the US has been the strongest regional equity market over the past decade, presenting investors with a conundrum: how can they hedge against downside risk without missing out on further potential gains?

One solution would be to choose a combination of strategies, pairing a defensively positioned fund with a growth-seeking strategy. To that end, Trustnet asked fund selectors to suggest pairs of US equity funds that complement each other and thrive in different market environments.

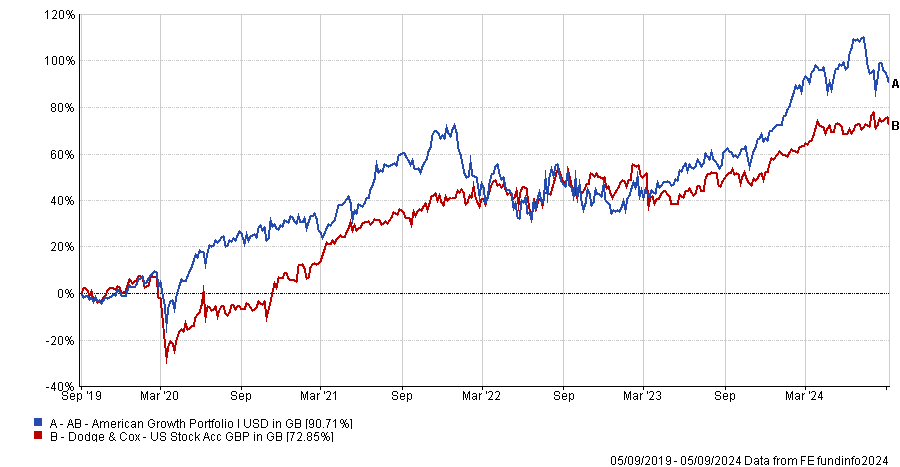

AB American Growth and Dodge & Cox US Stock

Invesco’s model portfolio service owns AB American Growth and the Dodge & Cox US Stock fund, said co-manager David Aujla. The former is a large-cap growth fund with significant positions in technology and durable growth companies, while the latter is a large-cap, value-oriented fund with “greater exposure to companies that could be described as more economically sensitive,” he said.

“Together this fund pair provides the portfolio with the potential ability to participate in US equity market performance whether it be a more momentum-led market or a valuation-led market. And we hope that over time the experience should be smoother as a result.”

Performance of funds over 5yrs

Source: FE Analytics

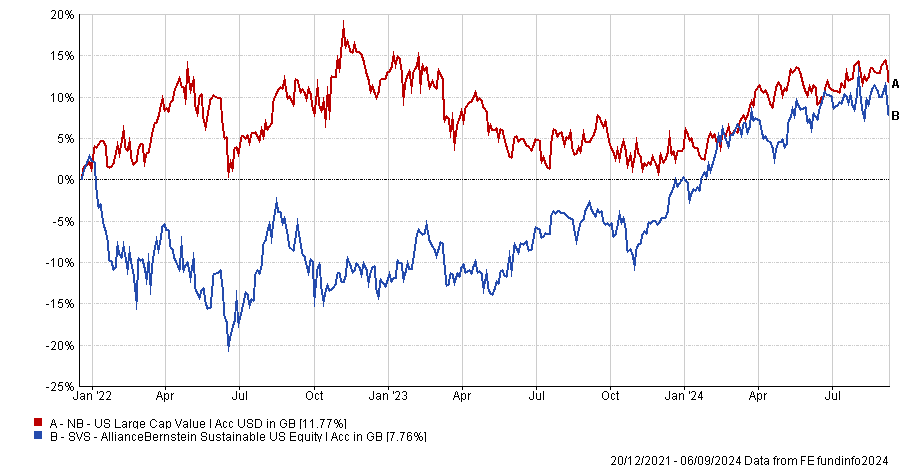

Alliance Bernstein Sustainable US and Neuberger Berman US Large Cap Value

Schroder Investment Solutions has changed its line-up of US funds to make its portfolios more conservative, adding funds that own attractively valued companies with good fundamentals.

Portfolio manager Rob Starkey said Schroders used Dodge & Cox as its US value manager until October 2022 but switched to NB US Large Cap Value, which has larger allocations to defensive sectors such as consumer staples.

“The intention was to allocate capital to a manager that would vary its exposure to higher quality stocks depending on the environment,” he explained. Schroders’ model portfolios now have “a value tilt in the American allocation to reflect the risk/reward opportunity set”.

On the growth side, Schroders rotated out of Brown Advisory US Sustainable

Growth into AllianceBernstein Sustainable US in the first quarter of last year.

“Brown Advisory, despite having similar metrics at the time in terms of quality long-term earnings growth, was a much higher valued strategy, so we wanted to shift to something that had less of a valuation risk while keeping those overall growth and quality metrics,” Starkey explained.

Performance of funds since NB US Large Cap Value’s inception

Source: FE Analytics

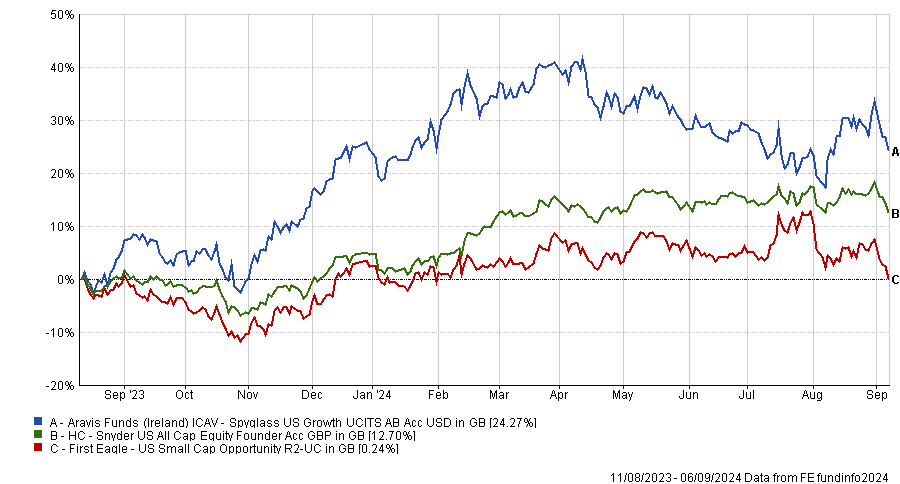

First Eagle US Small Cap Opportunity, Spyglass US Growth and Snyder US All Cap Equity

Downing has paired up two aggressive funds whose investment styles offset each other: First Eagle US Small Cap Opportunity and Spyglass US Growth.

Fund manager Simon Evan-Cook said these two strategies “might well be the most aggressive funds in the sector”.

Most US small-cap funds buy companies that would be considered mid-caps if they were listed in the UK, but First Eagle’s Bill Hench invests in minnows that would be considered small-caps on this side of the Atlantic as well.

“He is a proper deep value manager”, said Evan-Cook. Hench’s philosophy is that if 10% of his holdings don’t go bust in any given year, “he’s probably not taking enough risk”. On the flip side, three out of every 10 investments will probably multiply tenfold.

The fund is highly diversified and geared into the US economic cycle so if the economy performs well it should deliver outsized returns, Evan-Cook explained.

Jim Robillard, chief investment officer of Spyglass Capital Management in San Francisco, operates at the other extreme of the style spectrum. He is looking for small and mid-cap growth companies that are “in the right place at the right time with the right tech to become five times bigger over the next five years”, Evan-Cook said. Robillard is “valuation aware”, unlike some high-growth investors.

With fewer assets under management, Spyglass can invest in small, growing companies, while its proximity to San Francisco close to many start-ups is also advantageous.

Performance of funds since First Eagle US Small Cap Opportunity’s inception

Source: FE Analytics

For a more conservative play, Evan-Cook highlighted Snyder US All Cap Equity. It invests in the highest quality companies in the US with strong competitive advantages, balance sheets, brands and management teams, but the firm also has a tight valuation discipline.

Evan-Cook compared the strategy to a Venn diagram with two circles encompassing the best companies and the cheapest companies in the US. Snyder is “trying to find that tiny little spot where the two circles cross over,” he said.

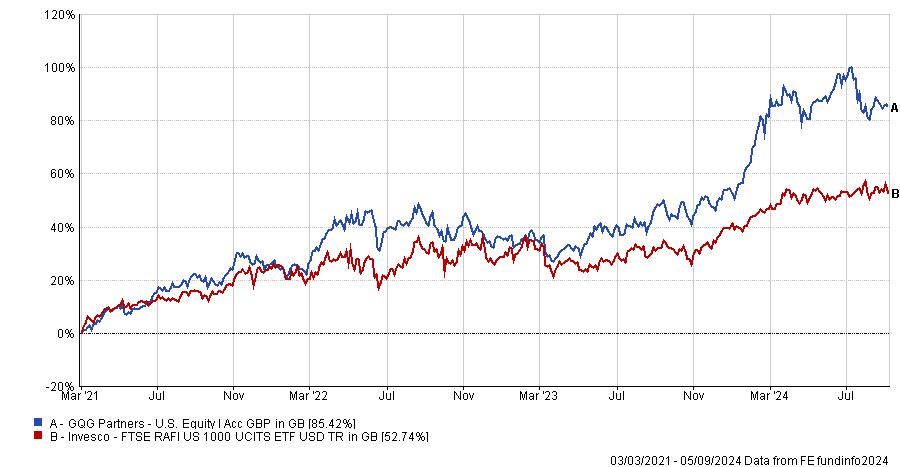

GQG Partners US Equity and Invesco FTSE RAFI US 1000 UCITS ETF

GQG Partners US Equity is a best ideas portfolio of 28 stocks managed by three FE fundinfo Alpha Managers – Rajiv Jain, Brian Kersmanc and Sudarshan Murthy – and it features on Bestinvest’s Best Funds List.

Jason Hollands, managing director of Bestinvest, said: “The approach is highly flexible and the managers do not shy away from making significant calls, which means relatively high turnover.

“For example, the managers significantly reduced tech exposure in May 2023. Part of their research approach is to use people with backgrounds in investigative journalism, which had helped them notice that job openings in tech were slowing, which they saw as a warning sign.”

Although he picked this fund for investors who are bullish on US equities, “the managers are very focused on downside protection,” he pointed out.

By contrast, the Invesco FTSE RAFI US 1000 UCITS ETF might suit investors worried about “frothy tech valuations” who want to diversify away from the S&P 500.

This exchange-traded fund (ETF) differs from market capitalisation-weighted trackers because it allocates to the 1,000 largest US stocks based on four fundamental factors: sales, cash flow, book value and average total dividends over five years.

“The outcome is broad exposure to the US market but with a tilt towards companies with attractive valuations and lower exposure to more speculative businesses,” Hollands explained.

In 2021, when the NASDAQ index plunged 24% and the S&P 500 was down 7.8%, the fund eked out a 1.8% return.

Performance of funds since GQG Partners US Equity’s inception

Source: FE Analytics