The Tip Sheet

Tempus questions whether it’s worth investing in China after Fidelity China Special Situations shares gained 30%, fueled by stimulus measures. Despite concerns over stimulus-driven rallies, Tempus sees value in FCSS’s focus on small and mid-caps, fee reductions, and a share discount. Meanwhile, Questor rates Apax Global Alpha a buy as it trades at a 35% discount.

By

Frank Buhagiar

22 Oct, 2024

Tempus – Is now the time to invest in China?

Shares in Fidelity China Special Situations (FCSS) have been on something of a tear in recent weeks. Soaring Chinese stock markets and improving sentiment on the back of a series of stimulus measures from the authorities designed to revive the economy saw FCSS shares put on 30% in just four weeks. But after such a strong run, The Times asks the question, is this the beginning or the end?

The problem with stimulus-induced rallies is that markets invariably want more. So, when there is a pause in new measures and policies, investors can be tempted to take profits – cue a 7% drop in the Shanghai Composite index and blue-chip CSI 300 on Wednesday 9 October. As Tempus writes “the fear is that the sugar rush will end as quickly as it came.” But, as the article points out, “the country still accounts for 19 per cent of the global economy, and for some investors it may simply be too big to ignore.”

And if that’s the case, then, according to Tempus, FCSS could be worth considering. The fund was launched in 2010 and primarily invests in small and mid-caps, as well as unlisted businesses – around 29% is invested in mid-caps (£1 billion to £5 billion market caps), 34% in small-caps (sub £1 billion market caps) and a further 10% in private companies. FCSS, no stock market tracker then. Throw in the fund’s scale – the asset base stands at £1.2 billion after FCSS took on abrdn China earlier this year; the prospect of lower fees – FCSS has guided for a lower ongoing charge figure; and the shares trading at a double-digit discount to net assets and Tempus believes “there is still value to be captured.” Seems this could well be just the beginning.

Questor – Private equity at a discount

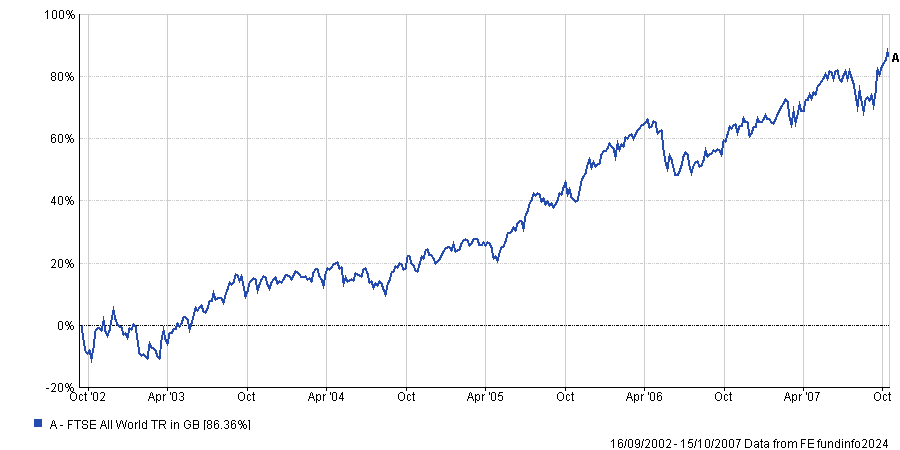

Apax Global Alpha’s (APAX) investment managers aim to spot “hidden gems”, or attractive businesses that the UK private equity investor can then go on to help become better companies by implementing organisational/operational improvements. But, according to Questor, APAX itself is something of a hidden gem in need of “some spit and polish of its own after a slump in performance.” For over the past five years, the £690m investment company has only managed an 18% total shareholder return compared to the 34%-145% generated by 10 other London-listed funds over the same period.

The Telegraph tipster points the finger at APAX’s listed holdings – the fund is able to invest up to a quarter of assets in listed companies. So, when stock markets fell on the back of higher inflation and interest rates, the fund took a hit – the shares are off 38% from a peak of 227p in December 2021. At the time of the article, the shares were trading at 137p, a 35%+ discount to net assets.

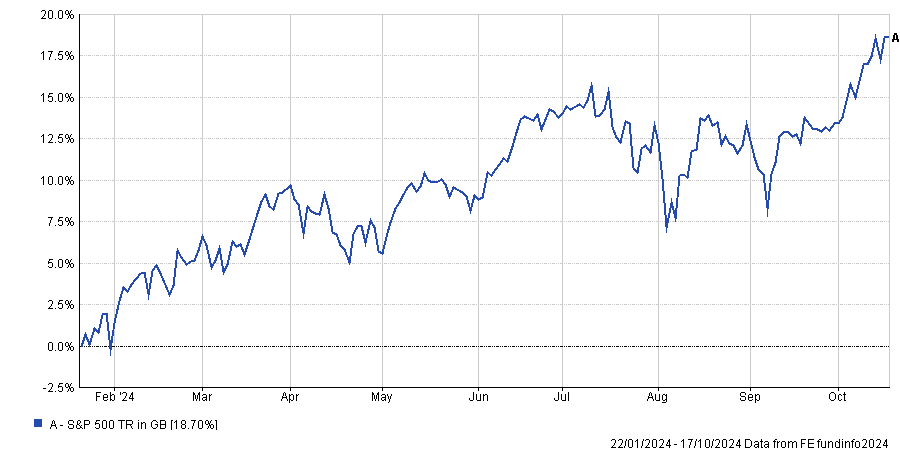

Action is being taken. Listed companies exposure has been cut to 7%. Apax’s former Investment Manager, Karl Sternberg, has been appointed as the fund’s new chair and is “laser focused” on improving shareholder returns – already €30m (£25m) has gone into a “distribution pool” to fund share buy backs and/or special dividends. Dividends too are to be fixed at 11p per share which, at current share prices, delivers an 8% yield, the highest among its peers. With APAX ringing the changes, the fund appears to be practising what it preaches. Along with expected changes to cost disclosure rules that will enable APAX to list its annual ongoing charges at the actual 1.8% as opposed to the 4.3% it has to disclose under the existing rules, enough there for Questor to rate the fund a buy.