Investment Trust Dividends

The rules for investing do not change no matter how disruptive or unpredictable the president is Tom Stevenson.

Related Topics

23 January 2025 10:00am GMT

Donald Trump’s modus operandi is to move fast and break things. That’s not necessarily a bad thing. Some things need disrupting and unpredictability can keep us on our toes. On the evidence of the first few days of Trump 2.0, the next four years will be a wild ride.

But investors should not make the same mistake as they did in 2017. We may not know where the new president’s attention will alight next but we do know that he sees the stock market as a barometer of his success. It may not look like it at times, but when it comes to managing our money, we’re on the same side.

It’s sometimes said that markets hate uncertainty. That’s not true. Markets neither like nor dislike the chaos that can be created by mavericks such as Trump. They simply respond to it – often excessively – in both directions. The ups and downs of the market are the price investors pay for the long-run outperformance of shares. Volatility is another word for opportunity. Our mistake is to think it’s the same thing as risk.

Investing in a perpetual state of uncertainty is the investor’s lot. So how can we manage our way through the next four unpredictable years? Here’s my plan.

The first thing to realise is that second-guessing the president is a mug’s game. He probably doesn’t know himself what he’s going to say or do. So trying to anticipate any particular outcome is pointless. If we are not wrong, we will be right but at the wrong time, which is just as bad.

In the wake of the Normandy landings, Eisenhower admitted that the D-Day plans were largely worthless. But he went on to say that planning, however, had won the war. We may not be able to predict the details of what the next presidential term holds in store but we can prepare. The two are not the same thing.

Warren Buffett has a “too hard” box on his desk. We can learn from this the importance of accepting the limits of our knowledge. We are wise not to move outside the boundary of our circle of competence. In the context of Trump, that might mean not trying to guess whether tariffs will be inflationary or deflationary. The answer is plausibly both, perhaps inflationary for a while and then deflationary in due course.

It certainly means not having a view on whether the dollar will be stronger or weaker in the long run. It suggests not trying to understand what the markets are telling us. They don’t know either.

If we don’t know what’s going to happen, we have even less idea of when. Timing changes in the market is another fool’s errand for investors. Since the 1920s, the US stock market has returned around 12pc a year. But that actual return has probably only been delivered on a handful of occasions. The dispersion around this average is wide, with annual falls and rises of as much as 50pc.

What makes things even harder to predict is the concentration of returns. A handful of days’ exceptional performance is responsible for a big proportion of the overall return. Miss these and you will struggle to keep pace with the market. And it is very easy to miss the best days because they are very often adjacent to the worst ones and occur when the outlook is most unpromising. Good luck anticipating them.

The good news is that good or lucky timing is helpful but not essential. As I noted last week, when looking at lessons from the Covid years, time in the market is more important than timing the market. Even if you had invested just before the pandemic plunge, you are safely above water now, five years on.

The third part of my Trump plan is to understand what I need financially and when. It really matters whether you will need to access your savings in the next few years or not for another couple of decades. If, as I am, you are close to or at retirement age then the answer is probably a bit of both. I need a buffer so that, if the market takes a plunge, I can take it in my stride. While I’m still working, my salary covers that off.

But when I stop, I will want at least a couple of years’ living costs, maybe more, in highly liquid assets such as cash or short-term securities. That way I won’t do anything silly with the greater part of my savings that I don’t need to touch for years to come.

A fourth strategy to rebalance regularly, not frequently. Once I’m happy with my long-term asset allocation, I will periodically revert to it. That way, I will benefit from the market’s inefficiency. Shares are more volatile than either corporate earnings or GDP. Rebalancing allows me to top up on investments that have fallen behind and trim those that have become over-priced.

Humans run in packs and the temptation is to stick with what’s popular even as the investment case for doing so is fading. Rebalancing is a simple, mechanistic way of introducing discipline into our portfolios. We all invest better when guided by rules, not gut instinct.

Finally, I intend to play to my strengths. My retirement fund has an investment committee of one. I’m not mandated to hold anything that keeps me up at night. That means there’s only one person to blame, too. And whatever he does or says, that person is not Donald J Trump.

Infrastructure

The small size of Downing Renewables & Infrastructure (DORE) has held the trust back and lost it its place on the Winterflood buy list.

The £140m trust has been replaced by sector behemoth 3i Infrastructure (3IN), which has a huge £2.9bn market cap and invests in ‘core-plus infrastructure assets’ across four ‘megatrends’: energy transition, digitalisation, renewing essential infrastructure, and demographic change.

The discount has widened substantially in the past year, from 8% at the start of 2024 to a current level of 17%, despite a pick-up in private deals.

Bird said the track record was ‘excellent’, despite the rising cost of capital, with the NAV increasing 85% over five years, versus 37% for the S&P Global Infrastructure index. Although, remarkably, the shares have only managed a 28% rise, giving rise to the discount.

She said managers Scott Moseley, Bernardo Sottomayor, and Rob Collins have ‘proven their ability to exploit value-accretive capex opportunities’.

Since 2016, the fund has achieved a 37% average uplift on the realisation of its assets, and this trend continued in 2024, with it receiving a binding offer for its 33% stake in renewable energy operator Valorem at a 15% uplift to the last valuation.

‘The fund’s track record of disposing assets at a premium… leads us to question the sustainability of the fund’s discount, particularly given the robustness of earnings growth within the portfolio, and the abundance of dry powder in private markets,’ said Bird.

Property

A ‘considerable rerating’ for Schroder Real Estate (SREI) saw it rotated off the buy list and replaced by Custodian Property Income (CREI), which is trading at a wider discount.

Shares in the portfolio are currently sitting at a 23.2% discount to NAV, making it more attractive to Bird than the Schroder trust, which is at a discount of 18.9%.

Custodian is now the largest diversified UK commercial property trust in the market with a market cap of £321m following a spate of corporate activity last year.

‘This, combined with the focus on smaller lot sizes, means the portfolio is well diversified, reducing asset- and tenant-specific risk,’ said Bird.

Targeting smaller properties also provides a ‘yield advantage’ given the assets are off the radar of most peers.

‘This supports Custodian’s attractive prospective dividend yield of at least 8.2%, which is fully covered by earnings, and the fund has increased its annual dividend each year since 2021, following a cut in response to the Covid pandemic,’ said Bird.

It has delivered a NAV increase of 16.6%, or 3.1% annualised, in total return terms over the five years to the end of September, outperforming the 1.2% annual return from the MSCI UK Property index. Bird believes the outperformance will continue given its asset management skills and sales at a premium to book value.

Supermarket Income (SUPR) was also added to the list as a ‘buy’ given its specialist exposure and ‘supportive fundamentals’.

The £823m trust buys up ‘omnichannel’ stores – which are used not just as grocery stores but also fulfilment hubs for online orders – meaning it ‘benefits from the structural trend of e-commerce growth’.

‘These supportive fundamentals ensure affordability of rents for the fund’s tenants, as well as driving market rental growth, particularly for omnichannel stores,’ said Bird.

The trust enjoys a 100% rent collection rate and a fully covered dividend, which has been increased every year since launch in 2017, helped by the fact that 80% of the rental contracts are inflation-linked.

‘Supermarket’s current discount of 24%… offers significant value relative to history,’ said Bird.

‘We think that there is scope for a rerating, given the stabilising underlying valuations, supported by a more benign interest rate environment, with the fund’s relatively large size… making it a likely beneficiary of an improvement in sentiment towards property as an asset class.’

1

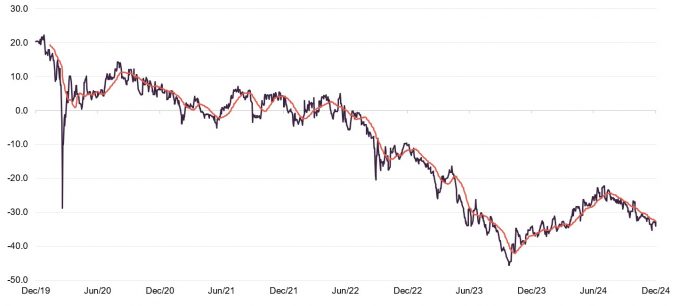

Despite having many attractive features, NextEnergy Solar Fund (NESF) has seen its share price derate significantly during the last two years (driven largely by macroeconomic headwinds, such as the impact of higher interest rates on income-producing assets, which has affected the whole renewable energy sector and has been a factor again very recently). A hefty and, in our view irrational, discount to net asset value (NAV) has opened up, bringing with it significant yield expansion – NESF now has the second-highest dividend y in the FTSE 350 – despite its dividend being 1.3x cash-covered during its financial year ended 31 March 2024 (FY2024), with a coverage target of 1.1x – 1.3x for the year ending 31 March 2025 (FY2025) on a higher target dividend.

NESF has been making progress with its capital recycling programme (a strategy that involves selling assets and reinvesting the proceeds into higher-returning opportunities) (see page 8), with the proceeds used to reduce debt and share repurchases that, at current discount to NAV levels, are very NAV-accretive. The final phase for 100MW of assets could prove transformational.

NESF aims to provide its shareholders with attractive risk-adjusted returns, principally in the form of regular dividends, by investing in a diversified portfolio of primarily UK-based solar energy infrastructure and complementary energy storage assets. Since its initial public offering (IPO), NESF has paid £370m of ordinary dividends – roughly its market cap – highlighting its strength as a total return play.

There has been a clear impact on NESF’s discount, which has widened in response to rising interest rates. Recent figures have shown inflation, while much reduced over the last couple of years, to be more stubborn than was expected even in the middle of last year. This has, at the margin, extended the higher interest rates for longer narrative, which has weighed on the discounts of all of the renewable energy funds, NESF included – leaving them all close to or at long-term discount highs.

Source: Morningstar, Marten & Co

The end-September NAV was 97.8p – down from 101.3p as at the end of June, 107.3p at end March 2024 and 107.7p as at end December 2023. On the positive side, time value, the sale of Whitecross, share buybacks and the revaluation of NextPower III added 7.7p, 0.6p, 0.2p and 0.1p respectively. NESF’s weighted average discount rate stands at 8.1%, having moved up by 0.1% for 31 March 2024 valuation.

Source: Morningstar, Marten & Co

| Year ended | Share price total return (%) | NAV total return (%) | Earnings per share1 (pence) | Dividend per share (pence) | Cash dividend cover (x) |

|---|---|---|---|---|---|

| 31/03/2021 | 4.9 | 7.2 | 6.32 | 7.05 | 1.1 |

| 31/03/2022 | 11.4 | 23.1 | 17.34 | 7.16 | 1.2 |

| 31/03/2023 | 8.2 | 7.2 | 7.55 | 7.52 | 1.4 |

| 31/03/2024 | (25.1) | (1.4) | (1.42) | 8.35 | 1.3 |

| 31/03/2025 | 8.432 | 1.1-1.33 |

Source: Morningstar, Marten & Co. Note 1) Fully diluted. 2) Target dividend for FY2025. 3) Forecast cash coverage of target dividend as per the company’s announcement on 15 May 2024.

NESF has invested $50m in NextPower III ESG – a private solar infrastructure fund that owns international solar assets – that targets gross IRR between 13 and 15% on its investments. This is significantly above the level that UK solar funds are offering.

Shortly after we last published, NESF announced that its first two international solar co-investments, in which it invested alongside NextPower III ESG, had been energised. The assets are a 210MW solar project in Portugal (Santarém) and a 50MW solar asset in Cadiz, Spain (Agenor). NESF directly owns 13.6% of Santarém, 24.5% of Agenor, and 6.21% of NPIII ESG. Both assets have long-term PPAs (power purchase agreements) with Statkraft (Santarém’s PPA is the largest in Portugal’s history).

NESF’s manger highlights that the investment in NextPower III ESG gave NESF instant international diversification (the fund owns development-stage and operational assets in OECD countries), removing the need for NESF to have its own teams on the ground around the world. NextPower III ESG now has 102 operating assets, and the co-investment opportunities that NESF is able to access have the additional benefits of no management fee and no carried interest (carry). This is a differentiating factor for NESF versus its peers.

Camilla 50MW standalone battery project online

Since we last published, NESF has brought Camilla, its first standalone battery project, online. This is also the first project from its JV (joint venture) with Eelpower (the joint venture is 70% owned by NESF and 30% by EelPower). The 50-MW lithium-ion BESS (battery energy storage systems) asset, located in Edinburgh, is a one-hour battery, but has been pre-augmented for two hours so any upgrade to this should be plug-and-play. BESS assets have a very different revenue stack to solar, and this asset is very complimentary to NESF’s existing portfolio (BESS asset revenues are much volatile but can be much higher than those from solar, which is very stable). With its investment in NextPower III, NESF has exposure to 1.8GW of batteries. NESF’s manager highlights that it is the only renewable generator that has a utility scale battery online at present and that this is approaching its one-year operating anniversary in March 2025.

Two out of five assets sold at a premium, adding 1.84pps to the NAV.

NESF has sold three of the five assets – Hatherden (November 2023), Whitecross (June 2024) and Staughton (November 2024) – earmarked for its capital recycling programme. These were all at premiums to their carrying values in the NAV, adding 2.76p cumulatively to the NAV. The three sales have raised £72.5m, of which £38.8m has been deployed to pay down NESF’s revolving credit facilities (RCFs), with c £4m used to repurchase shares (see page 8). However, NESF plans to look at alternative uses for the proceeds (for example, NAV-accretive investments) as the discount narrows.

Prior to the sale of all of these assets, NESF had added considerable value to both through its initiatives. For example, at Hatherden, approval for co-locating battery storage on the site was achieved, while an AR4 contract (Contracts for Difference contracts issued in the fourth round of the UK government’s CfD scheme) was secured for Whitecross. It adds that the latter had a very small snag list, so was very easy to sell.

NESF’s manager marketed the five assets as a portfolio but received more interest for the assets individually.

NESF’s manager says that it is taking its time with the disposal of the remaining two assets, which will be sold together in phase IV (the final phase), and exclusive negotiations are continuing with third-party bidders. It adds that it is seeing many pricing points in the market that are proving NESF’s NAV and there are superior valuations in the secondary market, versus the listed space, which in its view is being over-cautious.

Paying down floating rate debt

As at end September 2024, NESF had £333.3m of debt of which £156.4m was long-term debt at fixed rates. It also had £198.4m of long-term preference shares. Total gearing was 48.2% of GAV including the preference shares (the limit is 50%) and 29.1% excluding them. The weighted average cost of debt (the total interest paid on a company’s debt, weighted by the size of each debt) instrument was 4.9% including the preference shares. As noted on page 4, the bulk of the proceeds of the capital recycling programme have been used to reduce NESF’s floating rate debt and, while this is the more expensive of NESF’s debt sources, the financing provided by the RCFs is still very competitive at SONIA + 1.2%–1.5%, reflecting NESF’s scale and creditworthiness. Both RCFs were refinanced in March and April this year on existing terms or better.

The preference shares remain an attractive source of finance in the current environment. While they have an indefinite life, they can be redeemed at par or converted to equity in 2036 and there could be significant upside from this (the managers describe it as a great form of non-amortising debt). NESF has been amortising long-term debt across the remaining life of its subsidiaries.

NESF is an Article 9 fund

As a reminder, NESF is an Article 9 fund under EU SFDR and Taxonomy (these are funds that specifically target sustainable objectives, such as environmental or social benefits, ensuring all their investments align with these goals). During the year ended 31 March 2024, its renewable generation had avoided the production of 279.3 ktCO2e. As we have previously highlighted, if the UK is to meet its net zero targets, much more needs to be done and NESF is keen to play its part in this. Its manager, NextEnergy Capital is the largest specialist solar manager, managing c$4.4bn of solar assets across its key OECD target markets, and aims to be at the forefront of developments in the space. Ross Grier (chief operating officer and head of UK investments at NextEnergy Capital) sits on the UK government’s Solar Taskforce, which was established to drive forward the actions needed to meet the government’s ambition to achieve clean power by 2030.

In June 2024, NESF published its third standalone sustainability and environmental, social and governance (ESG) report, which you can read here . NESF is keen to highlight its commitment to biodiversity and 81% of its portfolio assets have enhanced biodiversity measures. New habitat provisions comprise 27 bat boxes, 35 beehives, 78 bird boxes, 131 bug hotels, 32 hibernacula, 35 kestrel boxes, six owl boxes and 1,246 shrubs planted. NESF also provided community funding of £106k and donated £339k to the NextEnergy Foundation in cash and solar modules during the last financial year.

NESF published its first nature strategy report in November 2024. Key elements set out in the report include: an SBTN-aligned commitment (a commitment to reduce its negative impact on nature and contribute to its conservation) to prevent the material loss of natural ecosystems in direct operations and supply chains; a responsible land use target including nature implementation plans and dual land use regimes; a nature restoration target to restore natural ecosystems in the regions where NESF operates that need support; and updated nature-related risk management procedures for supply chain transparency and sustainability.

The end-September NAV was 97.8p – down from 101.3p as at the end of June, 107.3p at end March 2024 and 107.7p as at end December 2023. The main negative drivers between end-June and end-September were lower than budgeted generation due to lower-than-expected solar irradiation (-2.1p) and changes in power prices forecasts (-3.0p), with changes in short-term inflation costing an additional 0.1p. On the positive side, time value, the sale of Whitecross, share buybacks and the revaluation of NextPower III added 7.7p, 0.6p, 0.2p and 0.1p respectively.

The main negative drivers of the reduction between end-March and end-June were lower than budgeted for generation due to lower-than-expected solar irradiation (-1.7p) and changes in power prices forecasts (-1.2p), although changes in short-term inflation added 0.4p and the revaluation of NextPower III added 0.1p.

The main negative drivers of the reduction between end-December and end-March were changes in power prices forecasts (-2.7p – mainly due to lower commodity prices – particularly gas, which sets the marginal price of electricity – which was down by around 30-40%, influenced by above-average gas storage levels, milder weather across winter 2023/24 and sustained reductions in demand) and lower than budgeted for generation (-1.7p). Furthermore, although changes in short-term inflation added 0.3p, the revaluation of new assets added 1.6p and the revaluation of NextPower III added 0.7p.

Weighted average discount rate is 8.0%.

NESF did not make any changes to its discount rate assumptions for the quarters ended either 31 March 2024, 30 June 2024 or 30 September 2024. On 21 November 2024, NESF said that, for the quarter ended 30 September 2024, it had:

NESF made the same statements for the previous two quarters, but, for the end-March valuation it also said that it had introduced new discount rate assumptions for its new 50MW operating energy storage asset, Camilla, which were in line with energy storage investment company peers. This increased NESF’s weighted average discount rate at 31 March 2024 slightly to 8.1% (31 December 2023: 8.0%), and it has remained at the level for the end-June and end-September valuations.

NESF uses a weighted average of the prices from three power forecasters in arriving at its own power price assumption. However, the manager believes that there is considerable upside that is not factored into these, for the following reasons:

The manager says the situation is actually quite exciting and not as doom-and-gloom as the predictions suggest.

Source: NextEnergy Solar Fund. Note: 1) For financial years ended 31 March. 2) Cash dividend cover is pre scrip dividends.

NESF has 10 years history of paying a growing cash-covered dividend (dividends fully supported by cash income). For the year ended 31 March 2024, NESF paid a total dividend of 8.35p per share, which is a yield of 13.1% on its share price of 63.9p as at 15 January 2025. This is the second-highest yield in the FTSE 350 Index (the highest, Ithaca Energy, is artificially inflated and uncovered, as it is honouring a pre-IPO commitment to distribute US$400m of dividends for its 2023 financial year).

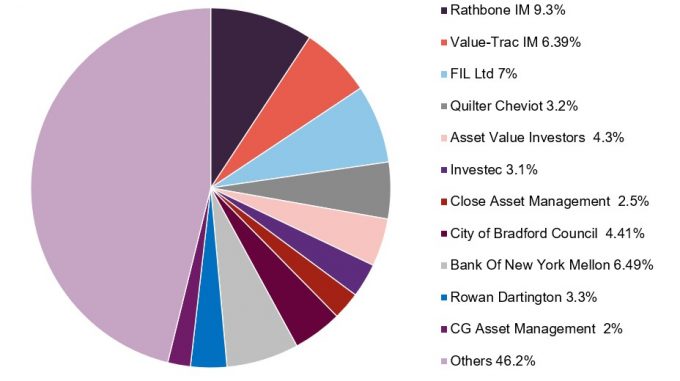

NESF has about 150m retail investors on its share register (around 26% of the total) and its board is acutely aware of the importance of income to these investors. NESF’s board sets a target for the year (usually announced in November as part of the interim accounts) which considers five-year forecasts of revenues and costs and allows for a sensible progression of the dividend over time that is both covered and sustainable. The target for the year 31 March 2025 is 8.43p per share, with forecast coverage of 1.1x-1.3x. The first and second quarterly interim dividends of 2.1p per share were paid on 30 September 2024 and 31 December 2024 respectively. Dividend cover for the first half was 1.5x.

The impact of the shifting sentiment on UK interest rates on NESF’s discount remains an obvious feature of Figure 2. Recent figures have shown inflation, while much reduced over the last couple of years, to be more stubborn than was expected even in the middle of last year. This has, at the margin, extended the higher interest rates for longer narrative, which has weighed on the discounts to NAV of all of the renewable energy funds, NESF included – leaving them all close to or at long-term discount highs.

As is illustrated in Figure 2, NESF’s discount remains very wide relative to its own history, offering significant narrowing potential, when interest rates retreat (something we started to see when inflation fell previously) and share repurchases continue. We also see potential for NAV growth through NESF’s capital recycling initiative. However, we still think that one of NESF’s key attractions is the size of its dividend yield, which is covered and supported by its attractive terms on its preference shares debt. We also see potential upside from the resolution of the cost disclosure issues that have plagued the sector, which should hopefully stem selling by professional investors.

Source: Morningstar, Marten & Co

Source: NextEnergy Solar Fund, Marten & Co

NESF has been very active, repurchasing a modest amount of shares most days.

On 18 June 2024, NESF announced that it was launching a £20m share buyback programme designed to help narrow the discount to NAV. As is illustrated in Figure 3, since the programme’s launch, NESF has been very active in repurchasing its own shares, buying back 10.9m shares, equivalent to 1.8% of its issued share capital. These purchases are strongly NAV-accretive, given the prevailing discount. All of the repurchased shares are held in treasury.

Board completely refreshed as 10-year anniversary passed.

Since we last published, Caroline Chan has been appointed as chair of the management engagement committee and Jo Peacegood has been appointed as chair of the audit committee, following the retirement of Patrick Firth (who had served his full nine-year tenure). The chairwoman, Helen Mahy, was previously the chair of TRIG and Paul Le Page is ex-Bluefield. Both joined the board in 2023.

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on NextEnergy Solar Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Andrew Courtney

For most of 2024, financial conditions had finally started to turn favourably for infrastructure investors. Inflation had dropped sharply from the previous year, allowing the Bank of England to begin its easing cycle, while the new government’s ambitious plans for infrastructure development provided a renewed sense of optimism across the sector. These green shoots were evidenced by GCP’s annual results, which showed a total shareholder return of 28.4%, leading to a significant narrowing of its stubborn discount. Unfortunately, a negative reaction to the UK budget, and concerns around the inflationary impact of US tariffs, saw gilts retrace their highs, erasing some of these gains.

Despite this, we remain increasingly optimistic about GCP’s prospects as it continues to execute on its capital recycling programme. Coupled with improving market conditions, an impressive policy backdrop, and its long track record of capitalising on changing market dynamics, we believe there is a considerable opportunity for investors at current prices.

GCP aims to provide shareholders with sustained, long-term distributions and to preserve capital by generating exposure primarily to UK infrastructure debt or similar assets with predictable long-term cashflows.

| 12 months ended | Share price TR(%) | NAV total return (%) | Earnings1per share (pence) | Adjusted2 EPS (pence) | Dividend per share (pence) |

|---|---|---|---|---|---|

| 30/09/2020 | (2.0) | (0.22) | (0.08) | 7.65 | 7.6 |

| 30/09//2021 | (7.9) | 7.2 | 7.08 | 7.90 | 7.0 |

| 30/09/2022 | 3.8 | 15.7 | 15.88 | 8.30 | 7.0 |

| 30/09/2023 | (25.2) | 3.6 | 3.50 | 8.58 | 7.0 |

| 30/09/2024 | 28.2 | 4.6 | 2.25 | 7.09 | 7.0 |

Source: Morningstar. Note 1) EPS figures taken from 30 September each year. Note 2) Adjusted earnings per share removes the impact of unrealised movements in fair value through profit and loss.

Regular, sustainable, long-term income

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. The company’s income is derived from loaning money predominantly at fixed rates to entities which derive their revenue – or a substantial portion of it – from UK public-sector-backed cashflows. Wherever it can, it tries to secure an element of inflation protection.

In practice, GCP is diversified across a range of different infrastructure sectors, although its focus has shifted more towards renewable energy infrastructure over the last few years. It has exposure to renewable energy projects (where revenue is part subsidy and part linked to sales of power), PFI/PPP-type assets (whose revenue is predominantly based on the availability of the asset), and specialist supported social housing (where local authorities are renting specially-adapted residential accommodation for tenants with special needs).

GCP is trading dividend yield of 9.8%

On 12 December 2024, GCP published its annual results for the period to 30 September 2024. The company’s NAV total return was 2.2%, while the shareholder total return was 28.4% with the discount narrowing significantly to 25%, although this has since widened to 32.6% at the time of publication. Whilst GCP does not compare its returns with those of a benchmark index, the sterling corporate bond index is a useful comparison, and this returned 10.7% over the same period.

Dividends continued to run at an annualised pace of 7.0p per share, so that GCP is trading on a dividend yield of 9.8%. On the company’s adjusted earnings basis, calculated on interest accruals, dividend cover was 1.01 times (down from 1.23x at the end of the 30 September 2023). On a cash cover basis, this ratio is much higher. Profit was £19.5m (down from £30.9m). As we have covered in our previous research, the company’s financial performance continues to be driven by electricity prices and inflation, both of which have normalised from elevated levels, leading to a negative impact on profitability.

The company’s NAV total return was 2.2%, while the shareholder total return was 28.4%

Despite this, the company was still able to deliver a positive NAV total return for the year, while the 28% total shareholder return reflected the steadily improving market conditions and the ongoing implementation of the company’s capital recycling programme, which has remained the key focus for the manager over the past 12 months.

It should be noted that the shareholder return did benefit from timing factors, and some of these gains have been given back as economic uncertainty remains elevated. However, as we discuss in the market backdrop section, we remain increasingly positive on the outlook for the sector and the ability for GCP to capitalise on the growing investment opportunity, considering the significant structural changes occurring across the infrastructure sector.

| Impact (£m) | Impact (pence) | |

|---|---|---|

| Tax computations | 1.1 | 0.13 |

| Principal indexation | 0.8 | 0.09 |

| Other inflationary movements | 3.2 | 0.37 |

| Total | 5.1 | 0.59 |

Source: GCP Infrastructure Investments

As Figure 1 shows, positive contributions to NAV for the 2024 financial year were limited to tax computations and inflationary mechanics across the portfolio thanks to the company’s inflation linkages and protections. The otherwise-limited portfolio activity reflects the adviser’s focus on consolidation and its capital recycling policy as the company seeks to reposition itself for further growth.

| Impact (£m) | Impact (pence) | |

|---|---|---|

| Power price movements | (13.7) | (1.58) |

| Increase in discount rates | (10.6) | (1.22) |

| Energy yield assessment | (7.8) | (0.90) |

| Project long-term budget | (5.6) | (0.65) |

| Inflation forecast | (3.4) | (0.39) |

| Onshore wind asset outage | (2.0) | (0.23) |

| Actual performance | (3.0) | (0.35) |

| Other downward movements | (3.2) | (0.37) |

| Total | (49.3) | (5.69) |

Source: GCP Infrastructure Investments

Faling electricity prices had the largest impact on the downside

Falling electricity prices had the largest negative impact, although the vast majority of these occurred in the first half of the company’s financial year. As we have discussed in our previous research, it is important to note that the UK energy market is emerging from several years of unusually high volatility and prices remain well above historical averages. Over the last 24 months, this has provided strong cash flow generation for the GCP portfolio. More recently, prices in the UK have shown signs of stabilisation.

Notably, one of the main goals for the company’s current portfolio development is to reduce exposure to electricity price volatility, as evidenced by the recent sale of GCP’s interest in Blackcraig Wind Farm (discussed on page 7). In addition, where possible, the company continues to fix prices under power purchase agreements and hedge electricity prices.

Increases to discount rates have also weighed on the NAV, as have inflation adjustments, with inflation falling steadily over the course of 2024. Whilst inflation has not impacted operational performance, lower inflation projections have reduced the cash expected to be generated by the company’s loans and therefore the associated valuation has been reduced.

Higher interest rates have weighed heavily on the infrastructure sector

We have written frequently about the challenges faced by the infrastructure sector in recent years, driven mostly by the rise in interest rates that has greatly increased the relative attractiveness of more traditional income sectors, particularly low-risk corporate and government debt.

As evidenced in the company’s 2024 performance, valuations have fallen due to rising discount rates, while the increase in financing costs has weighed on the sectors’ appeal, especially for those companies relying on leverage to help drive capital deployment programmes. Despite this, we believe the extent and duration of the current sell-off goes well past the mechanical impact of these events, highlighted by valuations which have fallen below levels seen during the worst of the GFC. This is especially true for GCP, which has maintained conservative leverage and continues to generate strong earnings thanks to its focus on diverse, long-term, public-sector-backed investments; inflation linkages; and regulated and contracted cashflows. For comparison, back in 2010, when yields were at a similar level to where they are today, GCP traded on a premium of almost 10% despite having a less diversified portfolio, and greater exposure to construction stage projects. As of publishing, its discount was 32.6%, a change of over 40 percentage points, which is clearly not a fair reflection of the quality of the company’s underlying assets.

The renewable infrastructure sector which now makes up over 60% of GCP’s portfolio.

We believe the entire sector has been tarred by the poor performance of a relatively small number of operators whose business models have proven to be untenable in the current market environment. There also appears to be a broader lack of understanding around these assets and the quality and reliability of the investments that have enabled dividend yields to head towards 10%. Positively, given the wealth of structural growth opportunities which exist across the sector, these depressed valuations do provide a compelling opportunity for companies such as GCP with the scale and flexibility to consolidate and capitalise.

Manager Philip Kent points to the company’s long-term track record of performance across various market cycles as a reason for optimism going forward. A focus on diversification across the infrastructure spectrum has allowed it to adapt to developments in any one sector (such as decreasing yields and more competition) and move into other areas if a sector no longer represents attractive risk-adjusted returns. This has been evidenced in recent years, with the company working through the divestment of its maturing supported living assets while shifting exposure into the renewable infrastructure sector, which now makes up over 60% of GCP’s portfolio. With multiple factors now driving infrastructure investment, including infrastructure deployment to address population change; decarbonisation; and energy security, there exists a wealth of opportunities to shift into higher-yielding and more-attractive sectors of the market.

In our previous research we highlighted how the adviser believes that there is a significant disconnect between the government’s stated aims for infrastructure investment and what is actually being built. This has only become more compelling following the policy initiatives announced by the new Labour government.

These included a range of measures to speed up infrastructure development including changes to the National Planning Policy Framework and the formation of the National Infrastructure and Service Transformation Authority to better support the delivery of significant capital projects. In addition to housing and energy security, the renewable energy sector was a key area of focus as the government attempts to deliver its ambitious goal of fully decarbonising the electricity system by 2030.

We expect the steady normalisation of interest rates to provide a catalyst.

GCP appears to be increasingly well positioned to capitalise on these developments thanks to its flexible, debt-focused funding approach. The company’s track record of being an early mover appears especially well matched with regard to new subsidy regimes for emerging technologies. These include net zero (green) hydrogen, carbon capture, and the expansion of existing market support measures (such as the CfD scheme), which offer an attractive opportunity for GCP to play a key role in the scaling-up and deployment of new infrastructure.

The steady normalisation of interest rates ought to be providing another catalyst. With inflation falling back to target, the Bank of England (BOE) has now begun to ease monetary policy, announcing two 25-basis-point rate cuts in 2024, dropping the bank rate to 4.75%. These announcements helped drive a solid re-rating for many of the better-performing infrastructure companies, including GCP, over the first half of 2024.

Unfortunately, it has not all been one-way traffic, with concerns around the inflationary impact of the budget and the potential knock-on effects from US policy uncertainty (particularly around tariffs) leading to a repricing in the number of rate cuts expected for 2025 and rising government bond yields. As shown in Figure 3, we are now expecting between two and three cuts over the next 12 months, for an implied rate around 4%. Although this is still a significant shift down from the peak of 5.25%, only a few months ago markets were anticipating up to five rate cuts over this period. As we discuss in the discount section on page 15, this has led to a repricing of some rate-sensitive sectors of the market after a period of optimism earlier in the year.

Despite this, the BoE remains committed to easing monetary policy and as interest rates fall, we expect capital to flow back towards alternative investments, especially given the attractive yields on offer, highlighted by GCP’s current yield of 9.8%.

Source: Bloomberg

The entire investment trust sector should also benefit from long-overdue cost disclosure reforms. On 22 November 2024, a Statutory Instrument came into law to remove the requirement for investment companies to publish ongoing charges, a figure widely accepted to be an inaccurate representation of the actual cost of investing in the sector.

On 22 November 2024, a Statutory Instrument came into law to remove the requirement for investment companies to publish ongoing charges

Although this is a no doubt a positive development, since the announcement there has continued to be confusion, with some investment platforms still requiring ongoing charges to be disclosed. The reforms have not been helped by a recently published consultation paper by the FCA on its proposed consumer composite investments regulation. Some have interpreted this as an intention to reinstate a single aggregated cost figure for trusts, without acknowledging that costs are already reflected in share prices. Unfortunately, the consultation will not close until March 2025, and implementation of any new rules might not be until the end of the year, suggesting that the row will drag on for a while yet. You can read our ongoing discussions around the cost disclosure issues here.

In December 2023, GCP announced a plan to release £150m (roughly 15% of the portfolio) to facilitate a rebalance of sector exposures, apply funds towards a material reduction in the RCF, and return at least £50m in capital to shareholders. It was initially hoped that this would be completed by the end of 2024; however, consistent delays throughout the year have meant the target completion date has been shifted to H1 2025. This delay is tempered by the expectation that realisations will now comfortably exceed the initial target.

To date, the company’s disposals total £38.2m, the bulk of which was achieved via the sale of GCP’s interest in loan notes secured against Blackcraig Wind Farm. The disposal occurred at a 6.4% premium to the valuation of the project as at 31 March 2024, generating net cash proceeds of c.£31m while reducing GCP’s exposure to power prices and equity-like investments (which now sit at just 6% of the portfolio). Importantly, the sale also provided further validation of the company’s underlying NAV. A portfolio of rooftop solar assets has also been realised, generating proceeds of £6.8m. Subject to contract, further proceeds of c.£20m are expected from the disposal of a portfolio of onshore wind farms.

To date, the company’s disposal’s total £38.2m

With the proceeds of Blackcraig now available to it, GCP has been buying back shares steadily since 12 December 2024.

Although the initial stages of this capital programme have taken longer than originally hoped, the company has made material progress in its stated aims of reducing the outstanding RCF, which was identified as a priority given the high-interest-rate environment. In March 2024, the RCF was refinanced from £190m to £150m with the drawn balance of this facility reduced significantly from £104m at 30 September 2023 to £57m. As further disposals are completed, the company expects this balance to be reduced to zero.

Over the 2024 financial year, the company also completed the repurchase of 3.4m shares under its existing buyback facility. The repurchase of shares continues to offer attractive returns, given the current discount to NAV, while helping to address any imbalance in supply and demand that may otherwise create volatility in the rating of the company’s shares. This remains a delicate balance, however, with the adviser remaining conscious that further buybacks may do little to move the discount and would reduce the size of the trust – decreasing liquidity and perhaps deterring some of its target investors.

As of 30 September 2024, there were 50 investments in GCP’s portfolio (including the rooftop solar portfolio discussed above, with the sale occurring after the financial year end). The average annualised portfolio yield over the financial year was 7.8%, and the portfolio had a weighted average life of 11 years.

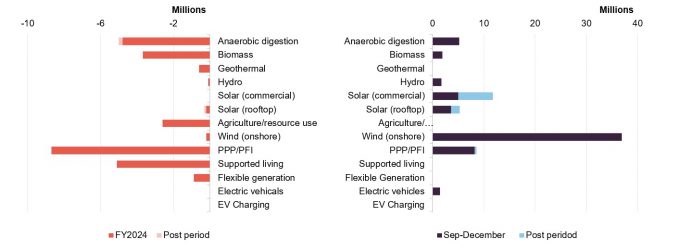

Source: GCP Infrastructure Investments

No new investments were made over the financial year, with the adviser focusing instead on its capital recycling programme.

Source: GCP Infrastructure Investments

Source: GCP Infrastructure Investments

As noted, the adviser views renewable energy infrastructure as a key area of focus and going forward. The rebalancing of the portfolio through the capital reallocation policy is targeting a reduction in social housing and equity-like exposures, which now sit at just 6%.

Source: GCP Infrastructure Investments. Note 1) does not include the sale of the rooftop solar portfolio which occurred post period end.

| % of total assets 30/07/24 | Cashflow type | Project type | |

|---|---|---|---|

| Cardale PFI | 12.7 | Unitary charge | PFI/PPP |

| Gravis Solar 1 | 9.7 | ROC/FiT | Commercial solar |

| GCP Programme Funding S14 | 5.4 | ROC/RHI/Merchant | Biomass |

| GCP Programme Funding S3 | 4.4 | ROC/PPA | Anaerobic Digestion |

| GCP Programme Funding S10 | 4.5 | Lease | Supported Living |

| GCP Bridge Holdings | 5.0 | ROC/PPA | PPE – Energy-from-waste / Energy efficiency |

| Gravis Asset Holdings H | 4.4 | ROC/RHI | Onshore wind |

| GCP Biomass 2 | 4.1 | ROC/PPA | Biomass |

| GCP Social Housing 1 B | 3.8 | Lease | Supported living |

| GCP Green Energy 1 | 3.7 | ROC/PPA | Commercial solar/onshore wind |

Source: GCP Infrastructure Investment

| Firm | % of total portfolio |

|---|---|

| Ecotricity Limited | 9.2 |

| Viridian Energy Supply | 7.8 |

| Office of Gas and Electricity Markets | 6.4 |

| Npower Limited | 6.3 |

| Statkraft Markets GmbH | 5.9 |

| Bespoke Supportive Tenancies Limited | 4.6 |

| Smartestenergy Limited | 4.5 |

| Total Gas & Energy Limited | 4.4 |

| Good Energy Limited | 4.4 |

| Gloucestershire County Council | 4.1 |

Source: GCP Infrastructure Investments

| Firm | % of total portfolio |

|---|---|

| Ecotricity Limited | 9.2 |

| Viridian Energy Supply | 7.8 |

| Office of Gas and Electricity Markets | 6.4 |

| Npower Limited | 6.3 |

| Statkraft Markets GmbH | 5.9 |

| Bespoke Supportive Tenancies Limited | 4.6 |

| Smartestenergy Limited | 4.5 |

| Total Gas & Energy Limited | 4.4 |

| Good Energy Limited | 4.4 |

| Gloucestershire County Council | 4.1 |

Source: GCP Infrastructure Investments

| Firm | % of total portfolio |

|---|---|

| WPO UK Services Limited | 21.0 |

| PSH Operations Limited | 13.0 |

| Vestas Celtic Wind Technology Limited | 11.3 |

| Solar Maintenance Services Limited | 9.7 |

| A Shade Greener Maintenance | 8.7 |

| 2G Energy Limited | 5.9 |

| Pentair | 4.6 |

| Atlantic Biogas Ltd | 4.6 |

| Thyson | 4.6 |

| Cobalt Energy Limited | 4.1 |

Source: GCP Infrastructure Investments

Although there were no new investments made over GCP’s 2024 financial year, the company did make one new loan to an existing borrower, totalling £2.6m. Follow-on investments of £24.7m were also made, with these focused on restructuring and management to preserve value and potential future profitability. This was offset by repayments of £39.2m, giving a net repayment from the existing portfolio of £11.9m.

Source: Gravis Capital Partners

Source: Gravis Capital Partners

Source: GCP Infrastructure Investments

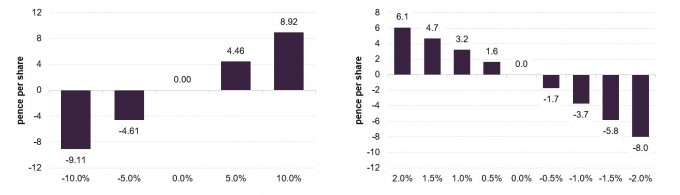

Figure 13 summarises the key assumptions used in forecasting cash flows from renewable assets in which the company is invested, and the range of assumptions that the investment adviser observes in the market. GCP’s advisers traditionally take a conversative approach, with the chart highlighting alternative, more aggressive valuation assumptions that could be taken. The net effect of this is that, were GCP to assume the most conservative assumptions in every category, the end-September NAV of 105.22p would be reduced to 101.37p. By contrast, were GCP to assume the least conservative assumptions in each category, the NAV would have been 115.94p.

Were GCP to assume the least conservative assumptions in each category, the NAV would have been 115.94p.

Such an approach is admirable, as it reduces the likelihood and severity of any unexpected shocks to GCP’s NAV, e.g. a sharp reversal in wholesale gas prices. It also raises the possibility of further NAV uplifts from portfolio disposals, such as with the Blackcraig wind farm. Note that valuation metrics do not affect either the dividend pay-out or the share price yield.

The investment adviser also provides a sensitivity analysis for its cash flows. Figures 14 and 15 show the impact of changes in power prices and changes in its base case inflation forecast.

As noted, one of the main areas of focus for GCP’s capital recycling programme is reducing the impact of power price volatility on its cash flows and NAV. As such, we expect the figures highlighted in Figure 14 to reduce materially going forward.

Source: GCP Infrastructure Investments

Source: GCP Infrastructure Investments

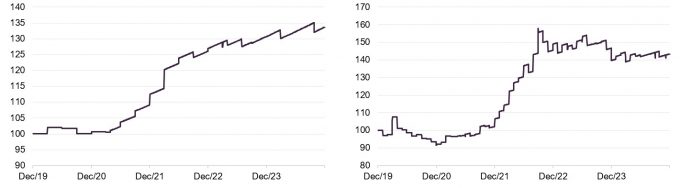

Despite less-favourable market conditions over the last few years, GCP has still managed to deliver a NAV total return of 33.6% since 2019. This supports our view that the market reaction, which has seen shares fall by 22% over the same period, is in no way a fair reflection of the quality of the company’s underlying assets.

Figure 17 illustrates the significant outperformance of GCP over the sterling corporate bond index. This figure provides another illustration of the tangible returns generated by the company above direct market comparables. We believe there exists a clear advantage for investors seeking sustained long-term distributions in GCP’s strategies, particularly in the face of increasing bond market volatility.

Source: Morningstar, Marten & Co

Source: Morningstar, Marten & Co

Whilst the NAV total return has been modest over the past 12 months, the company is yet to fully realise the benefits of its capital recycling efforts due to transaction delays experienced throughout the year. As we have noted, these are now expected to flow through the portfolio over the first half of 2025, suggesting there is a significant amount of potential upside as these positions are realised, bearing in mind the 6.4% premium to NAV at which the Blackcraig windfarm investments were solid. Additional realisations at or above NAV can only work to highlight the irrationality of the current discount, which remains near historical extremes. Coupled with improving market conditions, an impressive policy backdrop, and a long track record of capitalising on changing market dynamics, we believe there is a considerable opportunity for investors at current prices.

| 3 months (%) | 6 months(%) | 1 year(%) | 3 years (%) | 5 years (%) | |

|---|---|---|---|---|---|

| GCP share price | (7.8) | (8.0) | 7.5 | (16.9) | (22.0) |

| GCP NAV | 0.6 | 1.0 | 2.2 | 18.8 | 33.6 |

| Sterling corporate bonds | (0.3) | 2.8 | 6.8 | (9.9) | (4.9) |

Source: Morningstar, Bloomberg, Marten & Co

| Premium / (discount) (%) | Dividend yield (%) | Ongoing charge(%) | Market cap (GBPm) | |

|---|---|---|---|---|

| GCP Infrastructure Investments | (33.3) | 10.0 | 1.10 | 609 |

| 3i Infrastructure | (12.8) | 3.9 | 1.65 | 2,988 |

| BBGI Global Infrastructure | (15.1) | 6.8 | 0.93 | 896 |

| Cordiant Digital Infrastructure | (26.2) | 4.4 | 0.90 | 697 |

| Digital 9 Infrastructure | (58.5) | 0.5 | 1.33 | 164 |

| HICL Infrastructure | (23.9) | 6.9 | 1.14 | 2,386 |

| International Public Partnerships | (18.7) | 7.0 | 1.20 | 2,286 |

| Pantheon Infrastructure | (22.1) | 4.7 | – | 416 |

| Sequoia Economic Infrastructure | (17.3) | 8.7 | 0.95 | 1,238 |

| Peer group median | (22.1) | 6.8 | 1.1 | 896.0 |

| GCP rank | 8/9 | 1/9 | 4/8 | 7/9 |

Source: Morningstar, Marten & Co

Up-to-date information on GCP and its peers is available on the QuotedData website

GCP sits within the AIC’s infrastructure sector, which is made up of three companies that invest predominantly in public/private partnership project equity (BBGI, HICL and International Public Partnerships), two companies that have more revenue exposure towards demand driven assets (3i Infrastructure and Pantheon Infrastructure), two digital infrastructure companies (Cordiant Digital Infrastructure and Digital 9 Infrastructure) and one company (Sequoia Economic Infrastructure, which – like GCP – invests primarily in infrastructure debt, but using a much broader definition of what constitutes infrastructure).

Since our last note, median discounts in the infrastructure sector have widened from 15.9% to 22.1%. Unfortunately for GCP, its discount has slipped further, falling to 32.6%.

After a positive re-rating earlier in the year, GCP’s discount is now the second-widest in the sector, behind Digital 9 Infrastructure, a trust in managed wind-down following a number of operational issues. By contrast, as we have highlighted, GCP continues to execute well. We are confident that the discount remains a temporary phenomenon, given the quality of the company’s assets and the reliability of its earnings. Almost two-thirds of GCP’s investments are regulated or contracted, de-risking returns through highly visible and increasingly stable earnings. This structure has provided the foundation for the company’s current capital programs and leaves the adviser in a strong position to rebalance the portfolio when it does begin to make new investments.

GCP also boasts the highest dividend of its immediate peer group, adding additional appeal to the shares.

| 3 months (%) | 6 Months(%) | 1 year(%) | 3 years (%) | 5 years (%) | |

|---|---|---|---|---|---|

| GCP | (0.6) | 1.0 | 2.2 | 18.8 | 33.6 |

| 3i Infrastructure | 0.8 | 5.2 | 10.3 | 39.8 | 80.1 |

| BBGI | 1.4 | 2.5 | 5.4 | 23.0 | 40.7 |

| Cordiant Digital Infrastructure | 2.7 | 3.6 | 14.4 | 35.5 | n/a |

| Digital9 Infrastructure | 0.1 | (42.4) | (55.3) | (52.4) | n/a |

| HICL | 1.3 | 1.6 | 3.5 | 17.5 | 30.6 |

| International Public Partnerships | 1.4 | 0.8 | 1.8 | 17.9 | 28.3 |

| Pantheon Infrastructure | 0.9 | 5.6 | 12.0 | n/a | n/a |

| Sequoia Economic Infrastructure | 0.5 | 2.0 | 8.0 | 14.0 | 23.2 |

| Peer group median | 0.9 | 2.0 | 5.4 | 18.3 | 32.1 |

| GCP rank | 9/9 | 7/9 | 7/9 | 4/8 | 3/6 |

Source: Morningstar, Marten & Co

| Premium / (discount) (%) | Dividend yield (%) | Ongoing charge(%) | Market cap (GBPm) | |

|---|---|---|---|---|

| GCP | (33.3) | 9.9 | 1.10 | 609 |

| Aquila Energy Efficiency Trust | (45.1) | 0 | – | 43 |

| Aquila European Renewables | (27.0) | 8.8 | 1.10 | 207 |

| Bluefield Solar Income | (24.9) | 9.4 | 1.02 | 562 |

| Downing Renewables & Infra. | (32.9) | 7.3 | 1.60 | 135 |

| Ecofin US Renewables | (52.6) | 2.3 | 1.78 | 34 |

| Foresight Environmental Infrastructure Group | (31.0) | 10.3 | 1.24 | 490 |

| Foresight Solar Fund | (32.8) | 10.6 | 1.15 | 428 |

| Gore Street Energy Storage | (51.4) | 14.4 | 1.42 | 245 |

| Greencoat Renewables | (24.6) | 8.1 | 1.18 | 769 |

| Greencoat UK Wind | (17.4) | 7.6 | 0.92 | 2,954 |

| Gresham House Energy Storage | (59.3) | 12.3 | 1.19 | 256 |

| Harmony Energy Income | (26.5) | 0.2 | – | 148 |

| HydrogenOne capital growth | (78.3) | 0 | 2.56 | 28 |

| NextEnergy Solar | (32.6) | 12.8 | 1.11 | 383 |

| Octopus Renewables Infrastructure | (34.5) | 8.9 | 1.16 | 378 |

| SDCL Energy Efficiency Income | (38.3) | 11.2 | 1.02 | 608 |

| The Renewables Infrastructure Group | (27.5) | 8.5 | 1.04 | 2,173 |

| Triple Point Energy Efficiency | (41.5) | 11.9 | 2.06 | 46 |

| US Solar Fund | (42.9) | 5.3 | 1.39 | 105 |

| VH Global Energy Infrastructure | (42.1) | 8.8 | 1.39 | 255 |

| Peer group median | (33.3) | 8.8 | 1.2 | 256.0 |

| GCP rank | 11/22 | 8/22 | 5/21 | 4/22 |

Source: Morningstar, Marten & Co

In light of the increasing importance of renewable energy within GCP’s portfolio, we feel it is also relevant to compare the company to the constituents of the renewable energy infrastructure sector, shown in Figure 21. However, it is worth noting that this encompasses a diverse range of companies which are not all directly comparable to GCP, such as Ecofin US Renewables and the US Solar Fund, which have much-longer-term PPAs and are therefore less exposed to energy price volatility. GCP’s asset base also differs widely from the energy storage companies – Gore Street, Gresham House and Harmony – and the energy efficiency companies – Aquila, SDCL and Triple Point.

We think the best comparators are Bluefield Solar, Foresight Solar, Greencoat UK Wind, Foresight Environmental Infrastructure, NextEnergy Solar, Octopus Renewables and The Renewables Infrastructure Group.

Notably, in contrast to the lower discounts in the infrastructure sector, GCP’s discount is in line with the median for the renewable energy peer group, highlighting the negative sentiment surrounding the sector.

| 3 months (%) | 6 Months(%) | 1 year(%) | 3 years (%) | 5 years (%) | |

|---|---|---|---|---|---|

| GCP | (0.6) | 1.0 | 2.2 | 18.8 | 33.6 |

| Aquila Energy Efficiency Trust | 7.9 | 7.9 | 5.9 | 8.8 | n/a |

| Aquila European Renewables | 0.8 | (2.6) | (10.7) | 1.9 | n/a |

| Bluefield Solar Income | 1.8 | (2.4) | (0.9) | 24.2 | 45.2 |

| Downing Renewables & Infra. | 1.0 | 1.3 | 4.1 | 30.5 | n/a |

| Ecofin US Renewables | 6.4 | (17.8) | (25.0) | (20.3) | n/a |

| Foresight Solar Fund | 1.8 | 1.7 | 2.1 | 25.6 | 50.9 |

| Gore Street Energy Storage | 1.9 | (3.3) | (4.9) | 15.5 | 46.9 |

| Greencoat Renewables | 0.7 | (0.9) | (1.0) | 24.9 | 42.1 |

| Greencoat UK Wind | 1.6 | 2.4 | 2.4 | 40.9 | 74.0 |

| Gresham House Energy Storage | 1.3 | (16.3) | (24.4) | 4.5 | 37.7 |

| Harmony Energy Income | (6.7) | (8.0) | (22.8) | n/a | n/a |

| HydrogenOne Capital Growth | 0.0 | (2.7) | (0.6) | 5.3 | n/a |

| Foresight Environmental Infrastructure Group | (1.2) | 0.1 | (1.8) | 31.6 | 49.7 |

| NextEnergy Solar | (1.5) | (2.6) | (1.8) | 16.2 | 31.5 |

| Octopus Renewables Infrastructure | 1.5 | 2.8 | 2.7 | 18.9 | n/a |

| SDCL Energy Efficiency Income | 1.7 | 3.7 | 7.2 | 4.2 | 25.7 |

| The Renewables Infrastructure Group | 1.6 | 0.4 | (1.5) | 20.5 | 40.8 |

| Triple Point Energy Efficiency | 1.8 | 32.6 | 22.6 | 38.3 | n/a |

| US Solar Fund | 6.9 | 1.1 | (6.0) | (2.8) | 2.7 |

| VH Global Energy Infrastructure | 1.3 | (1.6) | 10.6 | 22.4 | n/a |

| Peer group median | 1.5 | 0.1 | (0.9) | 18.8 | 41.4 |

| GCP rank | 18/21 | 9/21 | 8/21 | 11/20 | 9/12 |

Source: Morningstar, Marten & Co

Dividends are declared and paid quarterly. Shareholders are able to elect to take their dividend as scrip (in shares rather than cash). In its 2024 financial year, GCP’s target dividend remained stable at 7.0p in line with its previous three financial years.

Over the past 12 months, GCP’s shares have traded on an average discount of 30.2%, a high of 22.2%, and a low of 37.2%. As of publishing, the discount stood at 32.6%. As Figure 23 shows, this narrowed considerably over the first half of 2024 as markets reacted to the expectation of lower interest rates. Unfortunately, as we have noted, financial conditions have steadily tightened in recent months, which has weighed on GCP’s shares. Despite this, on balance we remain confident that the overall policy backdrop remains supportive of the re-rating seen in the first half.

Source: Morningstar, Marten & Co

The investment adviser receives an investment advisory fee of 0.9% a year of the NAV net of cash. This fee is calculated and payable quarterly in arrears. There is no performance fee. The investment adviser is also entitled to an arrangement fee of up to 1% (at its discretion) of the cost of each asset acquired by GCP. Gravis will generally seek to charge the arrangement fee to borrowers rather than to the company, where possible. To the extent that any arrangement fee negotiated by the investment adviser with a borrower exceeds 1%, the benefit of any such excess shall be paid to the company. The investment adviser also receives a fee of £70,000 (subject to RPI adjustments) a year for acting as AIFM, which was £89,000 for the 2024 FY, after adjustments.

The investment advisory agreement may be terminated by either party on 24 months’ written notice.

Apex Financial Services (Alternative Funds) Limited is GCP’s administrator and company secretary. Depositary services are provided by Apex Financial Services (Corporate) Limited. The fee for the provision of these services during the year was £1.008m (FY23 £1.034m).

The ongoing charges ratio for the year ended 30 September 2024 was 1.1%, unchanged from the prior year.

As of 31 December 2024, GCP has 884,797,669 ordinary shares outstanding, of which 18,915,019 are held in treasury. The company’s financial year end is 30 September and AGMs are held in February.

GCP is an evergreen company with no fixed life and no regular continuation vote.

Structural gearing of investments is permitted up to a maximum of 20% of NAV immediately following drawdown of the relevant debt. At 30 September 2024, GCP’s net gearing was 4.5%, down significantly from 10.8% in FY2023.

As of 30 September 2024, the company has credit arrangements of £150m across four lenders: Lloyds, AIB, Mizuho and Clydesdale. At year end, £57m was drawn.

Source: Marten & Co

IF the ABDRN fcast is anywhere correct and your plan is to buy an annuity in 2026, maybe just maybe, unless Rachel from accounts rides to your rescue, you should have a contingency plan in place.

GL

Real Estate

Following months of stabilisation, the UK real estate market is reaching an equilibrium point.

Authors

David Scott

Head of UK Investment Research, Real Estate

Lance Eddis-Finbow

Senior Real estate Investment Analyst

Date: 21 Oct 2024

Economic growth remained robust over the second quarter at 0.5%, as the consumer and output sectors absorbed respective headwinds in their stride. The UK retains a position of cyclical strength, but it finds itself staring down a challenging fiscal outlook. While this is markedly better than a starting position of cyclical weakness, it doesn’t solve the new Labour government’s problems in closing a projected £30 billion shortcoming. Fiscal space is likely to be created from tweaks to the Bank of England’s (BofE) quantitative tightening regime, but additional revenue raising through amendments to capital gains and inheritance tax will be needed to bridge the gap. That said, growth is at the centre of Labour’s manifesto, and so the balance between fiscal tightening and economic expansion will be under scrutiny this autumn.

Domestic inflationary pressures in the UK seem to have faded over the summer months. While higher energy prices and fading base effects will soon contribute to the headline figure drifting higher, this is not expected to materially affect the progress made to this point. Indeed, largely positive economic signals afford the BofE a healthy margin of error in its policy path. However, it’s likely to err on the side of caution, as endogenous pressures and uncertainty around official data could complicate the path ahead.

Policy remains in restrictive territory and is quickly diverging from the more aggressive paths coming from the Federal Reserve and the European Central Bank. By holding borrowing costs at 5% in September in an 8-1 vote, the BofE emphatically reinforced its message to maintain caution. We therefore expect a series of quarter-rate cuts to follow from November. Given current levels of caution and the headroom available, we see the possibility of more rapid rate cuts if growth slows or the BofE believes that inflation persistence has dissipated, especially from the second half of next year.

| (%) | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| GDP | 7.60 | 4.10 | 0.10 | 1.10 | 1.30 | 1.10 |

| CPI | 2.60 | 9.10 | 7.40 | 2.60 | 2.00 | 2.00 |

| Policy Rate | 0.25 | 3.50 | 5.25 | 4.75 | 3.75 | 2.75 |

Source: abrdn, October 2024

Forecasts are a guide only and actual outcomes could be significantly different.

Following months of stabilisation, the UK real estate market is reaching, or has reached in some cases, an equilibrium point. Not only has the level of capital value decline for out-of-favour sectors moderated, but competition among the favoured and best-in-class assets has strengthened for certain segments of the market. With income returns across the favoured sectors remaining robust, total returns for the residential, industrial, and hospitality segments are now comfortably in positive territory year to date. Out-of-favour segments are struggling, largely as a result of limited liquidity, with a reasonable bid/ask spread remaining in place.

According to the MSCI Quarterly Index, all property saw capital values stabilise at 0% over the second quarter of 2024. As expected, the favoured sectors of retail warehousing, industrial, and residential drove positive growth of 1.5%, 0.6%, and 0.6%, respectively, while offices lagged at -1.8%. As ever, the bifurcation between best-in-class assets and poorer-quality stock will continue to widen as transactions pick-up, with offices offering the greatest opportunities.

Total returns increased over the second quarter to 1.2%, given less severe capital declines. The favoured sectors prevailed, as with capital value growth. The retail warehouse sector, in particular, posted a very robust return during the second quarter, with a total return of 3.1%, the strongest return for any segment. During the first half of 2024, all property saw a positive total return of 1.9%.

The UK real estate investment trust (REIT) index has generated a total return of 23.1% in the 12 months to the end of the third quarter, according to FTSE EPRA. The UK direct real estate market has historically lagged the UK REIT index by six-to-nine months, which provides a greater level of confidence that we are entering into a growth phase for UK direct real estate. In addition, UK REITs have been actively raising capital to deploy into growth strategies, rather than balance sheet repair, with a total of £2.27 billion raised in 2024. This sentiment is carrying over to the direct space, where the second quarter of 2024 recorded the highest investment volumes since the third quarter of 2022 at around £15 billion. Cross-border and private capital have been the most active year to date on the acquisitions side, while disposals from institutions have slowed from their recent peak in 2021

Bifurcation remains the main storyline in the office sector, as best-in-class space receives the attention of occupiers and investors. This leaves secondary space suffering, with prolonged vacancy rates and an uncertain future. Rental value growth in the favoured and undersupplied West End submarket has increased by 7.7%, taking prime headline rents to £140 per square foot, according to JLL. Despite a stickier vacancy rate in the London City office submarket, there is also evidence to suggest that tenants are willing to commit to higher rents to secure truly best-in-class space. The city recorded prime rental growth of 10% in the 12 months to the end of the second quarter of 2024, taking prime headline rents to £82.50. We still expect the West End to outperform over our forecast horizon, given supply constraints and more positive vacancy dynamics.

Across the UK, secondary offices have dragged capital values into steep annualised declines, running at -11.5% over the year to June. While these declines are severe, they are up from their low of –19.4% over the previous year. They have also slowed notably over the first half of 2024. With further reductions in pressure due from the BofE, we expect further declines to slow, particularly for well-located prime assets in central London.

With financing costs moving in the right direction, we are seeing an increase in acquisitions for conversion to hotel and residential use. A large amount of central London’s 20-plus million square feet of vacant stock will need to be retrofitted or converted in the near future to comply with regulations. The regions are proving less desirable for core investors, although a notable few assets across central locations in the Big-6 markets have traded recently.

Largely unchanged from the previous quarter, the industrial and logistics sector is benefiting from structural drivers. Rental growth and vacancy rates are softening from their respective post-pandemic strengths, although this is more of a normalisation of the sector rather than any structural weakness. Capital values have largely levelled off over the year to June, at a modest -0.2%, and contributed to a market-leading 4.2% total return over the same period.

Supply remains elevated in response to the strength in demand seen over the pandemic. Over 55 million square feet is currently under construction across the UK, according to CoStar, although construction starts have slowed materially and currently account for 1.5% of stock. Outward shifts in yields, prohibitive development financing costs and rising construction costs should maintain this supply balance. And with tenant appetite for ‘green’ buildings remaining strong, we see robust fundamentals in the future.

While overall demand has slowed from its peak, large releases of warehousing space from troubled retailers have helped drive net absorption into negative territory over 2024. This would be more concerning if the sector had structural troubles. Instead, tenant preferences for environmental, social and governance-compliant buildings, and expectations of a strengthening economy, should feed into growing demand. As such, we expect rental growth to remain robust, driven by ‘green’ premiums and refurbishment activity capitalising on these premia.

Investors remain upbeat about the sector. This is reflected in 2024’s year-to-date investment volumes comprising 19% of the market’s total, equalling the 10-yr average for the sector. REITs have been particularly active over 2024, as they recycle and raise additional capital in the expectation of improving economic conditions. Looking ahead, we see industrial yields sharpening as investor confidence returns to real estate. But outperformance will be generated by investors capturing reversion, by stock picking, and by creating polarisation in performance through quality.

The retail sector is enjoying high relative income returns. As capital value growth has shifted into positive territory, returns over the second quarter were a healthy 2%. Over the first half of the year, capital growth was slightly positive at 0.1%, much improved from 2023’s value of -5.7%. Importantly, this performance is not exactly broad based. Total returns over the second quarter varied, from outperforming retail warehouses (3.1%) and supermarkets (1.8%), to less favourable standard shops (0.8%) and shopping centres (1.0%).

Consumer confidence has improved since the throes of the pandemic. Despite some monthly wobbles, retail sales have improved over 2024 to post 2.5% year-on-year growth in September. The outperformer here was food retailers, which have been robust in their trading figures over 2024; except for Asda, which continues to struggle. As real wages improve, the retail sector should see more optimism.

The retail sector’s landscape is working to absorb shifting consumer preferences inclusive of ecommerce and experiential shopping trends. Retail parks and select prime high-street retail are seeing strong leasing demand, while dwindling construction and conversions to alternative uses reduce existing stock. As such, London’s Bond Street and Oxford Street have renewed interest from investors, particularly family offices and cross-border capital, who are keen to pay competitive yields. Meanwhile, retail parks have a strong pull with institutional investors who are attracted by re-based yields on parks with a bias towards value retailers.

The private rented sector (PRS) has been in the news of late, given the Labour government’s commitment to revitalising the UK’s housing market and the launch of the Renter’s Rights Bill. According to Realyse data, rents across the UK increased by 6.3% over the year to August 2024, down from 11.3% in August 2023. The abrdn real estate research team was already forecasting a moderation in rents for the PRS, largely because of affordability constraints. Importantly, rents are expected to grow from here as inflationary pressures ease and real wages remain in positive territory. Demand continues to comfortably outstrip supply, which remains constrained.

It’s unlikely that we will soon see any material rebound in supply, given prohibitive construction and financing costs. This is shown by the amount of build-to-rent (BtR) stock under construction, which has slowed by 19% over the past year. Given the more positive economic sentiment of late and the anticipation of further rate cuts from the BofE, we would expect these pressures to ease, resulting in more construction starts. Overall, we view the BtR asset class favourably. It’s maturing in the UK and serves an incredibly important role in addressing the shortfall in housing provision.

Purpose-built student accommodation has also made headlines, as supply constrained markets have seen meteoric rental growth. When digesting this segment, the impact of higher- versus lower-tariff universities on accommodation performance must be considered. The latest data from the Universities and Colleges Admissions Service (UCAS) demonstrates that while applications for higher-tariff universities have grown by 7.8% for the 2024/25 academic year, lower-tariff university applications declined by 4%. To minimise risk, appropriate stock tied to strong universities has quickly become a target model for institutional investors.

UK real estate seems to have taken the initial tailwinds of economic momentum in its stride as sentiment towards the sector improves. Investors have largely sat on the sidelines, awaiting further evidence of rate cuts from the BofE. With the bulk of the correction behind us and economic conditions improving, we see capital more actively seeking to allocate to UK real estate. Competitive tension is returning for prime assets in favoured sectors. With financing costs remaining prohibitive at present, current market conditions favour equity-backed buyers for UK real estate.

Sector bifurcation is still very relevant to expected performance, even as we expect the market to shift into gear. Notably, offices face structural problems outside of the relatively small proportion of best-in-class assets. The industrial and logistics, residential, and retail warehouse sectors will shine, given their thematic and structural drivers. We also see the ‘other’ segment performing well, driven by robust hotel fundamentals.

Given the UK’s headroom in economic policy compared with its peers, we see the BofE remaining cautious. There is an upside risk of swifter cuts from the second half of next year. Taking this possibility into account, we are forecasting a front-loaded return profile on the basis of large inward yield shifts.

The value of investments, and the income from them, can go down as well as up and an investor may get back less than the amount invested. Past performance is not a guide to future results.

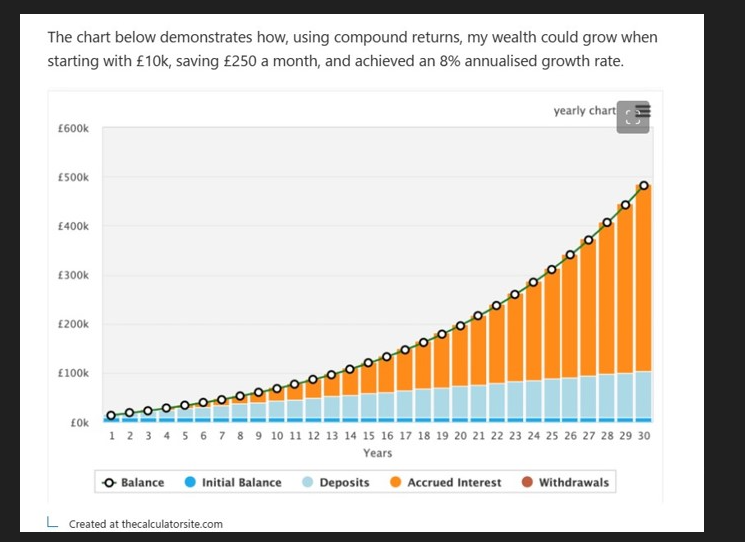

Remember a bad plan is still better than no plan because without a plan you have no end destination.

When investing your hard earned the final destination is your income when your retire, what ever age that is in your plan.

The only way to have an end destination is to have a dividend re-investment plan, you may not know the exact end figure but you can pencil in some figures with a high degree of certainity.

The Snowball’s current ten year plan is income of £16,519 or an income on 100k invested of 16% per year.

The other end destinations for a Total Return plan.

Buy an annuity which could be any percentage you want to include.

Remember if your retire at the wrong time, the following annuity might be offered:

Canada Life figures show the 65-year-old with a £100,000 pension pot could buy an annuity linked to the retail price index (RPI) that would generate a starting annual income of £3,896. That’s up from £2,195 in the New Year following a 77% spike in rates this year.

Oct 22.

You have to surrender your capital so not an option for me.

An alternative would be to buy UK gilts and as long as you buy near or below the redemption price they are risk free if you hold to maturity. Current yield around 4.5% but you keep your capital to pass on to your nearest and dearest.

The other option is to use the 4% rule where you withdraw 4% of your capital and hope that the cash fund doesn’t expire before you do. You need a cash buffer for when the next market crash occurs.

The remaining funds could be passed on to your nearest and dearest.

Like life it’s a gamble.

For anyone making a plan, you could include both income and Total Return, switching into income as you get closer to retirement.

Lifestyling has proved to be a disaster for many, especially with compound growth you will make more money in the last few years, with a dividend re-investment plan, than in all the early years.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑