Investment Trust Dividends

Why Dividend Investing Wins in a Crazy Market Market volatility freaks a lot of people out. Stocks drop, headlines scream, and suddenly everyone’s convinced the sky is falling. But if you’re a dividend investor? You don’t have to stress—because you’re still getting paid. That’s the beauty of dividend investing. Instead of relying on stock prices going up, you’re collecting real cash along the way. And in unpredictable markets, that steady income can be a total game-changer. Here’s why dividend investing is one of the best strategies, especially when things get wild. 1. You Get Paid No Matter What Stock prices bouncing all over the place? Doesn’t matter—your dividend checks keep rolling in. Unlike growth stocks, where you’re hoping the price goes up, dividends are real money hitting your account. You can reinvest them, buy more stocks when prices drop, or just pocket the cash. Either way, you’re making money no matter what the market’s doing. 2. Compounding Does the Heavy Lifting Reinvesting dividends is where the real magic happens. Each payout buys you more shares, which then earn even more dividends. It’s a compounding machine that keeps running in the background, growing your portfolio year after year. The best part? The longer you stay invested, the bigger that snowball gets. 3. Dividend Stocks Are Built for Stability Sure, high-growth stocks are exciting—until they crash. Dividend stocks, on the other hand, are usually well-established businesses with steady profits. They don’t rely on hype; they rely on consistency. And here’s the kicker: many of these companies increase their dividends every year—even during recessions. That means your income stream keeps growing, no matter what the market throws at you. 4. Volatility Becomes an Opportunity When stock prices drop, most people panic. But if you’re a dividend investor, lower prices just mean higher yields and a chance to buy more at a discount. Instead of stressing about red days, you’re in a position to take advantage of them—boosting your future income while others are selling in fear. 5. It Helps Fight Inflation Inflation eats away at your buying power, but dividend stocks help offset that. Many companies regularly raise their payouts, meaning your income grows over time instead of losing value. While cash in the bank gets weaker, your dividends keep getting stronger. Final Thoughts Dividend investing isn’t about chasing hype—it’s about getting paid, staying patient, and letting time do the work. Markets go up and down, but dividend stocks keep putting money in your pocket. That’s why I love them. Whether stocks are flying high or in free fall, dividend investing keeps you in control. So keep buying, keep reinvesting, and let your dividends do the heavy lifting. |

By Frank Buhagiar

BERI outperformed over the full year: +15.3% net asset value (NAV) per share return and +14% share price return both easily ahead of the blended comparator index – 40% MSCI ACWI Select Metals & Mining Producers Ex Gold and Silver IM (Mining), 30% MSCI World Energy Index (Traditional Energy) and 30% S&P Global Clean Energy Index (Energy Transition). For the record, the comparator index could only manage +0.5%. M&A within the mining portfolio cited as one of the reasons behind the outperformance. The strong showing no outlier either: +125% NAV return over 5 years compared to the +81.5% net total return of the MSCI ACWI Select Metals & Mining Producers Ex Gold and Silver IMI Index and +71.4% net total return of the MSCI World Energy Index.

Chairman Adrian Brown highlights “the flexibility of the Company’s investment mandate with the ability to shift exposure between Mining, Traditional Energy and Energy Transition sectors”. Helpfully, “The Board considers that all three sectors have an important role to play as the energy system continues its transition to a lower carbon economy; the Mining sector provides the material supply chain for low carbon technologies from steel for wind turbines to lithium for electric cars; traditional energy is needed to support base load energy to continue to power economies during the transition”. Sounds like BERI has got it all covered. Shares, which have had a strong run over the past year, took a pause for breath though, finishing the day largely unchanged at the 120p level.

Winterflood: “Stock selection contributed to relative performance. Top contributor was pipeline company Targus Resources, driven by expected power demand uplift from AI data centres. Nuclear energy benefitted from the same trend, with Cameco contributing. Traditional Energy was 31% of NAV. M&A (Filo Corp, Stelco) drove performance in Mining (40% of NAV) segment of the portfolio, while weak demand for commodities from China detracted. Key contributors to Energy Transition sleeve (29% of NAV) were industrials manufacturing energy efficiency products and electricity grid infrastructure equipment suppliers.”

JEMA, another to outperform and another to clock up double-digit returns for the year: NAV total return of +13.6% compared to the S&P Emerging Europe, Middle East & Africa’s +11.9%. Good stock selection, a key contributor to the outperformance. As for the share price, don’t be fooled by the +0.9% total return for the year into thinking performance was pedestrian. Far from it: over the period, 31 October 2024 to 31 January 2025, the share price oscillated between 120.5p and 244.0p. Chairman Eric Sanderson and the Board believe this “is due to the uncertainty about the values attaching to our Russian shareholdings.” As the investment managers note “the Company’s Russian holdings continue to be subject to strict sanctions, and their valuations have been discounted accordingly.” Salvaging any value from these would be something of a bonus then.

Those Russian holdings, which are subject of ongoing litigation in the courts, of course, a legacy of the previous Russian-focused strategy. As Sanderson points out, very much a different strategy these days “The Company continues to invest in higher quality companies, with a tilt towards value and income and a focus on maximising total return for shareholders. The portfolio’s geographical focus is on Saudi Arabia, South Africa and the United Arab Emirates, which at the year end represented 21.6%, 17.0% and 14.4% of the portfolio respectively.” And the investment managers believe “The portfolio will continue to evolve over coming years as our target markets develop and deepen”. With the Russian court case approaching, some investors appear to have taken some money off the table, for now at least – share price finished the day 5p lower at 204p.

Numis: “Whilst it is positive to see a period of outperformance, we suspect that investors will be more focussed on the status of the Russian holdings, which continue to be held at a nominal value. We note there has been some progress with the sale of one Russian holding, Nebius (Yandex), following its sole listing on Western exchanges, although the Board emphasises the unlikeliness of this being the case for further holdings in the near future, whilst their remains uncertainty with respect to an appeal related to VTB’s court proceedings against JPMorgan entities.”

EOT can’t make it a hat trick of outperformers after NAV total return came in at -8.4% for the half year. That compares to the MSCI Europe Total Return Index’s -3.3% (sterling). At -10.6%, the share price fared worse. Weakness among the fund’s largest holdings, specifically previous high-flier Novo Nordisk, blamed as well as “our ‘style bias’” towards investing in “innovative, world-leading companies in other sectors”. Longer term, the tables are turned: the +10.5% annualised NAV total return since launch, almost double the benchmark’s +5.8%. Still, Chair Matthew Dobbs is not hiding behind that long-term track record “the results and our returns in recent years are clearly disappointing. Our Investment Manager pursues a differentiated, high conviction approach to investment and we, as a Board, along with the team at Devon are fully committed to returning the Company to its former ranking at the head of its peer group.”

Investment manager Alex Darwall sees plenty of reasons why the portfolio’s holdings will come good. Firstly, there’s valuation “We believe that our portfolio is better value than at any time since 2017.” Then there’s earnings “Our earnings forecasts for the portfolio companies are markedly higher than those projected for the wider market.” As for balance sheets, EOT’s companies “have less debt than most European listed companies”. And at some point, the macroeconomic environment is expected to become supportive of the fund’s strategy which is “to identify ‘winners through the cycle’, a strategy that has been thwarted somewhat by the huge money printing programmes of the COVID era. The extended business cycle will turn down at which point our companies’ earnings resilience will be clear.” And when it does “Our healthcare, technology and payments companies should all make good progress. We remain confident that our strategy of picking companies that compete and succeed on the world stage will be vindicated.” Shares were up 4p to 872p – perhaps investors thinking vindication will come sooner rather than later.

Winterflood: “Board has proposed to make additional tender offer for up to 25% of shares at 2% discount to NAV, expected to take place in Q2 2025. Key (performance) detractors included Novo Nordisk, Edenred, Dassault Systèmes, Infineon Technologies and Worldline. Performance also negatively impacted by EOT’s style bias, with no exposure to Financials, which was the best performing sector in the index. Further, performance also suffered from outflows from European equities.”

Story by Becca Stanek, The Week US

Examples of passive income include dividends earned from stocks, income from a rental property and royalties from an e-book you published© Illustrated / Getty Images / Shutterstock

Making money without even trying might sound too good to be true — but there are ways to do it. Unlike the “active” income you earn from, say, your 9-to-5 job, “passive” income is a stream of cash that flows without regular work on your part.

But before you jump in and start buying up apartments to rent or dividend stocks, it’s important to understand everything that passive income entails. Some sources are more passive than others, and there are tax implications to consider.

Passive income is money you make “without a large amount of additional work added to your day-to-day routine,” said Kiplinger. Examples of passive income include dividends earned from stocks, income from a rental property and royalties from an e-book you published.

The aim of passive income is to generate an additional source of income alongside the money you’re bringing in from your job and other places. Doing so can “help you to grow your savings and increase cash flow,” Kiplinger said.

What to know before setting up a passive income stream

You’ll want to start by being realistic about how much time, effort and money you want to sink into your passive income project.

Typically, you will need “startup capital” to get your passive income endeavors off the ground, said Investopedia. “To develop a meaningful passive income stream from financial assets like cash-equivalents, stocks and bonds, you’ll need a decent account balance.” That said, there are some passive income streams that require a type of initial investment that isn’t necessarily monetary, such as talent or time.

When determining which passive income stream is a good fit for you, it is also helpful to assess what skillsets you already have. Do you already have experience with investing? Do you know how to create online content or courses? By zeroing in an area in which you already have some knowledge and experience, you can cut down on the time involved.

But regardless of your familiarity with your chosen income stream, you’ll likely need to put in some time at the outset to get the ball rolling. The amount of time involved will vary depending on your chosen method. For instance, opening a high-yield savings account or a certificate of deposit (CD) only takes a bit of research up front, plus some time invested in opening the account. Real estate investing, meanwhile, can be far from passive.

It’s also important to realistically assess the risk involved. Some passive income endeavors are riskier than others, and you’ll want to ensure you are only taking on as much risk as you’re comfortable with. For example, if you create a course that flops, your only loss would be the time it took for you to make it. But if you buy a potential rental property that ends up needing extensive repairs, that presents a much higher level of financial risk.

And last but certainly not least, you will want to factor taxes into the equation. Usually “net income from passive income investments is reported as ordinary income,” said Good Financial Cents, with the exception of capital gains income.

4 passive income ideas to consider

Now that you’ve read up on the basics of passive income, you can start thinking of some ways to earn it. Here are four of the most reliable sources of passive income.

Dividend investments

This can include dividend stocks as well as dividend index funds and exchange-traded funds (ETFs). In either case, you’ll get a regular payout of a portion of a company’s profits. However, income is not guaranteed; companies may have to decrease dividends or could become unable to pay them.

To get started, you’ll need to open a brokerage account. Also note that “you likely will have to tie up thousands, if not tens or hundreds of thousands, of dollars to earn significant income from dividend stocks,” said Forbes.

Bonds and bond index funds

Bonds allow investors to lend money to companies, as opposed to taking an ownership stake like they would when investing in stocks. Investors will then earn interest income.

For those who are more risk-averse, such as individuals approaching retirement, bonds can be a safer bet “because of their lower volatility and relative safety compared to stocks,” said NerdWallet. However, they will also “generally earn a lower return on your investment.”

High-yield savings accounts or CDs

The trick to making investing in a high-yield CD or savings account a solid stream of passive income is to search for the top rates. Often, you’ll find those at online banks.

Plus, said Bankrate, “investing in a CD or savings account is about as safe a return as you can find.” The downside is that returns might not be as impressive.

REITs

While your initial instinct might be to invest in physical real estate to generate investment income, that can come with a lot of headaches and more time investment than you may want. An alternative way to earn passive income through real estate is by investing in a real estate investment trust (REIT).

REITs “own and manage income-producing properties and distribute the profits to investors,” said Good Financial Cents. In some cases, you may need to be an accredited investor, though other platforms make real estate investing more accessible.

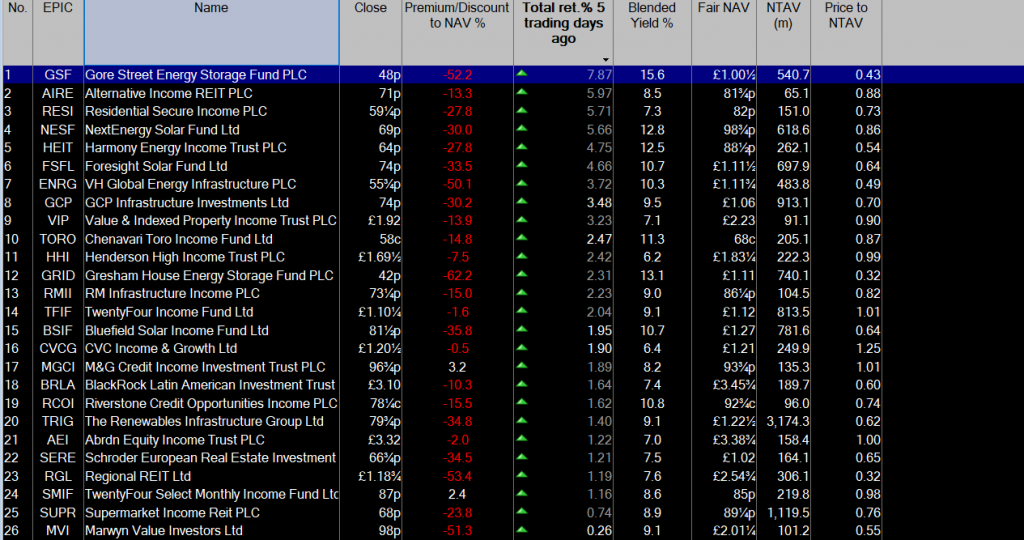

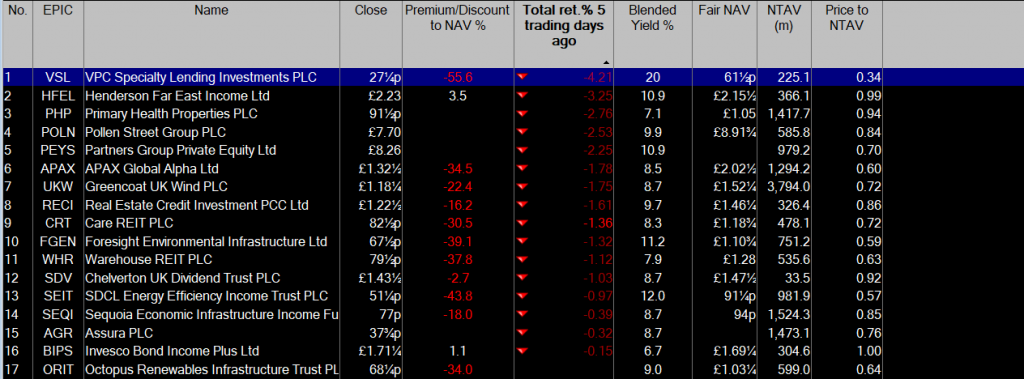

To increase size of table press control +

to return press control –

You may not have enough funds to follow WB and have a meaningful stake in Coca Cola but if what if we use LWDB as the working example, this time without dividends re-invested.

If you bought at 182p, six years later you are back to the beginning, thankfully you have dividends to re-invest, wherever you think best, it could be back into LWDB as the price fell.

Your buying yield was 3.4%, which has risen to a buying yield of 17.5% on 2k capital

If you bought 1098 shares for 2k, they would be worth today £9,936.00 plus dividends or £14,087 including dividends.

The current dividend is 32p so on the current value of £9,936.00 a running yield of 3.5% (1098 shares at 32p = £351.36)

If you intend to retire on your dividend stream, you could always re-invest part in higher yielding Trusts.

Story by Tom Stevenson

Albert Einstein called compounding the eighth wonder of the world. The famous economist John Maynard Keynes marvelled at ‘the awesome power of compound interest’.

Compounding is the addition, repeatedly, of interest to the principal of a deposit or a loan. It describes what happens when you earn interest on both the money you have initially put aside plus the interest you have already earned on that starting amount. Here’s how it works.

Imagine you save £100 in a bank account and you earn 10 per cent interest on that money (I know, it’s been many years since this has actually happened but bear with the illustration).

After one year your account will hold £110 (£10 of interest plus £100 capital, or 0.1 x 100 = £10 + £100).

Start saving young: Are you Prudence or Extravaganza when it comes to handling your finances? Find out below…

Now imagine that you leave the accumulated capital in the account and it again earns 10 per cent interest. By the end of the second year you will have £121 (£11 of interest plus £110 of starting capital, or 0.1 x 110 = £11 + £110).

See how the amount of interest grows because the same percentage is applied to a greater starting amount.

Do this year after year for, say, 20 or 30 years and something magical happens.

The numbers start to grow exponentially so that after a while the amount of interest you earn begins to dwarf the initial amount that you were able to save. The important factor here is time. It is the key component of compounding and the reason why everyone should start to save as soon as they can – preferably several years ago!

Tom Stevenson is investment director at Fidelity International.

I like to tell the story of two sisters. One starts putting aside a modest amount when she is just 18 years old.

She’s called Prudence, obviously. Saving £20 a week gives her £1,000 a year.

By the time Prudence is 38 she has accumulated £63,000 and now the extra £1,000 a year of saving starts to become irrelevant.

What matters now is the compounding of the 10 per cent growth and interest on the ever rising amount of her savings. By the time she is 60, she has accumulated a little over £500,000 even if she stops saving completely at the age of 38.

Now Prudence’s sister (I call her Extravaganza for obvious reasons) laughs at her careful sister and spends the 20 years from 18 to 38 enjoying herself and spending all her money. She’s not alone; for most of us there are plenty of other calls on our money in our 20s and 30s.

But aged 38 she sees how much Prudence has put aside and she thinks she would like to match her. She too starts saving £20 a week and earns the same 10 per cent as her sister.

But here’s the rub. Because she starts later and doesn’t benefit from the miraculous ingredient of time, she never catches her sister up.

When they are both 60, Extravaganza has accumulated just £80,000 compared with her sister’s half a million. And with every year that passes their fortunes diverge even further. (See how the sisters’ fortunes diverge in more detail below.)

It’s helpful to learn how to work out compound interest for yourself. But once you’ve grasped the essentials, there’s no need to go through this laborious process every time, writes This is Money.

Our monthly and lump sum saving and investing calculator does the task for you.

Our calculator assumes interest is calculated and compounded monthly.

But you can find other online calculators that do it annually, as in the example above.

So compounding is a powerful force. How do you work out how it might work for you ? Fortunately, there is a very simple rule of thumb to help you calculate compound interest. It’s called the Rule of 72. This is how it works.

Take the interest rate you expect to earn and divide it into 72 – the answer is the number of years it will take you to double your money. So at 6 per cent a year it will take you 12 years to double your money. A 3 per cent return will take 24 years. At 12 per cent it will only take six years.

One last point. Compounding works in reverse too. If rather than applying an interest rate to a deposit you are applying compound interest to a loan without either paying down the capital or servicing the interest, the amount outstanding will grow and grow.

Even though Prudence saves for 20 years and Extravanganza for 30, Prudence still ends up with considerably more by the time they reach the age of 68

££££££££££££££££££

Albert Einstein called compounding the eighth wonder of the world, or he didn’t.

By Keith Speights – Jan 25, 2025

Key Points

The late Senator Everett Dirksen once reportedly said, “A billion here, a billion there, and pretty soon you’re talking about real money.” With that quote in mind, Warren Buffett’s dividend income this year will be real money.

Technically, the dividend income will belong to Berkshire Hathaway. But for many, Buffett and Berkshire are practically synonymous. And they could make over $3 billion in dividend income in 2025 from these five stocks.

Buffett seems to have soured somewhat on Bank of America (BAC 1.34%). He significantly reduced Berkshire’s stake in the big bank last year. However, Bank of America (BofA) still contributes a lot of cash to the conglomerate’s coffers.

NYSE: BAC

Bank of America

As of Sept. 30, 2024, Berkshire owned 766,305,462 shares of BofA. With the company’s forward dividend of $1.04, that translates to nearly $797 million in dividend income this year. Of course, if Buffett sells more of this stock, the amount of dividends received will be lower.

The Coca-Cola Company (KO 0.38%) is one of Buffett’s “forever stocks.” He’s held it the longest of any other stock in Berkshire’s portfolio. In his 2022 letter to Berkshire Hathaway shareholders, Buffett wrote, “The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million.” That total should be even greater this year.

Berkshire has owned 400 million shares of Coca-Cola for a long time. Coke pays a forward dividend of $1.94. If Buffett doesn’t sell any shares (which seems to be a safe assumption), Berkshire will rake in at least $776 million in dividend income from the big food and beverage company this year. The amount will likely be higher, though. Coca-Cola is a Dividend King with 62 consecutive years of dividend increases. I fully expect the company will keep that streak going in 2025.

Chevron (CVX -0.71%) is a more recent addition to Berkshire’s portfolio. Buffett initiated a stake in the giant oil and gas producer in 2020 when its shares were beaten down due to the impact of the COVID-19 pandemic.

NYSE: CVX

Chevron

Berkshire owned 118,610,534 shares of Chevron at the end of the third quarter of 2024. With the company’s dividend of $6.52, the conglomerate should make at least $773.3 million in dividend income this year. Again, though, the actual total will likely be higher. Chevron has increased its dividend for 37 consecutive years and could boost its payout soon.

Buffett wrote to Berkshire Hathaway shareholders last year that American Express (AXP -0.12%) would “almost certainly” increase its dividends in 2024 by around 16%. He was close. Amex increased its dividend payout by nearly 17%.

The legendary investor also wrote that Berkshire would “most certainly leave our holdings untouched throughout the year.” I suspect it will do the same in 2025. If so, Berkshire’s 151,610,700 shares of American Express with the financial services company’s dividend of $2.80 will add up to at least $424.5 million in dividend income this year.

Apple (AAPL 0.32%) isn’t the apple of Buffett’s eye that it once was. His position in the consumer tech giant is much lower now than it was a couple of years ago. However, Apple remains Berkshire’s largest holding. It’s also still an important source of dividend income.

NASDAQ: AAPL

Apple

The math with Apple is easy. Berkshire owned 300 million shares as of Sept. 30, 2024. With a dividend of $1 per share, that translates to $300 million in dividend income for Buffett and his company in 2025. This amount will change if Apple increases its dividend (which is likely) or Buffett sells more of the stock (which could happen).

Which is the best stock of the five for income investors?

The expected dividend income for Buffett and Berkshire from these five stocks in 2025 totals $3.07 billion. Which is the best pick for income investors?

I think income investors who aren’t billionaires will find several of Buffett’s major income producers attractive picks. Coca-Cola offers an especially impressive dividend track record along with a solid forward dividend yield of 3.14%.

However, my vote goes to Chevron as the best stock of the five for income investors. The oil and gas company has the highest dividend yield of the group (4.17%). It has also reliably increased its dividend.

£££££££££££££££

Remember compounding dividends takes a while to start to build but the sooner you start the nearer you will be to your finish.

The Renewables Infrastructure Group Limited

Interim Dividend

The Renewables Infrastructure Group Limited (the “Company”) is pleased to announce the fourth quarterly interim dividend in respect of the three month period to 31 December 2024 of 1.8675 pence per ordinary share (the “Q4 Dividend”). The shares will go ex-dividend on 13 February 2025 and the Q4 Dividend will be paid on 31 March 2025 to shareholders on the register as at the close of business on 14 February 2025.

In accordance with the terms and conditions of the Scrip Dividend Alternative and the Directors’ power to cancel the Scrip Dividend Alternative where a change in market conditions might, in the reasonable opinion of the Directors, render the Scrip Dividend Alternative materially detrimental to those Shareholders electing for it, the Board has decided to cancel the Scrip Dividend Alternative in respect of the Q4 Dividend due to the Company’s Ordinary Shares currently trading at a larger than 10% discount to the published Net Asset Value (“NAV”). Accordingly, Shareholders will receive the Q4 Dividend in cash and, should they so wish, can choose to apply the cash dividend in acquiring Ordinary Shares in the secondary market.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑