An ETF so normally trades around NAV.

Not a share where dividends are re-invested back into the share but the high dividend is used to buy other Trusts while the dividend yields are above 7%.

Investment Trust Dividends

An ETF so normally trades around NAV.

Not a share where dividends are re-invested back into the share but the high dividend is used to buy other Trusts while the dividend yields are above 7%.

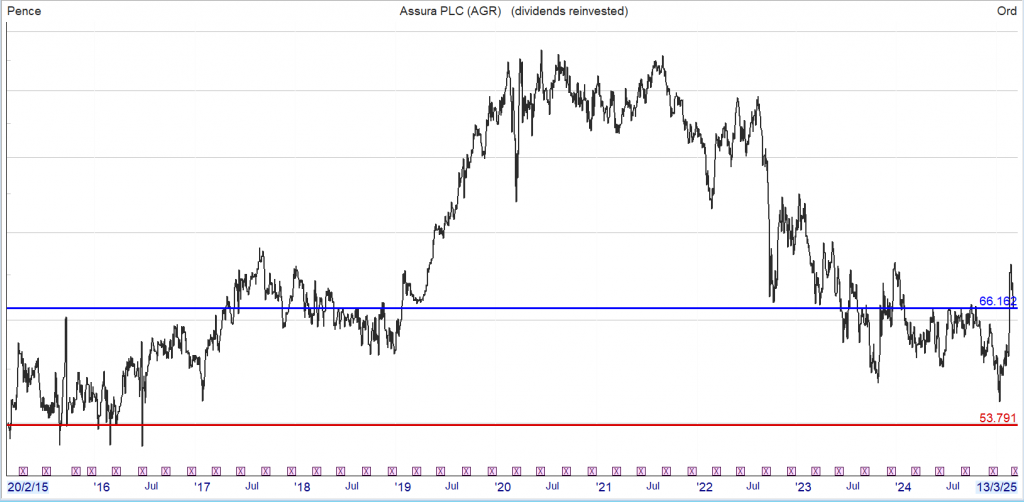

The Snowball’s comparison share, remember when the price is above the cloud the sun is shining on your position but below the cloud it might be raining on your parade. Now back to it’s November price area. The Snowball has in that period earned £27 pounds a day including weekends and bank holidays. GRS

Also an ETF normally trades around it’s NAV so no discount to NAV for a Brucie bonus if you are lucky

To date this year the Snowball has two takeover approaches, sadly they were both rejected but a profit of £3,182 has been re-invested in the portfolio so an extra £222 p.a. hopefully for ever, well your ever. Stick to your plan until it sticks to you.

Using good ole hindsight but that is the only thing you can base your decision on, for better or worse, not a share to re-invest your dividends in.

Not a share you might have bought for your Snowball as until recently as the share price has fallen the dividend increased enough to take the risk.

Current yield 8%

Assura plc, the UK’s leading diversified healthcare REIT, is pleased to announce it has exchanged on the disposal of seven assets for a gross consideration of £64 million.

The latest disposals mean that since the start of the financial year, the Company has sold 30 assets for gross proceeds of £200 million at a weighted average net initial yield of 4.8%.

The net proceeds have been deployed in reducing the acquisition debt used to finance the £500 million private hospital portfolio acquired in August 2024 at 5.9% yield on cost.

The disposal announced today marks further progress in Assura’s overall debt reduction plans and the Company’s proforma net LTV will reduce to 47%.

The sale also reinforces that the quality of the Company’s portfolio and the resilience of its underlying cash flows remain highly attractive to the investment market.

The disposal is immediately earnings enhancing as the cash receipts will be used to repay the revolving credit facility.

The seven assets disposed of today have been sold into Assura’s £250 million joint venture. Assura retains a 20% equity interest in the joint venture resulting in net proceeds of £51 million. Following this transaction, the joint venture has gross assets of £172 million. Assura continues to act as property and asset manager to the joint venture, receiving management fees linked to the valuation of the portfolio.

Jonathan Murphy, CEO, said:

“Reaching this £200 million milestone in our disposal programme means we are on track to achieve our target of net debt to EBITDA below 9 times and LTV below 45% well ahead of the previously outlined timetable. This accelerated delivery and our ability to achieve sales is testament to our operational excellence and the quality and attractiveness of our property portfolio.

“The disposal programme was announced at the time of our transformational acquisition of high-quality private hospital assets in August 2024. The acquisition has positioned Assura as a leader in a structurally supported market, and has cemented our position as the UK’s leading diversified healthcare REIT offering an attractive investment opportunity into favourable long-term trends.”

Notice of Dividend

Assura plc (“Assura” or “the Company”), UK’s leading diversified healthcare REIT, today announces that the next quarterly interim dividend of 0.84 pence per share will be paid on 9 April 2025 to shareholders on the register on 7 March 2025 (the “Record Date”). The Ex-dividend Date will be 6 March 2025.

18 February 2025

Statement re Possible Offer from Kohlberg Kravis Roberts & Co. Partners L.L.P. (“KKR”)

The Board of Assura plc (“Assura” or the “Company”) notes the announcement from KKR yesterday relating to the indicative, non-binding proposal that it submitted to the Assura Board on 13 February 2025 regarding a possible cash offer for the entire issued share capital of the Company at 48 pence per share (the “Proposal”).

The Board confirms that it considered the Proposal carefully with its advisers and concluded that it materially undervalued the Company and its prospects and therefore rejected it unanimously. No further proposal from KKR has been received.

The Board of Assura also notes the announcement yesterday from USS Investment Management Limited (as agent for and on behalf of Universities Superannuation Scheme Limited (acting in its capacity as sole corporate trustee of the Universities Superannuation Scheme)) (“USSIM”) of its intention not to make an offer for Assura, as part of a consortium with KKR or otherwise, other than in the circumstances set out in USSIM’s announcement.

The Board remains confident in the long-term prospects of the Company and believes that Assura is strongly positioned to create value for shareholders.

Shareholders are advised to take no action.

A further announcement will be made as appropriate.

Under Rule 2.6(a) of the Code, KKR must by no later than 5.00 p.m. on 14 March 2025, either announce a firm intention to make an offer for Assura in accordance with Rule 2.7 of the Code or announce that it does not intend to make an offer, in which case the announcement will be treated as a statement to which Rule 2.8 of the Code applies. This deadline will only be extended with the consent of the Panel in accordance with Rule 2.6(c) of the Code.

This announcement has been made without the consent of KKR.

I’ve bought back the AGR shares recently sold 24,159 for 10k.

It’s most probable the Snowball could have made a bigger profit with WHR as it’s now in ‘play’. But whilst making a profit is a positive, as you increase the size of your Snowball, the only consideration is the dividend to buy more shares that pay a dividend. The dividend with AGR is fairly secure and there is still the outside chance they will agree a deal with the bidder at a higher price.

That completes the buying for the Snowball, so most probably any dividends earned this year will be added to the highest yielding shares in the portfolio rather than opening a new position.

I’ve sold the portfolio shares in WHR for a profit of £1,583.00.

The ARR as WHR is a recent purchase is £1,207.55 %, which although factual is just chewing gum for the eyes.

The Snowball has one loan company in it’s portfolio, RECI as the loans are secured against real assets, property, so considered less risky.

But as always it’s best to DYOR as it’s your hard earned.

Thursday 6 March

Assura PLC ex-dividend date

BBGI Global Infrastructure SA ex-dividend date

Foresight Environmental Infrastructure Ltd ex-dividend date

Genus PLC ex-dividend date

HICL Infrastructure PLC ex-dividend date

JPMorgan Global Emerging Markets Income Trust PLC ex-dividend date

JPMorgan Global Growth & Income PLC ex-dividend date

LondonMetric Property PLC ex-dividend date

Mid Wynd International Investment Trust PLC ex-dividend date

North Atlantic Smaller Cos Investment Trust PLC ex-dividend date

Personal Assets Trust PLC ex-dividend date

Premier Miton Global Renewables Trust PLC ex-dividend date

Rights & Issues Investment Trust PLC ex-dividend date

Riverstone Credit Opportunities Income PLC ex-dividend date

Temple Bar Investment Trust PLC ex-dividend date

Utilico Emerging Markets Trust PLC ex-dividend date

VH Global Energy Infrastructure PLC ex-dividend date

VPC Specialty Lending Investments PLC ex-dividend date

Statement regarding Warehouse REIT PLC (“Warehouse REIT”, or the “Company”)

Blackstone Europe LLP (“Blackstone”) and Sixth Street Partners, LLC (“Sixth Street”) on behalf of certain of their respective affiliated investment funds or vehicles (together the “Consortium”) note the recent media speculation in relation to Warehouse REIT.

The Consortium confirms that on 23 February 2025 it made a fourth indicative all cash proposal to the Board of Warehouse REIT of 110.5 pence per share for the entire issued and to be issued share capital of Warehouse REIT (the “Fourth Indicative Proposal”). This proposal, which follows three prior proposals, was rejected by the Board of Warehouse REIT on 28 February 2025.

The Fourth Indicative Proposal, which is inclusive of the third interim dividend of 1.6 pence per Warehouse REIT share declared on 19 February 2025, values the issued, and to be issued, ordinary share capital of Warehouse REIT at approximately £470 million, and represents:

· a premium of 34.1 per cent to the closing price of 82.4 pence on 28 February 2025;

· a premium of 34.8 per cent to the 1-month volume weighted average share price of 82.0 pence on 28 February 2025;

· a premium of 36.9 per cent to the 3-month volume weighted average share price of 80.7 pence on 28 February 2025; and

· a premium of 0.8 per cent to the two-year high closing share price of 109.6 pence on 17 April 2023.

The Consortium believes the Fourth Indicative Proposal provides a highly deliverable and compelling alternative to shareholders, attributing a full valuation for the Company and its future prospects.

The Consortium is considering its position and accordingly there can be no certainty that any offer for the Company will be made.

Christopher Ruane has been poring over the latest shareholder letter from investor Warren Buffett. Here’s a handful of stock market insights he gleaned.

Posted by

Christopher Ruane

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more..

Last weekend, Berkshire Hathaway Chair Warren Buffett released his annual shareholders’ letter.

It contained some nuggets of investing wisdom, as always. Here are five that caught my eye.

Berkshire paid one dividend under Buffett decades ago but has preferred to plough its profits back into building the business ever since.

That is known as compounding. A private investor can do it even with a small ISA, by using dividends to buy more shares.

Buffett is a fan and referred in the letter to “the magic of long-term compounding”.

Clearly, as a compounder, Buffett believes in investing for the long term.

Indeed, he pointed to just how lucrative such an approach can be when it comes to taking a “buy and hold” approach to share ownership.

He wrote that Berkshire’s time horizon, “is almost always far longer than a single year. In many, our thinking involves decades. These long-termers are the purchases that sometimes make the cash register ring like church bells”.

Buffett is among the most successful stock market investors in history.

Yet he recognised that even he can and does make errors: “I expect to make my share of mistakes about the businesses Berkshire buys”.

If that is true of Buffett, it is undoubtedly true of a small private investor like me. This is why I pay close attention to risks when looking for shares to buy.

In the past Buffett has said that – while he obviously appreciates great management — he likes to invest in businesses that could be run by an idiot, because one day they might be.

As he explained this time around, “a decent batting average in personnel decisions is all that can be hoped for”.

I found this idea very interesting: “really outstanding businesses are very seldom offered in their entirety, but small fractions of these gems can be purchased Monday through Friday on Wall Street and, very occasionally, they sell at bargain prices”. I would add this happens in London, too.

Warren Buffett’s investment in Coca-Cola (NYSE: KO) is an example.

Coca-Cola has some outstanding business characteristics. Its target market is large, resilient, and spans the globe. The company’s brands, proprietary formulas, and distribution network all help set it apart from rivals.

I see them as long-term competitive advantages. Some of the marketing money Coca-Cola is deploying today will still be influencing shoppers’ purchase decisions decades from now.

Yes, there are risks. Shifting consumer tastes mean sweet drink sales volumes could fall. Packaging cost inflation has added substantial costs in recent years.

Still, Coca-Cola is a profit machine that has raised its dividend per share annually for over six decades.

It is very difficult to buy such a company in its entirety. Warren Buffett has the necessary financial firepower, but companies like Coca-Cola are rare and rarely for sale in their entirety at an attractive price.

As Buffett noted in his letter, though, the drinks maker’s shares can be bought on the New York stock exchange by even an investor of very modest means.

Unsurprisingly, Berkshire owns a large stake.

Henderson Far East Income (HFEL) – Yield: 10.1%

European Assets Trust PLC – Yield: 7.5%

abrdn Equity Income Trust PLC – Yield: 7.5%

Blackrock World Mining Trust (BRWM) – Yield: 6.6%

Henderson High Income Trust PLC (HHI) – Yield: 6.3%

TR Property Investment Trust PLC (TRY) – Yield: 5.8%

Blackrock Latin American – Yield: 5.5%

Lowland Investment Trust PLC (LWI) – Yield: 5.4%

JPMorgan China Growth & Income – Yield: 5.2%

Merchants Trust PLC (MRCH) – Yield: 5.2%.

Some Trusts to DYOR from ChatGPT

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑