How to Live Off

$500,000… Practically Forever

In this income investing report, you’ll discover…

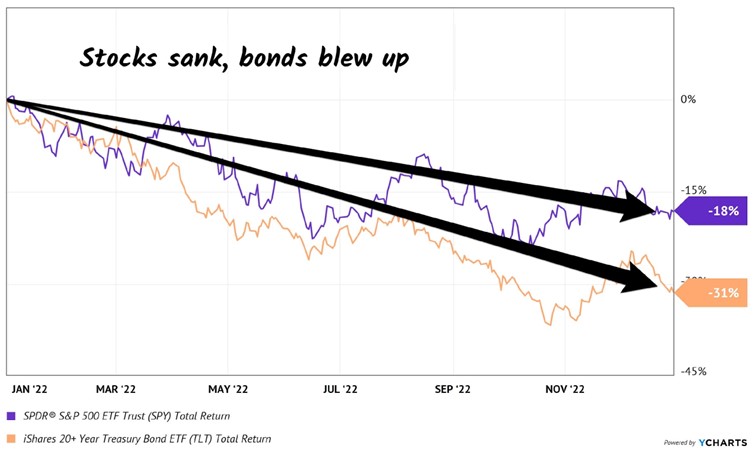

- How the 4% Rule and 60/40 Portfolio are now dead.

- How you could bank tens of thousands of dollars in yearly dividend cash for every $500,000 invested, and …

Dear Reader,

A half-million dollars is a lot of money. Unfortunately, it won’t generate much income today if you limit yourself to popular mainstream investments.

The 10-year Treasury pays around 4.3% as I write this. That’s not bad, historically speaking, but put your $500K in them and you’re only looking at $21,500, right around the poverty level for a two-person household. Yikes.

And dividend-paying stocks don’t yield nearly enough. For example, Vanguard’s popular Dividend Appreciation ETF (VIG) pays around 1.7%. Sad.

When investment income falls short, retirees are often forced to sell their investments to supplement their income.

Of course, the problem here is that when capital is sold, the payout stream takes an immediate hit – so that more capital must be sold next time, and so on.

Avoid the Share Selling “Death Spiral”

Some financial advisors (who are not retired themselves, by the way) say that you can safely withdraw and spend, say, 4% of your retirement portfolio every year. Or whatever percentage they manipulate their spreadsheet to say.

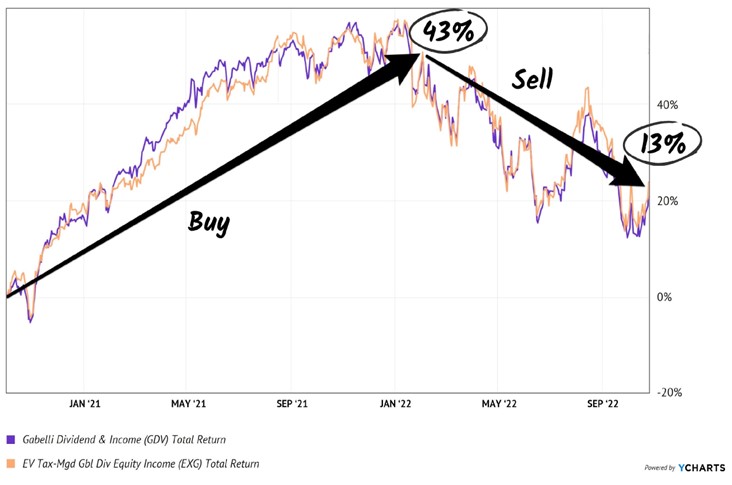

Problem is, in reality, every few years you’re faced with a chart that looks like this.

Apple’s Dividend Was Fine – Its Stock Wasn’t

As you can see, the dividend (orange line above) is fine — growing, even — but you’re selling at a 25% loss!

In other words, you’re forced to sell more shares to supplement your income when they’re depressed.

Remember the benefits of dollar-cost averaging that built your portfolio? You bought regularly, and were able to buy more shares when prices were low?

In this case, you’re forced to sell more shares when prices are low.

When shares rebound, you need an even bigger gain just to get back to your original value.

The Only Reliable Retirement Solution

Instead of ever selling your stocks, you should instead make sure you live on dividends alone so that you never have to touch your capital.

This is easier said than done, and obviously the more money you have, the better off you are. But with yields still pretty low, even rich folks are having a tough time living off of interest today.

And you can actually live better than they can off of a (much) more modest nest egg if you know where to look for lesser-known, meaningful and secure yield.

I’m talking about annual income of 8%, 9% or even 10%+ so that you’re banking $50,000 (and potentially more) each year for every $500,000 you invest.

You and I both know an income stream like that is a very nice head start to a well-funded retirement.

And it’s totally scalable: Got more? Great!

We’ll keep building up your income stream, right along with your additional capital.

And you’ll never have to touch your nest egg capital – which means you won’t have to worry about or running out of money in retirement, or even the day-to-day ups and downs of the stock market.

The only thing you need to concern yourself with is the security of your dividends.

As long as your payouts are safe, who cares if your stock prices swing up or down on a given day?

Most investors know this is the right approach to retirement.

Problem is, they don’t know how to find 8%, and 10% yields to fund their lives.

And when they do find high yields, they’re not sure if these payouts are safe. Will the company or fund have enough cash flow to pay the dividends into the future?

And how sensitive are these payouts to the latest headline, Fed policy changes or unrest on the other side of the globe?

We’ll talk specific stocks, funds and yields in a moment.

But first, a bit about myself.

I graduated cum laude with an industrial engineering degree — which is actually pretty popular with Wall Street recruiters.

But I couldn’t stand the thought of grinding it out in a cubicle for 80 hours a week. So I moved to San Francisco and got into the tech scene.

A buddy and I started up two software companies that serve more than 26,000 business users.

The result was a nice chunk of change coming in … and I had to decide what to do with my money.

I had seen plenty of young “techies” come into sudden cash and burn through their windfall in a year, ending up right back where they started.

That was NOT going to be me. I already had dreams of living off my wealth one day, decades before I retired.

I got plenty of cold calls from brokers wanting to “help” me. But I knew that nobody would care as much about my money as me.

So I went out on my own and invested my startup profits in dividend-paying stocks.

I’ve been hunting down safe, stable and generous yields ever since, growing my wealth with vehicles paying me 8%, 9%, even 10%+ dividends.

Over the past 10+ years, I’ve been writing about the methods I use to generate these high levels of income.

Today I serve as chief investment strategist for Contrarian Income Report — a publication that uncovers secure, high-yielding investments for thousands of investors.

Since inception, my subscribers have enjoyed dividends 5 times (and much more!) the S&P 500 average, plus big annualized gains!

And that brings me to a crucial piece of advice…

The ONE Thing You Must Remember

If I could leave you with just one nugget of investing wisdom today, it would be to NEVER overlook the incredible wealth-building power of dividends.

Few investors realize how important these unglamorous workhorses actually are.

Here’s a perfect example…

If you put $1,000 in the dividend-paying stocks of the S&P 500 back in 1973, you would have had $87,560 by 2023, or 87x your money.

But the same $1,000 in the non-dividend payers would have grown to just $8,430 — 90% less.

That’s why I’m a dividend fan.

The stock market is a fantastic wealth-building machine, but it doesn’t always go straight up!

There have been plenty of 10-year periods where the only money investors made was in dividends.

And that’s what gives us dividend investors such an edge.

When you lock in an 8%+ yield, you’re booking an income stream that’s bigger than the stock market’s long-term average return right off the bat.

Of course you can’t just buy every ticker symbol out there with a flashy yield, or you’ll get burned pretty fast.

So let’s wipe the false promises of mainstream finance from our minds and start thinking the “No Withdrawal” way…

The above article is for information only and is not an endorsement for Contrarian Income Report /Investor or investing in CEF’s.

As always it’s best to DYOR.