Now SEIT have declared their dividend, the income for the first six months should be in excess of £4,792.00, so on track for the fcast earnings of £9,120.00

The above figure does not include the dividend from VPC which will be paid next week.

Investment Trust Dividends

Now SEIT have declared their dividend, the income for the first six months should be in excess of £4,792.00, so on track for the fcast earnings of £9,120.00

The above figure does not include the dividend from VPC which will be paid next week.

SDCL Efficiency Income Trust plc

(“SEIT” or the “Company”)

Interim Dividend Declaration

SDCL Efficiency Income Trust plc is pleased to announce the fourth quarterly interim dividend in respect of the year ending 31 March 2025 of 1.58 pence per Ordinary Share, covered by net operational cash received from investments.

The shares will go ex-dividend on 12 June 2025 and the dividend will be paid on 30 June 2025 to shareholders on the register as at the close of business on 13 June 2025.

The Warren Buffett indicator suggests that shares are expensive. But Stephen Wright feels investors should think carefully about what to do.

Posted by Stephen Wright

MotleyFool

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

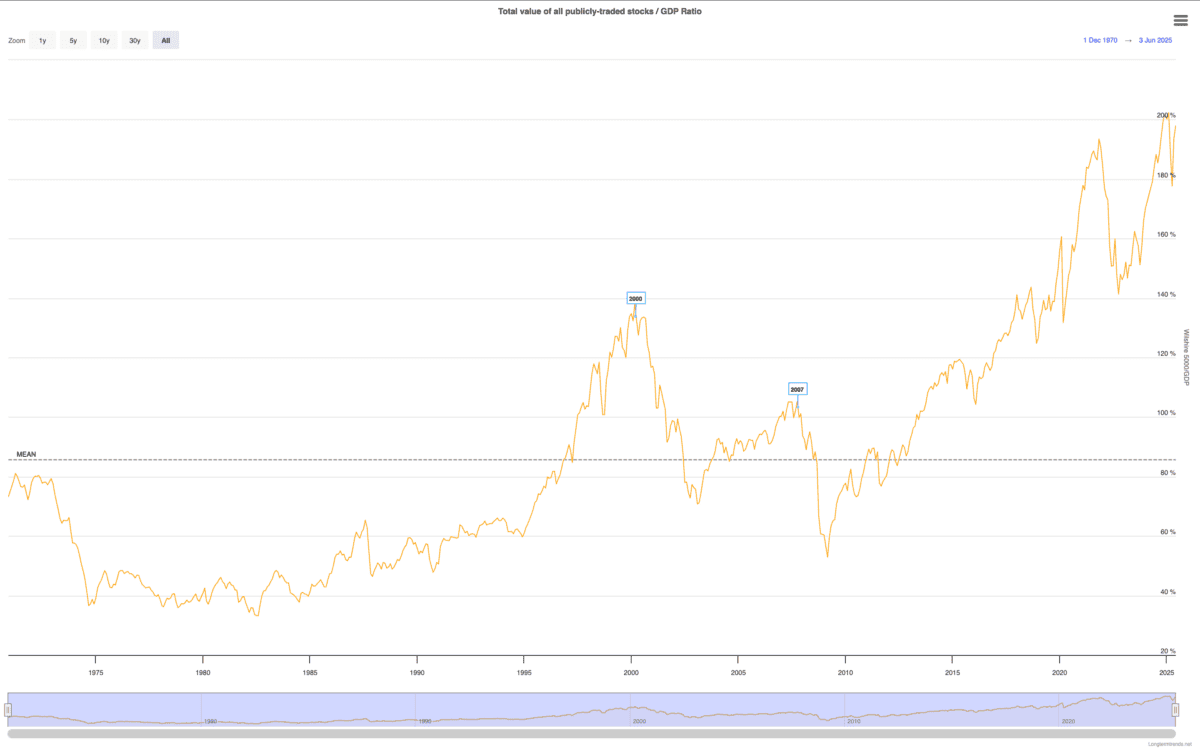

Billionaire investor Warren Buffett has a well-known metric for measuring stock market valuations and it indicates that share prices – specifically US ones – are expensive at the moment.

Given that US companies account for almost 70% of the global equities, it’s probably fair to say this means stocks as a whole are expensive. But what should investors do about this?

Buffett’s famous metric involves comparing the market value of equities with gross domestic product (GDP). And on this basis, US equities look unusually expensive at the moment.

Source: Longtermtrends

The so-called Buffett indicator has a decent history of being a good indicator of a stock market crash. Unusually high levels have often been followed by a sharp downturn in share prices.

Right now, the metric is the highest it has ever been, but I’m wary of making predictions on this basis. The main reason is that it’s been high for some time.

The Buffett indicator has been at unusually high levels since 2019. But the only stock market crashes in that time have been attributable to other things – Covid-19 and US trade tariffs.

I don’t think valuation metrics are a good indication of what stocks are going to do in the near future. But they do mean that the effect on share prices can be dramatic if something happens.

From a long-term perspective, the picture is slightly different. One reason for this is that there can be cases where valuation multiples don’t give a good indication of how expensive an individual stock is.

Polaris (NYSE:PII) is a good example. The firm is one of the leading manufacturers of recreational vehicles, including boats, motorcycles, and snowmobiles.

At a price-to-earnings (P/E) ratio of 56, the stock looks very expensive. But I think this is a case where things aren’t quite what they seem at first sight.

Polaris relies on consumers having disposable income. And a lot of its sales involve financing, which means high interest rates can dampen demand and weigh on margins, leading to profits falling away.

This is what has been happening recently and that’s the risk with this business. Furthermore, it makes the firm’s dividend look unsustainable if things don’t pick up reasonably quickly.

If this trend reverses however, the stock could look very cheap at today’s prices. And Polaris has generated average annual earnings per share of just over $5 over the last 10 years.

On this basis, the current share price implies a P/E ratio of around 8, which looks much more reasonable. So despite the high valuation multiple, I don’t actually think the stock is that expensive.

I think the Buffett indicator is worth paying attention to. But I’m not making plans for a stock market crash based on the historically high reading at the moment.

Instead, I’m looking for individual stocks to buy. And one type of opportunity is where unusually low earnings are making share prices look more expensive than they are.

Polaris is one example I think is worth considering right now. The P/E ratio might be high, but there’s a clear reason why this shouldn’t necessarily put investors off.

In the second article in a new series, a DIY investor explains how he spreads risk, including owning a mix of active and passive funds, and having a separate cash pot to avoid selling investments when stock markets are volatile.

by Kyle Caldwell from interactive investor

In our new DIY Investor Diary series, we speak to interactive investor customers to find out how they invest in funds and investment trusts, what their goals and objectives are, current issues and concerns regarding their portfolio, and what they’ve learned along the way. The premise is to try and provide inspiration to other investors, and we would love to hear from more people who would like to be involved.

One of the golden rules of investing is to spread risk far and wide by having a diversified portfolio. This is achieved through mixing a range of stock market investments with other investment types, primarily bonds and commercial property.

The theory is that different types of investments are unlikely to all outperform or underperform at the same time, which therefore reduces the volatility of your overall portfolio. Due to the fact that investments perform differently relative to each other every year; a mixed investment approach gives a portfolio ample opportunity to grow, while at the same time guarding against serious short-term losses.

The second DIY investor in our new series is not only diversified by asset class, but has also spread risk by owning a mix of active and passive strategies.

The DIY investor, who is a 63-year-old male and retired a couple of years ago, is not currently drawing on his investments, but has put a plan in place to do so in the coming years.

Given that the ISA will be utilised first, our investor has structured this tax wrapper to be less risky than the SIPP. It has greater exposure to income-producing assets. Overall, it contains 17 holdings, with 13 active funds. His holdings include Fundsmith Equity, Personal Assets Ord.

The SIPP contains 15 holdings, of which 10 are a diverse spread of passively managed index funds, including L&G International Index, Vanguard LifeStrategy 80% Equity, and Vanguard Global Small-Cap Index, Scottish Mortgage Ord

Overall, he prefers investment trusts to open-ended funds. “The long-term performance of investment trusts tends to be better,” he says. “They are also more visible, in having annual reports to read through. And I find they are also cheaper than funds as well.”

In addition to the ISA and SIPP, he has a cash buffer equivalent to around five years of forecast expenditure.

He says: “As I intend to access the ISA first, the SIPP allows me to be riskier. But I do want to sleep at night. I want to preserve wealth and not lose it, rather than attempting to punch the lights out.”

Both the diversification in how he has structured his investments, and the cash buffer, help to keep a lid on risk. By having a separate cash pot, he says that “this protects [him] from having to sell investments if there’s a major market downturn”.

He also intends to keep risk in check in future years by taking the income produced by the fund (the ‘natural yield’). This will involve switching from accumulation share classes to income share classes.

In a scenario where stock markets fall sharply, taking the natural yield from a portfolio helps protect the value of investments and allows them the chance to recover.

He says: “I will be aiming to take the natural yield from the ISA, but for any gaps, I can always sell fund units. By having five years’ worth of expenditure in cash, this will hopefully protect against any major market downturn.”

While he has a mix of active and passive funds, this DIY investor is increasingly favouring the latter approach for its simplicity in providing the return of a stock market minus the fees levied, which tend to be low.

He is not alone. There’s been a big shift towards passive strategies over the past 15 years. In 2007, before the financial crisis, the amount held in tracker funds was £29 billion, which at the time represented 6.3% of the total held in all funds. Today, there’s around £300 billion invested in total. This is about 20% of the funds industry, according to trade body the Investment Association (IA).

He says: “My views on active versus passive funds have changed over the years. Active funds require dedication and time, whereas in hindsight I could have kept it more simple by just keeping the returns in line with the market with a passive fund. When you plot the performance of passive funds over five and 10 years, you can see the returns have been good enough.

“I am now questioning why I am bothering with active funds. Fund managers retire (or jump ship or are moved on), and investment styles go in and out of fashion.”

There are various factors influencing the popularity of simply buying the market through an index or exchange-traded fund (ETF), with one being that some investors are losing faith in the ability of active fund managers to outperform a comparable stock market.

Our investor looks to ensure that the active funds he owns are offering something genuinely different compared to what an index fund or ETF can offer. One example is Scottish Mortgage, which attempts to find exceptional growth companies, both publicly listed stocks and private firms (which amount to a maximum of 30% of the portfolio).

Scottish Mortgage’s short-term performance has come off the boil, due to its investment approach suffering in a higher interest rate environment. However, its long-term returns are stellar. Over 10 years, its share price total return is 320% versus 200% for the average global trust. Over one and three years, however, it has lost 18.5% and 18.0%.

Our DIY investor says: “With active funds, I am trying to fill in what is missing from an index fund, while avoiding paying a high fee. Scottish Mortgage certainly ticks the boxes. It provides exposure that I won’t get in an index fund.”

Our investor acknowledges that there are occasions when it is worth considering converting paper gains into real profits.

He says: “I am a buy and hold investor, but there are times when you do need to take profits. I took some profits from Scottish Mortgage when it had a really strong period of performance following the Covid-19 pandemic, but I kept most of it and I should have sold more. However, I am still confident for its prospects over a 10-year time horizon.”

While hoping Scottish Mortgage’s fortunes change for the better, one investment that will not see all the losses recovered is the fund formerly managed by Neil Woodford. It was not a huge holding, so while the losses were unwelcome, they were easier to stomach.

He had formerly invested in Woodford when he worked at Invesco, prior to the former star investor setting up his own fund management firm. A lesson learned from the saga was that the “worst thing a fund manager can do is something different”, as opposed to sticking to the investment strategy in place. In hindsight, he says: “The fund was not doing what I bought it for.”

Other key lessons he has learned are to avoid panic-selling, as over time the stock market recovers its poise, and that timing the market is virtually impossible.

Our DIY investor also avoids investing in things he doesn’t fully understand. For this reason, he doesn’t invest in bonds, instead preferring to gain bond exposure through the index funds he owns and some of the active funds. “I would sooner leave bond exposure to the professionals, such as Capital Gearing and Personal Assets,” he says.

Finally, he stresses the importance of fund charges, which are one of the only things DIY investors have control over. Fees are central to the active versus passive fund debate, and, as our investor says, it is a question of whether “active funds reward [you] for the additional risk”.

Story by Royston Wild

Young female analyst working at her desk in the office© Provided by The Motley Fool

Real estate investment trusts (REITs) can be effective ways to target a large and growing passive income over time.

Like any dividend share, the levels of income they pay are linked to the amount of earnings generated. However, REIT obligations state they must pay a minimum of 90% of annual profits in dividends in exchange for tax breaks. So investors often enjoy better income visibility with these assets.

Here are two top investment trusts that have grabbed my attention today. As well as offering that security, they also have the sort of dividend yields that suggest above-average passive income over the near term. So I feel they’re worth a closer look.

Dividends are never, ever guaranteed. But if broker forecasts prove accurate, a £15,000 lump sum investment spread across these stocks will deliver a £1,088 second income just for their current financial years.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Euro star

Though its 15 different assets, the Schroder European Real Estate Investment Trust invests in what it deems ‘winning cities’ across France, Germany and The Netherlands. These are locations that have significant scope for long-term growth.

While it’s focused on commercial assets, the trust spreads its exposure across multiple industries including retail and offices. This geographical and sector diversification helps it navigate weakness in particular areas and deliver a stable return over time:

Source: Schroders

Higher interest rates have been a problem across the REIT complex in recent years. And this Schroders trust could experience more stress than UK peers if the US and EU engage in a bloody tariff war.

However, lower inflation in the eurozone compared with Britain suggests the threat here could be less severe. Indeed, news last week that German consumer price inflation (CPI) fell to 2.1% in May — fractionally above the ECB’s target — is an encouraging sign.

At 66.8p per share, the Schroder European Real Estate Investment Trust trades at a 31.5% discount to its net asset value (NAV) per share. I think it demands serious attention at this price.

A ‘safe’ selection

To my mind, Primary Health Properties is one of the most secure passive income shares to consider today. It’s why I hold it in my Stocks and Shares ISA.

As the name implies, it focuses on the primary healthcare sector and operates 516 GP surgeries and other medical centres in the UK and Ireland. This isn’t just a rock-solid sector that’s immune to economic conditions, it’s one with substantial growth potential as governments act to divert patients from crammed hospitals to get treatment elsewhere.

Another reason I like Primary Health Properties is the majority (89%) of its rental income is bankrolled either directly or indirectly by government bodies. This provides earnings with another layer of security.

As I say, REITs like this are vulnerable to unfavourable interest rate rises. This particular one could also come under pressure if UK health policy changes.

But I hope these dangers are reflected in its low valuation. At 100p per share, the trust deals on a sub-1 price-to-book (P/B) ratio of 0.9.

The post 2 REITs to consider in June to target a £1,088 passive income! appeared first on The Motley Fool UK.

SERE

18 December 2024

SCHRODER EUROPEAN REAL ESTATE INVESTMENT TRUST PLC

(“SEREIT” or the “Company” and, together with its subsidiaries, the “Group”)

French tax disclosure update

Schroder European Real Estate Investment Trust plc, the company investing in European growth cities and regions, provides a tax disclosure update.

As previously announced, the French tax authority is proceeding with a tax audit in relation to the Group’s French tax structure.

In the Group’s 2024 Annual Report it was disclosed that the range of potential outcomes indicates a possible exposure of between €nil and €12.6 million, excluding potential penalties.

As part of the ongoing tax audit, a formal ‘Proposal for Adjustment’ has been received from the French tax authority which includes a proposed penalty on any tax found ultimately due. Including the application of interest and penalties, the potential exposure for the Group is expected to be up to €14.2 million.

Based on external tax and legal advice received at the time of implementation, and which has continued to be reviewed on an ongoing basis, the Board continues to believe that an outflow is not probable and therefore no provision is recognised.

The Group disagrees with the ‘Proposal for Adjustment’ and will continue to contest its position and will provide further updates as required.

My name is Brett Owens and I’m an unabashed dividend investor. Ever since my days at Cornell University and all through my years as a startup founder in Silicon Valley, I’ve hunted down safe, stable, meaningful yields.

Fortunately for you and me, the financial markets aren’t 100% efficient. And some corners are even less mature and less combed through than others.

These corners provide us contrarians with stable income opportunities that are both safe and lucrative.

There are anomalies in high yield. In an efficient market, you wouldn’t expect funds that pay big dividends today to also put up solid price gains, too.

We’re taught that it’s an either/or relationship between yield and upside – we can either collect dividends today or enjoy upside tomorrow, but not both.

But that’s simply not true in real life. Otherwise, why would these monthly payers put up serious annualized returns in the last 10 years while boasting outsized dividend yields?

For example, take a look at these 5 incredible funds that pay monthly and soar:

This is the key to a true “8% Monthly Payer Portfolio” – banking enough yields to live on while steadily growing your capital. It’s literally the difference between dying broke and never running out of money!

But I’m not suggesting you run out and buy these funds.

Some have been on my watchlist and in our premium portfolios over the years, but I mention them only as examples of the potential ahead.

In our new DIY Investor Diary series, we speak to interactive investor customers to find out how they invest in funds and investment trusts, what their goals and objectives are, current issues and concerns regarding their portfolio, and what they’ve learned along the way. The premise is to try and provide inspiration to other investors, and we would love to hear from more people who would like to be involved.

Swotting up to learn how history’s most successful investors made their fortunes is a great way for DIY investors to pick up the tips and tricks of the trade.

Part one.

This is exactly what the first DIY investor to be profiled in our new monthly series did when he came across Warren Buffett. The investor, who works for a financial education charity and is in his early 50s, read up on the investment principles of Buffett, as well as the Sage of Omaha’s tutor Benjamin Graham.

There are various attributes that Buffett looks for, but his basic approach is to sniff out companies he thinks can consistently increase their intrinsic value and sustain a high return on equity over the long term. Crucially, Buffett has a beady eye on valuations, as he does not want to overpay for a company.

To find companies well-placed to keep competitors at arm’s length in the decades to come, Buffett looks for businesses with strong economic “moats”. The quality growth names to which he is naturally drawn possess some sort of competitive edge, such as being armed with intangible assets or selling a product or service bought repeatedly by a loyal customer base. Such companies are typically price-makers, as they are able to dictate what they charge for their product. In a high inflationary environment, like now, this quality becomes even more attractive.

The DIY investor, who is male, wanted to benefit from Buffett’s approach, so put his money into Buffett’s firm Berkshire Hathaway Inc Class B

. Over the years, he attended a couple of annual general meetings (AGMs) to soak up his wisdom in person.

He invested in Berkshire Hathaway for several years until 2010 when Terry Smith launched his Fundsmith Equity fund.

Smith invests in well-established high quality companies with strong competitive advantages. His stance is that he does “not seek to find tomorrow’s winners – rather, to invest in companies that have already won”. The portfolio has 26 holdings, with Microsoft Corp, L’Oreal SA Visa Inc Class A V0.59% among the top 10 holdings.

“Terry Smith builds on Buffett’s principles, and the way he invests resonates with what I believe,” our DIY investor says.

“The way I saw it, I would rather a spread of shares [Fundsmith Equity typically holds fewer than 30 companies] than just exposure to one company, Berkshire Hathaway. In addition, there’s less exchange rate risk as Fundsmith Equity is priced in pounds.”

The DIY investor still holds Fundsmith Equity today. It is a position he’s kept adding to, and he has not taken any profits. Since launch, the fund is up 519% versus 195% for the average global fund.

“Terry Smith is a rare example of a fund manager articulating his investment approach in a credible and robust way. He is very true to the strategy, and doesn’t spin a narrative.

“Hopefully, he will continue running the fund for a long time to come, but there’s also a strong team, with Julian Robins a potential successor.”

The DIY investor today has 40% of his overall investments in Fundsmith Equity, and the remaining 60% in UK smaller company funds and investment trusts. Regarding the latter, he says he wished he knew about investment trusts earlier, due to the various bells and whistles they have, which private investors can use to their advantage.

One of the main differences is that investment trusts have a fixed pool of assets that do not fluctuate with investor demand. In contrast, funds – unit trusts or OEICS – are required to sell assets to meet investor redemptions.

Having a fixed pool of assets is particularly advantageous for specialist investment trusts holding assets that cannot be easily or swiftly bought and sold, such as property, private equity or very small companies. Managers don’t have to sell their holdings to release money to investors looking to liquidate their investments when markets dip; instead investors sell their shares on the stock market and the share price takes the strain.

Due to this, our DIY investor prefers investment trusts for smaller company exposure. Among his holdings are JPMorgan UK Smaller Companies (LSE:JMI), BlackRock Smaller Companies Ord and Invesco Perpetual UK Smaller (LSE:IPU).

His interest in smaller companies was piqued by long-term data showing how they have delivered higher returns compared to larger companies over the long term. Research by the London Business School found that £1 invested in 1955 in UK smaller companies would have grown to £7,933 by the end of 2020. In contrast, £1 invested in UK large companies over that 65-year period would have grown to £1,054.

Given that smaller companies have been out of favour for the past 18 months or so, now presents an opportunity to put into practice Buffett’s ‘buy low’ philosophy.

Our DIY investor points out: “I have time on my side, so I am prepared to patiently wait for smaller companies to recover. In the meantime, it is often a good time to buy when something is out of favour.

“When I am looking at smaller company options, I am looking to gain an understanding of the nuances of how the fund manager invests. My preferred way to invest in this area is investment trusts, as the structure lends itself to it given the fund manager won’t be a forced seller.”

In his early 50s, the DIY investor is aiming to continue growing his investments for the foreseeable future. However, when the time comes to start drawing down on his pot, he won’t be switching his investments from growth to income. Instead, he says he will sell down fund units when he wants to spend some of the capital growth achieved over the years.

“I completely agree with Terry Smith on this – I don’t get why people focus so much on income. At the end of the day your pension fund – such as a self-invested personal pension (SIPP) – is meant to be run down at retirement, so sell a bit of your investments when needed.”

Smith’s stance on income is that while reinvested dividend income may be a crucial element of long-term returns, it does not follow that investment styles focused on maximising dividend income will deliver more growth.

The DIY investor’s portfolio does not contain any passively managed strategies – index funds and exchange-traded funds (ETFs). He points out that Buffett’s stance on the active versus passive fund debate is one that he agrees with. Buffett has said that for most people they are better off opting for a low-cost index fund.

However, with his own investments, our DIY investor prefers active funds, which have the ability to outperform an index.

He said: “I agree that passive is a good option for many as a core holding, but I am prepared to take the risk of picking active funds in the hope of outperformance. There’s a lot of fund managers who have rubbish track records picking stocks, but there’s also a lot of dross in a passive fund.”

He has no plans to hang up his boots. Our DIY investor points out that investing is one of his hobbies and that he will continue with it while he is mentally active, and that a key motivation for investing is financial independence. He notes that investing “creates more options for myself. It’s money not for the sake of it, but it gives options for myself or to help others.”

Our DIY investor’s top tip is the earlier you invest, the better. This is to benefit from the power of compound interest, achieved through investing for the long term.

In a nutshell, compound interest refers to the way investment returns themselves generate gains. For instance, if you invest £1,000 into a fund returning 5% over one year, you’ll earn £50. Assuming that you don’t withdraw any money, the next year you’ll earn 5% on £1,050, which is £52.50. This doesn’t sound like much of an uplift, but as each year passes, the compounding effect multiplies.

He also stresses the importance of fees, including platform charges, which is one of the only things that private investors can control.

Our DIY investor says that investing for the long term and keeping your emotions in check are other ways to increase your chances of investment success.

He also names a couple of other very useful tips: “Write down the rationale for every purchase and sale. This particularly helps when markets are jittery. Also remember that shares don’t have emotions, but humans do. This is important to remember regarding losses.”

At such times, he says, rather than panic-selling investors should take a step back and come to a rational decision, one that is not based on emotion. “Challenge yourself on what you believe and what you disbelieve – letting go of a view is difficult for most of us,” he says.

As history shows, for those willing to take a long-term perspective sharp dips end up being a mere footnote in the grand scheme of things. At times of stock market turbulence, it is worth remembering that volatility is part of the deal of investing in equities. It is the price investors pay for the fact that, over the long run, putting money into shares rather than leaving it in cash will yield greater rewards.

A plan needs to have an end destination, otherwise it’s not much of a plan.

The Snowballs preferred end destination, ranked in order.

1. A dividend re-investment plan, then live off the dividend stream for your ‘pension’.

2. A TR plan and use a gilt/treasury ladder for income.

3. A mixture of 1/2.

4. A TR plan and use the 4% rule for income.

5. A TR plan and buy an annuity.

That’s my preferred options for the Snowball, just as your Snowball should be different so should your preferred options.

Brett Owens, Chief Investment Strategist

Updated: June 3, 2025

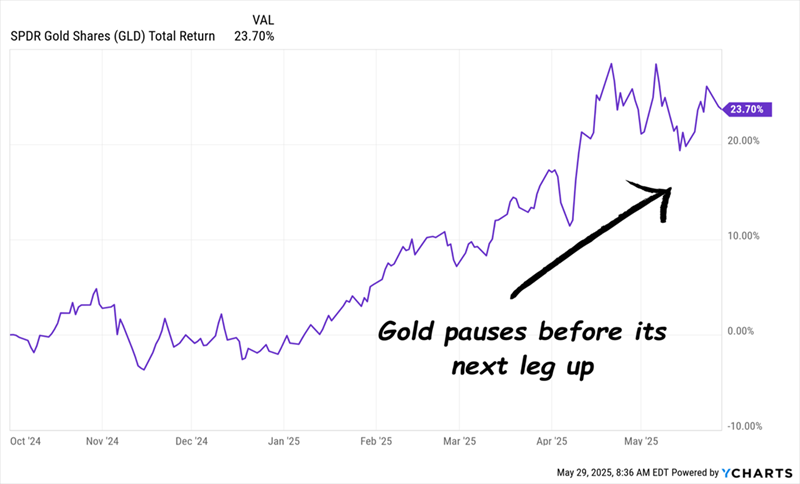

Gold prices have taken a breather—and we’re getting a rare opportunity to snag two shimmering dividend plays paying up to 8.3%.

Here’s why this setup is on the table: While recession worries are still valid, they’re overblown. Plus, the doomsayers are missing critical details set to kick gold higher. Let’s break all of this down, then get into the 8.3% (and growing) payouts the archaic metal is poised to deliver.

The “No-Landing” Economy: Alive, Well—and Bullish for Gold

Last fall, we talked about a “no-landing” economy in the US, where growth ticks along, but inflation sticks around, too. Fast-forward to today, and that’s pretty much how things have played out.

“But wait,” the first-level thinkers cry. “Didn’t the economy shrink in the first quarter?”

Sure, GDP growth did slow in Q1. But the underlying numbers were more bullish than the headlines suggested.

The drop mainly came from a surge in imports ahead of tariffs—and imports are calculated as a drag on GDP. Government spending also fell in light of DOGE cuts, while consumer spending held up.

In other words, this wasn’t real weakness. It was a data blip. And we’ll happily take it!

“No-Landing” Becomes Reality, Gold Takes Off

Consecutive negative quarters would signal an “official” recession, but President Trump and Treasury Secretary Scott Bessent do not want this scarlet letter heading toward the midterms. Jay Powell wants nothing to do with it, either.

So we can expect the government and the Fed to continue their (quiet) interplay to keep rates down and growth ticking along. Inflation—or just the fear of inflation, which is all we need to spur gold—will likely come along with it, prompting higher gold prices.

Bessent and Powell Team Up to Spur Gold

Let’s start with the “One Big, Beautiful Bill,” which is nothing if not stimulative (even though it adds to the $2-trillion-and-growing deficit abyss Uncle Sam is staring into), with its broad array of tax cuts.

Consider, for example, the potential elimination of taxes on tips and overtime. According to the House Ways and Means Committee, this could put $1,700 in the pockets of individual taxpayers who collect either one.

These folks, who lean toward the lower end of the income scale, tend to spend their earnings in the real economy, driving growth (and potentially inflation). Wealthier taxpayers, on the other hand, are more likely to pump any tax savings into investments.

The bill has passed the House, and we have to see what happens with it in the Senate. But with both parties broadly supporting the tip/overtime measure, it’ll likely survive.

Next up we have Jay Powell, who, despite his tough talk, recently stepped up the Fed’s bond buying by an extra $20 billion a month!

Finally we have Treasury Secretary Scott Bessent, who’s likely to stick with a tactic used by former Treasury Secretary Janet Yellen: Leaning more on short-term Treasuries to finance the government’s needs, thereby reducing issuance—and increasing demand—for longer-term Treasuries.

Without this shift toward shorter-term borrowing, the 10-year Treasury yield would be 30 to 50 basis points higher, according to a 2024 paper by economist Nouriel Roubini. In other words, the 10-year yield would top 5% today. And the cost of borrowing for business (lending rates) and individuals (mortgage rates) would be notably higher along with it.

The bottom line? These measures (and more) are likely to keep inflation worries alive, even if they keep long rates capped and slow economic growth. That makes today’s pullback in gold worth buying. Here are two ways to do it, for either high income now or dividend growth (and price gains) later. Or both!

Gold Play No. 1: An 8.3%-Paying Fund With a Discount “Kick”

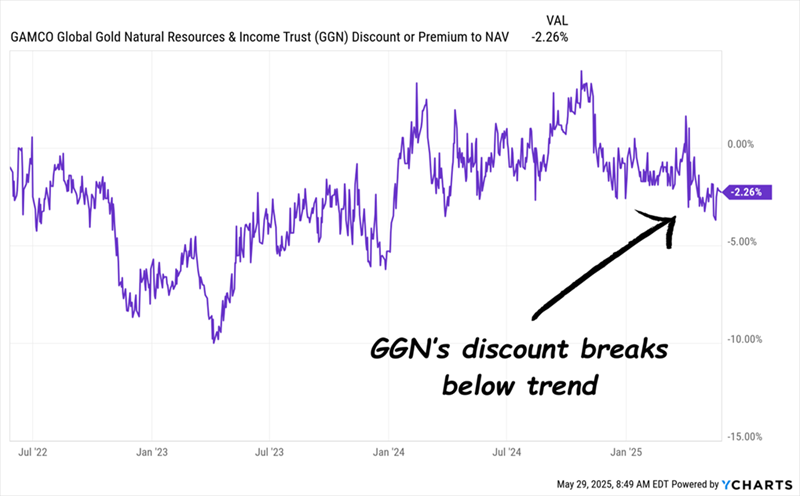

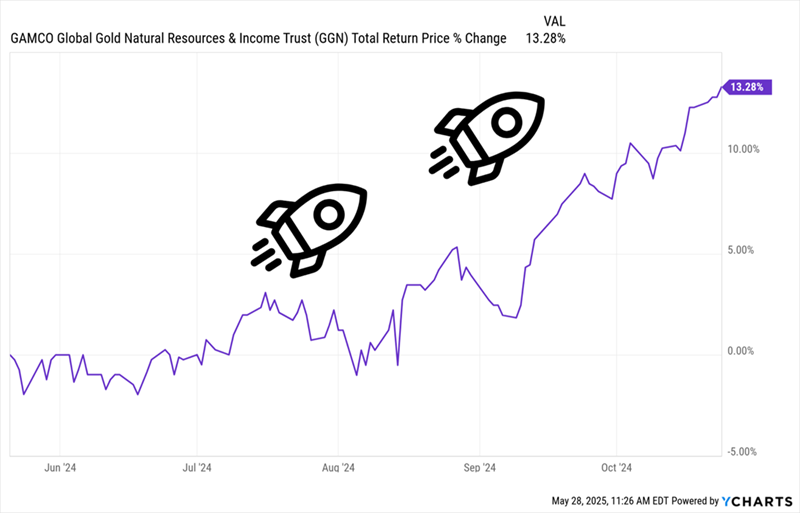

I’ve been critical of the GAMCO Global Gold, Natural Resources & Income Trust (GGN) in the past, because its discount to net asset value (NAV) never seems to drop to a level that catches our interest.

That, in turn, has been part of the reason why GGN typically trails gold prices. But that discount story is starting to change (As a CEF, GGN regularly trades at a different level than its portfolio value, or NAV).

GGN’s “Hidden” Discount

CEF discounts like these quietly drive price gains as they flip to premiums. And while GGN’s 2.3% discount isn’t huge, it’s a far cry from the premiums we saw late last year. That suggests this trade is much less crowded now, even as gold’s outlook improves.

Moreover, that 2.3% markdown is right around where it was a year ago. Here’s how buyers did back then, as that discount shot to a 4% premium over the following five months (note that about a third of this gain came in the form of dividends):

GGN’s Last “Disappearing Discount” Drove a Fast 13% Gain

Another premium could be ahead, sparked by those moves by the Fed and the Trump administration we just talked about.

Now there is something we need to keep in mind with GGN: It isn’t a “pure” gold play. As the “Natural Resources” in the name suggests, about 60% of the portfolio is in mining stocks—including some non-gold names like Freeport McMoRan (FCX), which focuses mainly on copper.

Another third or so is in energy stocks, with Exxon Mobil Corp. (XOM) the fund’s top holding. That may be okay if you’re bullish on oil. But with another part of Bessent’s economic strategy being, quite literally, “drill, baby, drill,” we think shares of gold mining companies offer better, er, “prospects” now, especially if you’re less focused on current income.

Which brings me to …

Gold Play No. 2: A Way to Profit From Cheap Energy, Soaring Gold

Imagine for a second you’re an exec at a gold miner like Newmont Corp. (NEM), the biggest of the bunch. As I write this, the WTI crude price is around $62, not far off lows last seen in 2021. That’s huge, with energy being a major input cost for any miner.

At the same time, the selling price of your main output, gold, is around $3,300. That’s still near historic highs, even with the modest pullback we’ve seen.

I think you’ll agree that this is a very good setup for a gold miner—maybe as good as it gets! No wonder Newmont’s revenue shot up 25% year over year in Q1, while EPS soared to $1.68 from $0.14 a year earlier. Fourteen cents!

And yet—as I write this, shares trade at just 12-times forward earnings, far below the five-year average of 19.3.

NEM yields 1.9% now and pays a base plus variable dividend that fluctuates with gold prices. But the dividend clocks in at just 27% of NEM’s last 12 months of free cash flow, so it’s safe and primed to rise if gold keeps climbing.

The Last Word: GGN for Income, NEM for Gains (and Payout Growth)

Here’s where that leaves us with gold miners like NEM: Gold is likely to move higher, and energy prices are likely to remain low—both thanks to Bessent and Powell.

That makes NEM worth a look, especially if you’re okay with a bit of movement in the dividend. Higher gold also helps strengthen GGN’s 8.3% payout, even with the prospect of continued lower energy prices. That payout comes in monthly and has held steady since mid-2020.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑