Why We’re Buying This US Debt Downgrade (Starting With This 9% Dividend)

by Michael Foster, Investment Strategist

This latest US debt downgrade is a buying opportunity for us contrarians. I say that because we had the same (profitable) setup the last three times the ratings agencies took Uncle Sam’s credit rating down a peg.

You might find that last sentence surprising. Three times? Indeed, the US government has seen its debt downgraded on three different occasions: 2011, 2023 and most recently a couple of weeks ago.

You can be forgiven for not remembering all of these: In some cases (2023 comes to mind), they didn’t really make headlines. In others, they set up a small dip in stocks (and stock-focused closed-end funds yielding 8%+) that was well worth buying.

Let’s go through all three occasions and see what they can tell us. We’ll also look at how they affected the performance of the Adams Diversified Equity Fund (ADX), a holding in my CEF Insider service.

ADX pays a roughly 9% dividend as I write this and sports a discount to net asset value (NAV, or the value of its underlying portfolio) of around 8%. The fund holds some of the biggest (and most credit-worthy!) US stocks, like Apple (AAPL),Microsoft (MSFT) and Visa (V), not to mention top-quality lenders like JPMorgan Chase & Co. (JPM).

Let’s start in August 2011, when debt-ceiling wrangling in Congress prompted Standard & Poor’s to downgrade US government debt. At the time, this move was historic: No agency had ever downgraded the US government’s credit, which was considered incredibly safe.

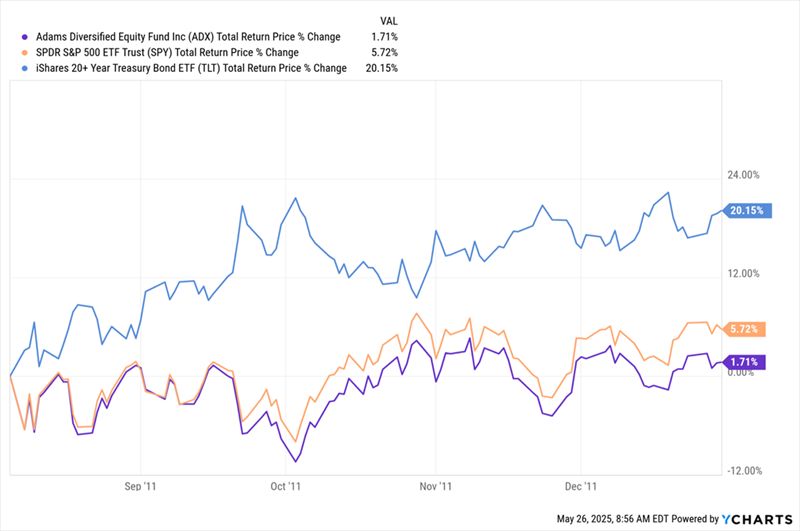

What happened next? US long-term Treasuries (in blue below) surged some 20% from the day of the downgrade through the end of 2011. The S&P 500 (in orange) also had a good run, returning nearly 6% over those few months. ADX (in purple) trailed behind, but as we’ll see next, this lag made it the best opportunity of the three.

Bonds Sprinted Ahead After the 2011 Downgrade …

Buying the S&P 500 was clearly a smart move here. But playing the contrarian and buying bonds after the downgrade delivered even faster returns. Over the long run, however, it was ADX (in purple below) that won out, with dividends reinvested:

… But ADX Was the Clear Long-Run Winner

Now let’s look at the next downgrade, in August 2023. This time it was Fitch that cut Uncle Sam to the agency’s second-highest rating.

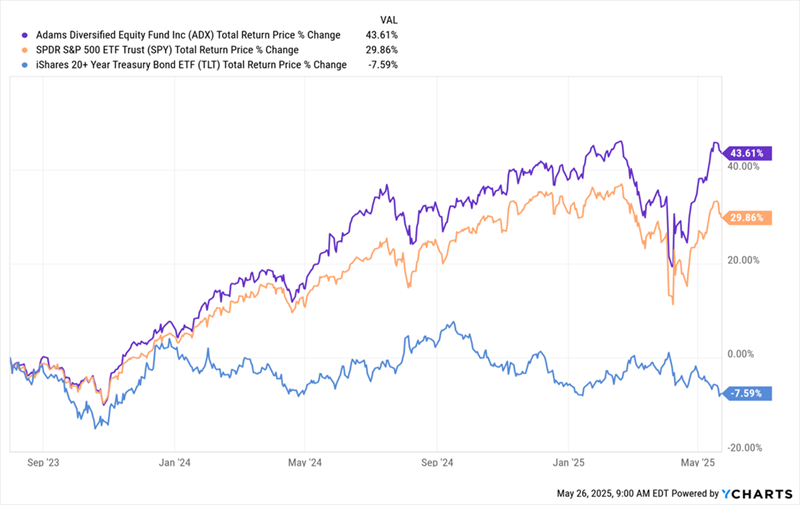

Another Downgrade, Another Win for ADX

ADX (in purple above) has returned about 44% since then, as of this writing, well ahead of the S&P 500’s 30% gain (in orange). Meantime, Treasuries (in blue) are in the red.

Why the difference in government-bond action between this downgrade and the first one? That’s another article on its own, but suffice it to say, it had more to do with slower-than-expected Fed rate cuts than the downgrade.

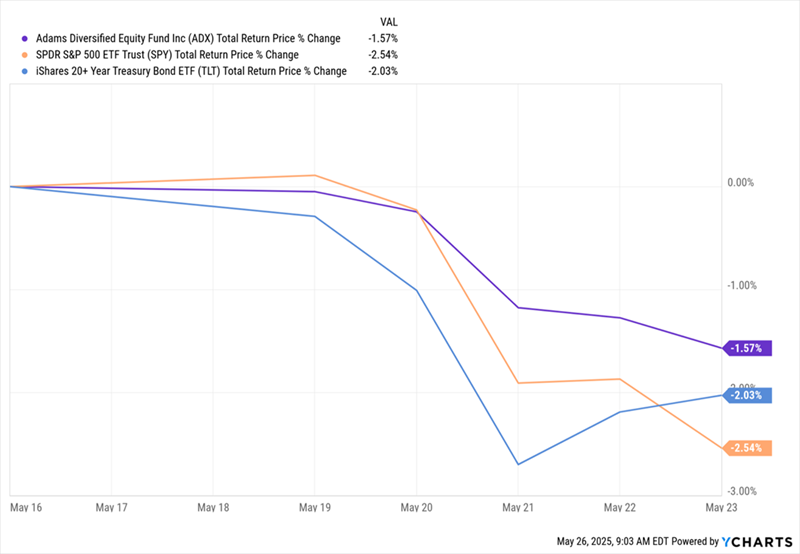

The most recent downgrade, just a couple weeks ago, did cause a dip in stocks, ADX and bonds, however – though ADX has fallen the least as I write this. These declines are likely the result of tariff uncertainty, which has caused more anxiety than we saw in late 2023, when stocks were recovering from the 2022 pullback.

Tariff Worries Drive a Short-Term Dip

As you can see above, all three stayed flat until falling a little on May 20, then falling sharply the next day, when Walmart warned about price increases (and therefore lower consumer spending), and Target reported disappointing sales.

The smart money did not sell when the news was first released on the 16th, but we are probably seeing more selling pressure as the retailers’ warnings have added anxiety.

In the coming days, we could see stocks go flat or slightly negative if the sour attitude sticks around. But that would be a buying opportunity – especially for equity CEFs like ADX – similar to the openings we saw in 2023 and 2011.

Downgrade Only Covers Some Types of Debt

Another important point: the downgrade doesn’t impact all US assets. In its announcement, Moody’s makes clear that the downgrade impacts America’s “long-term issuer and senior unsecured” debt, but “the US long-term local- and foreign-currency country ceilings remain at Aaa.”

In other words, the downgrade applies to US Treasuries greater than one year in duration (government bonds, basically, up to and including 30-year issues). Those bonds now have the second-highest rating from all three ratings agencies.

At the same time, non-government debt issuers in the US can still have the top rating – including American companies. In fact, Apple (AAPL), Microsoft (MSFT) and Johnson & Johnson (JNJ) still have the Aaa rating from Moody’s. (Note that ADX holds Apple and Microsoft, so it’s a good pick if you’re still concerned about credit quality.)