Top-performing investment trusts: Europe leads the pack in H1

European small caps have been the best-performing investment trust sector so far this year, as investors move money out of the US. Can it continue?

(Image credit: Westend61 via Getty Images)

By Katie Williams

It has been one of those years where decades happen in weeks, to misquote Lenin, and we are only halfway through 2025. From DeepSeek at the start of the year, to trade wars and an escalation in the Middle East more recently, there has been plenty to rattle markets.

Despite this, investment trust performance has been strong. The average trust (excluding venture capital trusts) is up 7% over the past six months in share price terms, according to the Association of Investment Companies (AIC).

European trusts have been a standout performer, with European small caps securing the top spot in the AIC’s performance table, up 24% in the first half of the year. European large caps came in close behind in third place, up 17%.

Get 6 issues for £1

+ a free notebook

Stay ahead of the curve with MoneyWeek magazine and enjoy the latest financial news and expert analysis.

“It has been a strong six months for Europe as investors have reallocated away from the US into the European investment trust sectors. Trusts investing in the UK, China and Japan have also been beneficiaries of this tilt away from the US,” said Annabel Brodie-Smith, AIC communications director.

Latest Videos From Moneyweek

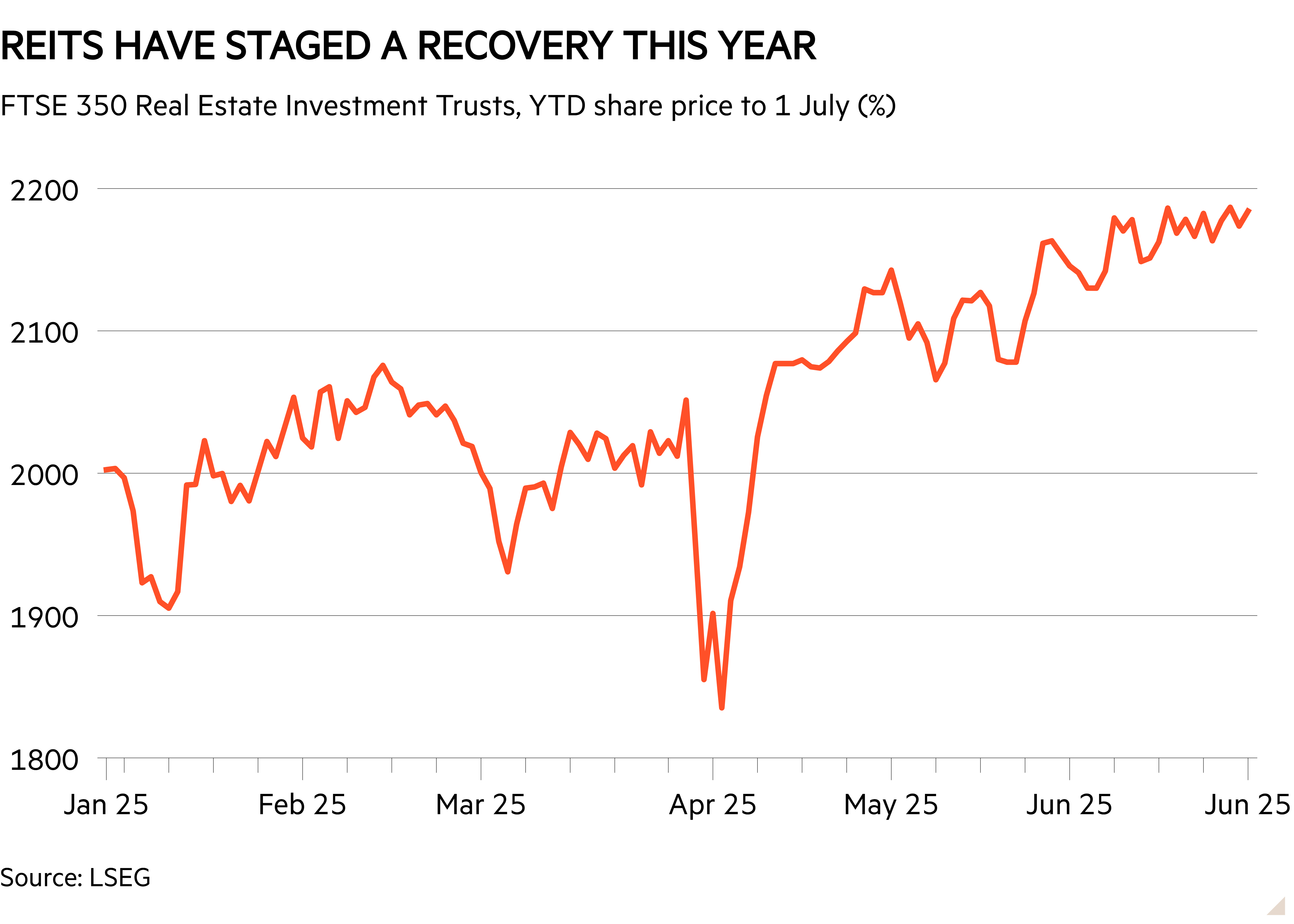

The UK commercial property sector has been another strong performer, coming second in the AIC’s rankings in the first half of 2025. It is up 18% so far this year, having rebounded after a period of weak performance. The sector is down 16% on a three-year basis.

“The sector has bounced back this year due to interest rates starting to come down, strong rental growth and an increase in M&A activity,” Brodie-Smith said.

Having struggled against a tough economic backdrop in recent years, including weak consumer sentiment and a property market slump, the Greater China sector has also shown strength in the first half of 2025.

Chinese equity trusts are up 15% over the past six months, but are still down 11% on a three-year basis and 6% over the past five years.

| Sector | H1 2025 | 1 year | 3 years | 5 years | 10 years |

| European Smaller Companies | 24.41% | 22.95% | 53.44% | 80.82% | 174.32% |

| Property – UK Commercial | 17.94% | 22.29% | -15.73% | 21.48% | 46.00% |

| Europe | 17.48% | 7.11% | 52.63% | 57.39% | 142.01% |

| China / Greater China | 14.60% | 25.07% | -10.93% | -6.27% | 84.60% |

| UK All Companies | 13.18% | 17.24% | 54.68% | 70.85% | 107.07% |

| Japan | 12.28% | 14.43% | 42.10% | 28.77% | 124.36% |

| Private Equity | 12.03% | 27.30% | 168.55% | 291.77% | 550.53% |

| UK Equity Income | 11.62% | 16.25% | 36.69% | 74.31% | 97.21% |

| Debt – Structured Finance | 11.42% | 24.05% | 54.14% | 106.20% | 106.42% |

| Global Emerging Markets | 11.42% | 15.09% | 32.16% | 34.20% | 109.91% |

| Average investment trust ex VCTs | 7.09% | 12.48% | 36.42% | 64.72% | 176.38% |

Source: AIC/Morningstar. Share price total return in % to 30/06/25. Excludes VCTs. See AIC sector definitions.

Investors diversify into Europe

Europe has benefitted from inflows this year as investors question whether US exceptionalism can continue. Donald Trump’s erratic policymaking and the threat posed by tariffs (weaker growth and higher inflation) have prompted this reallocation.

Although the S&P 500 has recovered from the heavy losses suffered at the start of April, recently hitting a new high, further volatility could lie ahead.

The president’s “big, beautiful bill” was also signed into law on 4 July, and includes a range of tax cuts and spending rises. There are fears it could cause US debt to balloon by at least $3 trillion, according to figures cited by the BBC. The national debt is already at an eyewatering $37 trillion.

The dollar has weakened and US Treasury yields have risen as a result, as investor confidence in the world’s largest economy starts to ebb.

The latest figures from the Investment Association (IA), published on 3 July, show UK investors pulled £622 million from North American equity funds in May. European equity inflows accelerated over the same period, hitting £435 million.

The IA noted that “new commitments to infrastructure and defence spending” have helped support flows into Europe.

Investment trusts: can Europe’s strong performance continue?

Until recently, European equities had been unloved for some time, meaning the region offered fertile ground for bargain hunters.

After recent share price gains, research company Morningstar only sees “modest upside” for the region going forward. However, moving down the market-cap spectrum could create better opportunities.

While the overall market is currently trading at a 5% discount to fair value, the discount on small caps could be as large as 20%, based on Morningstar’s analysis. This part of the market could have further to run.

“European small caps are trading at a significant discount not only to their larger-cap peers but also to their own long-term history,” said George Cooke, manager of the Montanaro European Smaller Companies Trust.

Historically, the asset class commanded a price-to-earnings premium thanks to its “superior earnings growth”, but this relationship has since reversed.

“Small caps now trade at a double-digit discount, wider than during the depths of the global financial crisis, the Eurozone debt crisis, or even the Covid-19 shock. This dislocation cannot be explained by fundamentals alone,” Cooke said.

Once investors realise the scale of the discount, the market could undergo a re-rating. Lower inflation and falling interest rates could help matters, given small caps are generally more interest-rate sensitive than their large-cap counterparts.

Of course, investing in the region isn’t without risk. If the US and EU fail to achieve a trade deal, European markets are likely to fall as investors price in higher trade barriers and weaker growth. However, some investors believe small and mid caps could be more sheltered from Trump’s tariffs given their domestic focus.

“Their higher exposure to domestic revenues provides a degree of insulation from ongoing global trade tensions, while allowing them to benefit more directly from regional stimulus measures,” said Jules Bloch, co-manager of the JPMorgan European Discovery Trust.

“Falling interest rates, improving real wages, and infrastructure-led fiscal policy – particularly in Germany – create a supportive environment for smaller, locally-focused businesses.”