Having reviewed the portfolio, it was very overweight with Solar but had no wind generation assets.

I have sold the Snowball shares in Foresight Solar for a total profit of £863.00 and bought 10k of UK Wind UKW. See below.

Investment Trust Dividends

Having reviewed the portfolio, it was very overweight with Solar but had no wind generation assets.

I have sold the Snowball shares in Foresight Solar for a total profit of £863.00 and bought 10k of UK Wind UKW. See below.

Capital Allocation

· The Company declared total dividends of 5.18 pence per share with respect to the period and paid a dividend of 2.50 pence per share with respect to Q4 2024 in the period.

· During the period the Company has bought back 35 million of its own shares at an average cost of 115 pence per share.

· Post period end, the Company announced part disposals of three wind farms for £181 million which will bring total divestments in the past year to £222 million.

· Aggregate Group Debt was £2,254 million as at 30 June 2025, equivalent to 41.5 per cent of GAV. Were the proceeds of the disposals announced today applied to debt repayment, pro forma gearing would stand at 39.5 per cent.

Commenting on today’s results, Lucinda Riches, Chairman of Greencoat UK Wind, said:

““The Board and the Investment Manager remain fully aligned with investors and continue to focus on driving long-term shareholder value through proactive capital allocation and active asset management. We are pleased to have announced further disposals, delivered at NAV, which will bring total divestment proceeds to £215 million.

Despite lower portfolio generation due to low wind, the Group delivered robust cash generation of £163 million to achieve dividend cover of 1.4x. The team continues to progress a number of key initiatives aimed at optimising asset performance and enhancing long-term value.

We are an established leader in the sector, with a simple, low risk and proven model, a substantial portfolio of high-quality assets, and an attractive net return for investors. We remain confident in our ability to deliver on our objectives of growing the dividend in line with RPI and capital preservation over the long term and extend our track record of outperforming our peers.”

Dividend Announcement

The Company also announces a quarterly dividend of 2.59 pence per share in respect of the period from 1 April 2025 to 30 June 2025.

Dividend Timetable

Ex-dividend date: 14 August 2025

Record date: 15 August 2025

Payment date: 29 August 2025

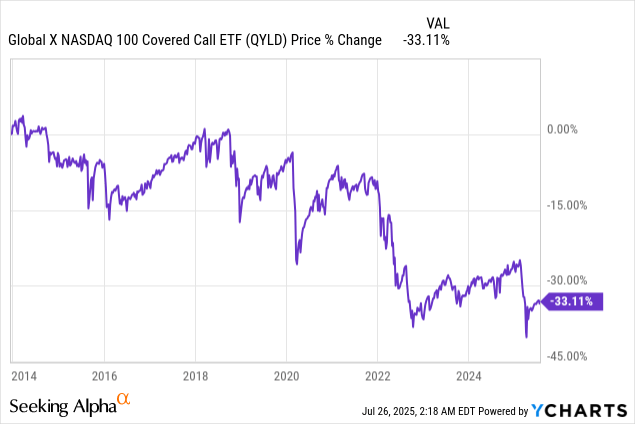

One problem with charts is that they can be used to make a point. With QYLP above, they pay a high yield, so looking at the chart without the dividends gives a false impression.

When you include the dividends, which can either be re-invested into your Snowball or used to pay your grocery bill, the picture is entirely different.

Body or tail or both, the choice my friend is yours.

Brett Owens, Chief Investment Strategist

Updated: July 28, 2025

Brand new dividends are often the best divvies to buy. Here why.

Companies typically initiate a new payout when they are serious about it. This means not only is management going to make sure the dividend is adequately funded, but they are also likely to raise it in a year.

Perennial raises command our attention because these growing payouts tend to pull their stock prices higher. This is the “Dividend Magnet” phenomenon we often discuss and highlight in my Hidden Yields research advisory. The most lucrative stocks to buy today are the ones that are growing their payouts the fastest tomorrow.

Let’s welcome these five new divvies into the world—and explore whether they are worth our retirement capital.

Millrose Properties (MRP)

Dividend Initiation Announcement: March 17, 2025

First Dividend Payment: April 15, 2025

Dividend Amount: $0.69 (Quarterly)

Dividend Yield: 8.8%

Millrose Properties (MRP) made 2025’s biggest income splash by coming out of the gate swinging with an 8%-plus yield.

Millrose is a real estate investment trust (REIT), and an unusual one at that. MRP—which was spun off by homebuilder Lennar (LEN) in 2024 and started trading in February 2025—exists to buy and develop residential land, then sell finished homesites back to Lennar and other homebuilders through option contracts with predetermined costs. Lennar, for instance, will pay Millrose an 8.5% annual option fee.

This is a first-of-its-kind REIT, so we’ll need Millrose to register a few more quarters’ worth of results before we can really dig in and understand what normal operations are supposed to look like. But what we do know is that so far in its short history, everything is pointed in the right direction.

MRP is Serious About Dividends

An additional bonus that we can’t see in this chart? Millrose has already delivered a dividend hike.

Yes, the dividend line is pointed up and to the right, but that’s because MRP paid a prorated dividend in April before paying a full one in July. However, in its inaugural dividend announcement, Millrose noted that the 38-cent prorated dividend would equate to a 65-cent dividend on a normalized basis—meaning July’s payout actually represents a 6% increase.

MRP, welcome to our Contrarian Outlook watch list! I’ll be monitoring this stock to see if it is indeed a future fit for Hidden Yields or Dividend Swing Trader.

Bristow Group (VTOL)

Dividend Initiation Announcement: Feb. 26, 2025

First Dividend Payment: TBD (Projected Q1 2026)

Dividend Amount: $0.125 (Quarterly)

Dividend Yield: 1.4%

Bristow Group (VTOL) is a global provider of “vertical flights solutions” (read: helicopter transportation), operating a fleet of aircraft across six continents.

VTOL is technically an energy-sector stock, as its primary business (~70% of revenues) is providing helicopter transport to offshore energy customers. However, another 25% of its revenues come from providing search and rescue (SAR) and aircraft support solutions to government and civil organizations, and the remaining sliver of sales comes from corporate and other services.

Bristow Group’s roots go back to 1955, when the company was known as Bristow Helicopters. It has gone through several changes in ownership throughout the years, and it even was forced to enter Chapter 11 bankruptcy protection in 2019 after years of net losses. But it re-emerged as a public company in June 2020, under the ticker VTOL, when it merged with fellow helicopter operator Era Group.

Operationally, Bristow has shown significant improvement over the past few years. It finally turned a profit in 2022, and though it slipped to a thin loss in 2023, it followed that up with a spectacular 2024, delivering its biggest full-year bottom line in a decade. Management is confident that’s no fluke—or at least, that’s what we can reasonably assume given its February 2025 announcement that the company planned on initiating a dividend program.

But VTOL’s dividend announcement is one of the weirdest ones I’ve ever seen. Bristow said it will start paying 12.5 cents quarterly—starting in February 2026. That’s a full year’s worth of advance notice!

Maybe Bristow hopes a slow-boil hype cycle will give its stock some life. Nothing else has seemed to.

VTOL Has Been “Dead Money” Sans Dividend

WillScot Holdings (WSC)

Dividend Initiation Announcement: Feb. 18, 2025

First Dividend Payment: March 19, 2025

Dividend Amount: $0.07 (Quarterly)

Dividend Yield: 0.9%

When we think about the “space” business, we typically think about self-storage REITs like Public Storage (PSA) and Extra Space Storage (EXR).

But WillScot Holdings (WSC) makes those companies look like one-trick ponies.

WillScot (not a REIT, by the way) designs, delivers and services on-site, on-demand space solutions. That includes jobsite trailers, portable container office trailers, temperature-controlled refrigerated trucks, blast-resistant modular buildings, and its “Flex” modular office solutions “that are vertically stackable for evolving workspace needs.”

A Temporary Two-Floor Office? Coming Right Up!

Credit: WillScot.com

Space, as it turns out, is indeed a growth business. WillScot’s top line has been growing without interruption since 2017. Meanwhile, WSC flipped from annual losses to a profit in 2020 and hasn’t looked back—though those earnings have been extremely variable.

WSC Shares Have Been as Inconsistent as Profits

Not variable enough, however, to prevent WillScot from announcing its first dividend. In February, it announced it would begin paying a modest 7-cent quarterly dividend starting in March.

The short-term pain might not yet be done for WSC shareholders, either; full-year 2025 could see both the top and bottom lines contract, if the experts’ prognostications are correct. But even then, WillScot’s new payout is less than 20% of weak 2025 earnings projections, indicating plenty of room for WSC to become a more serious dividend player down the road.

Western Digital (WDC)

Dividend Initiation Announcement: April 30, 2025

First Dividend Payment: June 18, 2025

Dividend Amount: $0.10 (Quarterly)

Dividend Yield: 0.6%

2025 has also seen a few big blue-chip names kick off dividend programs, including Western Digital (WDC).

Western Digital develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology. Its products include internal, external and portable HDDs, data center storage and accessories.

It used to deal in NAND flash memory products, too, until February of this year, when it spun off that part of the business into a separately traded company, Sandisk (SNDK). If that name sounds familiar, that’s because Sandisk operated independently until 2016, when Western Digital bought it out.

In jettisoning Sandisk, Western Digital effectively lost the business (flash) with greater growth potential, but it retained the business (HDD) in which it has a roughly 40% market share and that still has plenty of drivers. Regardless, the broader memory business is an extremely cyclical one—WDC delivered substantial net losses in four of the past 10 years, including 2023 and 2024.

That’s part of why, despite drastically improving fundamentals and projections for robust profits for the next few years, it was a little surprising that Western Digital announced its first dividend just a couple of months after the spinoff—a 10-cent quarterly payout that was first distributed in June.

It’s also surprising because we’ve seen this rodeo before. Western Digital started paying 25 cents per share in 2012, and across several hikes eventually doubled that to 50 cents quarterly by early 2015. However, it had to turn tail and suspend the dividend in 2020 as it needed to invest more in its business and knock out debt.

The current dividend is just 8% of WDC’s projected earnings for 2025, indicating that under normal circumstances, we could be looking at years of fat dividend hikes to come. But the cyclical nature of memory and Western Digital’s past missteps has me wary of expecting too much out of this tech name.

Is WDC’s Dividend the Start of Stability, Or Is More Turbulence in Store?

Regeneron Pharmaceuticals (REGN)

Dividend Initiation Announcement: Feb. 4, 2025

First Dividend Payment: March 20, 2025

Dividend Amount: $0.88 (Quarterly)

Dividend Yield: 0.6%

Regeneron Pharmaceuticals (REGN) is one of the market’s largest biotech companies. Its best-known drugs include Eylea (for eye diseases), Dupixent (for asthma and eczema) and Libtayo (a cancer immunotherapy). Regeneron also works in rare diseases, inflammatory conditions and infectious diseases, using proprietary genetic research and antibody technology.

And this year, the longtime biotech winner finally decided to join Big Pharma in sharing its wealth with stockholders, announcing an 88-cent-per-share quarterly dividend starting in March.

But REGN sure picked an interesting time to do it.

Rarely Do We See a New Dividend While a Stock’s Being Cut in Half

Normally we’d expect a crash like that to be accompanied by a massive dropoff in sales and/or profits. But that’s not what we’re seeing here—at least not enough to justify hacking the stock in half.

The primary concern has been rapid deterioration in sales of Eylea, which accounts for roughly a third of Regeneron’s sales. We can blame competition from Roche’s (RHHBY) Vabysmo as well as several biosimilars. More recently, the stock was also hit when it suffered a surprise Phase 3 trial failure for a COPD drug it has been developing with Sanofi (SNY).

As with any pharma company, a hit to a blockbuster drug only has so many fixes—sometimes it’s additional indications for that drug, but often it’s simply finding replacements from the pipeline. Unfortunately for Regeneron, it could be a few years before it can fully counter what it’s losing from Eylea.

REGN might see stabilization soon—again, sales and profits are expected to rebound in 2026, and its valuation is now cheaper than the broader health care sector. And the dividend? Even including 2025’s expected declines, the payout accounts for just 10% of earnings, so it’s not unreasonable to think REGN could offer us a traditional pharma-esque yield on cost a few years down the road.

Jul. 26, 2025

Samuel Smith

Dividend investing has been a wonderful experience overall for me, in addition to learning a lot about the world and its major corporations, as well as learning a lot about myself, I have managed to enjoy significant total return outperformance of the S&P 500 (SPY), thanks to implementing a valuation and fundamentals-focused opportunistic capital recycling strategy. That being said, I have also learned quite a few costly lessons along the way. With that in mind, in this article I am going to share four lessons that I wish I knew before investing in dividend stocks.

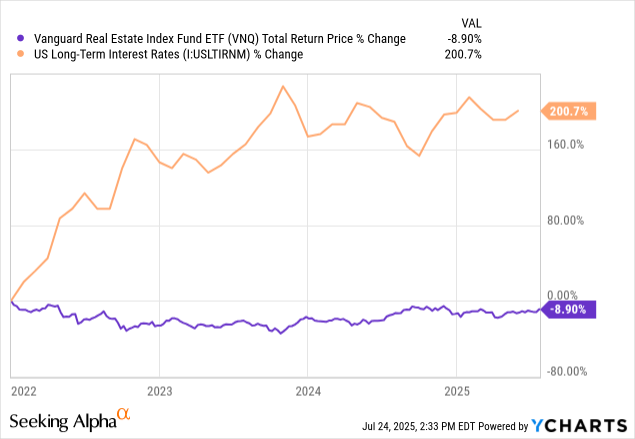

The first major lesson is that dividend stocks tend to be relatively poor long-term compounders, though of course there are some exceptions. The reason for this is that stocks that pay dividends, especially high yields, do so in large part because they have limited opportunities to reinvest and retain cash flows at high returns. Therefore, while they may present attractive current income and may even grow at a rate that meets or beats inflation over time, they are unlikely to be highly dynamic growers due to their limited retained capital. These are the sorts of stocks you see in a lot of high yield sectors like REITs (VNQ) such as Realty Income (O), business development companies (BIZD) such as Ares Capital (ARCC), MLPs (AMLP) like Energy Transfer (ET), and even some consumer goods companies like Altria (MO).

Of course, some of these do have very impressive long-term total return track records; however, most of their peers lack such impressive long-term compounding performance, and in the case of companies like O and ARCC, it is largely due to the fact that they have at times traded at premiums to their underlying NAVs, which enable them to issue additional shares on an accretive basis to accelerate the compounding process. Meanwhile, stocks like MO were able to grow their earnings per share at a strong clip for years with a powerful moat, but their moat is now rapidly eroding as their core smokeables business is experiencing huge volume declines and they are struggling to grow out of it.

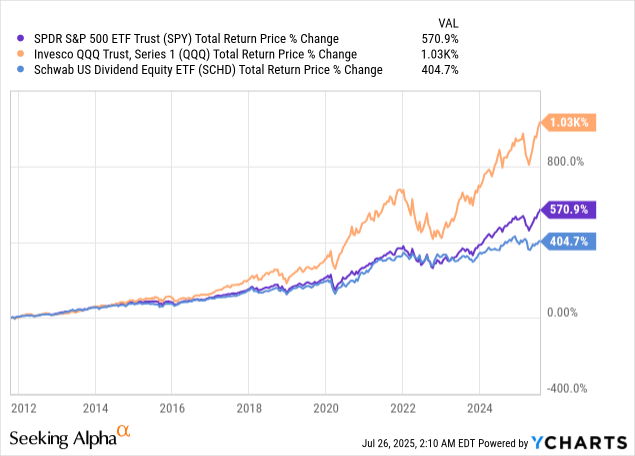

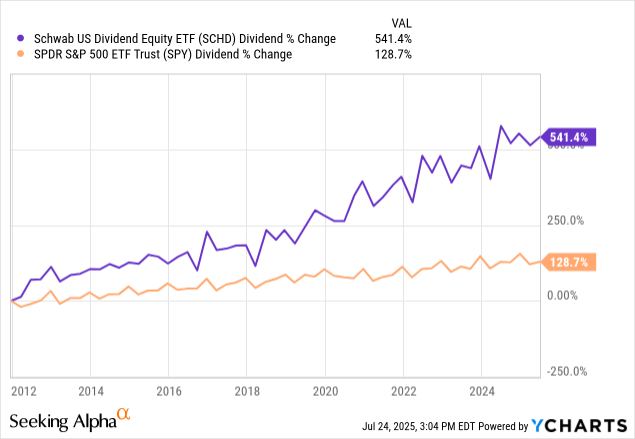

All that to say, when you are investing in a portfolio of higher-yielding stocks like this, capital recycling needs to be a part of your strategy if you truly value long-term total return performance. The inability to reinvest a lot of capital at high rates of return makes these companies limited from a long-term compounding perspective, especially compared to dynamic growth and innovation stocks like Microsoft (MSFT), Meta (META), and Tesla (TSLA) that are constantly developing new technologies and retaining the vast majority of their cash flows to pursue growth opportunities. This is evidenced by the fact that the S&P 500 and the NASDAQ (QQQ) have significantly outperformed dividend stocks, as evidenced by comparing their performance relative to the Schwab U.S. Dividend Equity ETF (SCHD) over the long term:

Another important lesson that I wish I had learned before investing in dividend stocks is that certain types of dividend stocks can be either extremely tax inefficient or extremely tax efficient investment vehicles, depending on which accounts you hold them in. For example, REITs, BDCs, and MLPs are all pass-through entities, and so they are largely exempted from corporate income taxes, which can make them extremely tax-efficient investment vehicles.

However, BDCs primarily invest in loans, so the vast majority of their dividends are classified as ordinary income. Given that the vast majority of the total returns they generate tend to come from the dividends themselves, since they have to pay out at least 90% of their taxable income as dividends to maintain their status as BDCs, they are very tax-inefficient to hold in taxable accounts. However, these investment vehicles are excellent to hold in a retirement account, since the dividend tax classification is meaningless, while the underlying business itself is largely tax-exempt.

REITs are a bit more complicated, as some of their payouts do count as return of capital, and they also qualify for a 20% QBI deduction in many cases. So, depending on the REIT’s dividend yield and the classification of its dividend, it could be a good fit for a taxable account, or in other cases where much of the dividend is classified as ordinary income and has a high yield, it is likely much better suited to holding in a retirement account.

Finally, MLPs that issue K-1 tax forms are much better suited to taxable accounts, since the distributions are largely classified as return of capital, making them very tax-efficient income instruments for a taxable account, whereas if they are held in a retirement account, they can generate UBTI, which could force you to pay a tax bill in an account that is supposed to be tax-sheltered.

Beyond that, dividend stocks, as previously mentioned, are not the best wealth compounders, so capital recycling is often a useful strategy to overlay on top of them. This is particularly true since they tend to be easier to value than high growth stocks, because you simply look at the yield for a large portion of the return and then add to that some relatively modest yet highly predictable growth rates to determine what kind of total return you are going to get from the investments. Therefore, if you do plan on implementing a capital recycling program with stocks, it is best to hold as many of them as possible in a retirement account in order to mitigate the tax headache that can come from frequent selling positions at short-term capital gains rates. Note that none of this is tax advice, rather simply my opinion based on my years of experience dealing with tax-related issues from investing in dividend stocks. Be sure to do your own diligence and speak to your own tax advisor before making any of these decisions.

Another lesson I wish I had learned before investing in dividend stocks is that it is very important to understand what type of dividend stock you are investing in. For example, if it is a cyclical stock, you need to be extra careful because they can often experience sharp declines in earnings as you head into down cycles and, with it, a deep decline in the stock price. If the balance sheet is not particularly strong, this can lead to steep dividend cuts or even dividend eliminations, as I learned the hard way with Hanesbrands (HBI) and some investors who are currently in Dow (DOW) are currently learning the hard way as well.

Meanwhile, if it is a stalwart, steady stock like Enbridge (ENB), IBM (IBM), or NNN REIT (NNN), you can count on very dependable dividends, but you are not going to get much in the way of growth. As a result, these are the sorts of stocks you need to make sure you buy on a value basis and will likely want to implement a capital recycling program on to accelerate the compounding process if total returns are important to you. Meanwhile, stocks that have lower yields but high dividend growth rates are ones that can generate a lot of wealth, but you need to be careful because once the dividend growth rate slows meaningfully, the stock is likely going to pull back sharply as well. Just look at what happened to the late NextEra Energy Partners (XIFR) as an example of this.

BDCs, MLPs, and REITs generally tend to belong in the stalwart category, yet their underlying mechanics are quite different in terms of how they relate to macro factors. BDCs tend to benefit from rising short-term interest rates, whereas REITs tend to suffer when interest rates rise. MLPs, meanwhile, are much more commodity price sensitive in terms of unit price performance, even if their underlying cash flows are quite stable. Therefore, you need to make sure you realize these factors when buying these securities instead of just looking at the yield that they offer and ignoring all the other considerations that go into those investments.

Finally, I wish I had known that high-yield funds are often fundamentally flawed. This is because it is very rare for a large portfolio of stocks to offer a sustainably high yield such as these high-yield funds offer. Yes, you can find perhaps one or two dozen high-yield stocks at any given time that have genuinely sustainable high yields and compelling valuations. This is what I do, in fact, in my portfolio.

However, many of these other funds are very broadly diversified, and so they generate their yields from less sustainable sources. One way they do this is by selling covered calls as the JPMorgan Equity Premium Income ETF (JEPI) does, which often leads them to long-term NAV erosion risk as evidenced by the abysmal long-term performance of the Global X Nasdaq 100 Covered Call ETF (QYLD).

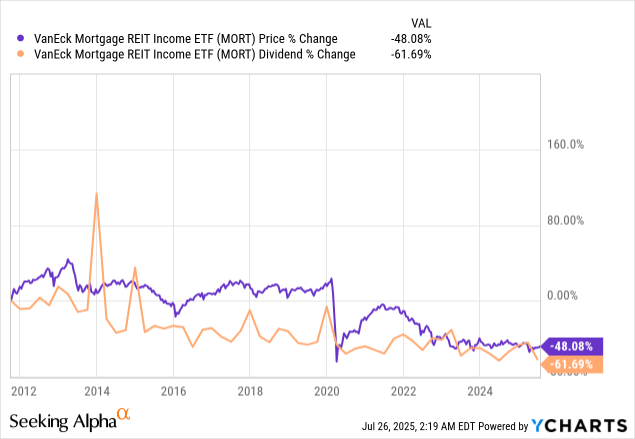

Another way they can do this is by filling their portfolio with very low-quality underlying holdings, which get exposed whenever the markets experience a downturn. An example of this is the VanEck Mortgage REIT Income ETF (MORT), which has seen its dividend payout decline meaningfully over time.

Another option is that they may employ significant leverage risk, which can juice returns in the short term and enable them to pay out a higher yield, but also puts them at significant risk during a market crash. This is especially common in the closed-end fund space, where piling on significant amounts of leverage is quite common, as seen with funds like the PIMCO Dynamic Income Fund (PDI), the Cohen and Steers Quality Income Realty Fund (RQI), and the Cohen and Steers Infrastructure Fund (UTF). Note that some funds can navigate carrying significant leverage quite well, but the risks are still elevated when this route is taken.

Finally, there are other funds such as the Liberty All-Star Equity Fund (USA) that pay out a high yield yet generate that yield entirely from the proceeds of selling underlying positions rather than actually generating it from dividends from underlying holdings. This exposes them to significant sequence-of-return risk and/or dividend cut risk because if the market were to ever enter a prolonged bear market, they would either significantly erode their NAV and lock in permanent losses on their underlying holdings or they would have to cut their dividend. Either of these outcomes should be a major no-go for investors looking for long-term, sustainable, and growing passive income.

Realizing that many dividend stocks are actually pretty poor long-term compounders, that they can be potentially extremely tax-inefficient investments if you do not understand what you are doing, that they can also lead to dramatic downside risk both in terms of share price performance and dividend payouts if you do not understand what type of dividend stock you are investing in, and that high-yield funds are often yield traps due to some fundamental flaw are some very important lessons that I have learned the hard way as a dividend investor over the years. However, it is important to keep in mind that each of these challenges can be mitigated or avoided altogether while still reaping the long-term wealth and passive income compounding that comes from dividend investing. Hopefully these lessons are useful for you as you craft your own dividend portfolio, as they are invaluable to me as I build my portfolios of high-yielding, high-performing stocks at High Yield Investor.

The Snowball never intends to kill the Golden Goose but to use the income generated to provide retirement income.

Company Type Amount Currency Ex-Dividend Date Impact Payment Date

AEW UK REIT PLC Interim 2 GBX 31Jul25 1.84% 29Aug25L

Artemis UK Future Leaders PLC Interim 3.85 GBX 31Jul25 1.00% 29Aug25

Brunner Investment Trust PLC Quarterly 6.25 GBX 31Jul25 0.44% 19Sep25

CQS Natural Resources Growth & Income PLC Interim 4.25 GBX 31Jul25 1.93% 01Sep25

CQS New City High Yield Fund Ltd Final 1.51 GBX 31Jul25 2.86% 29Aug25

Custodian Prop Income REIT PLC Quarterly 1.5 GBX 31Jul25 1.85% 29Aug25

Ecofin Global Utilities & Infra Trust PLC Interim 2.125 GBX 31Jul25 0.96% 29Aug25

GCP Asset Backed Income Fund Ltd Quarterly 1.58125 GBX 31Jul25 2.39% 01Sep25

HICL Infrastructure PLC Quarterly 2.08 GBX 31Jul25 1.66% 30Sep25

M&G Credit Income Trust PLC Interim 1.92 GBX 31Jul25 1.99% 22Aug25

The current blended yield for the Snowball is 9.6%.

All positions are not equally weighted so only a snapshot not detailed research.

9 Investment Trusts and 2 ETF’s.

One Investment Trust > VPC is being wound down and that will leave ten positions. One ETF > QYLP is currently underweight.

Story by Stephen Wright

House models and one with REIT – standing for real estate investment trust – written on it.© Provided by The Motley Fool

Realty Income (NYSE:O) is a favourite stock among investors looking for passive income. And with a monthly dividend that’s increased quarterly for over 55 years, it’s easy to see why.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

At the moment, 30-year government bonds yield 4.9% in the US and 5.4% in the UK. Compared to that, Realty Income shares look like a very attractive passive income opportunity.

The stock currently has a 5.6% dividend yield. And the firm has increased its distribution at an average of 4.2% per year since listing on the US stock market in 1994.

Past dividend growth doesn’t guarantee future increases. But Realty Income’s impressive track record hasn’t come about by accident – it’s the result of skilled management.

The first thing UK investors need to keep in mind is taxes. Distributions from US companies are subject to a 30% withholding tax, though this falls to 15% for investors with a W-8BEN form.

In the case of Realty Income, it means the 5.6% yield is actually more like 4.75%. That means UK investors should expect a lower starting return than government bonds currently offer.

Inflation is another issue. Both the Bank of England and the US Federal Reserve are aiming for 2% currency depreciation per year, which would cut the starting return to 2.75% in real terms.

That’s less than half the 5.6% investors might have initially expected. But the bigger problem is that the annual dividend growth rate has slowed to 2.2% over the last five years, rather than 4.2%.

A starting yield of 5.6% with 4.2% growth is very different to a starting yield of 4.75% with 2.2% growth. And the contrast can be quite dramatic over a 30-year time period.

The higher number is what UK investors might hope for from a £10,000 investment in Realty Income shares. But I think the lower one is a more realistic expectation in real terms after taxes.

That’s why it’s important to pay attention to the various factors that can weigh on real returns. Sometimes investors can find themselves getting much less than they initially expected.

I used to have a big (by my standards) investment in Realty Income. The reason I don’t any longer is that I think I’ve found better opportunities in the UK.

Over the long term, I’m not sure the potential returns are exciting. A combination of inflation, a slowing growth rate, and withholding taxes make me wary of what I might get back

Could be one to DYOR if you want to pair trader it with a higher yielder to lower your overall risk. The current target yield for the snowball is 7%

GL

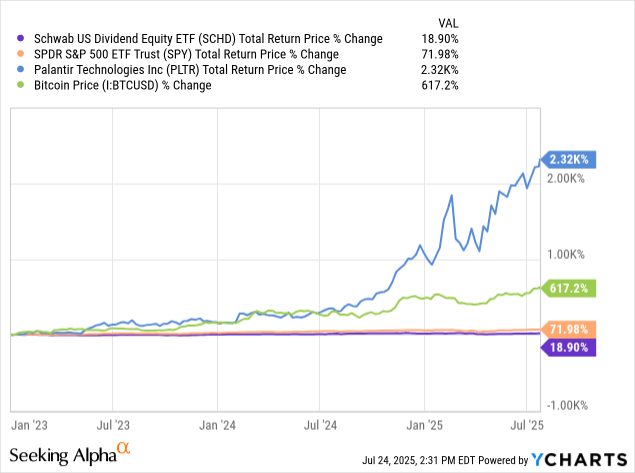

Staying the course as a dividend investor can be very challenging at times, and thus far, 2025 has illustrated this as well as any year in recent memory. Over the past several years, dividend growth investors, especially those in funds like the Schwab U.S. Dividend Equity ETF (SCHD), have gotten left behind the S&P 500 (SPY) with some very lackluster performance, as the market’s sentiment has been overwhelmingly favorably directed towards mega-cap tech stocks, rapidly growing AI companies like Palantir (PLTR), and of course, Bitcoin (BTC-USD).

Further compounding the headwinds for dividend stocks have been the higher interest rates plaguing the sector, and in particular REITs (VNQ) and other high-yielding sub-sectors of the dividend space.

As such, it can be easy for investors to throw in the towel and instead chase whatever stocks are hot right now. Moreover, earlier this year, the market crashed in a panic over the rollout of the Trump administration’s tariffs on virtually all the U.S.’s trading partners across the world. Many observers forecast a severe recession, and as a result, stocks sold off very aggressively.

As a dividend investor, it would have been easy to panic there, sell your stocks, and try to guard against further losses, because it seemed like the market was headed lower day after day. However, many who did that ended up getting left behind as the market quickly rebounded in the days and weeks that followed. Therefore, if you remained calm and bought the dip, you would be better off today than you were before the crash even occurred. With this in view, in today’s article, I am going to share why I think investors should continue to keep calm and stay the course with dividend investing, even though they have suffered from significant underperformance in recent years. In addition, I am going to share some of the best dividend stocks to buy today for long-term income and total returns on a risk-adjusted basis, even as investors wait to see if the Fed will finally give dividend investors much-needed interest rate relief.

Let us address each of these issues in turn and explain why investors who stay the course are highly likely to end up ahead over the long term. First of all, the concerns about the AI boom are likely short-lived because eventually the benefits of AI are going to begin to flow through to dividend stocks. In many cases, they already are, as we see dividend growth machines like Brookfield Renewable Partners (BEP) (BEPC), Brookfield Infrastructure Partners (BIP) (BIPC), Enbridge (ENB), and many others announcing major growth opportunities coming from the data center build-out and the need for increased energy production and infrastructure to support the AI boom. This will likely only become more evident in the coming quarters and years, which should drive strong growth in these and similar dividend stocks.

Additionally, even industrials and consumer stocks like FedEx (FDX), PepsiCo (PEP), McDonald’s (MCD), Walmart (WMT), and many others will likely be huge beneficiaries of the AI boom, as advanced models get employed and their large treasure troves of proprietary data as well as economies of scale can be deployed to leverage their competitive strengths over peers. Additionally, dividend-paying biotech and pharma giants like Pfizer (PFE) will likely benefit as well, as their R&D will likely become much more efficient once advanced AI models become much more prominent in the drug development process.

Meanwhile, the concerns about the interest rate headwinds are legitimate, and certainly, there is a viable scenario in which they last for an extended period to come, especially on the long end of the curve. However, ultimately, it should not matter too much to dividend investors deploying capital today. This is because the higher interest rates are largely already priced in and, in some cases, I think, are priced in too much. Therefore, you are able to buy dividend stocks at higher yields and lower valuations than you would be able to otherwise. Moreover, as long as you are insisting on quality companies with strong balance sheets, which you should be doing anyway as a dividend investor, higher for longer interest rates should not be that big of a deal. If anything, they should be cheered because they allow you to grow your passive income stream faster than you would otherwise have been. Meanwhile, if interest rates do move down in the coming years, it could provide a very powerful catalyst for share price appreciation and therefore, elevated total returns on capital deployed today.

Finally, concerns about an economic downturn, whether they are caused by tariffs and trade uncertainty or otherwise, should not be overly feared by dividend investors either. This is especially true if you employ sound principles of dividend investing, which include adequate diversification across sectors and insisting on putting the bulk of your capital to work in durable, defensive business models with strong balance sheets and well-covered growing dividends. Therefore, in the event of an economic downturn, your dividend income stream should remain quite stable and likely even continue to grow, while in turn giving you more attractive prices to be able to redeploy the capital into more attractive opportunities. Additionally, an economic downturn would likely solve the interest rate problem by forcing the Fed to cut rates and bring down interest rates overall, thereby helping to offset economic headwinds on stock prices. And even if the stock prices do not immediately rebound from a fall in interest rates due to economic concerns overshadowing them, it should lower the cost of capital for the businesses that you hold in your portfolio, thereby enabling them to accelerate growth investments, which should bear fruit over time, and eventually the stock prices will catch up with that fact.

With all of that said, what are some of the best dividend stocks to buy today? A great place to start is with Realty Income (O), as it is widely considered the gold standard of real estate investment trusts with a long history of over a quarter century of growing its dividend every year at a mid-single-digit CAGR, thereby making it an investment that should outpace inflation over the long term. In addition, it offers a current dividend yield of nearly 6%, which is well covered by cash flows, and those cash flows are extremely durable given that they come from a portfolio of thousands of triple-net lease properties that are leased to high-quality tenants, many of which are investment grade and are also largely resistant to recessions and e-commerce headwinds.

With an A- credit rating underpinning the business, O stands out as a company that should withstand technological disruption, economic turmoil, and higher for longer interest rates. Moreover, as a bond proxy, it should enjoy significant upside if interest rates do falter. In the meantime, investors can collect a juicy dividend yield and continue to reinvest it in buying shares at an attractive price while waiting for the interest rate environment to change.

Another great opportunity to buy right now is Oneok (OKE), as it is a well-diversified energy infrastructure company that stands to benefit from numerous potential catalysts, including growing energy demand for the AI boom as well as energy export tailwinds. Meanwhile, it issues a 1099 tax form that makes it a C-corporation, and yet it trades at a compelling discount to many of its C-corp peers like Kinder Morgan (KMI) and the Williams Companies (WMB) on an EV/EBITDA basis, while offering a dividend yield of over 5%, attractive growth potential, and trading at a much lower enterprise value to EBITDA multiple.

A third attractive dividend investment is to simply buy the Schwab U.S. Dividend Equity ETF ((SCHD), as it has one of the lowest expense ratios of all dividend growth ETFs at 0.06%, is diversified across over 100 blue-chip dividend growth stocks, offers a dividend yield of nearly 4% on a forward-looking basis, and has a dividend track record of growing its payout at a near 11% CAGR over the past decade.

Last but not least, alternative asset managers like Blackstone (BX), Brookfield Asset Management (BAM) (BN), and Blue Owl Capital (OWL) are all highly compelling dividend investment opportunities right now, as they offer dividend yields in the 3–5% range on a forward-looking basis, double-digit expected annualized growth rates for both their underlying cash flows and dividend payouts, and have strong investment-grade credit ratings. Meanwhile, a sharp decline in interest rates should also be a huge boon to their businesses since they tend to employ significant leverage in their underlying holdings and are also viewed as competing products with traditional investments like bonds.

Staying the course with dividend investing has not been easy recently due to the AI stock market boom largely bypassing the sector, interest rates remaining higher for longer than many were hoping, and concerns about how trade tensions and other macro risks may affect dividend-paying stocks. However, staying the course is important to keep the compounding process going, leading to large increases in passive income from dividends over the long term. A quick look at SCHD’s exemplary long-term dividend growth—despite also paying out a significantly higher dividend yield than SPY does—tells a powerful story of the power of compounding with dividends:

While stock prices rise and fall with the whims of Mr. Market, the hard power of dividends is what matters most to me in the long term. Therefore, I continue to buy blue-chip dividend growth stocks whenever they go on sale. In fact, I view the recent underperformance in the dividend stock sector as a huge gift from Mr. Market because it has given me an opportunity to lock in attractive yields and valuations on these stocks. As a result, I continue to opportunistically yet aggressively deploy capital at High Yield Investor.

SDIP

Super Dividend Re-evaluated

The Oak Bloke

Jul 28

For those who followed my idea “should you be SDIP-id” on 14th April today at £7.14 per share you’re now £1.06 better off (£6.08 → £7.14) and have enjoyed 4 months of dividends worth £0.23.

£1.29 total is a 21.2% return in just over 3 months. I’m very happy with that and my finger hovered over the sell button. I started writing this thinking I was going to call time on it.

But then I look at what’s up and what’s down. After all, SDIP blindly rebalances based on companies based on a set of eligibilities. Just like fellow fun runner Mr Head it arbitrarily gets rids of any company that breaks its rules. To replace it SDIP picks the next best one (judged on highest eligible yield) that it doesn’t already own. It also periodically rebalances so it part sells what’s gone up to reduce the holding back to 1% and buys more of what’s gone down to rebalance those to 1% also, so each quarter everything rebalances to 100 shares of 1% each.

So this ETF potentially waters its weeds and trims its flowers, with the important exception that the weeds have to also flower (deliver dividends) and any that either cut dividends or profit warn that indicates they could prospectively cut then get removed. So SDIP waters its weeds OR remove its weeds – it’s an important distinction. But it does trim its flowers back to 1% of fund regardless of how successful they are.

Eligible companies must have:

No official announcement (e.g. RNS), at the quarterly rebalance dates, that dividend payments will be cancelled or significantly reduced in the future.

Market Cap >$500 million.

Average liquidity >$1 million over the last three months.

Primary listing in a Developed Market or Emerging Market (but excludes India, China, and Argentina). (Includes Hong Kong)

Dividend yield of >6% and <20%, if they are not current constituents, and at least 3% if they are current constituents.

Traded on 90% of the eligible trading days for the previous 6 months.

Free Float percentage of total shares outstanding of at least 10% or a minimum Free Float Market Capitalisation of $1 billion.

No Closed End Fund, Business Development Companies (BDCs), Partnership or Investment Trusts.

There is a quarterly rebalance back to 100 constituents at 1%, with the highest yield (that meet the above criteria)

SDIP delivers around ~0.8% yield per month so about a 10% per annum:

Let’s look at the biggest risers:

5.2X bagger Bright Smart based in Hong Kong is a cash offer buy out by Morgan Stanley. That’s interesting, the South and SE Asian markets are red hot with IPOs in 2025.

Marfrig is a large Brazilian Beef producer up 49%. Record exports are behind the rise.

BW LPG is a tanker fleet operator up 37% on growing profits.

Kenon is a renewable energy producer based in Texas. That’s interesting too. That is thriving, up 32% YTD, so energy producers are still doing well even if President Trump dislikes them. There’s strong demand for energy.

Now let’s consider the downs.

#99 Two Harbors another Real Estate investment trust, cut its dividend too.

#98 Franklin Real Estate Finance – a third one to cut their dividend. So three that will drop away and in the bottom 10 I spot several more US Realty companies.

The clue is in the name and this manufactures 2/3rd of Turkish tractors and sells to 125 countries also. It also makes Farm Machinery like combine ‘arvesters, and Construction Equipment (diggers, loaders, bulldozers) The Turkish economy has been…. challenging.

Interest rates peaked at 58.8% and are now “only” 42.6%. The Turkish government gives a 50% interest rate subsidy bring the cost of finance to 21.3% but even this is painful. Its profits have dropped 90% and a dividend will be impossible. So it’s SELL SELL and Bye Bye Turk Tractor.

There are more Real Estate losers and bits and bobs, and overall the trust sums to 99.9% so its winners have managed to offset the losers since the last rebalance.

Of the 100 there are 8 UK holdings. Those are up on average 9.6% since the last rebalance, and I’m happy with all of those.

Percentage return of the UK-listed components of SDIP since last rebalance in May 2025

Of the others it’s interesting to see Europe, HK, Israel all are generally strong performers while the US, SE Asia and BRICS nations underperform. Trump Tariff fall out anyone? (100% is the initial 1% holding at the last rebalance, so holdings traded in France are up 26% for example, while Indonesia is down -21%.

With “deals” now completing (the EU completed as I write) then perhaps the tariff issue improves going forwards (or weeds get cut)

Conclusion

I’m not going to sell SDIP. I said I’d revisit and revisit I have. This gives exposure to large cap dividend-paying companies that you wouldn’t otherwise easily access and yet is far more focused than a global index.

There is a 0.45% management charge plus trading costs (quarterly) which I expect aren’t awfully high, but I couldn’t find what they were (the TER isn’t disclosed that I could see).

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑