Thursday 17 July

Gore Street Energy Storage Fund PLC ex-dividend date

Invesco Bond Income Plus Ltd ex-dividend date

JPMorgan China Growth & Income PLC ex-dividend date

Montanaro UK Smaller Cos Investment Trust PLC ex-dividend date

NB Private Equity Partners Ltd ex-dividend date

Schroder European Real Estate Investment Trust PLC ex-dividend date

Schroder Oriental Income Fund Ltd ex-dividend date

TwentyFour Income Fund Ltd ex-dividend date

Month: July 2025 (Page 9 of 15)

Global X ETF ICAV – GLOBAL X SUPERDIVIDEND UCITS ETF USD DIS SDIP

Dividend Summary

The next Global X ETF ICAV – GLOBAL X SUPERDIVIDEND UCITS ETF USD DIS dividend is expected to go ex in 3 days and to be paid in 10 days.

The previous Global X ETF ICAV – GLOBAL X SUPERDIVIDEND UCITS ETF USD DIS dividend was 7.65c and it went ex 18 days ago and it was paid 11 days ago.

There are typically 12 dividends per year (excluding specials).

Current yield 11.7% which when re-invested back into your Snowball will earn extra interest each month.

The Snowball’s position is currently in profit £948.00, although according to market wisdom you shouldn’t buy high yielders.

Of the profit dividends account for £747.42, which have been re-invested back into the snowball earning more dividends.

The conundrum will be whether to take a capital gain currently £201.00, which considering the high yield it isn’t worth booking, yet. Of course it may disappear like snow on a summer’s day and solve the conundrum for me.

ISF yields around 3%.

The difference dividends make. Here the dividends have been re-invested back into the share.

Pair Trading

You could have re-invested the dividends into a higher yielder, where the returns would have been greater.

Note the graph time from 2005 to 2009 where you would have been printing a loss and only the dividends were increasing your wealth.

SUPERMARKET INCOME REIT PLC

(the “Company”)

ACQUISITION OF A Tesco IN ASHFORD at 7.0% NIY

Supermarket Income REIT plc (LSE: SUPR), announces the acquisition of a Tesco omnichannel supermarket in Ashford, Kent, for a total purchase price of £54.1 million (excluding acquisition costs), reflecting an attractive net initial yield of 7.0%[1] (the “Acquisition”).

Tesco, Ashford acquisition

The Acquisition of this top performing food store comprises a 93,000 sq ft gross internal area omnichannel supermarket and a petrol filling station, situated on an 8.2 acre site. Tesco has traded from the site for over 30 years and uses the store as an online fulfilment hub with 14 home delivery vans, as well as offering Click & Collect services. The store is being acquired with an unexpired lease term of nine years with annual RPI-linked rent reviews (subject to a 5% cap and a 0% floor).

The Company believes that current market conditions provide an attractive buying opportunity, at an inflection point in the real estate cycle where supermarket property valuations are at multi-year lows and long lease inflation linked assets can be acquired at accretive yields.

This Acquisition represents the first transaction for the Company as it redeploys the proceeds arising from the formation of its recently announced strategic joint venture with funds managed by Blue Owl Capital into a pipeline of attractive investment opportunities. The Company sees a number of complementary routes to help drive growth, scale and liquidity whilst maintaining sector focus. This may include increasing the tenant weighting to operators for which the Company currently has limited or no exposure to, and across a broader range of store formats, whilst maintaining the quality of the Company’s income profile. The Company is pursuing earnings enhancing acquisitions with the strategic objective of delivering a growing and fully covered dividend over the long term.

Rob Abraham, CEO of Supermarket Income REIT, commented:

“I’m very pleased that we have begun redeploying the proceeds arising from our recent joint venture, acquiring this top trading Tesco supermarket at an attractive price, which will make a material contribution to our earnings from day one. The team continues to work hard to execute on a number of further pipeline opportunities as it focusses on scaling the business whilst delivering sustainable earnings growth for our shareholders.”

What I Wish I Knew Before Becoming A Dividend Investor

Jul. 11, 2025

ETO, EPRT, OWL, SLG, NLY, BEP, BEP.PR.A, BEP.PR.G:CA, BEP.PR.M:CA, BEP.PR.R:CA, BEP.UN:CA, BRENF, NLY.PR.F, NLY.PR.G, NLY.PR.I, SLG.PR.I31

Summary

- I have done very well over the long run.

- But I had to learn some lessons the hard way.

- Learning from my mistakes could save you thousands.

- High Yield Investor members get exclusive access to our real-world portfolio.

Written by Jussi Askola

I have now been an active dividend investor for well over a decade.

Overall, I have done quite well over time, and our portfolio at High Yield Investor has massively outperformed the broader market.

But I have made many mistakes along the way, some of which have cost me thousands.

In today’s article, I will give you the chance to learn from my mistakes so that you don’t need to suffer the same losses.

I have ranked the mistakes from the least to the most important, so make sure to read till the end:

Mistake #1: Favoring Monthly Dividend Payers

Early on, I would favor monthly dividend-paying stocks over quarterly dividend-payers, thinking that the monthly dividend would help me achieve higher returns by accelerating the compounding.

I also liked the idea of getting paid monthly, even if I didn’t need the money, and was reinvesting all the payments.

But this is a mistake.

In reality, the dividend frequency is just a capital allocation decision, and it should be just an afterthought in your investment decision-making.

There are other far more important factors to consider (fundamentals, valuation, etc.), and if you are going to chase monthly payers, you will miss out on lots of potentially better opportunities that pay quarterly.

As an example, I know many REIT investors who have bought Realty Income (O) instead of Essential Properties Realty Trust (EPRT) just because of its monthly dividend. Both REITs are similar in that they focus on net lease properties, but EPRT has been far more rewarding ever since it went public:

It offered a much higher yield when we first invested in it and has managed to grow its dividend at a far faster pace over time.

This illustrates that buying a stock based on its dividend frequency is often a mistake. The difference in compounding is minimal, and there are good reasons why most companies choose to pay quarterly rather than monthly. It gives the company more flexibility with its cash flow, and it also reduces administrative costs, which you ultimately pay for as the shareholder.

So, don’t select your stocks based on their dividend payout frequency. This should really just be an afterthought.

Mistake #2: Avoiding Foreign Stocks Due to Withholding Taxes

Early on, I was also reluctant to invest abroad, fearing that the withholding taxes on dividends would put me at a disadvantage and reduce my returns.

This led me to miss out on many great opportunities that would have earned me far higher returns, even despite the additional tax.

I was being penny-wise, pound-foolish by trying to avoid paying those taxes.

Today, a big portion of my portfolio is invested abroad, and I gladly pay those taxes to better diversify my portfolio and increase my investment universe.

In most cases, there is no impact from withholding taxes anyway. I typically get a tax credit in my home country to avoid double taxation altogether.

Mistake #3: Focusing Too Much on Payout Ratio

Another mistake that has cost me dearly is thinking that a dividend was safe simply because the payout ratio was low.

This cost me a lot of money early in my investing journey.

I still remember buying the stocks of popular high-yielding companies, thinking that they could easily sustain their well-covered dividends.

But in reality, the payout ratio often doesn’t tell you much about dividend sustainability.

Even the dividend of a company with a low 50% payout ratio can be very risky if the company is heavily leveraged and its cash flow is declining.

In fact, I would argue that the direction of the cash flow and the leverage levels are far more important in assessing the sustainability of a dividend.

Even with a high payout ratio of 90%, a dividend may be safer if the balance sheet is safe and the cash flow is growing. As an example, Blue Owl Capital (OWL) has a very high near 100% payout ratio, and yet, I think that its dividend is sustainable and set for rapid growth because of how well its business is performing. In contrast, I think that the dividend of SL Green (SLG), a popular office REIT with a low 60% payout ratio, is at high risk of being cut in the coming years.

So, don’t put so much weight on the payout ratio alone. It really doesn’t tell you that.

Mistake #4: Forgetting About Management Quality

Management quality really should be your #1 concern when investing.

A company may have the best assets and the strongest balance sheet, but none of that truly matters if the management is misaligned with shareholders and more interested in lining their own pockets than creating shareholder value.

Too often, I have forgotten this rule and invested in a company, just to get burned later because I overlooked the importance of management quality.

Therefore, I think that the first step should always be to assess the management. These days, we are lucky to have the scale and reputation, thanks to our newsletter, High Yield Investor, to gain exclusive access to management teams to conduct interviews.

But you don’t need that. To assess the management quality and alignment, I would recommend studying its track record, its past capital allocation decisions, its compensation, its insider ownership, and past insider transactions.

This matters much more than many understand.

Mistake #5: Chasing High Yield

Finally, this is arguably the biggest mistake of all, and we see it all the time here on Seeking Alpha.

Investors will get greedy and chase very high-yielding stocks, with dividend yields often exceeding 10%, not realizing that such high-yielding stocks are commonly some of the worst-performing stocks in the entire market.

The market may not be perfectly efficient, but it is not completely stupid either. If it is pricing a stock at a 10%+ dividend yield, there is typically a good reason for it. Either its management is misaligned, it is overleveraged, or its cash flow is set to decline.

Take the example of mortgage REITs. They consistently attract a lot of yield-starved investors, as many of them offer very high dividend yields. As an example, Annaly Capital Management (NLY) is currently offering a 14.4% dividend yield!

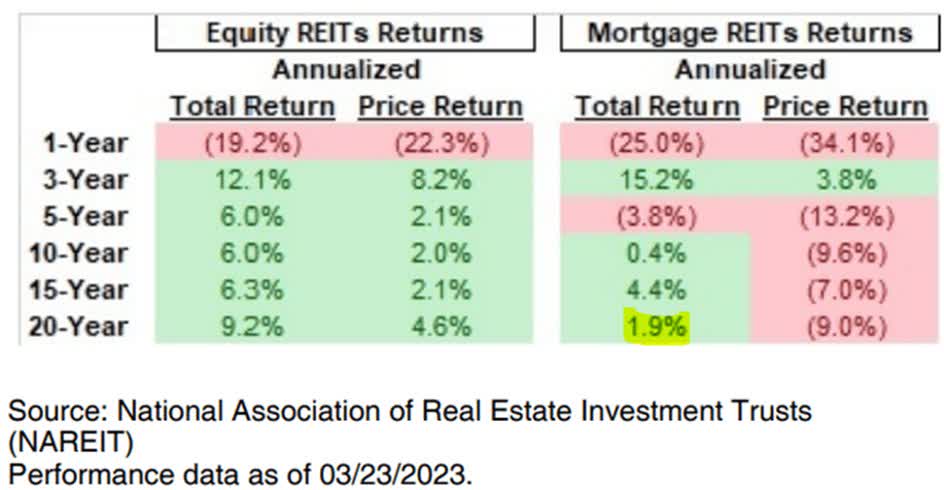

But what sounds too good to be true, typically is. Over the long run, such mREITs have typically been very poor performers, earning only a 2% average annual return:

This means that the high dividends were matched with steadily declining share prices. There is no point in that, as you are not truly getting ahead. Any company can manufacture a high yield to attract investors, but if that ultimately destroys value, you are just lying to yourself by investing in those companies.

We are high-yield-seeking investors. After all, the name of our service is even “High Yield Investor”. But that does not mean that we will blindly buy 10%+ yielding companies. In fact, we very rarely do.

We look for an optimal mix of yield, growth, safety, and upside, and most often, we find that in the 6-8% yield range these days.

These are high-quality companies that can pay sustainable and growing dividends, but they are often undervalued because they are facing temporary challenges that are impacting their market sentiment. As an example, Brookfield Renewable Partners (BEP) dropped significantly following President Trump’s victory due to the perception that his administration would be less favorable to renewable energy sectors.

But in reality, we think that the headwind is minor and only temporary. The company has guided to grow its cash flow per share by 10% annually, even despite Trump’s victory, and yet, we got to buy a lot of shares with a yield in the 6-7% range. That’s very attractive coming from a BBB+ rated blue-chip company. Over the past few months, the stock has surged nearly 30% as the market recognized its mistake.

Hard to beat that in terms of its ratio of yield, growth, safety, and upside. That’s exactly what high-yield investors should target instead of focusing on the 10%+ yielding stocks, which, more often than not, are priced at such high yields for a good reason.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

by Rida Morwa

The #1 Service for Income Investors and Retirees, +9% dividend yield.

Unlock Value From Your Portfolio Via Income

Tired of seeing your portfolio and wondering if you’ll be safe and secure for 30 years of retirement? You’re not alone.

Over 80% of retirees are struggling in retirement or at risk of seeing massive financial issues if the economy faces turbulence.

High Dividend Opportunities offers you a route to see your life’s savings not only face these battles with a winning strategy but also thrive in the storm. You can see your portfolio start producing high levels of income today, without having to wait a decade to see the true benefits. With over 6800 members, you will be among friends in High Dividend Opportunities.

Instead of paying thousands of dollars to a Financial Advisor who follows a cookie-cutter approach and looks at your portfolio twice a year, find a community that is welcoming and diligently reviews the holdings in our Model Portfolio.

Gather Income, Don’t Sell Yourself Short

The biggest mistake many retirees make is selling themselves and their hard work short. They work diligently, scrimp, and save for retirement. Yet, they’ve been sold the biggest lie in investing: That you must sell your portfolio to live year to year in retirement.

This is simply not true. It is ridiculous. Do you routinely sell your possessions to pay your mortgage or power bill? No! You would only do so in an emergency. Yet, we spend our entire lives working for income, piling up savings to simply sell it off when we reach retirement?

No wonder so many people struggle to save for retirement.

Consider these issues:

- Many don’t see the benefit if they have to simply sell it off later

- It doesn’t seem different than their normal savings account

- The stock market makes no sense to them

- Selling shares to live in retirement is inconsistent with their life today

Is this you? Facing retirement lacking what many say you will need to survive comfortably. Or have you been a diligent saver but feel that getting $40,000 a year from $1 million seems extremely small? You feel that way because it is!

It’s time to flip the script. Change the story on retirement and investing. You need a portfolio that meets you where you are and doesn’t expect you to entirely change how you’ve learned to live.

That’s what High Dividend Opportunities has to offer. We are income investors. We buy shares in companies and funds that pay us dividends today. This is cash money into our pockets that we can use to pay bills, reinvest in the market, or do whatever we want with!

Investing in Dividends? You’re Kidding, Right?

Not at all! Dividend and income investing have been a large portion of investors’ approaches to the market for generations. Many of the first companies to be part of the stock market used to pay large double-digit dividends to their shareholders. Over time, the market, financial advisors, and the 24/7 news cycle got more excited about the market’s rapid ups and downs. Many forgot all about making large sums of money simply from investing for dividends.

Dividend investing generates reliable and regular cash payments to you which are needed to support one’s income needs, but dividend investing is a defensive investment style that generates regular cash flows for investors and tends to outperform when markets are volatile. The key thought here is flexibility. You have cash in hand to do whatever you want!

High Dividend Opportunities, ranked #1 Investor Group for the 7th consecutive year on Seeking Alpha, is dedicated to bringing investors the newest and most profitable dividend ideas and fixed income securities trading at attractive valuations. Our portfolio targets yields of +9% in high-quality securities, and our investment philosophy emphasizes diversification and safety alongside highly predictable dividends.

In today’s high-interest rate world, our Model Portfolio, together with our Preferred Stock and Bond Portfolios, provides income investors a safe and recurrent source of income. We follow a strategy unique to our service that we call the “Income Method” to boost members’ income instantly so they can enjoy worry-free passive high-income investing.

Whilst the Snowball is not invested with the aim of making a capital gain, when you have made a profit you can re-balance your portfolio by booking ‘profits’ and re-investing back into the current portfolio or buy another high yielder.

AGR,ASLI,MRCH,SOHO,WHR, where the shares were sold at a profit and re-invested into the portfolio.

LBOW was sold at a substantial loss.

GRID was sold at a loss but would have printed a large profit if held.

How much should a 30-year-old put in a SIPP to make a £100k passive income at 65 ?

Harvey Jones crunches some numbers to show how much a young investor has to put away each month to earn a generous passive income in retirement.

Posted by Harvey Jones

Published 13 July

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.Read More

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Passive income is one of the most powerful ideas in personal finance. Money that goes to work, while investors get on with their lives.

For a 30-year-old aiming to retire at 65, a Self-Invested Personal Pension (SIPP) could be the most efficient way to build it. With enough time in the market and the right level of contributions, a six-figure retirement income doesn’t look out of reach. It takes time and effort, but a £100,000 retirement income would make it worthwhile. In 35 years’ time, it won’t be worth as much as it is now, but it should still be a very nice annual sun to live on.

Building the future

Every £80 paid into a SIPP is automatically topped up to £100 by the government for basic-rate taxpayers, with higher earners paying in just £60. That tax relief gives contributions an immediate boost.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

By building a balanced portfolio of mainly FTSE 100 stocks, those savings could potentially deliver a big retirement income.

Especially if invested in a diversified spread of blue-chip income stocks, such as British American Tobacco (LSE: BATS).

The company has long been a favourite in the FTSE 100 for dividend seekers. It continues to reward shareholders despite constant pressure on its core product. On 3 June, it said full-year revenues would beat earlier expectations by 1% to 2%, while adjusted operating profits are on track to rise 1.5% to 2.5%.

British American Tobacco is on fire

Both revenues and profits are forecast to grow faster in 2026. US operations are recovering strongly, thanks to a rebound in cigarette sales and rapid growth in oral nicotine brand Velo. The business continues to innovate, invest and return capital to shareholders.

The share price has jumped a stunning 53% over the past year. That’s trimmed the dividend yield to 6.22% on a trailing basis, which is still an outstanding level of income.

With more than 25 consecutive years of dividend increases under its belt, British American Tobacco is a dividend superstar. Despite its strong run, the shares trade on a modest price-to-earnings ratio of just over 10.

Despite it being worth considering, it won’t suit every investor. Tobacco carries regulatory risks. Litigation is always a threat. And smoking rates are falling across the developed world. But the company keeps making money. And the dividends keep flowing.

Diversification counts

No portfolio should rely on a single company or sector. A well-built SIPP that includes financials, healthcare, energy, mining and tech alongside income stocks like this could provide more resilience over time.

Mixing dividend shares with long-term growth stocks could generate annual income returns of around 6%, while still offering the chance of capital gains. To draw £100k a year from a 6% yield, a portfolio worth a hefty £1.67m is required.

With 35 years to build that, it would take almost £1,000 a month. Basic-rate tax relief reduces the monthly cost to £800. For higher-rate taxpayers, it falls to £600. This assumes 7% annual compound growth.

Obviously, most of us can’t afford to save anywhere near that much. The vast majority of 30-year-olds have more urgent calls on their cash.

But even smaller sums could still grow into something worthwhile. With patience, diversification and the ability to sit through volatility, there’s a realistic shot at building serious passive income by 65.

Here’s the dividend forecast for a hot income stock

This steadily recovering income stock has the highest dividend yield in the FTSE 250, which looks like it’s here to stay. Should investors be rushing to buy?

Posted by Zaven Boyrazian

Published 12 July

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Renewable energy income stocks currently offer impressive dividend yields. That’s because Investor sentiment in this space remains subdued due to higher interest rates and falling energy prices. And as a consequence, many of these shares are trading at discounted valuations.

NextEnergy Solar Fund‘s (LSE:NESF) one such enterprise with its shares trading close to a 20% discount to its net asset value, offering a staggering 11.5% yield. Yet despite this pessimism, the share price has actually been on the rise this year, climbing by 11% and outpacing many of its peers.

So is this just a short-term rally? Or are we looking at the start of a long-awaited rebound?

The bull case

As the name suggests, NextEnergy Solar focuses on investing in utility-scale solar energy infrastructure. The bulk of its asset portfolio consists of UK solar farms with some European exposure, totalling an 865 megawatt energy-generating capacity. For reference, that’s roughly enough to power 330,000 homes.

The business model’s simple. Generate clean electricity and sell it to the grid. The continuous need for electricity makes for a highly recurring revenue model that’s translated into relatively stable cash flows.

As with many renewable energy enterprises, the weather can slow things down. Yet, prudent capital allocation has enabled management to continuously hike dividends every year for the last 10 years, staying ahead of inflation. And even with the headwinds of falling electricity prices, the company’s robust cash coverage indicates that payouts will continue to flow to shareholders.

Dividends for its 2024 fiscal year totalled 8.43p. If the latest analyst forecasts prove accurate, that’s expected to increase to 8.68p by 2027. The growth rate’s hardly phenomenal. But with the yield already in double-digit territory, there remains a potentially lucrative income opportunity here. Even more so as the UK strives towards a Net-Zero energy grid by 2030.

What could go wrong?

If the extraordinary 11.5% dividend yield’s here to stay, why aren’t more investors rushing to buy shares? We’ve already touched on it – energy prices. While energy inflation’s certainly wreaked havoc on many households lately, the long-term trends suggest that electricity’s on track to get steadily cheaper over the next 20 years.

That’s great news for consumers, but less so for energy generators who operate with a lot of fixed costs. Lower prices mean less profit, which could eventually compromise dividends. And with just shy of £200m of debts and equivalents on its balance sheet, it could force management to sell off some of its assets at their currently discounted prices to cover upcoming loan maturities.

Pairing all this with the ever-increasing erratic behaviour of the weather results in a lot of uncertainty – the bane of the investing world.

The bottom line

All things considered, few income stocks can boast of their ability to maintain double-digit dividend yields. However, the lack of projected growth does give me pause. Even more so when considering other renewable energy firms like Greencoat UK Wind are preparing to ramp up their dividend rather than keep it stable.

With that in mind, I’m personally not rushing to buy. But that doesn’t mean the stock isn’t worthy of a closer look from opportunistic income investors.