This 15% (!) Dividend Is Ready to Pop as the Fed Cuts

Brett Owens, Chief Investment Strategist

Updated: August 19, 2025

Could the Fed cut rates—and actually cause interest rates to rise?

Absolutely. In fact, it’s a setup I see as very much in play. Today we’re going to talk about a 15%-yielding (!) stock that’s well-positioned to benefit.

Powell Vs. the 10-Year, Round 2

How would this “rate split” come about? To get at that, we need to bear in mind that the Fed only controls the effective Federal funds rate. That’s the “short” end of the yield curve—or the rate at which financial institutions lend to each other.

Meantime, the “long” end—pacesetter for consumer and business loans (including mortgages—more on those shortly) is tied to the 10-year Treasury yield—and has a mind of its own.

This wouldn’t be the first time the 10-year has called out Jay Powell. Last September, the Fed cut rates for the first time since 2020, after hiking to counter the 2022 inflation spike.

The bond market was having none of it. Even as the Fed cut, 10-year Treasury rates jumped, sending Powell a clear message: Slow your roll.

Powell Gives the “All-Clear.” Bond Market Says “Not So Fast”

When the Fed cut rates, it ironically sparked a rally in long yields. Once Powell backed off, leaving the Fed’s rate where it is now, the 10-year yield steadied, too.

History doesn’t repeat, as the saying goes, but it does rhyme. As I write this, inflation is still above target. But even so, July’s CPI report came in below expectations. That’s another point in favor of a lower Fed rate—and a higher 10-year Treasury rate.

And yes, producer prices did jump in July, and tariffs likely played a role. But as we’ve written before, recent studies have found that tariffs are not inflationary, because rising prices depend on a hot economy. A trade war brings in the opposite, since tariffs are a short-term headwind on growth.

And don’t forget that Powell’s term ends in nine months, and whoever the administration appoints is likely to cut quickly—inflation or no.

Mortgage REITs Borrow “Short” and Lend “Long”

In my August 5 article, we looked at business development companies (BDCs) as contrarian plays on this “rate split.” But there are other options, like mortgage REITs (mREITs).

When most people think of REITs, they think of equity REITs—landlords of buildings, such as warehouses and apartments. mREITs deal in paper—buying mortgage loans and collecting the interest.

They make money by borrowing at short-term rates to buy mortgages that pay income tied to long-term rates. The profit is in the difference, so management always wants short-term rates to be lower than long-term ones (which they typically are).

Moreover, the value of these loans gets a nice bump when short-term rates decline and long-term rates hold steady or, better yet, move lower. That’s because lower rates mean mREITs’ mortgages—issued when rates were higher—yield more than newly issued ones, so they’re worth more.

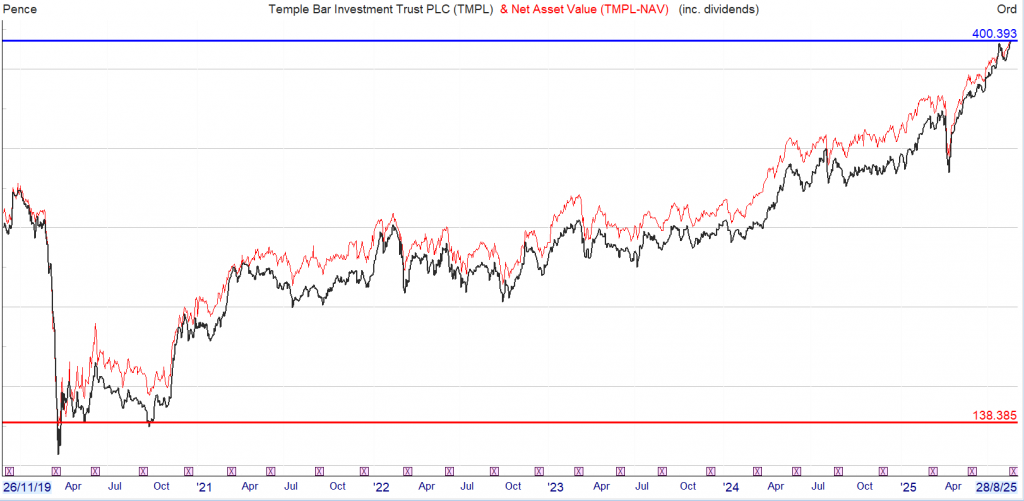

That, in a nutshell, is the setup we’re looking at now. Look at this chart of 30-year mortgage rates. You can see they’re drifting lower now, but not quickly enough to encourage a wave of refinancing or prepayments. The sweet spot for mREITs!

30-Year Mortgages Edge Lower, Boosting mREITs’ Loan Values

This comes at a time when mREITs, as measured by the iShares Mortgage Real Estate ETF (REM), in purple below, have lagged the REIT pack, as measured by the Vanguard Real Estate Index Fund (VNQ), in orange.

mREITs Lag the Field, Tee Up an Opportunity

However, as you can also see toward the left of the chart above, mREITs have outperformed for long stretches, such as during the low-rate 2010s. In the coming months, with the gap between mREITs and REITs as a whole still wide and the Fed set to lower rates, we’ve got a nice setup for another run of mREIT outperformance.

To add an extra layer of safety, we’re going to focus on an mREIT dealing in “agency” mortgage-backed securities (MBS)—those guaranteed by Fannie Mae, Freddie Mac and Ginnie Mae.

A 15% Dividend About to Get “Backup” From the Fed

That would be AGNC Investment Corp. (AGNC), which yields 15% now. It buys MBS (often through repurchase agreements) and profits off the spread between its loan cost and the yield these assets deliver. Its profits are easy to spot: In the second quarter, its average asset yield was 4.87%, while its average repo cost was 4.44%, down slightly from Q1.

Falling short-term rates would cut its repo costs almost immediately, further widening this spread (and boosting AGNC’s profits). The mREIT did post a modest loss in Q2, but we love the fact that management added to its assets at attractive prices as a result of the April “tariff terror”:

Source: AGNC Q2 2025 investor presentation

Now let’s talk about that 15% dividend. As you can see below, management cut the payout (in purple) when the Fed hiked rates (in orange) through to the end of 2019 and into the COVID lockdown period. We’d expect that, as rising rates boosted repo costs and COVID uncertainty—especially in the early days—put the real estate market on ice.

But look to the right and you’ll see that AGNC did hold the line on the dividend as the Fed drove rates higher in response to the inflation surge of 2022/2023. That’s a great sign—and shows the payout likely got an assist from the hedging programs AGNC uses to cut its rate risk:

Dividend Falls Heading Into COVID, But Holds Up in 2022 Dumpster Fire

Now that the Fed looks to be headed back into cutting mode, the dividend should get some extra backup on lower borrowing costs. Going forward, analysts have the mREIT pegged for $1.60 per share in earnings for this fiscal year. The dividend—$0.12 per month for a total of $1.44 annually—accounts for 90% of that.

That is a bit high, but bear in mind that a falling Fed funds rate would add to profits and therefore reduce that number. It may even open the door to a dividend increase, especially if 10-year Treasury rates hold steady or gradually move lower, as I expect.

Finally, as I write this, AGNC trades at 1.1-times book value and six times forward earnings. A wider gap between the Fed rate and 10-year Treasury yield would boost both numbers—putting a lift under the share price as it does.

That 15% dividend is pretty sweet, but it’s one we do have to watch like a hawk. After all, rates can turn on a dime. When they do, they can knock down AGNC’s payout—and share price—without little warning.