Investment Trust Dividends

Brett Owens, Chief Investment Strategist

Updated: August 14, 2025

The market-at-large is expensive by historical metrics. So let’s look past the pricey, low-yielding ETFs in favor of cheap dividend stocks.

That’s right, good ol’ value investing bargains. With high yields too! We’re talking about divvies of 5%, 8% and even 11% that we’ll discuss in a moment.

The spring market dip sure was brief, wasn’t it? The S&P 500 sank into near-bear territory in roughly a month, then snapped back just as quick.

Now? If We’re Buying the Market, We’re Buying Even Higher

In doing so, Mr. and Ms. Market took valuations to high levels. The S&P 500’s forward price-to-earnings (P/E) ratio of 22.1 remains in rarefied air, last reached during the COVID rebound, and before that, the dot-com bubble.

Which is fine. We’ll leave the 22 P/Es to the vanilla investors while we focus on bargains with respect to two “cash is king” metrics:

Let’s start with Virginia-based electric utility AES Corp. (AES, 5.5% yield), which we recently discussed as a low-beta name. This means AES, being a safe, stodgy utility, is more insulated from market pullbacks than run-of-the-mill dividends.

AES also has upside potential. Its renewable energy-selling business gives it growth potential that many utility stocks don’t have.

Potential, But So Far, It Hasn’t Shown Up Much in Practice

It’s also cheap. AES trades at a cheap 5 times cash-flow estimates, as well as a 0.6 PEG that implies it’s also cheap compared to its growth estimates. (Remember: A PEG under 1.0 signals that a stock is inexpensive.) The stock yields more than 5%, to boot, which is better than the already generous utility sector.

Edison International (EIX, 5.9%) is another utility company—this one more typical of the sector. It’s the parent of regulated utility Southern California Edison (SCE), which serves more than 15 million customers and generates much of its electricity from renewable sources including solar, wind, and hydro. It does, however, have a second business—Trio (formerly Edison Energy), a global energy advisory firm that serves large commercial, industrial and institutional organizations.

Unlike other utilities, however, EIX is a bit more “exciting.” It spent years in court fighting litigation over wildfire damage and ended up having to pay multiple billion-dollar-plus settlements. And the legal drama has returned in 2025. Shares have lost more than a quarter of their value, with most of that coming in January amid Los Angeles County wildfires, including the massive Eaton Fire, which prompted multiple suits against SCE over allegations that the company had “violated public safety and utility codes and was negligent in its handling of power safety shut-offs.” SCE is also being investigated in connection with the Hurst Fire.

In Fact, Wildfire Woes Have Been Par for the Course

If, for a minute, we closed our eyes and ignored all that, there’s a lot to like about Edison. It’s expected to generate decent top-line growth and a significant snap-back in profits over the next couple years. The big drop in shares has launched EIX’s yield to nearly 6%. It trades at just 3 times cash-flow estimates. And its PEG, which at fractionally under 1 suggests the stock is only mildly underpriced, is substantially down from the nearly 3 it traded at when I evaluated the stock a couple years ago.

But we can’t ignore the fire liabilities—they’re why EIX’s valuations are so low. That makes Edison a much bigger high-risk, high-reward gamble than the average utility.

Amcor (AMCR, 5.2% yield) is technically a cyclical stock, but it acts defensively. That’s because, as a packaging specialist, it’s in the business of—well, other business’s business. It makes everything from high-barrier paperboard trays for beef and meats to glass dressing bottles to overwrap for home and personal care. And its applications go far beyond the grocery store: Amcor’s products are used in garden and outdoor products, agriculture, pet care, healthcare, even building and construction. So Amcor is simultaneously a play on the broader economy and all the businesses it supports, but it also fills a vital need across a diversified set of companies.

AMCR stands out for a few reasons:

Kodiak Gas Services (KGS, 5.2% yield) is an energy services firm that provides natural gas compression services, mostly in the Permian Basin of Texas and New Mexico. Its compression units are critical to upstream and midstream natural gas firms, so it’s able to secure multiyear, fixed-revenue contracts. There’s nothing novel about the business model, though. Like other energy services firms, if natural gas/liquefied natural gas (LNG) is in demand, Kodiak will be in demand, so the fact that global LNG demand is expected to grow over the next few years bodes well for KGS.

That’s in large part because Kodiak is extremely well-positioned to capture that growth. In late 2023, KGS announced it would acquire CSI Compressco LP to create the industry’s largest compression fleet. Kodiak’s fleet is young, too (read: less maintenance and replacement costs).

There’s not much stock history to examine, however. Kodiak is a relatively new issue that went public just a few months before the CSI announcement. But the company has started a dividend and raised it twice since then, including a nearly 10% improvement announced in April 2025.

A Stock Doubler-Plus + A New and Rising Dividend. Nice Start!

Meanwhile, its yield has wafted up to over 5% amid energy’s weakness this year—and left shares relatively cheap. KGS trades at roughly 6 times cash flow estimates and a low PEG of 0.13.

Atlas Energy Solutions (AESI, 8.4% yield) is another Permian Basin energy equipment and services firm, this one providing transportation and logistics, storage solutions, and contract labor services to oil and natural gas E&P firms, as well as other oilfield services companies. Its most important offering is mesh frac sand used in hydraulic fracturing (fracking). I had been keeping tabs on it because of its unorthodox streak of dividend hikes, but that streak stopped earlier this year.

The Trap Door Opened Soon After AESI Stopped Raising

It’s not ideal. Nor is the fact that AESI shares have been hammered to the tune of 45% this year. Again, energy services haven’t had a great 2025, but Atlas has been downright miserable amid slower-than-expected U.S. completion activity and droopy frac-sand prices. If there’s any silver lining to that, it’s that AESI shares now trade at just 5.7 times estimates for cash flows, as well as an attractive PEG of 0.75.

The dividend at least appears to be safe, too. While things look bad from an adjusted earnings perspective ($1.00 in dividends annually vs. forecasts for just 25 cents this year), Atlas has more than enough FCF to cover the payout. Example: Last quarter, it generated $48.9 million in adjusted FCF while paying out $30.9 million. Those cash flows are substantial because AESI is a low-cost operator—crucial for survival in this industry. But like any energy services provider, Atlas needs commodity prices to cooperate.

It’s unusual for a blue-chip stock like United Parcel Service (UPS, 7.5%) to yield north of 7%, but it’s also rare for a blue-chip stock like UPS to have its shares hemorrhage so much without a recession or broader bear market.

Lower-margin e-commerce volumes, higher costs because of its unionized workforce, and a weak freight environment hampered the company in 2024.

Then in early 2025, it spooked investors with a weak 2025 forecast and announced that—in hopes of shifting away from those lower-margin volumes—it would drastically reduce its business with Amazon (AMZN), which accounted for roughly 10%-12% of annual UPS revenues. The April tariff announcement also hit shares hard.

The result? UPS shares have lost nearly half of their value in just two years.

The upshot? UPS trades at roughly 8 times cash-flow estimates and has never offered a better yield in its 26 years of trading.

Sadly, Dividend Growth Had Little to Do With It

Is UPS a dividend trap? Perhaps. The company pulled its full-year revenue and profit forecasts in April, and didn’t bring them back in its late July report.

Meanwhile, Wall Street is expecting a roughly 15% drop in adjusted earnings, to $6.61 per share. That specific number matters: UPS has a target dividend payout ratio of approximately 50% of prior-year adjusted EPS. It currently pays $6.56 across four quarterly dividends. (That’s 99%!) CEO Carol Tomé continued to signal commitment to the dividend in the earnings call—“UPS is rock-solid strong and so is our dividend. The UPS dividend is backed by solid free cash flow and a strong investment-grade balance sheet,” she said—but if the delivery giant continues to struggle, simple numbers might force management’s hand.

Western Union (WU, 11.3% yield), somehow, is still in business. Payment apps like PayPal, Venmo and Zelle have been taking business from the “OG” of money transfer. WU boasts a big yield but for the wrong reason—its divvie looks big because shares are (deservedly) way down!

Western Union Has Been Headed South for Years

WU, to its credit, has launched an initiative called “Evolve 2025” in which it’s rolling out new products, improvements and an operational efficiency program. It’s also expanding its digital wallet offerings in Mexico and Singapore. And its latest move, announced just a couple days ago, is the $500 million acquisition of Miami-based International Money Express (IMXI), aka Intermex, which serves some 6 million customers who send money from the United States, Canada, Spain, Italy, the United Kingdom, and Germany to more than 60 countries.

But c’mon man—this dog is dead. The business trades for 4x cash flow and a sub-5 forward P/E, but who cares? Not me.

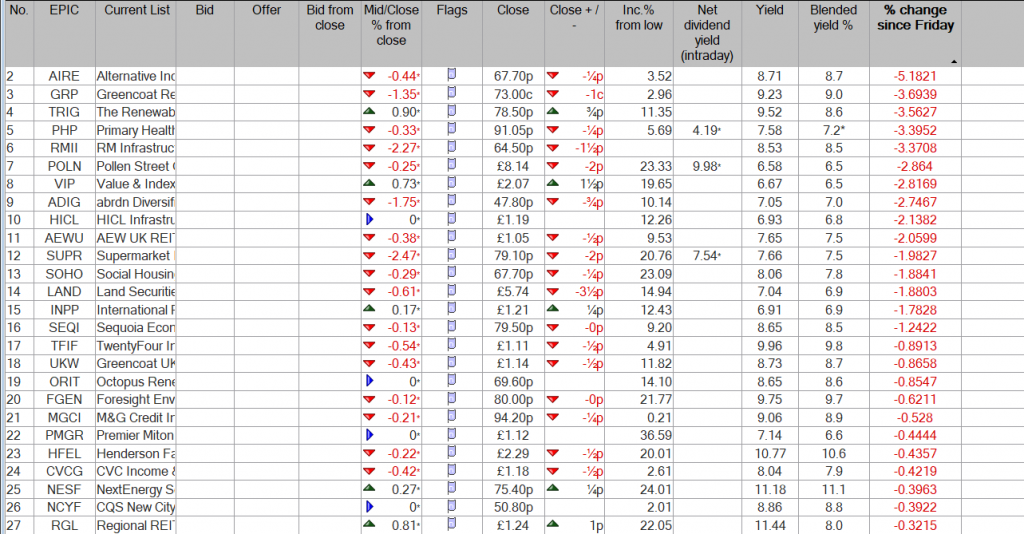

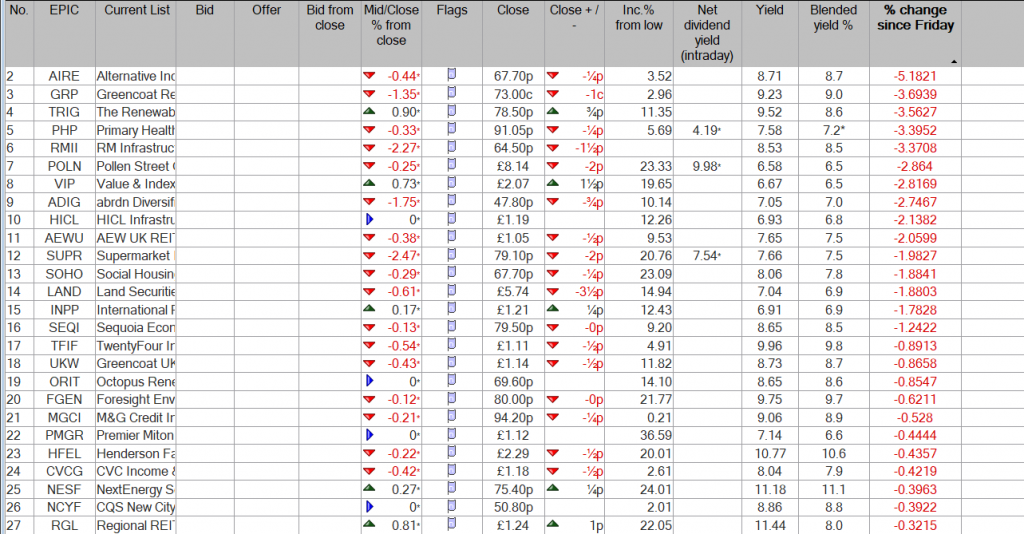

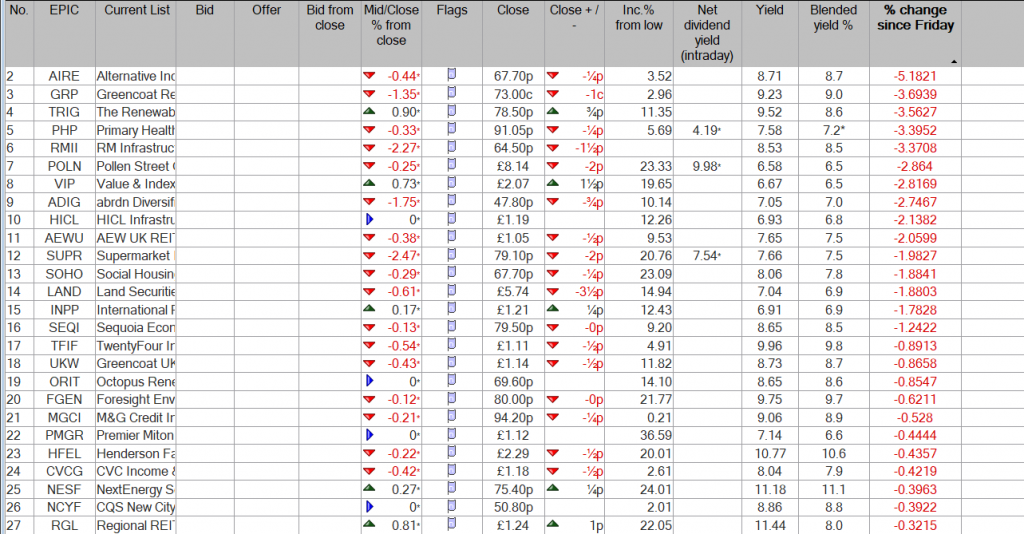

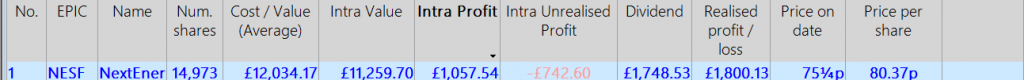

Dividends received £1,748, current yield eleven per cent. If NESF continues to pay a dividend in nine years the Trust should be producing income at a zero, zilch, nothing cost. Also unless NESF is taken over the Snowball should be this time next year be 25% closer to achieving the holy grail of investing.

NESF could be producing income at zero cost and the dividends re-invest into the Snowball should be producing income around 7% another £850.00.

The ‘belt’ is printing a small loss but the ‘braces’ are printing a good profit.

Remember the market could take back all the profit, so it’s often best to re-invest into the Snowball, even at a lower yield.

TwentyFour Select Monthly Income Fund Limited

Re: Dividend Announcement

The Directors of TwentyFour Select Monthly Income Fund Limited (“SMIF“), the listed, closed-ended investment company that invests in a diversified portfolio of credit securities, have declared that a dividend of 0.5 pence per share will be paid, in line with the Prospectus, representing the regular monthly targeted dividend for the financial period ended 31 July 2025 as follows:

Ex-Dividend Date 21 August 2025

Record Date 22 August 2025

Payment Date 5 September 2025

Dividend per Share 0.50 pence (Sterling)

No special dividend announced, with any special dividends the blended yield is around 8%.

SDIP Dividend Dates

Upcoming SDIP Ex-Dividend Dates

EPIC Name Market Share Price Dividend Div Impact Declaration

Date Ex-Dividend Date Payment Date

SDIP Global X SuperDividend UCITS ETF ETF 712.0p $0.075 0.78%

14-Aug-25 Dividend Announcement 21-Aug-25 29-Aug-25

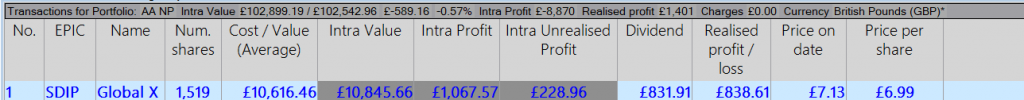

SDIP yields around ten percent, so in ten years time it could have return all your capital without compounding.

So it could achieve the holy grail of investing, in that it will produce income at a nil, zero,zilch, cost.

The income re-invested in the Snowball compounded at 7% will also be producing income.

As you can see SDIP is in profit of £1,067 of which dividends are £831.00.

Of course the market could take back all the profit, including the earned dividends but if the dividends are re-invested elsewhere in your Snowball the chances are reduced. This years dividends re-invested should produce further income of around £80.00

All baby steps.

Posted on | By David Stevenson

This month’s dive into the world of funds examines a high-quality way to invest in US equities, whose valuations are edging relentlessly higher. However, it’s not just US equities that are outperforming – after a prolonged period of underperformance, the share prices of many UK-listed alternative funds have pushed ahead.

One of my favourite discussion topics when talking to investors is to get them to determine their actual underlying exposure to US equities, especially the Mag7. Add up what’s in your various portfolios, ISAs, your speculative positions, your SIPPs, and your DC target risk and target date funds. Unless you are nearing retirement, you probably have a much higher exposure to US equities than you realise—mainly because US stocks and shares have performed so well. Many long-term investment plans and global equity funds are benchmarked against an index called the MSCI ACWI index (with the MSCI World or FTSE World as alternatives). This index has 64% exposure to US equities, with Information Technology as a sector accounting for 24%, and the Mag7 making up just under 20% of the index. A close rival is the MSCI World index, which has nearly 72% exposure to US equities and just under 22.5% to the Mag7.

At this point, investors start to feel slightly uncomfortable. They’ll smile at the fact that returns have been excellent – even in recent weeks – but they’ll soon begin to worry about all the myriad risks in that exposure: the valuations, the concentration in a handful of stocks and the exposure to the dollar. Has the exceptional outperformance of the US (and its deep, liquid markets) created a risk to your portfolio?

Let’s be specific here: there are three interconnected but separate issues to consider. The first is whether overexposure to the US as a country and the dollar as an asset (which is currently weakening on the FX markets) is beneficial. Next is what we could call style risk for US equities, meaning whether I am overexposed to a specific type of US equity, such as tech stocks or growth stocks. The third risk is concentration risk, where you are concerned about being exposed to just a few stocks, specifically a suitably magnificent seven. It is helpful to distinguish these risks because, for example, you might be comfortable being overexposed to US assets, equally comfortable being overexposed to US tech growth stocks, but worried about putting all your eggs in the Mag7 basket.

Begin by considering concerns about overexposure to the dollar and US assets generally during Trump’s presidency. The dollar has been weakening (which is bad news for UK investors in US assets as valuations have dropped), and it could decline further (Trump would probably welcome that), but there is no evidence of a ‘flight from the US’ so far among private investors. Strategists at US investment bank Morgan Stanley recently analysed fund flow data on what foreign investors are buying and selling and found little sign of a widespread sell-off of US dollar assets. In fact, weekly data from Lipper on global equity ETFs and mutual funds show that international investors have been net buyers in the weeks following Liberation Day and throughout most of May.

But have we all – outside the US – become more exposed to its equity market? The short answer to that question is yes! In 2015, the MSCI ACWI index was only 51% invested in US equities; now it’s 64%. In 2015, Apple was the biggest stock (not Nvidia as it is now) with Microsoft not far behind at just under 1%. The price-to-earnings ratio of this index (a key valuation metric) was 18.50 back then. If we go back further to the year 2000, the US was at 48% (with the UK in second place at 8% exposure). So, is the US close to all-time highs in terms of geographic exposure? Yes, but not exceptionally so – and let’s be honest, if it is, that’s because US corporates have been growing their earnings at an above-average rate.

We can see this clearly with the S&P 500 benchmark index, which tracks US blue chips and has produced an annualised return of 12.8% over the last ten years. US profit margins are among the highest globally, which helps explain why the American index trades at a robust 27 times earnings, which is a somewhat excessive level, to put it mildly.

What about concentration risk or a bias towards specific sectors? Again, there are reasons to be worried, but let’s not get hysterical. The information technology (IT) sector is the biggest slug at 31% of the index, while the Mag7 comprise 32% of the value of the S&P 500 index. Technology’s share of the benchmark US index is high, but not amazingly high. As for concentration risk, if we look at the top ten stocks in the US index over the last century or so, all the way through to the mid-20th century, the top ten names have usually hovered around 20-30%, dropping below that level in the 1990s and 2000s, and then rising sharply in the last few years, reaching a peak of 40% in early 2025. And one sector has long tended to dominate the index – it used to be banks, now it’s tech.

So, what should you do? I’m more cautious about US equities than most and feel more comfortable running US equities at a closer to a 50 to 60% range in a portfolio full of equities. That’s what many successful global equities fund managers, such as the Alliance Witan Investment Trust, have been doing for a while now, notching US equity exposure to below 60%. Like many active fund managers, I’d be overweight Japan as well as the UK, which strikes me as cheap and provides valuable global diversification.

If you still want significant US exposure but seek more diversification, consider choosing a different style or type of stock within a fund. Instead of merely investing in a few tech giants, you could track US equities through something like the Invesco S&P 500 Quality UCITS ETF, which includes the 100 companies with the highest quality scores within the parent S&P 500 index. Alternatively, you might prefer cheaper, more value-oriented stocks and strategies. In that case, there’s an ETF from a firm called Ossiam that tracks an index devised by economist Robert Shiller – it’s called the Shiller Barclays CAPE index. This index (and ETF) still invests in big tech names, but it also tilts towards other well-known firms, with somewhat cheaper share prices, such as Eli Lilly, Costco, and Walmart. More generally, most active, stock-picking US equity fund managers tend to be biased against Mag7 stocks and more exposed to cheaper, value, and quality stocks, as they are more concerned about concentration risks and high valuations.

Oh, and if you think all this talk about US exceptionalism is just needless worrying, then why not go all in, bet on the coming AI transformation, and just buy the Mag 7 names, perhaps excluding Tesla and replacing it with Broadcom, another tech leviathan. One actively managed investment trust that embodies this ‘all-in’ AI-first strategy is the Manchester and London investment trust, which essentially represents a substantial bet on Nvidia and Microsoft (64% of the portfolio) alongside Broadcom and Arista, two other AI-related companies (another 12.5% of the portfolio). Two tech investment trusts, Polar Capital Technology and Allianz Technology, are also betting big on AI and on US tech, but with a more diversified portfolio, which even includes some international names.

Contrian Investor

Inefficient Markets Help Us

Bank $100,000 Annually (per Million)

Fortunately for you and me, the financial markets aren’t 100% efficient. And some corners are even less mature and less combed through than others.

These corners provide us contrarians with stable income opportunities that are both safe and lucrative.

There are anomalies in high yield. In an efficient market, you wouldn’t expect funds that pay big dividends today to also put up solid price gains, too.

We’re taught that it’s an either/or relationship between yield and upside – we can either collect dividends today or enjoy upside tomorrow, but not both.

But that’s simply not true in real life. Otherwise, why would these monthly payers put up serious annualized returns in the last 10 years while boasting outsized dividend yields?

For example, take a look at these 5 incredible funds that pay monthly and soar:

This is the key to a true “8% Monthly Payer Portfolio” – banking enough yields to live on while steadily growing your capital. It’s literally the difference between dying broke and never running out of money!

But I’m not suggesting you run out and buy these funds.

Some have been on my watchlist and in our premium portfolios over the years, but I mention them only as examples of the potential ahead.

Many people look forward to taking more holidays when they retire. But what sort of trips could your pension buy you? We look at the holidays to match different retirement.

Geiranger Fjord, Norway: A large pension pot could give you the funds to do a two-week all-inclusive cruise every year

(Image credit: Getty Images)

By Ruth Emery

Many pension savers look forward to retiring and having plenty of time to take holidays.

When you stop working, you can – in theory – go travelling whenever you like, no longer constrained by requesting annual leave from your employer.

However, holidays cost money, and the type of break and destination choice will depend on the size of your pension pot and any other income sources.

Stay ahead of the curve with MoneyWeek magazine and enjoy the latest financial news and expert analysis.

So, what sort of holiday will your pension stretch to in retirement?

Pensions UK has attempted to answer this question by looking at the holidays that three different retirement lifestyles could afford, from UK city breaks and European week-long trips to cruises and all-inclusive holidays.

The industry body regularly calculates the annual income a pensioner needs to have to achieve a “minimum”, “moderate” or “comfortable” retirement.

Known as the Retirement Living Standards, they take into account food, clothing and leisure costs – including theatre trips and TV streaming packages – as well as transport and DIY expenses. They are designed to help prepare people for life after work.

Pensions UK has now detailed the kinds of holidays pensioners can enjoy each year, according to these three lifestyles.

Cali Sullivan at Pensions UK comments: “When people picture retirement, they often imagine relaxing in the sun, exploring new places, or simply taking a well-earned break from the everyday. But many worry about whether they can actually afford to get away.

“The good news? Retirement doesn’t have to mean giving up on travel. Whether you’re aiming for the minimum, moderate or comfortable level, there’s a budget for all retirement levels, meaning getting away is still very much on the cards.”

Single retiree: £13,400 annual income (£20,000 to £35,000 pension pot required)

Couple: £21,600 combined annual income (no pension pot required)

The figures above assume the retirees receive the full new state pension. This is worth £11,975 a year. So, if a couple both received this amount, they would get £23,950 in total.

This is more than enough to deliver the minimum standard of retirement, which costs £21,600 for a couple, according to Pensions UK.

In contrast, a single pensioner would need to find some extra income to deliver a minimum retirement lifestyle. The industry body estimates that a pension pot worth between £20,000 and £35,000 could buy an annuity to top up their income to £13,400.

Sullivan points out that about three-quarters of households are expected to achieve a minimum standard in retirement, and two-person households, who can share living and travel costs, are even more likely to do so. This is due to the generous state pension, and the fact many people are auto-enrolled into workplace pensions.

While it wouldn’t be possible to holiday abroad every year on a “minimum” budget, Sullivan says retirees can look forward to a welcome break each year – “a change of scenery is possible”.

She comments: “A week away in the UK is within the budgeted costs, with plenty of inviting destinations to choose from – whether it’s the coast of Devon, the hills of Yorkshire, the lochs and glens of Scotland, or the charm of Norfolk or Wales.”

Pensions UK says retirees could afford seven nights in a Norfolk caravan park with access to a swimming pool, entertainment and a range of paid activities. A generous £720 budget would be available during the trip for food, meals out and visiting attractions like a Sea Life Aquarium and National Trust properties.

Single retiree: £31,700 annual income (£330,000 to £490,000 pension pot required)

Couple: £43,900 combined annual income (£165,000 to £250,000 pension pot per person required)

There are more travel options open to retirees with a bit more flexibility in their budget. To achieve a “moderate” lifestyle, single retirees will need to save at least £330,000 in workplace or personal pensions (on top of the full state pension).

Couples will need pension pots worth at least £165,000 per person.

“Picture two weeks soaking up the sun in Tenerife, Mallorca, Turkey, Rhodes or Spain, all-inclusive. You can also look forward to a three-night city break in a UK gem like Bath, York, Glasgow, Manchester or Cambridge,” comments Sullivan.

“There’s no one-size-fits-all approach either. Some people prefer a couple of shorter trips. Others go for one big splash. Think of it as a ‘pick and mix’ retirement and tailor your holidays to suit your style, mood and budget.”

For example, you could spend a fortnight in an all-inclusive three-star Mallorca resort, costing £1,073 per person plus £200 spending money per person, as well as a three-night city break in Bath, costing £346 with £350 spending money.

Single retiree: £43,900 annual income (£540,000 to £800,000 pension pot required)

Couple: £60,600 combined annual income (£300,000 to £460,000 pension pot per person required)

To achieve a comfortable standard of retirement, you’ll need big pension pots worth at least £540,000 for a single retiree, and £300,000 each if you’re in a couple.

“With a comfortable retirement income, you can expect more freedom to travel further afield and have a longer trip. You could set sail on a two-week cruise to the Mediterranean, or a 12-night all-inclusive cruise around the Norwegian Fjords,” suggests Sullivan.

For example, a 12-night all-inclusive P&O Norway and Iceland cruise costs £2,239 per person (cabin with sea view; including classic drinks package), and your budget could stretch to £900 per person in spending money on top.

Sullivan adds: “Prefer dry land? Lake Garda or a suite in Mallorca might be more your speed. Or if you are looking for variety, you could even split your time on the sea and land.”

As well as two weeks abroad, this level also includes some sightseeing weekends, with three long weekends in the UK included, such as to Bath, York or Cambridge.

Most people are not saving enough for their retirement. Last month, the government revived the Pensions Commission to tackle the retirement savings crisis.

It warned that people retiring in 2050 are on track to be poorer than pensioners today, and said that 45% of working-age adults do not save into a pension.

According to Lisa Picardo, chief business officer at PensionBee, “framing retirement planning around lifestyle goals can be a powerful motivator to save”.

She tells MoneyWeek: “For many savers, retirement offers more time to tick new experiences off their bucket lists, and domestic breaks or trips overseas may be a key part of that.

“Thinking about the types of trips you want to take and the activities you want to pursue in later life can help make the idea of saving feel more tangible and rewarding. The earlier you start planning, the more flexibility and choice you will have when the time comes to enjoy the retirement you have worked hard for.”

According to Pensions UK, a couple looking to have enough financial flexibility to afford an annual two-week trip abroad in retirement would need a combined annual income of £43,900.

But, Sullivan says it’s important to note that retirees on smaller incomes can still relax and enjoy a holiday, even if it’s not overseas. And there are holidays to suit every budget.

“We know many people face tough choices due to rising costs, both before and during retirement,” she comments.

“By taking time now to understand your savings, making the most of employer contributions, and planning for the lifestyle you want, you can give yourself the best chance of enjoying the kind of retirement that suits you, complete with the trips, treats and freedom you have worked hard for.”

Small but regular investments in this leading FTSE 100 financial stock can generate potentially life-changing passive dividend income over time!

Posted by Simon Watkins

Published 13 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

FTSE 100 insurance and asset management giant M&G (LSE: MNG) is one of my core passive income stocks. This is money made with minimal effort from me, most notably in my view from dividends paid by shares.

Many people wrongly believe they need a large capital sum to start making such returns.

In fact, they can generate life-changing passive income for as little as the price of a fancy cup of coffee.

Specifically, £5 saved and invested each day (£150 a month) in M&G shares will make £9,178 in dividends after 10 years.

This calculation uses the stock’s current average 7.6% dividend yield, with dividends reinvested back into it. This is a standard investment practice called ‘dividend compounding’.

On the same twin basis, the dividends will increase to £154,822 after 30 years.I see this period as a standard investment cycle beginning at 20 and ending perhaps in early retirement at 50.

At that point, this £5 daily investment will have created an M&G holding worth £208,972 (with the monthly deposits included).

And on the same 7.6% dividend yield, this would generate an annual passive dividend income of £15,882! None of this is guaranteed of course and investors could get back much less.

A stock’s dividend yield moves in the opposite direction to its price. This is provided that the annual dividend does not change.

In M&G’s case, a recent surge in the share price has seen its dividend yield drop from around 10% to where it is now. This largely resulted from Japanese financial powerhouse Dai-ichi Life taking a 15% shareholding in M&G. It expects the partnership to deliver at least $6bn of new business flows over the next five years

A risk to the business is that the tie-up does not deliver the anticipated benefits.

However, consensus analysts’ forecasts are that M&G’s earnings will increase by a whopping 41% a year to end-2027. And it is ultimately growth here that powers any firm’s dividends and share price higher over time.

Indeed, analysts project that the firm’s dividends will increase to 20.6p this year, 21.3p next year, and 22p in 2027.

These would generate respective yields on the current £2.63 share price of 7.8%, 8.1%, and 8.4%.

Price and value are not the same thing in stock market investment. The former is whatever the market will pay for a share at any given time. The latter is the true worth of the stock based on fundamentals for the underlying business.

Identifying mismatches between the two is the key to generating big, sustained profits over time, in my experience. And this comprises several years as a senior investment bank trader and decades as a private investor.

By far the best way of achieving this is through discounted cash flow modelling. This pinpoints where any firm’s share price should be, based on cash flow forecasts for the underlying business.

The DCF shows M&G shares are undervalued by 49% at their present price of £2.63.

Therefore, their fair value is £5.16.

Given this and its very high passive income potential, I will buy more of the stock as soon as possible.

The Snowball will only invest in IT’s/ETF’s.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑