Story by Callum Mason

Investing can be the key to unlocking life milestones that allude so many younger people (Photo: Richard Drury/Getty)

My entry to the world of work in August 2016 coincided with the Bank of England lowering its base rate to 0.25 per cent – the lowest level on record (until 2020 at least).

Throughout the following seven years as the base rate – and therefore savings rates – fell further, these low-paying accounts were where I funnelled any hard-earned cash I had left over after paying my rent, bills and other costs each m

Inflation throughout that period regularly topped 2 per cent, and therefore in effect, I was haemorrhaging money left, right and centre.

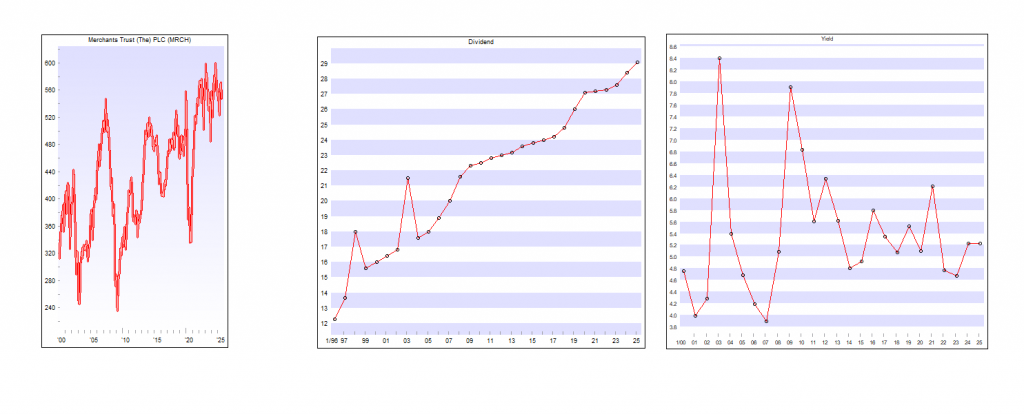

In that period between 2016 and 2023, if I’d put my money in investments I could have had returns of more than 100 per cent on my original deposit, instead of the less than 15 per cent I made on cash.

That’s not the case. I could have had this return simply by putting the cash into a fund that tracked the performance of 500 of the biggest companies listed on stock markets in the US – an S&P 500 tracker – and forgetting about it for seven years.

Granted, US stock market performance has been particularly strong over the past decade – and I’d have had no way of knowing nine years ago that this would be the case – but it serves to illustrate how much harder your money can work in investments, as opposed to cash.

So why didn’t I make the move back in 2016? And what do I wish I’d have known back then, that I do now?

It’s not as hard as it seems

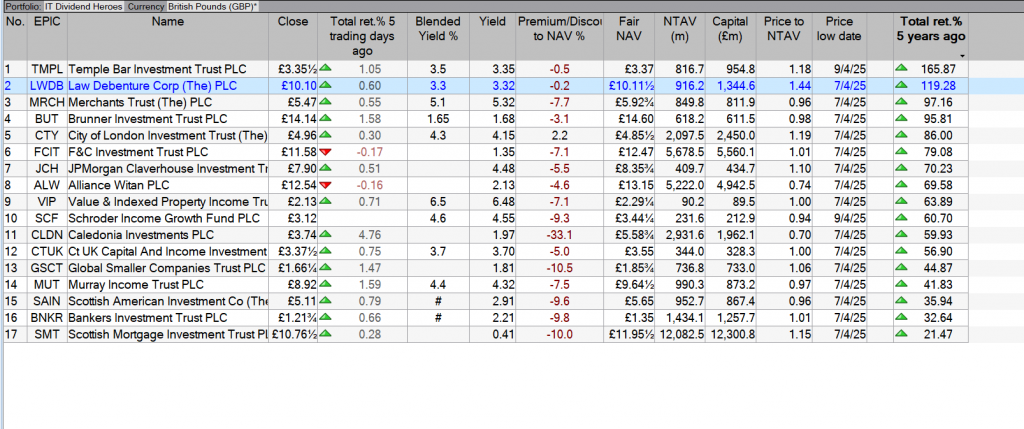

You don’t. If you’re not comfortable buying individual equities, a simple option is to invest in exchange-traded funds (ETFs). These expose your money to a basket of different investments, which could include stocks, but also currencies and other commodities like gold.

In the most simple case, you can invest in ETFs which simply passively track the performance of major stock markets. One option being the likes of an S&P 500 tracker or an All-World tracker – which exposes you to thousands of stocks in countries across the globe.

But if even doing this feels too much, an alternative option is to get a managed investment account, where someone manages your money for you.

Although this can be a good entry point into investing, remember that you will be charged a fee for this, and there’s no guarantee your return will actually be better than if you do it yourself.

Understanding the ‘risk’ factor

The second point I wish I’d known is the level of risk you are encountering with investing. With cash, your money can of course only go upwards. When investing, there is a risk that you lose money, as well as gain it, we are often told.

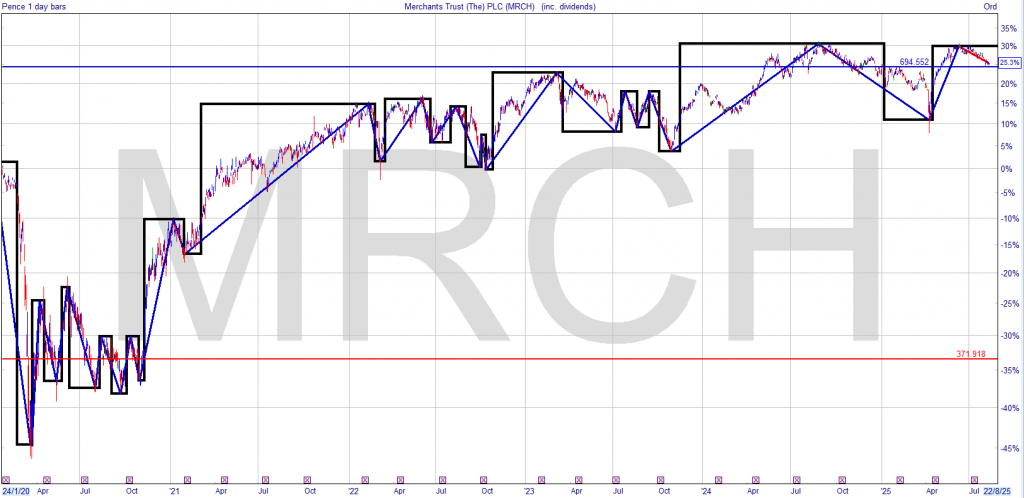

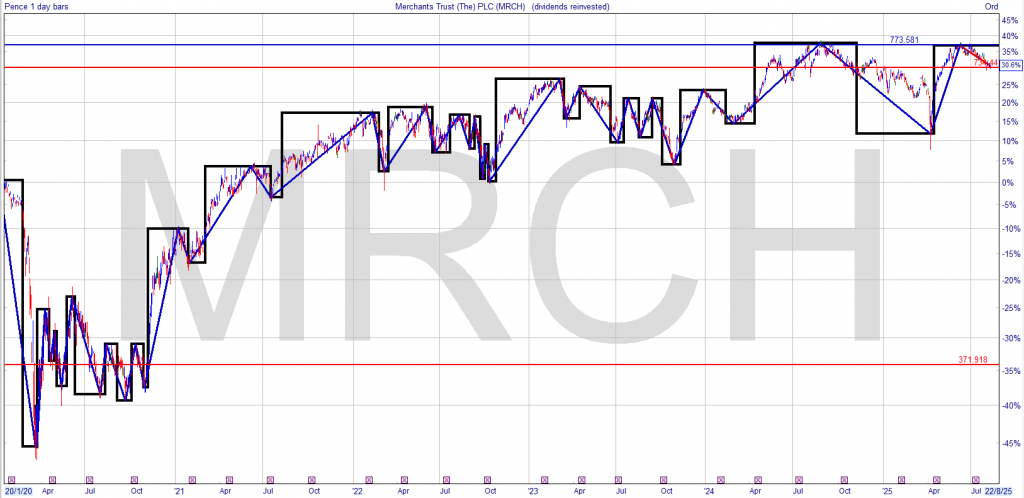

Of course, though the above is true, it needs to be put into context. Though stock markets do dip from time to time – think the Covid pandemic or the aftermath of Donald Trump’s tariff blitz in April – they tend to recover and grow over the longer term.

Even the FTSE 100, which tracks the biggest UK stocks, has grown 30 per cent over the past decade despite multiple dips.

Your risk of losing money is also less if you put your money in a range of diverse investments, like an ETF, rather than buying large amounts of individual stocks.

The downside of cash savings

Finally, I wish I’d better understood that having your money in cash is not risk-free.

Although you can’t lose money in cash terms – you’ll always end up with a higher total sum than you started with – if your savings are languishing in accounts that pay interest of below the inflation rate – currently 3.6 per cent – you are really losing money in real-terms.

If this happens repeatedly over time, you are compounding your losses, when an alternative exists.

Ultimately, more and more young people are starting to slowly learn that investing is the best way to grow their wealth.

Industry figures show that in February 2020, 19 per cent of 18- to 34-year-olds had investments, but by May 2022 this proportion had increased to 29 per cent.

Investing can be the key to unlocking life milestones that elude so many younger people.

It’s never too late, but the earlier you begin, the better.