DEUTSCHE BANK REINITIATES PRIMARY HEALTH PROPERTIES WITH ‘BUY’

RBC CUTS GREENCOAT UK WIND PRICE TARGET TO 145 (150) PENCE – ‘OUTPERFORM’

Investment Trust Dividends

DEUTSCHE BANK REINITIATES PRIMARY HEALTH PROPERTIES WITH ‘BUY’

RBC CUTS GREENCOAT UK WIND PRICE TARGET TO 145 (150) PENCE – ‘OUTPERFORM’

Greencoat UK Wind – Net Asset Value and Dividend |

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO, THE UNITED STATES (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE DISTRICT OF COLUMBIA), AUSTRALIA, CANADA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR JAPAN.

GREENCOAT UK WIND PLC

(the “Company”)

Net Asset Value and Dividend Announcement

| Net Asset Value / Net Asset Value per share | £3,066.8 million / 140.7 pence |

| Dividend per share | 2.59 pence |

The Company announces that its unaudited Net Asset Value as of 30 September 2025 is £3,066.8 million (140.7 pence per share).

The Company’s September 2025 Factsheet is available on the Company’s website, http://www.greencoat-ukwind.com.

The Company also announces a quarterly interim dividend of 2.59 pence per share with respect to the quarter ended 30 September 2025.

Dividend Timetable

Ex-dividend date 13 November 2025

Record date 14 November 2025

Payment date 28 November 2025

| Company Name | Place change | |

| 1 | Royal London Short Term Money Mkt Y Acc | Unchanged |

| 2 | L&G Global Technology Index I Acc | Up 1 |

| 3 | Vanguard LifeStrategy 80% Equity A Acc | Down 1 |

| 4 | Jupiter Gold & Silver I GBP Acc | Up 4 |

| 5 | Vanguard LifeStrategy 100% Equity A Acc | Up 5 |

| 6 | Artemis Global Income I Acc | Unchanged |

| 7 | Greencoat UK Wind UKW0.27% | New |

| 8 | Golden Prospect Precious Metal Ord GPM6.00% | New |

| 9 | HSBC FTSE All-World Index C Acc | Down 5 |

| 10 | City of London Ord CTY0.19% | Down 1 |

Investors have continued to pile into funds with a focus on gold and silver amid a fall in prices. The gold price tumbled last Tuesday, interrupting a run of extremely strong performance. Meanwhile, the share price discounts to net asset value on commodity investment trusts widened last week, suggesting some investors were taking profits.

Others seemingly saw this as a chance to buy in, with Golden Prospect Precious Metal Ord GPM

entering the list of top-selling funds in ISAs for the week. The trust had experienced one of the biggest instances of discount widening and is sitting on huge gains for 2025.

Meanwhile, an open-ended rival, Jupiter Gold & Silver, climbed into fourth place. A renewable energy infrastructure trust entered the list in the form of Greencoat UK Wind UKW

which had hovered in 15th place a week earlier. The trust hasn’t seen any recent major news but its yield, which comes to more than 9%, is likely proving a draw for some.

It’s one of a few income plays in the list, with Artemis Global Income still in sixth place and UK income stalwart City of London Ord CTY

clinging on in 10th place. The Artemis fund has a 12-month trailing dividend yield of 3.5%, while CTY shares currently trade on a 4.1% yield.

Some other investor favourites remain hard to shake. Royal London Short Term Money Mkt Y Acccontinues its long reign at the top of the list, while L&G Global Technology Index climbs one rung to second place.

The L&G fund is a straightforward way to bet big on some of the biggest US stocks: NVIDIA Corp NVDA

accounts for almost 16% of the fund, with Microsoft Corp

MSFTand Apple Inc AAPL each on weightings of almost 14%.

Two of Vanguard’s LifeStrategy portfolios, which offer exposure to a mixture of stocks and bonds using tracker funds and have something of a home bias to UK equities, make it into the list again. But only one more conventional global tracker fund, HSBC FTSE All-World Index, now sits in the top 10.

Funds and trusts section written by Dave Baxter, senior fund content specialist at ii.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Please remember, investment value can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a stocks & shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

| Things have been looking iffy for renewable energy investment trusts for more than three years now, but the sector has always managed to keep paying dividends, battery storage trusts aside. But could this be about to change ? Income investors have broadly continued to receive what they originally asked for: regular payouts that grow every year. This is despite higher interest rates hitting demand for shares, and then lower power prices hitting revenue. Discounts became widespread, although this has also meant that income seekers enjoyed ever-increasing yields. |

|

| Everything has a limit, however, and now there is a growing sense of unease about whether these payouts can continue. Wind generation has been lower than average this year, which is impacting dividend cover, defined as how many times a trust can pay its dividend from its revenue. Anything close to or under one means alarm bells. Some trusts are faring better than others, depending on their revenue mix and individual features. But Stifel analysts estimate that at Greencoat Renewables (GRP), dividend cover for the second half of 2025 will be around 0.9 times. And the Renewables Infrastructure Group (TRIG) said in August that covering the dividend for 2025 “may be tight”. Overall, Stifel analysts believe it’s “likely” that wind asset trusts’ revenues in the second half of the year will not cover expected dividends. Wind is not the only issue. For example, Stifel also expressed concerns around dividend cover at energy efficiency play SDCL Efficiency Income Trust (SEIT), where it is currently 1 times, which leaves “little room for budgets to be missed”. What’s that ringing noise ? Falling dividend cover does not automatically imply dividend cuts; trusts can use reserves to meet their obligations, and indeed have done so in the past. “Over the next couple of years, and absent a strategic change in direction, dividend cover will decline as historic power price hedges roll off – but I don’t expect to see dividend cuts,” says Charles Murphy, senior research analyst at Singer Capital Markets. James Carthew, head of investment companies at QuotedData, sounds slightly less confident, noting that it’s just very hard to tell. He points to power price forecasts that keep getting cut, despite growing demand for electricity (for example, because of data centres). Both point out that there is also a long-term question which will come to a head in the next decade or so. Renewable energy trusts need to refresh their assets, or NAVs will continue to decline, but while trading at a discount, they don’t have the capital to do so. “Longer term, I believe that dividend cuts are inevitable,” says Murphy. “Historically, the thinking was that nominal power prices would have risen sufficiently to cover the shortfall from the loss of subsidy and government support. However, the power price forecasts (in real terms) continue to decline, undermining this.” One trust where a cut is a real possibility is Bluefield Solar Income (BSIF). After trying and failing to sell its portfolio, the trust is now proposing an “integrated business model”, which would incorporate the trust’s assets with its investment manager, Bluefield. There isn’t a lot of information on how this will work yet, but it would likely involve a trade-off: more scope for future growth in exchange for a lower dividend in the short term. Carthew notes that over the next few years, it might make more sense for trusts to consider a more radical solution, as Bluefield Solar has done, rather than simply trim payouts. But whether trusts and shareholders agree remains to be seen, and there are questions over whether Bluefield Solar’s plan is feasible. So while the renewables sector remains cheap and somewhat interesting, income investors should be aware that regular payouts are not as watertight as history suggests. At the very least, the real value might decline. In recent years, not all trusts have managed to increase their dividends in line with inflation, and Greencoat UK Wind (UKW) is the only one that explicitly aims to do so. Even if inflation falls back, it might become harder to keep up. |

|

| By Val Cipriani, funds editor at Investors’ Chronicle |

Warren Buffett has set up passive income streams most people can only dream about. Our writer sees some practical lessons he too can apply.

Posted by Christopher Ruane

The content of this article was relevant at the time of publishing. Circumstances change continuously and caution should therefore be exercised when relying upon any content contained within this article.

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice.

When it comes to passive income, few people have mastered it like Warren Buffett. The legendary investor’s company Berkshire Hathaway generates billions of pounds each year without doing anything for it beyond holding shares in blue-chip businesses such as Apple and Coca-Cola.

Although Buffett has far more resources at his disposal than any small private investor, I still believe the lessons from how he does what he does can be profitably applied even on a much more modest scale.

For example, Buffett is not really an innovator. Nor is he a trader, frequently jumping in and out of shares trying to make a quick profit.

Rather, he does a fairly simple thing – and does it well. He identifies companies he understands and thinks have excellent long-term commercial prospects and are trading at attractive share prices. Then he buys them and often holds them for the long term, hoping that if he has chosen correctly he will be rewarded with dividends, share price growth, or both.

That is a simple, but potentially very powerful, passive income idea.

When Buffett gets dividends, he does not use them to fund payouts to Berkshire shareholders. Instead, he reinvests them. That simple move can be used by small shareholders, by compounding their dividends.

Imagine I invested £300 each month in income shares and compounded at 7% annually, thanks to reinvesting dividends. After a decade, I would already have a portfolio throwing off £3,600 each year in dividends.

I could keep compounding like Buffett does, or start drawing it as passive income.

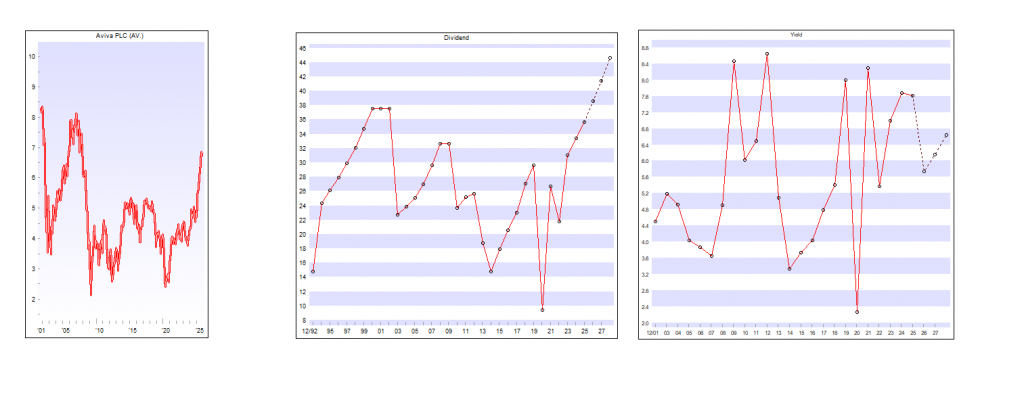

As an example, one share I think dividend-focused investors should consider is insurer Aviva (LSE: AV). The FTSE 100 firm cut its dividend in 2020 but has since been steadily raising it again. Currently, the yield stands very close to my example above, at 7.1%.

In practice, like Buffett, I always keep my portfolio diversified across different shares. That means I may still hit an average target yield even though some shares I own offer more and others less.

The insurance market is huge and I see no reason for that to change. Some insurance is mandatory, while a lot of it is voluntary but customers buy it year after year. That attractive level of demand makes for a highly competitive industry. One risk I see for Aviva is smaller rivals trying to chip into its strong market position by offering more competitive prices, meaning it could lose customers.

Its large customer base is in fact one of the things I like about Aviva. I also think its strong brand and deep experience in what is a complex industry can help it perform competitively.

Not for the Snowball so

Brett Owens, Chief Investment Strategist

Updated: October 17, 2025

Generally speaking, we like monthly dividends better than quarterly payouts. I mean, why wait 90 days to get paid when “every 30” is possible?

Here’s another great thing about monthly divvies—they often have big fat annual yields attached to them.

For example, today we are going to discuss a batch yielding between 8% and 19.8%. On a modest $500,000 in savings, these monthly machines will dish between $40,000 and $99,000 per year!

If we randomly select a few monthly dividend payers, chances are we’ll earn (way!) more. Here’s the difference between the stock market’s monthly dividend stocks and the major indices:

Dividend heroes or yield traps? Let’s look at this four pack in more detail.

Sabine Royalty Trust (SBR)

Distribution Yield: 8.0%

We’ll begin with a rarity among rarities—Sabine Royalty Trust (SBR).

Royalty Trusts are among the most passive income vehicles on the market. They exist to own shares in income generated from natural resources (crude oil, natural gas, minerals, etc.), which they turn around and pay back to unitholders, less costs, in the form of distributions. Sabine Royalty Trust, for instance, receives Sabine Corporation’s landowner royalties, overriding royalty interests, minerals, production payments, and more from proved but undeveloped oil-and-gas properties in six states, predominantly in the Permian Basin.

How central are distributions to royalty trusts’ existence? Here’s the first paragraph from the first page of SBR’s most recent earnings report:

Source: Sabine Royalty Trust Q2 2025 Earnings Presentation

Who can argue with a business that has no debt, pays a generous monthly distribution that by nature has to be covered, and has run laps around the broader energy sector?

Why Drill for Oil When Collecting Royalties Is So Much More Lucrative?

Well, there are a few oddities we must address.

Sabine Royalty Trust won’t be with us forever, for one. While it technically has no termination date, the company was established to fizzle away one day. Its asset base was established in 1983, and those assets are fixed—SBR can’t acquire new ones, so when their current assets are depleted, they’re gone. The trust itself would likely terminate shortly before that. SBR will terminate if there are two successive fiscal years in which Sabine’s gross revenues from royalty properties are less than $2 million per year, or if unitholders vote for a closure.

Because SBR only collects royalties, it’s extremely sensitive to commodity prices, so it can be far more volatile than the energy sector. The distribution isn’t predictable, either—over the past five years, distributions have ranged between 2.7 cents per share and $1.14 per share. Those distributions aren’t tax-efficient, either; they’re considered ordinary income, so we’re taxed at our marginal rates.

Capital Southwest Corp. (CSWC)

Dividend Yield: 12.7%

Capital Southwest Corp. (CSWC) is a business development company that provides capital to lower middle market firms with EBITDA (earnings before interest, taxes, depreciation and amortization) of between $3 million and $25 million. Its current portfolio stands at 122 firms—roughly 90% of its deals are first-lien loans, 9% are equity, and the rest are a sprinkling of second-lien and subordinated debt.

The blessing and (more so at the moment) curse of many BDCs is that they deal in a high percentage of floating-rate debt, which is outstanding when rates are rising, less so when they’re declining. And the stock market being what it is, sometimes the connection isn’t perfect—BDCs can just as easily trade on expectations for policy as it can the policy itself:

Still, It’s Clear the Fed Has a Lot of Say in BDC Performance

However, in CSWC’s case, some Fed pain now might be a blessing in disguise.

The BDC industry is a difficult one that, as a whole, tends to lag the market. But a few individuals stand out, and CSWC is one of them, clobbering its peers and outperforming the S&P 500 over the long term. It’s internally managed (so external managers aren’t bleeding fees from it), it has moderate leverage, the dividend is well-covered and, as of summer 2025, those dividends are paid on a monthly basis. Most of its high dividend is attributable to its regular dividend, but CSWC kicks in supplementals that account for another percentage point or so of yield.

So why would lower rates be a blessing for a company that wants higher rates? They won’t be—at least not for Capital Southwest. But they could provide a little relief for prospective buyers who don’t want to pay the current 21% premium to net asset value (NAV) for shares.

PennantPark Floating Rate Capital (PFLT)

Dividend Yield: 14.0%

Another BDC, PennantPark Floating Rate Capital (PFLT), which targets midsized companies that generate $10 million to $50 million in annual EBITDA.

PFLT effectively invests us in more than 190 portfolio companies spread across over 110 PE sponsors. It’s also a “value-added” BDC that lends its expertise in specific industries, hence its portfolio focus on five categories: health care, software and technology, consumer, business services and government services.

And the name pretty much says it all. PennantPark Floating Rate does about 90% of its funding through first-lien debt, almost all of which is floating-rate in nature. (The remaining 10% is made up of equity co-investments and joint venture equity.)

Like with CSWC, it’s clear that rates are the straw that stirs PFLT’s performance.

Though PFLT Hasn’t Been Nearly as Strong a Performer as CSWC

I’ve previously looked at PFLT and noted that its dividend coverage was getting tight. It’s getting tighter, too, with the dividend outstripping NII across a few quarters over the past year-plus. A dividend reduction is at least in the realm of possibility, though management believes that joint venture growth (including a new JV, PennantPark Senior Secured Loan Fund II) and additional leverage can help it meet its NII needs. Wall Street may be a little skeptical; PFLT trades at a 20% discount to NAV.

Orchid Island Capital (ORC)

Dividend Yield: 19.8%

REITs are well-known for their above-average dividends, but if we want to test the upper limits, we want to look at mortgage REITs.

Most REITs are equity REITs, which own (and sometimes operate) physical real estate. But mortgage REITs purchase stacks of paper with a business model that goes something like this:

And whereas you can commonly find nice yields in the mid-single-digits among equity REITs, it’s extremely common to find double-digit yields in the mREIT space.

Orchid Island Capital (ORC) is one such mREIT dealing in agency residential mortgage-backed securities (read: Fannie Mae, Freddie Mac, etc.), including fixed-rate pass-through securities, interest-only securities and inverse interest-only securities. It’s externally managed and advised by Bimini Advisors. And its yield is in the stratosphere, currently just shy of 20%.

We discussed another mREIT with a rising dividend a couple weeks ago, and I mentioned that “Generally speaking, the Federal Reserve’s easing should be a boon for mREITs, including the potential for improving originations in the residential space.”

In fact, you can see ORC’s improving health over the past two years or so as the rate environment has improved.

Unfortunately, You Can See Something Else, Too

Orchid Island’s long-term total return since its 2013 initial public offering is bad enough. But the massive dividend papers over a trainwreck of a price performance, with shares off 90% since that IPO. The declines have been so precipitous that just a few years ago, ORC had to initiate a 1-for-5 reverse stock split; without it, shares today would trade for less than $2.

And as the chart above shows, ORC has no compunction about reducing its dividend at the drop of a hat.

Our writer shows how modest sums of money invested regularly into the stock market could turn a portfolio into a passive income machine.

Posted by Ben McPoland

Published 28 October

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

Warren Buffett famously said that the stock market is “a device for transferring money from the impatient to the patient“. What the celebrated billionaire investor means is that it rewards those who hold quality stocks through the inevitable ups and downs.

And it really rewards those who buy from others selling out of fear. For instance, consider perhaps Buffett’s most famous investment — Coca-Cola. Back in the 1980s, he was greedily buying shares of Coke from impatient investors. In fact, he ended up with roughly 6.2% of the firm’s outstanding shares.

Fast forward to today, Buffett’s Berkshire Hathaway owns more than 9% of the beverage giant, without buying another share. How so? Due to Coca-Cola’s regular share buybacks, which have reduced the total share count and indirectly boosted Berkshire’s stake.

What’s more, Buffett’s holding company has received rising dividends, lots of them. Indeed, it’s on track over the next few years to receive annual dividends of $1bn, which would be incredible considering he bought the entire stake for about $1.3bn.

Naturally, not all of us have the wherewithal to take chunky 6% stakes in global corporations. But the same patient Buffett-esque mindset applies to building wealth, even when starting with modest sums of money.

To give an example, let’s assume someone who gets paid weekly can afford to invest £99 into the stock market. That might not sound like it would do much, but it’s actually £5,150 every year.

If this investor were to generate half the returns that Warren Buffett has throughout his illustrious career, that would be around 10%. This is the ballpark figure for global stocks over the long run, with dividends reinvested.

Generating this average rate of return on £5,150 each year would end in a portfolio worth £885,627 after 30 years!

At this point, things would become interesting because an investor would have two choices. They could plough on investing their £99 every week, turning the £885k portfolio into almost £1.5m after another five years.

Or, alternatively, they could choose to stop investing and enjoy spending the dividends being generated. If the portfolio yielded 6% at this point, that would be just over £53,000 every year in passive income.

By this point, the portfolio should be sufficiently diversified to offset the risk of individual dividends cuts. And also big enough to absorb those stocks that don’t generate positive returns (not all shares do, sadly).

Returning to Coca-Cola, I think its namesake from the FTSE 100 is worth considering for a portfolio. That’s Coca-Cola HBC (LSE:CCH), the bottling firm that makes, distributes, and sells brands like Coke, Fanta, and Monster in certain markets across Europe and Africa.

In Q3, the firm reported organic sales growth of 5%. That was below market expectations for 6.3%, which highlights that the company might be experiencing slowing growth due to weak consumer spending (this is a risk).

However, zooming further out, year-to-date organic revenue growth was still strong at 8.1%. Most firms would give their right arm for this level of growth in today’s challenging market.

Also, the company is buying a 75% controlling interest in Coca-Cola Beverages Africa for $2.6bn. This will create an emerging Coca-Cola bottling giant, with leading market positions across Africa and Europe.

Primary Health Properties PLC

Acquisition of Assura plc – CMA Phase 1 Clearance

Further to the announcement by the UK’s Competition and Markets Authority (“CMA”) earlier today in relation to its Phase 1 review of the Company’s combination with Assura plc (“Assura”), PHP is pleased to note that the CMA has concluded that the transaction gives rise to no competition concerns.

As a result of this decision, the CMA’s requirement for the businesses to be held financially and operationally separate, subject to certain derogations, is expected to conclude shortly. PHP will now turn its full attention to the integration of the two businesses and realising the full benefits of the combination, including delivery of the expected run-rate cost synergies of at least £9 million.

Mark Davies, CEO of PHP, commented:

“We are pleased with the decision announced by the CMA today that there are no competition concerns with this strategically important transaction and we appreciate the work done by the CMA team during their review.

The management team can now focus on the integration of the two companies and is excited about the prospect and opportunity it will bring by creating a £6bn healthcare REIT owning, managing and investing in critical social infrastructure assets in a sector well placed to deliver growth.

This earnings-accretive transaction, which has compelling strategic and financial benefits, will give PHP a lower cost of capital and a strong platform to accelerate our future expansion.

I’m looking forward to working with our new colleagues from Assura and working together to help the NHS deliver its 10-year plan by shifting more patients into primary care which will help the NHS save money. We have the knowledge, expertise and relationships and with a lower cost of capital are well-placed to help deliver modern, flexible healthcare buildings in communities around the UK and Ireland.”

The person responsible for arranging the release of this announcement on behalf of PHP is Toby Newman, Company Secretary.

An investment trust is a common way for people to buy into existing portfolios of managed investments. Our writer weighs some potential pros and cons.

Posted by Christopher Ruane

Published 27 October

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

There are lots of different ways to put money into the stock market. One is to buy shares (or even a single share) in an investment trust.

Investment trusts come in all shapes and sizes but basically they are pooled investment vehicles. Think of an investment trust as a company listed on the stock market that has investing as its own business.

Each trust needs to be considered on its own merits. But at a high level, there are some potential pros and cons of buying into an investment trust, as I see it. Here are a couple of each.

Even a private investor with a small amount to put in the market ought to reduce their risk by spreading it over multiple investments.

That can be hard to do on a very limited budget – but an investment trust can offer a potential solution.

Take Scottish Mortgage Investment Trust (LSE: SMT) as an example. Its share price is currently below £12.

But its portfolio spans dozens of companies. They include listed tech giants like Meta Platforms and Nvidia. They also include unlisted companies a small private investor may otherwise struggle to invest in, such as SpaceX (Scottish Mortgage’s biggest holding right now).

By buying just one share in Scottish Mortgage, an investor would get access to a diversified portfolio.

Over the long run, Scottish Mortgage has been a runaway success story. It has not cut its dividend per share for almost a century.

The investment trust’s share price has moved up 16% over five years, but that has included periods of significant volatility. It is up 80% since October 2020, for example – but still 24% beneath its price back in November

Why has Scottish Mortgage been so volatile? Its focus is on growth companies. As their prices have moved around a lot, so has Scottish Mortgage’s.

The investment trust has professional fund managers who help decide what shares to buy and sell. Expert managers can offer skills and experience a private investor lacks. But not all managers are equally good.

Still, in many cases I think an investment trust having a team of professional stock pickers can help make it more attractive.

Who pays for that? After all, fund managers do not usually come cheaply no matter how good or bad they turn out to be!

Above I said an investment trust is a listed business (that just happens to be a pooled investment). So it needs to pay costs like staff wages.

To do that an investment trust typically levies an annual management fee. That can be modest, but over the long term can add up.

Being listed in its own right also brings another possible disadvantage (though it can actually work to investors’ advantage too).

The stock market price for an investment trust reflects what investors are willing to pay for it. That can differ from a ‘sum of the parts’ valuation (or what is known as the net asset value).

For example, Scottish Mortgage currently trades at a 12% discount to its net asset value.

That may frustrate shareholders, who think the market undervalues their holding. Seen as a cup half-full, though, such discounts may offer investors a chance to buy something for less than its value.

Thursday 30 October

abrdn UK Smaller Cos Growth Trust PLC ex-dividend date

Bluefield Solar Income Fund Ltd ex-dividend date

Brunner Investment Trust PLC ex-dividend date

CQS Natural Resources Growth & Income PLC ex-dividend date

Edinburgh Investment Trust PLC ex-dividend date

Foresight Solar Fund LTD ex-dividend date

Henderson Far East Income Ltd ex-dividend date

Invesco Global Equity Income Trust PLC ex-dividend date

JPMorgan Claverhouse Investment Trust PLC ex-dividend date

M&G Credit Income Investment Trust PLC ex-dividend date

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑