How much do you need in an ISA to target a £20,000 passive income at 60?

The power of compound returns means the prospect of retiring with a good passive income from stocks and shares can be within reach.

Posted by Alan Oscroft

Published 27 October

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

It might be obvious that the sooner we start saving and investing, the better our chances of reaching 60 with some decent passive income in the bag.

How much we need depends on how much we hope to withdraw. There’s a rough rule that suggests taking 4% per year.

Should you buy Empire Metals Limited shares today?

The idea is that should still leave enough capital to grow with inflation for the future. Based it on that, the sums are easy. We need £500,000 by age 60 to take out £20,000 per year.

25 years? Nah!

That’s not a trivial task. But the miracle of compound returns makes it look more achievable.

What we need to do is reinvest any dividend cash we get into new shares. And then those new shares earn us extra dividends next year, which we then can use to buy even more shares… and so on.

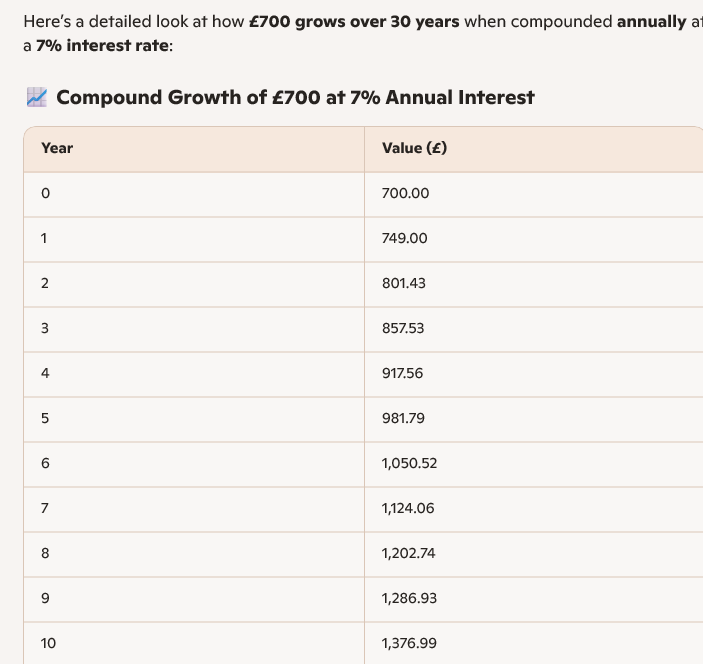

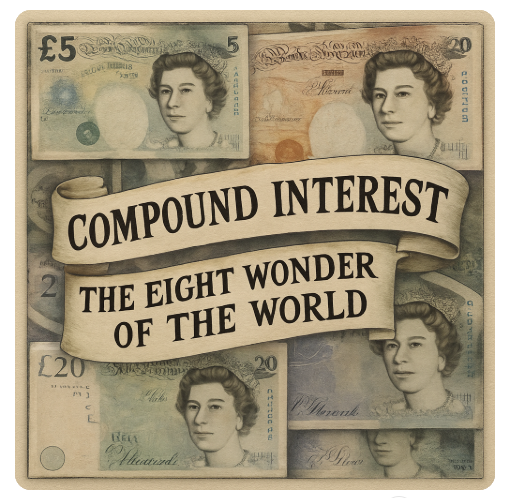

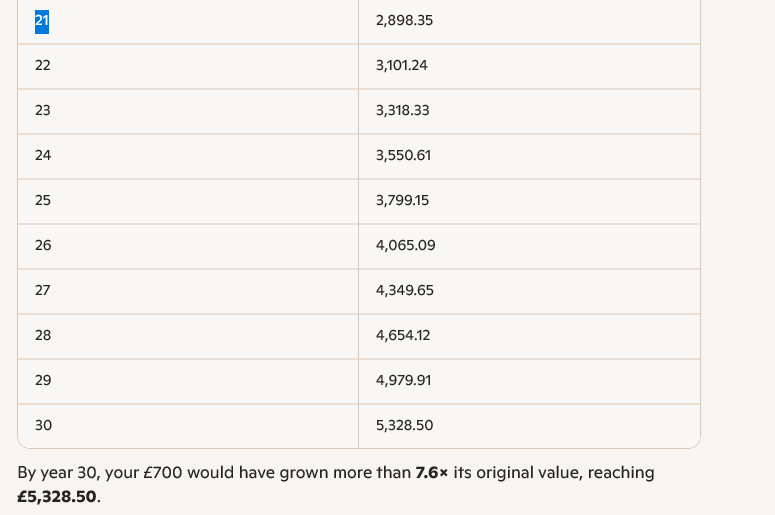

Over the past 10 years, the average Stocks and Shares ISA has returned 9.6% annually. That’s ahead of the annual FTSE 100 average over the past 20 years, approximately 7%. Let’s take the more conservative of those two figures.

How soon?

Invest the full ISA limit every year in shares, and buy new shares with all dividend cash. With an annual 7% return, we could reach the half million in a bit less than 15 years.

Someone age 45 today could reach £500,000 by 60. But… a 40-year-old who starts today could have £850,000 by the same age. Starting just five years earlier could result in a 70% bigger passive income pot!

Now, we can’t all reach the ISA limit every year. But whatever we can afford to invest, the key thing is that starting sooner can make a huge difference.

Starting earlier could make another difference too.

Empire strikes back

We all dream of finding the elusive multi-bagger. And the more years we have at our disposal, the better our chances. Looking at what’s happened to Empire Metals (LSE: EEE) reminds me of that — it’s up 460% over the past 12 months, and more than 1,000% in five years

Even with such a rise, Empire has crashed more than 90% since 2010

It’s a mining explorer, going after precious and rare metals. Companies like that can be very risky. And once they get way down in penny-share territory, they often never make it back.

But then, the company made a titanium discovery in Australia in 2023, which gave it a boost. And now we have some clues of the size.

An update on 14 October described it as “One of the largest and highest-grade titanium resources reported globally.” Estimates suggest there’s more than 200m tonnes of titanium oxide down there.

Balance is best

I’m not saying we should pin our passive income hopes on finding big winners. In fact, it’s easy to lose 100% on a speculative investment like this. As it happens, Empire shares have already fallen back from September’s peak.

But the more years of investing ahead of us, the more we can consider risking a small amount on a stock like this. I’m thinking about it for my ISA.