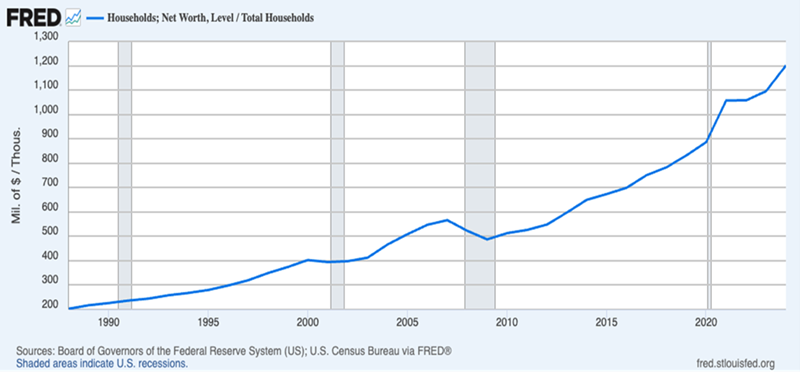

| Investors are being bombarded with messages about the rising risk of a stock market crash, and more specifically the bursting of the artificial intelligence (AI) ‘bubble’. Some observers predict a grim correction that will lay waste to portfolios, pensions and funds. In such an event, economic growth would also be jeopardised, given that the hundreds of billions of dollars of investments being pumped into AI are estimated to be driving 40 per cent of US GDP growth, while wealth generated by portfolio gains is supporting consumer spending. Others assert that while a correction or bear market is likely to happen, it will not approach the scale of the dotcom collapse because there are too many differences this time around. Former Scottish Mortgage Investment Trust manager James Anderson has nevertheless expressed concern about certain echoes of the turn of the century boom, namely the scale of AI-linked companies’ astonishing leaps in value (after a rocky start to the year, Nvidia has almost doubled its worth since April’s market lows) and a rising trend of ‘circular investments’ whereby companies support key customers by investing in them or offering finance deals. The Bank of England is also concerned about over-exuberance and circular deals. Even the tech giants’ own bosses admit it is a near-impossibility that their earnings can keep growing at the same pace indefinitely. Goldman Sachs warns that when AI investment slows, the knock-on effect on company valuations could wipe up to 20 per cent from the S&P 500. The counter-argument is that the steep rises in valuations of companies at the heart of the AI bubble are justified by factors that were not present in the dotcom bubble: staggering profitability and margins. Ben Barringer, head of technology research at Quilter Cheviot, adds that valuations are still well below previous bubbles – current valuations are half the peak of 60 times earnings seen in 2001 – while analysts at Capital Economics similarly note that forward price/earning ratios for big tech and the S&P 500 are not as high as they were at the peak of the dotcom era. Capital Economics’ view is that there will be a big correction in the S&P at some point once enthusiasm for AI in the market has peaked, but that this, barring some extraordinary development, will not be before 2027. It sees the S&P 500 hitting 7,000 at the end of this year, reaching 8,000 at the end of the next and then falling back to 7,000 at the end of 2027. How should investors prepare for a bear market, despite not knowing if it will happen soon or in a few years’ time? Crashes happen for a reason and there are plenty of possible triggers to make confidence drain away and pull the whole bull-market edifice down – disappointing US corporate earnings, cracks appearing in the AI story as benefits and promised productivity gains fail to materialise, or an unknown unknown. Investors will make their own minds up about whether such an event will happen sooner rather than later, but in light of the risk, it would be wise to conduct regular portfolio reviews with a view to adjusting weightings and being mentally prepared to avoid a panicked response. Like the mini earthquakes that precede volcanic eruptions (sometimes by years), we have already seen early warning signs in Tesla’s difficult year, Deepseek’s initial impact on Nvidia’s share price and trade wars causing stampedes for the exits. You may not want to sell down your US holdings if you have faith in your choices and in the long-term resilience of the US market. But you should bear in mind your time horizon: can you ride out a worst-case downturn lasting several years? The Nasdaq took 15 years to recover from the dotcom bust. Even if you are happy to keep backing US exceptionalism, you should pay attention to your tech exposure, which may now be far higher (and your portfolio far less diversified) than you intended with your original strategy. Many investors are still blind to the very significant chunk of Magnificent Seven exposure in their S&P 500 and global index trackers. You could reduce this risk by trimming holdings and reallocating to funds that have deliberately cut back on tech, as we outline here, or to defensive sectors and income generators. Fund flows show that many investors have been doing exactly that as they try to rebalance their portfolios ahead of an anticipated correction. Experienced investors know to stay focused on the long-term outcome, and that time in the markets, not timing the market, is what counts. It’s then a question of being prepared to ride out a correction and accepting the risks that some valuations may never recover, as happened during the dotcom fallout. Rosie CarrEditor |