Why every investor should consider REITs

Mark Hartley explains how real estate investment trust rules provide big benefits to shareholders, making them attractive to income investors.

Posted by Mark Hartley

Published 23 November

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Real estate investment trusts (REITs) are a specific fund type that focus on buying and letting property. They’ve long been popular among passive income investors due to rules that help ensure steady dividend returns.

They also offer simplified exposure to the real estate market without the high cost and risk of direct investment. Let’s have a look at the pros and cons of this unique investment option.

Should you buy AEW UK REIT plc shares today?

Key benefits

REITs give investors access to large-scale property development projects in residential, commercial and industrial spaces. The relatively low initial investment, combined with an experienced management team, makes them particularly attractive for beginner investors.

What’s more, the rules require them to distribute at least 90% of their taxable income to shareholders annually. This typically leads to high and consistent dividend yields, which is attractive for income-focused investors.

Moreover, they have far higher liquidity than standard real estate, trading on major stock exchanges where the shares can be bought and sold easily.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Notable risks

While the rules result in higher yields, they also limit retained capital for further investment. This can result in slow or even negative growth, which could eat into returns during weak market periods.

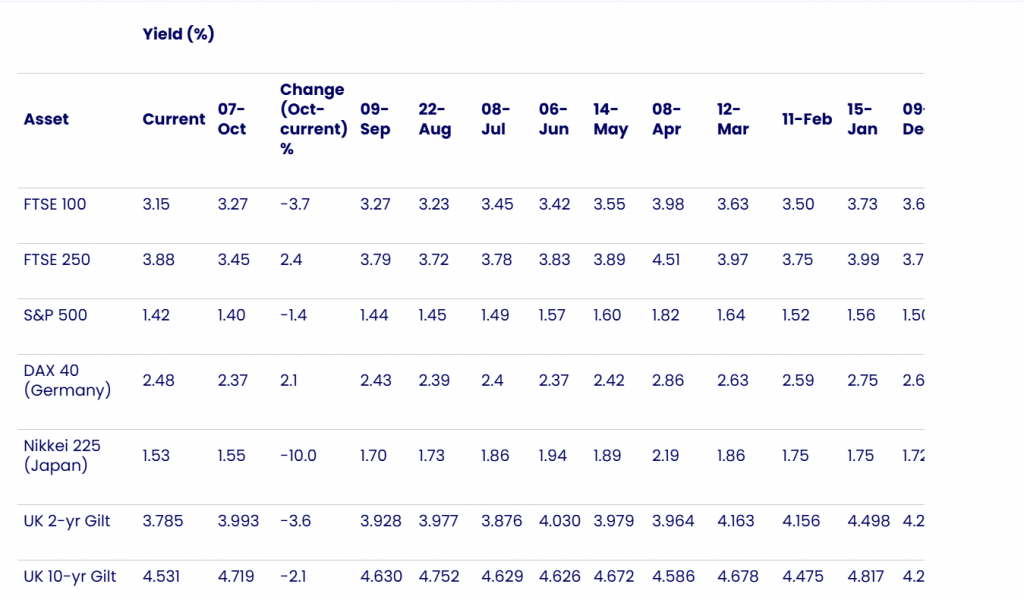

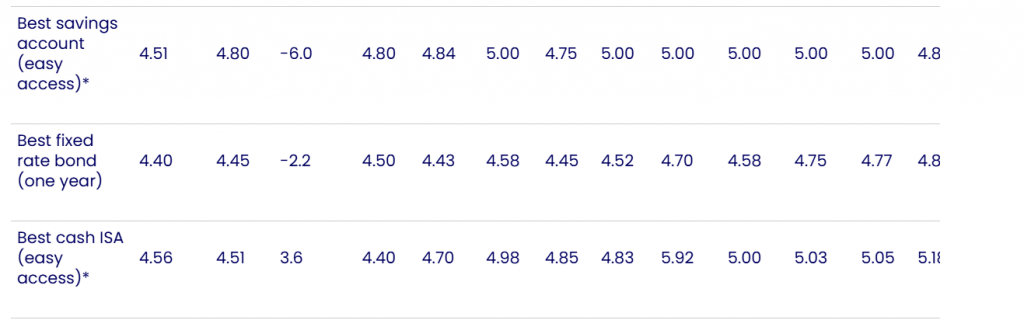

They’re also highly sensitive to interest rate fluctuations, which can limit profits during high-rate periods. In addition, they typically include ongoing management fees which must be accounted for when calculating potential returns.

One example

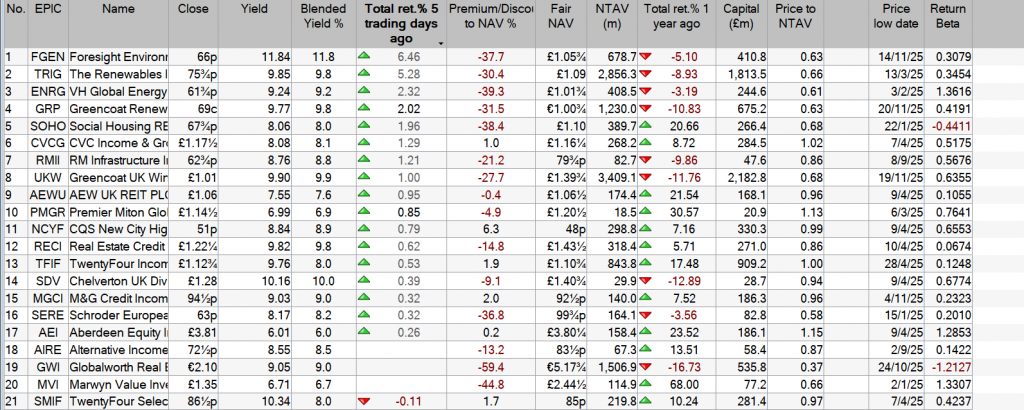

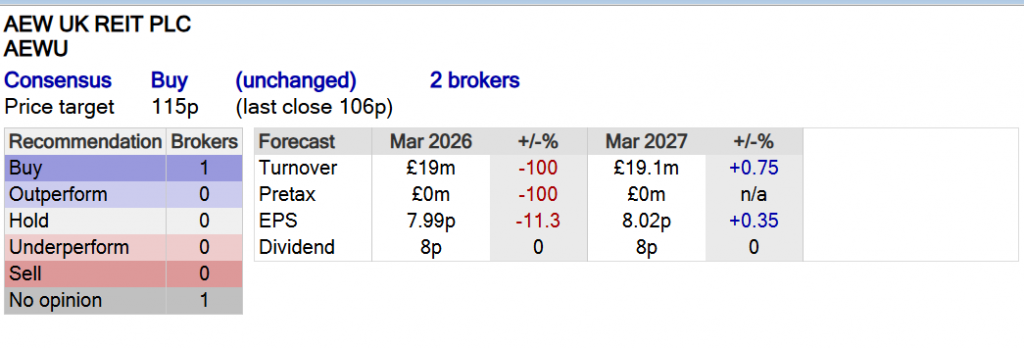

AEW UK (LSE: AEWU) is an up-and-coming REIT that started life just 10 years ago. Its strategy is to buy assets with shorter leases, aiming to exploit re-letting and redevelopment opportunities. It’s an interesting angle — but one with the added risk of tenant departures and higher vacancy rates.

It’s also very small, with a £167m market-cap, putting it at higher risk of volatility. The advantage being that the market tends to undervalue small-cap shares. As such, it has a net asset value (NAV) of 109p per share with shares currently trading at only 103p.

The past decade has dealt its fair share of ups and down but despite everything, it’s grown about 30% since Covid. Analysts expect the current growth trajectory to continue, with the average 12-month price target up 10%.

Importantly, its 7.6% yield isn’t only above average but is well covered by both earnings and cash flow. What’s more, its balance sheet looks healthy, with only £59.9m in debt against £174.4m in equity.

Earnings took a dive in 2022 but have made an impressive recovery, posting £24.34m in profit in 2024. Revenue in 2024 dipped slightly from 2023 but has been steadily increasing over the long term.

A long-term mindset

Whether investing in REITs, growth stocks or dividend shares, the key to building a solid passive income stream is a long-term mindset.

Investors who are quick to panic sell at the first sign of trouble often regret it down the line. No investment journey is smooth, and stomaching the ups and down is part of the ride.

But steady and reliable income stocks can help ease the turbulence. The key is picking the rights ones. With steady growth, a clean balance sheet and a impressive track record, I think AEW UK REIT is one worth considering.

Current yield 7.5%