The dividend total for the Snowball will be £11,621.00

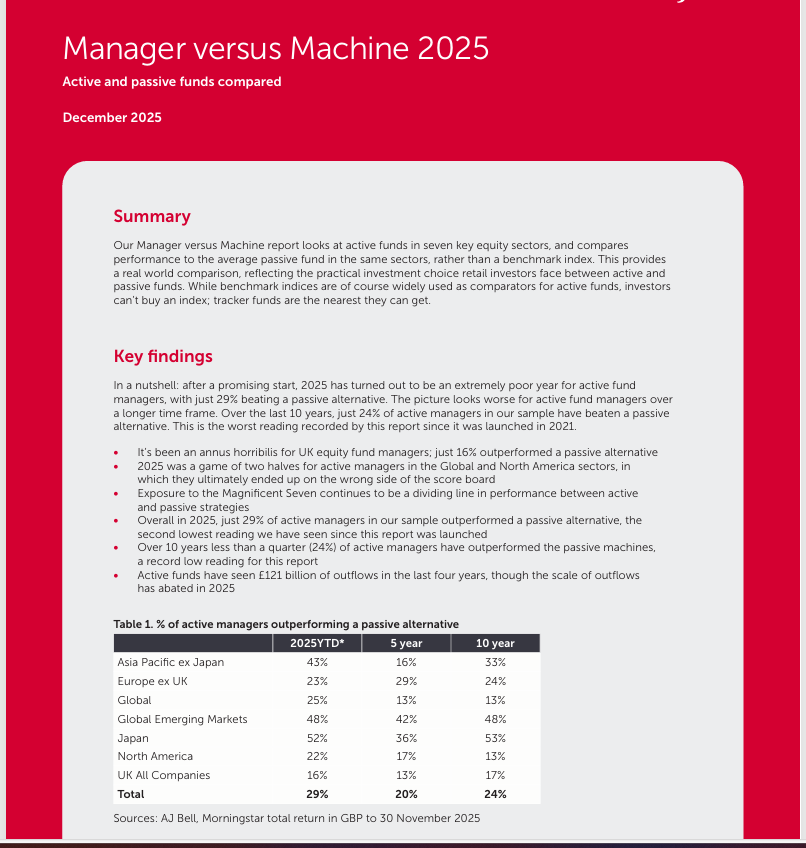

Next years target remains 10k.

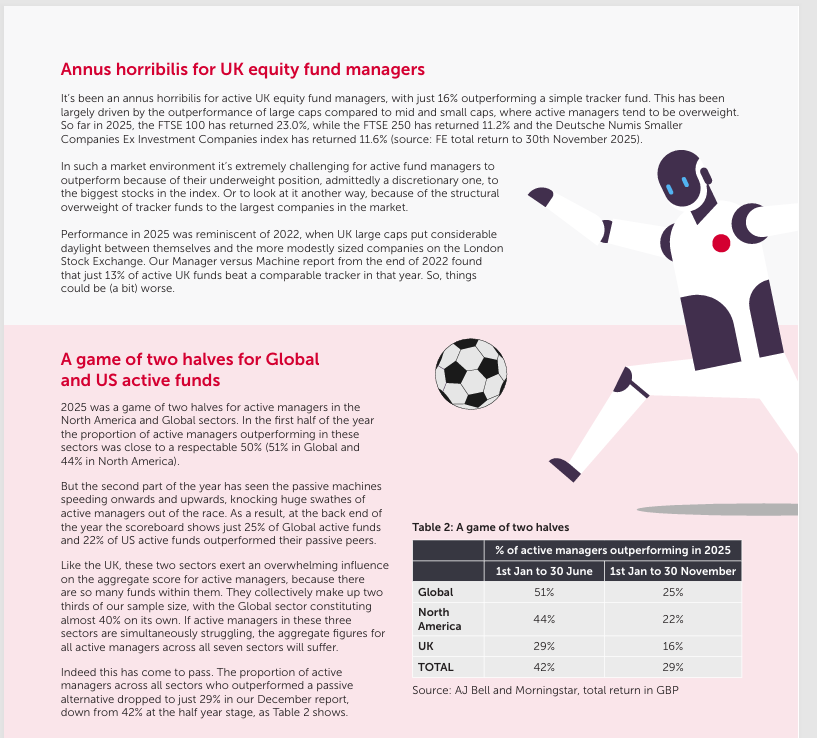

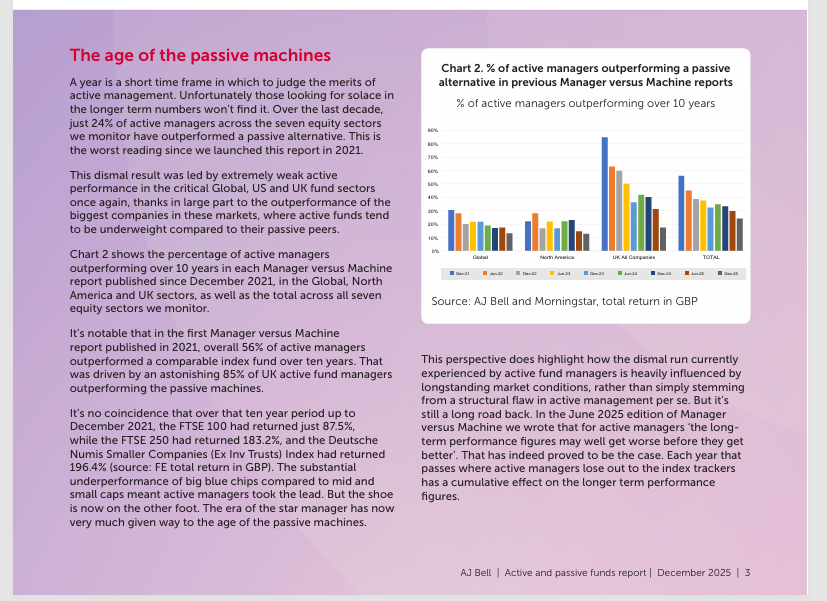

Investment Trust Dividends

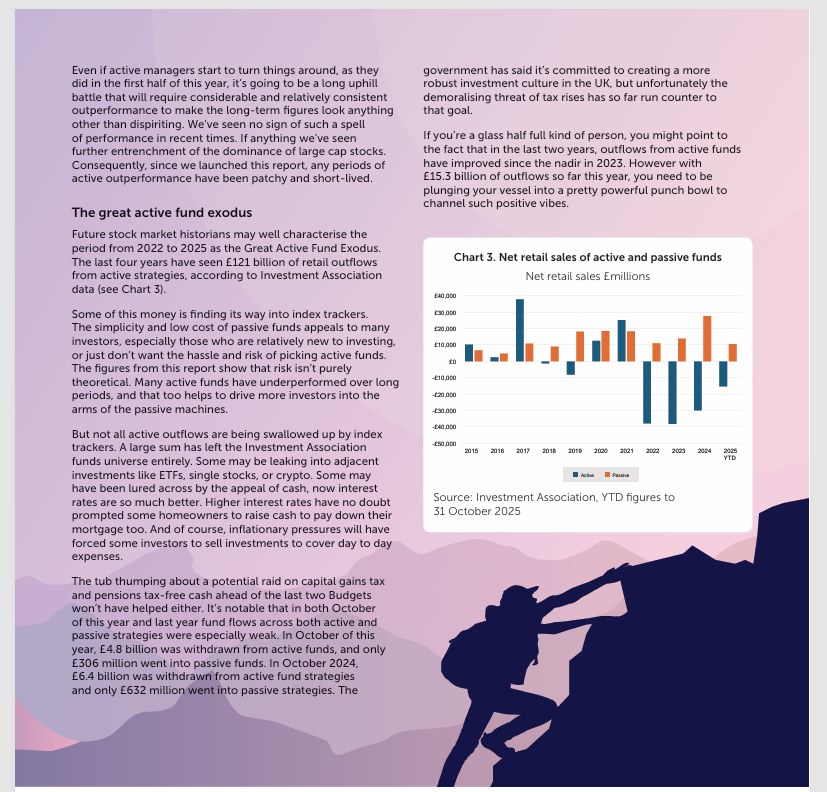

The dividend total for the Snowball will be £11,621.00

Next years target remains 10k.

What might we learn from the ‘dot com’ era that we can apply to today’s markets ?

Alan Ray

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

One of the profound differences between today’s investor and the investor of 25 years ago is that it is much easier today for us to imagine that a very large company can grow at extremely high rates than it was at the turn of the century. That statement may contradict many investors’ recollection, lived or otherwise, of what happened 25 years ago. After all, didn’t everyone’s imagination run wild, inventing new financial ratios to justify valuations that were absurd then and absurd today? Well, yes, if one focuses on the very narrow period of 1999 to 2000. But in the aftermath of the bubble bursting, perhaps embarrassed by our irrational exuberance, it took many of us years to get comfortable with the idea that a few very large companies could grow at a rate that had only been thought possible for a small business. The old ‘elephants don’t run’ adage was often recited, and for a sustained period after the bubble burst, investors in what came to be called ‘old economy’ businesses did much better than their ‘new economy’ counterparts. In the end though, investors grudgingly accepted that it was possible that a handful of large companies were ‘special’. And over time, it became increasingly meaningless to identify ‘old’ and ‘new’ economy companies as technology became ordinary and ubiquitous.

Indeed, long-time investors in the investment trust sector may recall that the transformation of Scottish Mortgage (SMT) to its status as a leading investor in high growth businesses took several years to complete. Whereas the manager at the time had arrived at the above conclusion early on, the process of persuading shareholders of what was a relatively traditional global equity trust took some time. What we have no trouble imagining today was, for many, a huge leap of faith.

Back in 1999, bankers were run ragged by dozens of new IPOs of increasingly outlandish businesses with no obvious route to profitability. These were eagerly bought by investors who wanted to own anything and everything that embraced the new technology of the day. This approach missed the vital point that many established businesses were transforming to embrace the internet but doing so at a measured pace and using their traditional brands and customer bases to anchor them while they made the transformation. For example, retail has been changed out of all recognition by the internet, but some ‘pre-internet’ brands have made a successful transition, learning from the mistakes of startup rivals. It’s taken the best part of a quarter of a century for the logistics and infrastructure that supports that transformation to catch up, and having existing ‘bricks and mortar’ has proved, for smart management teams, a bigger advantage than having the slickest website. For example, the resulting transformation of the property market is, today, a key theme in the portfolios of REITs such as Picton Property Income (PCTN) or Schroder Real Estate (SREI).

Today, bankers are less focused on IPOs and more on funding rounds for large private companies that are at the heart of the next wave of AI-related technology. We no longer have difficulty imagining that the eye-watering valuations of those companies will eventually be justified because we have all witnessed it happening before. It would be wrong to say that this is the sole focus of investors looking for AI ‘angles’, with businesses involved in the infrastructure behind power and data networks being a popular theme in many equity trusts, as one example. But in contrast to 1999, there are few high-profile IPOs presenting investors with absurd business models. At least, not yet.

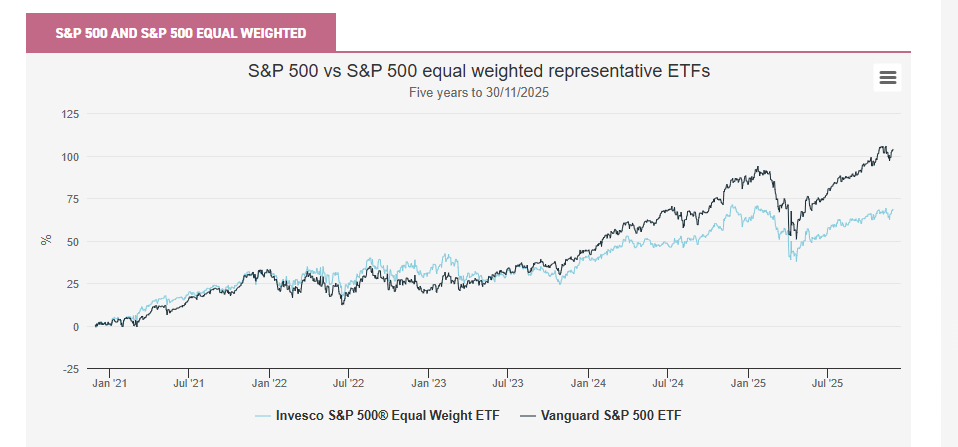

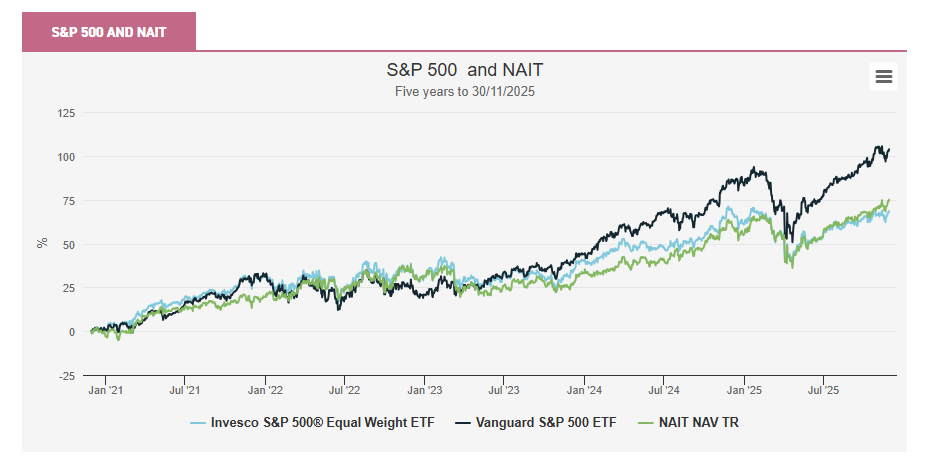

So, while it is tempting, and quite sensible, to draw parallels to 1999/2000, there are some significant differences in what we know now compared to then. But once again we seem to have trouble imagining that the products and services that the same very large companies are developing might, if they are to succeed, transform the rest of the corporate world. The chart below shows how this lack of imagination is manifesting itself in stock market terms. This is the S&P 500 Index we are all familiar with plotted against the ‘equal weighed’ S&P 500 Index. For readers not familiar with the difference, while the S&P 500 Index weights each company according to its market cap, the ‘equal weight’ applies the same weight to every company. When a few very large companies perform well, the regular S&P 500 Index will perform well too, but the equal weighted version will perform less well. Which is exactly what has happened recently. As ever, we represent those indices in the charts using ETFs that track them, since those are real-world instruments that any investor can buy.

Source: Morningstar

Past performance is not a reliable indicator of future results

What this means is that we have a pattern where our ‘version 2.0’ imagination has no problem with future success for a handful of businesses, but this seems to be entirely at the expense of the rest of the market. For investors with a contrary nature or who are interested in the ‘only free lunch’ of diversification, this has the potential to be a very interesting opportunity. Again, we have no problem imagining that some of these large companies will get larger, but to do so they will need to provide products and services that others want to buy. Will all the other companies left behind in the index buy their products if they aren’t helpful to their business?

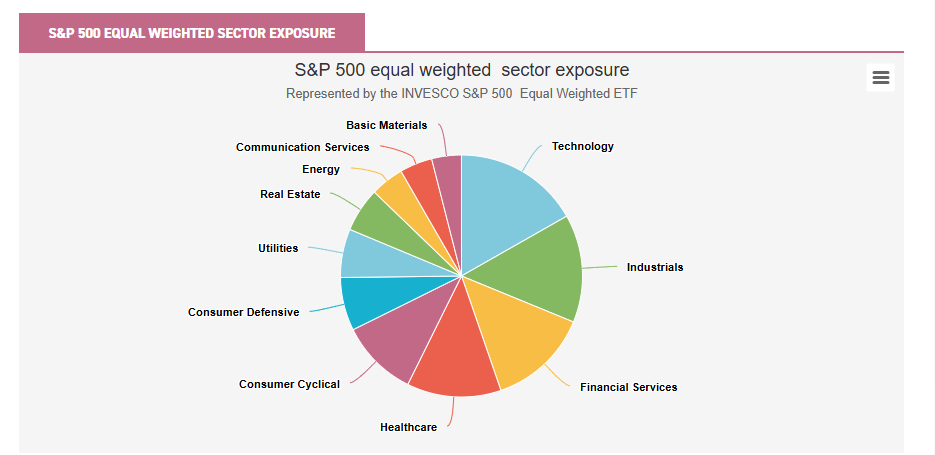

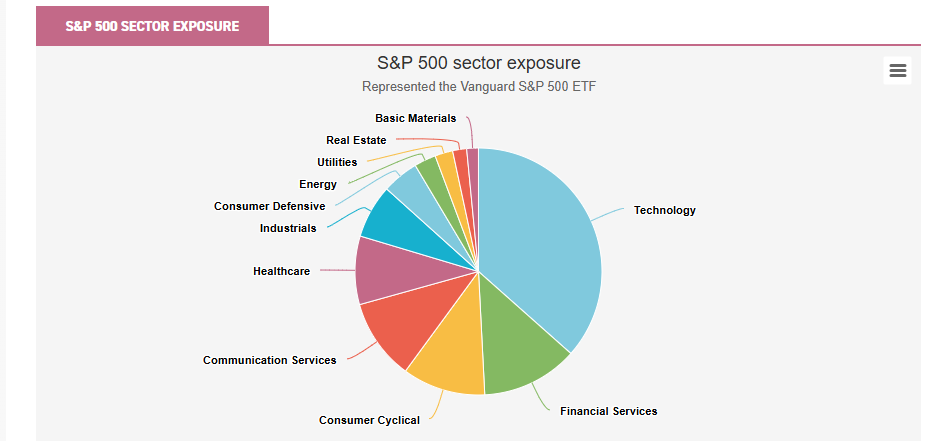

Speaking of diversification, to conclude the point on the two versions of the index, the next two charts show the sector exposure for the S&P 500 Index and its equal weighted neighbour. The largest ten constituents of the S&P 500 Index are about 40% of the overall index, which puts it right up there with active ‘focus’ funds in terms of its ‘conviction’. Technically, the equal weighted version doesn’t have ten largest constituents given the nature of its construction, although it’s likely one will find slight variations in position sizes for ETFs tracking the index. But one should expect any ten holdings to add up to 3% or less of the total. It’s also worth noting that US equities are over 70% of world indices, so even those investors who prefer global over US-specific trusts will likely find they are experiencing a similar concentration risk.

The first of the two charts shows the sector exposure for the equal weight index and is, perhaps, a good representation of what, in our imagination, the US equity market looks like.

Source: Morningstar

The second chart, the market cap weighted index we are all familiar with, shows in sector terms just how concentrated things have become in the US market. And again, global indices will be subject to the same influence.

Source: Morningstar

In the investment trust world, there are a couple of good mainstream ways to alleviate concentration risks in respect of US equities. First, JPMorgan American (JAM) deservedly holds the status as the leading ‘core’ US equity trust, combining elements of large-cap growth and value, together with a smaller (<10%) combination of small-cap growth and value, to achieve a more balanced mix of the US’s leading companies, including some of those mega-cap names. By dint of its equity income mandate, North American Income (NAIT) provides a very different set of exposures. Whereas its mandate is by no means akin to the ‘equal weight’ index, it’s very interesting that, as the chart below shows, an active mandate that is naturally underweight those mega-cap growth companies has performed very similarly to that index. In a scenario where investors decided to dust down the ‘old economy’ vs ‘new economy’ idea, one could imagine NAIT being very well positioned to benefit.

Source: Morningstar

Past performance is not a reliable indicator of future results

At our recent online event, Real Dividend Heroes and Growth Giants, a range of fund managers gave their own views on this topic, and all the presentations are available to watch back, and the accompanying presentations are available to download. One particularly interesting slide can be found in the presentation given by the manager of the global growth trust Brunner (BUT), which has been reducing exposure to the most highly valued companies in the US in favour of first or second derivative beneficiaries. If one downloads and views slide 17 of the presentation one will see a couple of eye-watering statistics that bring the issue of valuations to life. First, South Korean auto manufacture Kia has similar net income to Tesla, but the latter company has an enterprise value 87x (not a typo) that of the former. Second, US AI defence stock Palantir’s market cap is c. $430bn on revenues of $3bn. Whereas, the next five largest defence stocks in the US have a combined market cap of $550m on revenues of $262bn. Once again, our 2025 version of imagination probably feels quite casual about that and can easily fill in the growth case for the difference. But can we really be so confident that we aren’t missing out on the other side of these trades?

One of the toughest places to be a fund manager in the last couple of years has been US small caps. Both the specialist investment trusts in this space, Brown Advisory US Smaller Companies (BASC) and JPMorgan US Smaller Companies (JUSC) identify as ‘quality growth’ investors and this has been a very difficult place to be. Earlier we noted that there isn’t the same mania for IPOs of companies with only very sketchy business models, but in US small-cap land there certainly has been a more recent mirror of the S&P 500 Index’s experience, where a handful of stocks attached to the AI theme have dominated small-cap indices. Many of these businesses are unprofitable and therefore don’t meet the ‘quality growth’ threshold. This has been a major contributor to both of these trusts’ underperformance, but again, can we really be so confident that there aren’t opportunities on the other side of this trade?

Stock markets are more complicated than we’ve portrayed above, of course and the US and other markets are influenced by other big factors of the day. While the so-called ‘hyper scalers’, or mega caps, or whatever we choose to call them, are proceeding at pace with their capital expenditure plans to build the infrastructure required to power AI, much of the rest of corporate America has delayed its own spending and investment while it ponders the implications of trade tariffs. The UK has just been through its own arguably unnecessary period of uncertainty around the budget, with similar results for corporate spending. No doubt this very distinctive contrast is skewing earnings reports, and as we note above, has led to a very polarised smaller-companies market in the US. But uncertainty is waning as the US administration moves on to other matters. With greater certainty we may see a more balanced cycle of expenditure across other businesses.

It’s very difficult for many of us to imagine, and perhaps confront, the transformative effect AI will have on our lives and on businesses. It’s far less difficult for us to imagine that a few large companies will end up fully justifying the valuations we’ve placed upon them, and that belief has profoundly influenced the composition of US and global stock markets. But it seems far harder for us to imagine that, for that to happen, all the other companies need to have a reason to buy their products. In our imagination, that’s where the opportunity increasingly lies.

Brett Owens, Chief Investment Strategist

Updated: December 16, 2025

Today I have a sweet dividend “double shot” for you: The first? A 2.8% payout set to grow thanks to AI—and take the stock price up with it.

The second gives you high payouts now, in the form of a monthly-paid 7.8% divvie that also looks set to head higher.

Both of these tickers are cheap. In fact, they (and the sector they’re in) could very well be the last bargains on the board as the bull runs into its fourth (!) year.

Pharma Goes From “Dead Money” to the Next AI Winner

These two dividend plays are on sale because they’re often lumped in with drug stocks—a sector that’s lagged for years.

There have been exceptions, like Eli Lilly & Co. (LLY), whose Mounjaro and Zepbound GLP-1 weight loss drugs have helped the stock overtake that of Novo Nordisk (NVO) maker of Ozempic and Wegovy. Beyond that, breakthroughs have been thin on the ground. That’s why pharma has been “dead money” for years now.

Well, that and politics.

Remember, Trump 1.0 kicked off the insulin caps. Biden’s Inflation Reduction Act followed with price limits on 10 blockbusters starting in 2026—a potential $160-billion profit hit. Then Trump returned and aimed to tie US drug prices to the lowest in the world.

But on cue, pharma did what it always does: It lobbied. The lobbyists not only slowed the political avalanche—they pushed it back up the mountain.

Sure the White House struck headline-friendly deals with Pfizer (PFE), AstraZeneca (AZN) and other big pharma firms. The optics looked tough on pricing. But the fine print rewarded these companies for their co-operation with faster FDA reviews and more predictable reimbursement structures.

Now, drugmakers are looking to AI, which could cut drug development by up to nine years.

A Building Wave of Breakthroughs

Pharma is one place where we can clearly say there’s no AI bubble. Which is funny, because it’s where the tech can drive some of the biggest gains.

What’s the potential here? Enormous.

Right now, designing a drug and getting it through clinical trials takes 10 to 15 years and costs around $2.5 billion, according to research from Springer Nature. With AI, pharma companies can develop new treatments with far less “trial and error” than human scientists alone. That cuts risk and cost and amplifies these experts’ work.

As a result, industry experts now say the drug-discovery cycle will likely be chopped from 10 to 15 years to just six! That’s critical because patents only last 20 years, so the faster a drug gets out the door, the more its maker can sell before generics eat its lunch.

The bottom line? Pharma profits are poised to pop!

But we’re not going to try to pick the next big winner. Why bother when we can buy into companies that make what every drugmaker needs? I’m talking medical-equipment makers, our favorite “pick-and-shovel” plays on AI-driven drug research.

BDX Is Cheap—and Headed for a Unique “Value Unlock”

Let’s start with Becton, Dickinson & Co. (BDX), whose products are hospital mainstays: syringes, needles, catheters and the like, as well as blood-flow monitors.

Those give BDX revenue that will float higher as the population ages. Then it adds growth from its Life Sciences division, maker of products pretty well every lab needs, like flow cytometers, used to analyze immune cells, cancer cells, and biomarkers.

BDX also makes specimen-collection systems, as well as devices for cell imaging, analysis, genetic testing and other critical lab functions. As AI helps scientists develop more new drugs, demand for these products will grow.

Waters Deal Adds Growth, Streamlines BDX

The company is merging its bioscience and diagnostics businesses with Waters Corp. (WAT), where they’ll match up nicely with Waters’ gear. Waters focuses on equipment in areas such as chromatography (separating and identifying components in a mixture), lab automation and mass spectrometry (breaking down a molecule’s structure).

Management sees the deal doubling the size of the market open to Waters, to $40 billion, and teeing up 5% to 7% yearly growth. BDX’s shareholders will hold 39.2% of the merged company, and Waters investors will hold the rest. That’s just fine; it keeps BDX in the game as AI paces drug development higher. And it lets BDX tighten its focus, too.

The topper? When the deal closes around the end of the first quarter, BDX will get $4 billion in cash. Management will send half of that to shareholders as share buybacks and use the rest to pay down debt.

Buybacks cut the number of shares outstanding, boosting earnings per share and dividends, as they leave BDX with fewer shares on which to pay out. That should help BDX’s share price close the gap with its payout growth, which it had been tightly tracking until a disappointing earnings report in May sent the stock tumbling.

BDX’s “Dividend Lag” Says It’s Oversold

As demand for Becton’s products rises, through both its remaining products and its Waters stake, it’ll support dividend growth. Investors will notice (they always do!) and bid the stock up, closing the gap between BDX’s price and dividend.

While we wait, we can be assured that BDX’s payout is built on a strong foundation, accounting for just 45% of free cash flow. That makes now a good time to consider the stock. But if you’d prefer a more diversified medical-device play, we’ve got one teed up for you. It pays more than BDX’s 2.8% yield, too.

An “All-in-One” Medical Device Play With a 7.8% Dividend

I know a lot of readers prefer closed-end funds (CEFs), for good reason: big dividends! And CEF-land has given us a fund perfect for this “dumpster-dive” moment in pharma: the 7.8%-paying BlackRock Health Sciences Fund (BME).

BME’s portfolio is a who’s-who of medical-device makers. What’s more, Becton Dickinson is not a top-10 holding (it’s No. 16, at 1.88% of assets), so you could pick up BME and BDX without overly exposing yourself to that one stock.

Meantime, BME’s top holdings do include medical-device kingpins like Abbott Laboratories (ABT), Thermo-Fisher Scientific (TMO) and Boston Scientific (BSX). Drugmakers like Lilly and Amgen (AMGN) also show up.

We love CEFs because they generally have a fixed share count for their entire lives, so they can trade at a premium or discount to their net asset values.

It’s here that we see how much investors have lost the plot on pharma. As I write this, BME trades at an 8% discount to NAV, far below its five-year average of 2.9%. That primes it for gains from our “AI-powered” drug-development wave, boosting its lead on the benchmark iShares US Pharmaceuticals ETF (IHE) since the ETF’s inception in May 2006:

BME’s Closing Discount Could Widen This Healthy Lead

Let’s wrap with that 7.8% divvie, which pays monthly. It’s also grown nicely in the last five years.

A (Monthly-Paid) 7.8% Dividend That Grows

Source: Income Calendar

As AI boosts drug development, I expect BME’s payout to climb higher. That would draw in investors, closing its “discount window” and putting upward pressure on the share price. Buying now lets you lock in a 7.8% dividend before that happens.

BME is a terrific example of what we love about CEFs: They let us tap trends like the AI-driven pharma boom while paying us huge dividends—at a discount, to boot!

Monthly payouts are key, too. No matter what markets are doing, we know our next cash payout is only 30 (or 31) days away, and our yield is much higher than most investors get from “mainstream” stocks.

With little more than a week to go before the big day, Wall Street is showing little sign of festive cheer. It’s not much better here. ii’s head of markets explains why.

16th December 2025 08:21

by Richard Hunter from interactive investor

Time is running out for any hopes of a Santa rally, as investors continue to fret about the AI trade, which for the moment has fallen sharply out of fashion.

The rotation into what are seen as relatively stable sectors compared to the previous AI euphoria rumbles on, to the benefit of the likes of industrials, consumer discretionary and healthcare.

Meanwhile, Oracle Corp ORCL

and Broadcom Inc AVGO

continue to be at the eye of the AI storm, falling further with losses of 2% and 5% respectively and, while poster-child NVIDIA Corp NVDA0 managed a small gain, Microsoft Corp MSFT also drifted.

It remains to be seen whether the imminent slew of economic data will be too stale to be meaningful. A combined October/November non-farm payrolls is expected to show an increase of 50,000 jobs, which would compare to 119,000 in September, although the quality of the data could be called into question given the effects of the government shutdown.

Retail sales are also expected, again possibly too historic to be of use given that they will relate to October, although overall the numbers could at least provide some further clues as to the Federal Reserve’s thinking for next year. There is currently a disconnect between market expectations of two cuts and the Fed’s current dot plot, which suggests a solitary reduction.

In the meantime, with no obvious positive catalysts on the immediate horizon, the main indices are in consolidation mode. In the year to date, gains of 13.8%, 15.9% and 19.4% for the Dow Jones, S&P500 and Nasdaq respectively reflect what has become a positive year despite the ever-present headwinds which have variously threatened to upset the investment applecart.

Asian markets also failed to enter into any kind of festive cheer, with technology stocks under pressure given the Wall Street read across. Domestic issues also remained in focus, with the Nikkei 225 declining as preliminary factory data pointed to a slight slowdown, while private sector growth cooled as services declined in Japan. The data comes ahead of a widely expected rate hike from the Bank of Japan at the end of the week, which could further dampen sentiment.

China echoed a subdued economic theme, with retail sales growing by just 1.3% year on year in what was the weakest reading since during the pandemic, while investment and lending numbers were also tepid, inevitably leading for calls of further stimulus from the authorities to revive growth meaningfully.

Domestic issues were also in focus in the UK, where a rise in unemployment to 5.1% in the three months to October should be the final piece of the jigsaw in ensuring that the Bank of England cuts interest rates on Thursday. The reluctance of businesses to invest, hire and plan for the immediate future was already evident leading up to the Budget, let alone in the aftermath, with a moribund economy now patently in need of some immediate stimulus.

The FTSE250 drifted lower at the open, but has still managed a gain of 6.7% so far this year. The FTSE100 was also bereft of any sustainable positive momentum after a stronger showing in the previous session.

The ongoing US tech weakness weighed on the likes of Polar Capital Technology Ord PCT

while a dip in the gold price led to rare losses for the likes of Endeavour Mining EDV2 and Fresnillo FRES. The premier index is also consolidating its strong gain of 19.2% so far this year, with a large exposure to the likes of the banks, miners and defence sectors having been major tailwinds.

SCHRODER EUROPEAN REAL ESTATE INVESTMENT TRUST PLC

(“SEREIT” or the “Company” and, together with its subsidiaries, the “Group”)

KPN gives formal notice to terminate lease

Schroder European Real Estate Investment Trust plc, the Company investing in European growth cities and regions, provides a further lease update for its Apeldoorn investment.

Further to the update provided in its Annual Results statement on the 5 December 2025, the Company has now received formal notice from its tenant, Koninklijke KPN N.V. (“KPN”), of its decision to terminate its lease. KPN currently occupies a mixed-use office and data centre property in the Netherlands, representing approximately 19% of the Company’s portfolio income and 6% of portfolio value as at 30 September 2025. The lease termination will take effect from 31 December 2026.

The Investment Manager is pursuing a number of mitigation strategies, which include marketing the asset to new occupiers, exploring alternative uses such as medium-density residential development, or a potential sale to enable capital redeployment into accretive opportunities.

Apeldoorn is centrally located in the Netherlands, at the intersection of the North-South and East-West motorway axes, and is regarded as an attractive, steadily growing residential region, offering affordable housing and a higher quality of life compared to larger cities.

The Apeldoorn property was acquired in February 2018 for its income-generating characteristics, and has delivered an unlevered total return of over 8% per annum to date. As at 30 September 2025, the property was valued at €11.8 million, with valuations adjusted periodically to reflect the diminishing term of the lease.

As previously highlighted, KPN’s departure is expected to negatively impact the Company’s future income profile. In the event the Investment Manager is unable to fully offset the loss of income from the Apeldoorn asset, the level of future dividends or earnings cover will be impacted.

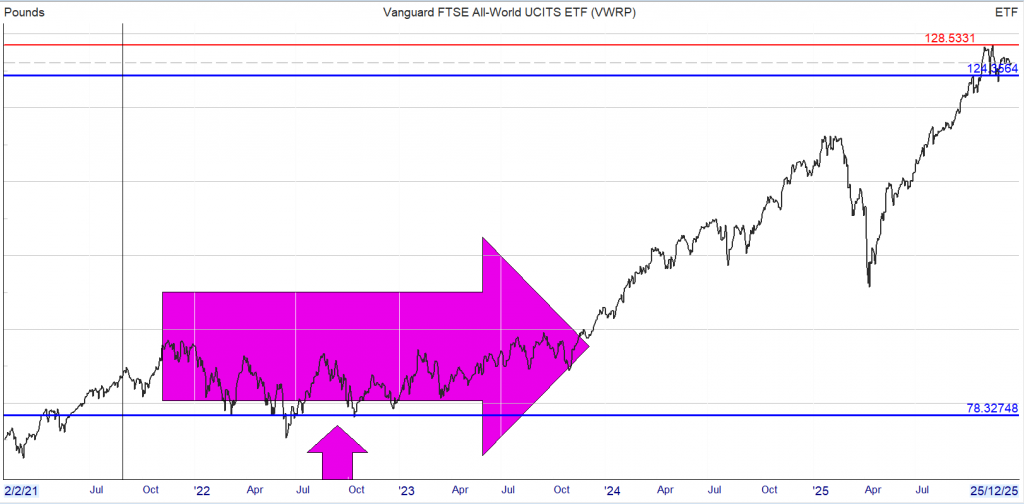

Comparison share VWRP

Current value £151,169.00 not too shabby.

Using the 4% rule it would provide a pension of £6,046.00

A joint life annuity currently pays around 5.24%.

So using the value of the comparison share you would today receive an annuity income of £7,921.00 but you still have to surrender all your capital.

I get an itch when there is cash un-invested not earning a dividend, so until I decide on a longer term home for the un-invested cash I’ve bought for the Snowball 18907 shares in SEIT SDCL Energy Efficient.

Yield 12%

Discount to NAV 40%

Even a poor plan is better than no plan, remember a plan without an end destination is a poor plan because it’s a gamble.

Three options when you want your hard earned to provide a pension.

An annuity

The best annuity rate will vary depending on the value of your pension pot, the provider and your own personal information.

We asked retirement broker HUB Financial Solutions to crunch some numbers to get an idea of how much someone aged 65, 70 and 75 could generate from a £100,000 pension pot when purchasing an annuity. The quotes are based on someone living in the S66 postcode in England.

Its analysis shows that Legal and General is currently a market leader when it comes to annuity rates.

A 65-year-old could turn a £100,000 pension pot into an annual income of £7,732.80 by purchasing a single annuity. This changes to £8,459.88 if they have a medical condition, such as lifelong asthma in this scenario.

Older people can often access higher annuity rates. For example, that same £100,000 pot could generate an annual income of £9,957.60 from an annuity for a 75-year old, or £11,006.16 if there is a disclosed medical issue.

However, note that rates can vary and will change regularly.

A joint life escalation is £5,246.00

The 4% rule.

Above is the comparison share for the Snowball. Note the multi year sideways performance before it moves higher.

Current value £151,169.00 not too shabby.

Using the 4% rule it would provide a pension of £6,046.00

The Snowball will return income of over 10k this year, with a target of 10k for 2026.

So the options.

A joint life annuity of £5246.00. You have to surrender all your hard earned and the amount you will actually receive is a gamble on Gilt returns at the time. It could be lower or higher.

A 4% ‘pension’ currently £6,046.00. If the market crashes you may be forced to sell shares and the withdrawal amount will fall. It could of course be higher but you keep all of your capital

A dividend income stream currently 10k and should continue to increase and you also keep all of your capital.

You could include an ETF in your plan supported by your dividend paying shares. The choice my friend is yours.

Michael Foster, Investment Strategist

Updated: December 15, 2025

One thing I’ve always been astonished by is how fast a winning strategy (in investing and in life!) can suddenly slam into a wall—and start causing a lot of pain.

Consider, for example, the life of a mortgage banker in the 2000s: They made easy money for years, then the subprime-mortgage crisis threw them out of work overnight.

This happens in investing, too, which is why it’s always good to stay humble and well-diversified. Some high-yielding closed-end funds (CEFs), for example, look like big winners at any given moment. But if you buy without looking under the hood, you’re risking sharp losses.

Which brings me to …

The Top-Performing CEF of 2025

The year isn’t over, but the ASA Gold & Precious Metals Fund (ASA) is so far ahead of other CEFs that it would take a miracle for it to be overtaken by year-end.

ASA’s Unbelievable Year

ASA is up 172% (!) in 2025, and it’s easy to see why: The CEF invests in miners of gold and precious metals, and gold has been on a tear. But the scale of its run is still breathtaking, as none of the 5 CEF subsectors tracked by my CEF Insider service have even cracked 15%.

Source: CEF Insider

So with that in mind, is ASA a buy now?

No way. For one, the fund yields just 0.1%, while the average CEF pays over 8.3%. So for us income investors, ASA is a no-go. Second, since gold miners’ share prices are tied directly to gold, ASA does well when gold soars, which happens every so often (such as in the past year), but these surges tend not to stick around.

We can see that last point in ASA’s long-term performance, in purple below, in relation to a popular S&P 500 ETF (in orange).

This Gold Fund Trails Stocks …

Over the last two decades, ASA has badly trailed the S&P 500 on a total-NAV-return basis (that is, by the performance of its portfolio, not its market-price-based return).

Worse, if you retired 20 years ago and bought ASA at that time with the intention of relying on it, many of your withdrawals would’ve cost you money, especially during the seven-year period in the 2010s when ASA (again in purple below) would’ve been mostly underwater for you.

Moreover, not only does ASA lag stocks in the long run, but it trails gold prices, too, shown in orange above by the performance of the gold-price-tracking SPDR Gold Shares (GLD) ETF, in orange, since that fund’s inception in late 2004.

… and Gold Prices, Too

The bottom line? If you’re looking for gold exposure, ASA is not the way to do it. In addition, the fund is a good illustration of why we avoid gold at CEF Insider: We’re looking for high current income first and foremost (our portfolio yields 9.5% on average), and there aren’t enough gold investments with yields high enough to excite us.

3 High-Yield Stock CEFs That Beat ASA

Looking beyond gold, there are many CEFs—on the stock and bond side, specifically—that beat ASA in terms of long-term outperformance and income. Below are three that all trade at attractive valuations, as well.

Both the Adams Diversified Equity Fund (ADX) and Liberty All-Star Equity Fund (USA) focus on stocks, including key blue chips like Nvidia (NVDA), Microsoft (MSFT) and Visa (V). And they give us those stocks at attractive discounts, with ADX sporting a 7.1% discount to NAV and USA trading about 10% below its portfolio value.

The 10.9%-yielding PIMCO Corporate & Income Opportunity Fund (PTY), meanwhile, is a corporate-bond fund that’s maintained a strong, and monthly paid, dividend since inception in 2002 (with regular special dividends).

PTY does trade at a 10.1% premium to NAV now, but that’s because it’s a PIMCO fund, and the firm has a sterling reputation in the small CEF world. And that 10.1% premium is actually a bargain, as it’s traded at a 19.7% average premium over the last 52 weeks.

These three funds get you a “mini-portfolio” yielding 10% on average, or roughly 90 times more than ASA. They’ve outperformed the gold CEF (in orange below) going back to 2003, the year that the youngest of these funds, USA, went through its IPO:

Top Bond and Stock CEFs Outrun ASA

Since then, ASA (in orange above) has delivered a return less than half the size of the other three, on average, while yielding basically nothing.

Of course, if we look only at 2025, we don’t see this: ASA looks like a big winner that is crushing the other three funds. That’s the risk investors face when they ignore history: a recency bias that can cost a lot of money.

Anyone making big profits today with ASA might feel like a big winner, and they are—for now. But over the long term, they have a strong chance of underperforming, especially if the fund reverts to the trend line it’s been on for decades. Worse, there’s no real income to tide shareholders over while they wait for ASA’s next rise.

Contrarians: These 8%+ “AI-Powered” Dividends Are My Top 2026 Buys

As we just discussed, gold, and gold-focused funds like ASA, are long overdue for a breather (or worse!). So we’re NOT chasing them as 2026 dawns.

But the sector we ARE buying as the new year breaks will likely surprise you: AI.

Not just AI stocks, but AI stocks (CEFs, to be specific) kicking out huge dividends! I’m talking about 4 specific funds throwing off 8%+ dividends as I write this.

Look, it’s impossible to ignore all the chatter about an AI bubble right now. I get it. But the bottom line is, corporate profits are still rising and American GDP is growing. This is NOT the opening act of a recession—it’s a boom in productivity!

And it’s still early days, too.

The trouble for us income investors is that “classic” AI stocks, like NVIDIA (NVDA), pay low (or no) dividends. Which is why we look to CEFs for our AI buys.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑