Non-Cuttable Expenses: A Hidden Opportunity For Financial Growth

Rida Morwa Investing Group Leader

Summary

- Mortgages form the backbone of home affordability in America and represent an expense that cannot be cut without catastrophic household consequences.

- Utilities are in heavy demand, and operators can raise prices without losing customers.

- We discuss our top picks from these non-negotiable expenses, offering yields of up to 7.5%.

- Looking for more investing ideas like this one? Get them exclusively at High Dividend Opportunities.

Co-authored with Hidden Opportunities

Every new year almost always begins the same way, with resolutions. We plan to eat better, lose weight, exercise more, sleep more, read more, save, and invest more. The goals are diverse, and we set out with the best intentions, aiming to create a better version of ourselves.

Yet, once the calendar flips, reality quickly reasserts itself. Despite the intentions being good, our time constraints don’t magically disappear, and our habits and priorities don’t magically reorganize themselves. Life keeps moving at the same pace it always has, and keeping up that New Year’s resolution requires serious effort. This isn’t a secret, and it is why the second Friday of January is often considered “Quitters Day,” when the energy and the momentum behind the resolutions tend to fade.

You may be interested to know that cancelling streaming services like Netflix (NFLX) is typically a popular New Year’s resolution as part of the general household audit for many consumers. Amidst rapidly rising costs of goods and services, a wider pursuit of resolutions to find areas to cut expenses wouldn’t be surprising. Yet, there are a few places where the expenses are unavoidable and must be made, even to maintain a modest lifestyle and well-being.

Without fail, you will pay your mortgage and your utility bills. These expenses won’t take a break, whether your resolution to optimize spending stays strong or wanes. Let us dive into our top picks that benefit from this necessity.

Pick No. 1: MTBA – Yield 6%

Owning a home has historically been regarded as a symbol of success and forms an important pillar of the American dream. Out of 85.6 million owner-occupied homes, 51.6 million (60%) have outstanding mortgages. It is fair to say that mortgages are a helping hand for millions of Americans to realize their dream. At the end of September 2025, household mortgage balances totaled $13.07 trillion, representing 82% of all household debt.

That simple mortgage you took from your favorite bank isn’t that simple after all. The bank doesn’t hold it on its balance sheet for 30 years, only to collect interest from you. Banks sell the loan to aggregators, which happen to be government-sponsored enterprises like Fannie Mae, who pool hundreds of thousands of mortgages together to form a security known as MBS (mortgage-backed security). When homeowners make principal and interest payments, the loan servicer collects them and passes them through to investors.

Who are these investors?

U.S. banks, depository institutions, and the Federal Reserve happen to be the largest investors in agency MBS.

Why would these institutions invest in mortgage-backed securities? Isn’t there a risk of mortgage default?

Fixed-rate agency MBS securities are guaranteed by government-sponsored institutions like Fannie Mae, Freddie Mac, and Ginnie Mae. These securities hold 30-year, 20-year, and 15-year mortgages that were securitized by these agencies. So, even if individual borrowers default, these agencies would guarantee payments to investors.

Agency MBS are AAA-rated and present exceptionally safe investments with negligible default risk, making them at par with U.S. Treasuries.

Agency MBS are only available to institutions, which means as an individual investor, you can only buy them through diversified funds or mortgage REITs. The latter often use leverage, which makes them highly sensitive to interest rates. Diversified funds, on the other hand, present a wide range of options for investors.

Simplify MBS ETF (MTBA) is an ETF that invests in Agency MBS with no leverage. This fund focuses on buying newer MBS, which typically carry higher coupons and pay higher yield to maturity, and shorter durations of 3-4 years.

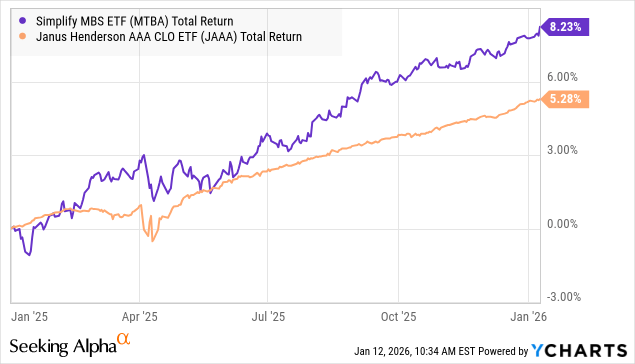

In 2025, MTBA gained due to greater inflows of institutional capital into MBS, as spreads to Treasuries tightened. This resulted in MTBA delivering better total returns than our frequently discussed AAA-CLO ETF—Janus Henderson AAA CLO ETF (JAAA).

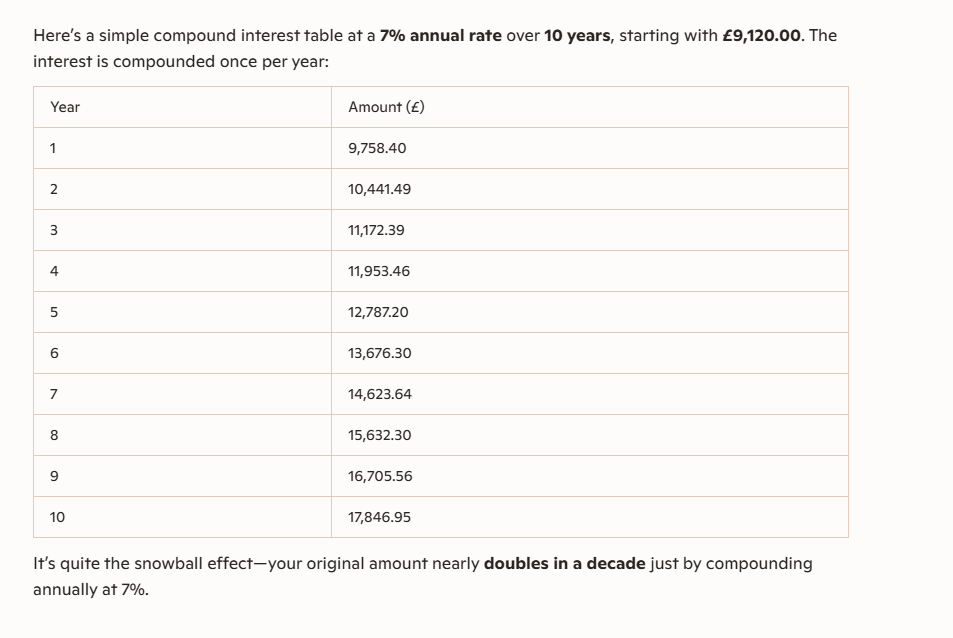

Looking ahead, there is room for further tightening in agency MBS spreads, and MTBA offers a low but steady CD-beating 6% yield with no credit risk.

With MTBA, you are partly funding the American dream of homeownership while collecting low-risk monthly distributions.

Pick No. 2: UTF – Yield 7.6%

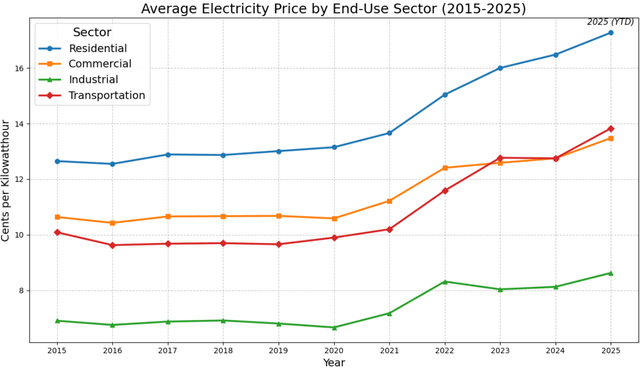

Utility costs continue to outpace inflation, driven by heavy demand from big tech data center ambitions. The U.S. power grid is aging and inadequate for the soaring demand, making the unit costs higher for every sector, with the residential base experiencing the worst effects. Data Source

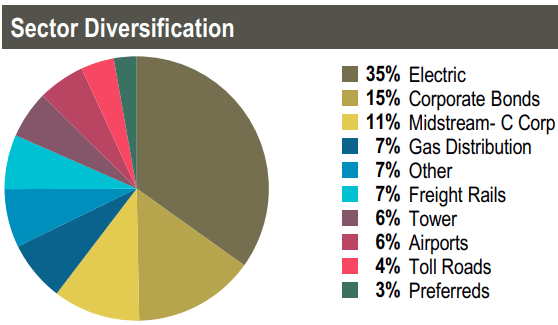

Cohen & Steers Infrastructure Fund (UTF) is a CEF (closed-end fund) dedicated to investing in infrastructure, as its name suggests. The fund’s assets are invested across electric utility, midstream, gas distribution firms, freight rail, towers, etc. The fund has a notable allocation into fixed-income securities from these essential sectors. In fact, energy (electricity, gas, and midstream) represents almost 50% of the portfolio. Source

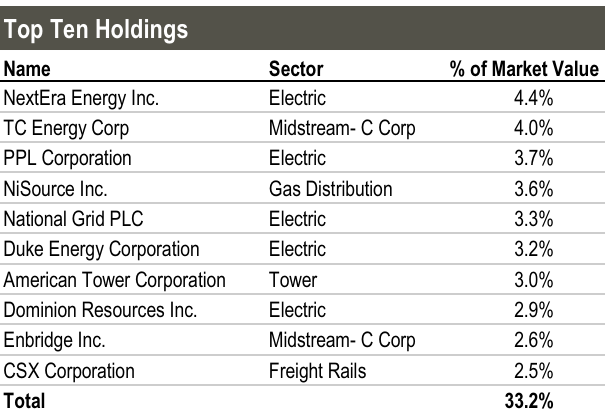

UTF’s top holdings are some of the largest global corporations in their respective subsectors, with a notable callout that they aren’t direct competitors in major business areas. Rather than serving as direct competitors, these firms occupy separate geographic or industrial niches and often act as complementary partners within the infrastructure supply chain. UTF’s top 10 holdings represent a third of the CEF’s invested assets.

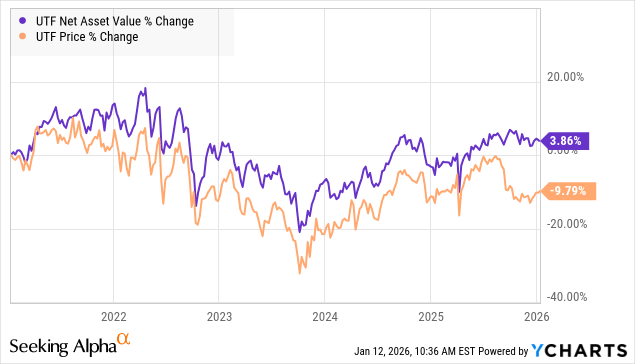

If you look at UTF’s price and NAV performance, they have been in unison over the past five years, climbing together in the near-zero economy, being weighed down due to the headwinds from rate hikes, and a predictable recovery with rate cuts. And there is one place where they clearly break the pattern, in Fall 2025.

This is when UTF announced a rights offering, which was completed in October, resulting in the issuance of 14.9 million shares to raise $353 million in proceeds. The offering led to a 15% dilution to shareholders, and the entire process led to a +10% drop in the CEF’s price, despite NAV remaining relatively steady. So what happened? Value remained the same, but investors’ perception of that value changed, creating an opportunity.

Despite a steady NAV level over the five-year period marked by volatile interest rates, UTF has distributed steady monthly income to shareholders, amounting to $9.30/share, which has mostly been tax-friendly, in the form of Long-Term Capital Gains and Qualified Dividends.

Looking ahead, infrastructure projects will be expensive due to the natural effects of inflation on materials and labor—creating a steep barrier for competition. Existing infrastructure is aging and inadequate, but companies owning them are best positioned to maintain and slowly expand those assets while enjoying powerful asset monetization. With UTF, you can be a beneficiary of this strength, with 7.6% yields.

Conclusion

MTBA and UTF are two very different securities. One leans on structured, government-backed cash flows from millions of people pursuing their American Dream; the other draws income from real assets that provide critical services. Their drivers are different, their risks are different, and that is precisely how we like to invest.

At High Dividend Opportunities, we build portfolios with this sort of contrast by design. Rather than relying on a single sector or macro outcome, we combine complementary income sources to generate reliable cash flow across any market cycle. Summer or winter, bull or bear market, high or low-interest rates—I need my dividends, and I need them now.

Rates will move, politics will shift, narratives will change, and volatility will return, but our simple yet disciplined, diversified income strategy allows us to stay invested, stay flexible, and continue getting paid along the way. This is the beauty of our income method and the power of income investing.