Dividend shares to consider for a 5-star ISA !

Posted by Royston Wild

Published 27 July

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Thanks to the power of compounding, investing in dividend shares can be the fast-track to building significant wealth in a Stocks and Shares ISA.

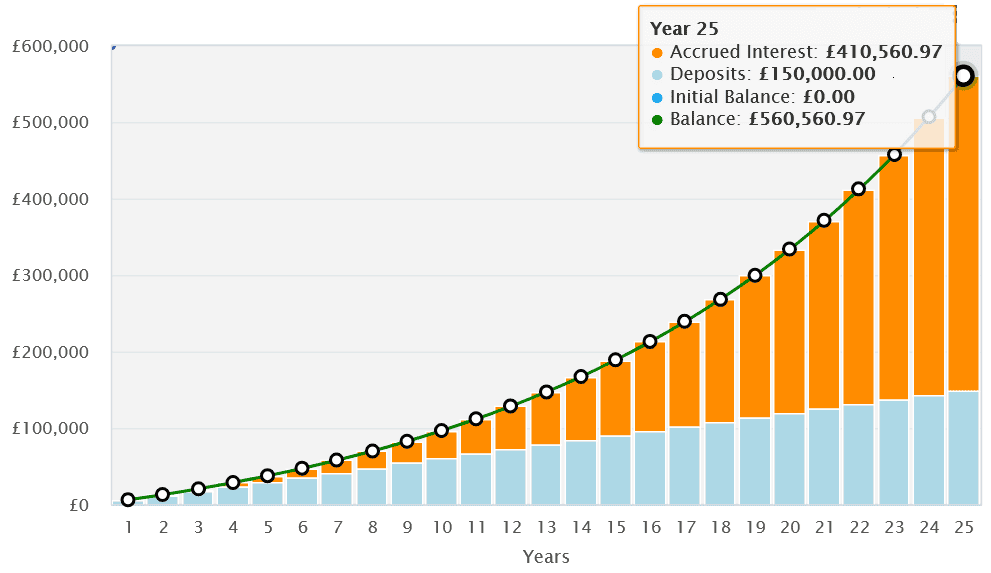

Compounding involves reinvesting all the dividends one receives to buy more shares. More shares mean more dividends, and over time this snowball effect can supercharge long-term portfolio growth.

Let’s say an investor puts £500 monthly into a Stocks and Shares ISA, reinvesting dividends along the way. Thanks to the compounding effect, they’d have a portfolio worth £560,561 after 25 years, comprising deposits of £150,000 and three times as much as this — £410,561 — in investment returns. That’s based on an average annual return of 9%.

There are thousands of dividend-paying shares, funds, and trusts to choose from in the UK alone.

Leave a Reply