If you used T56 as a core constituent of your Snowball, you would receive two payments a year with a total yield of 5.46%. If held in a tax free account you could buy and forget about the Gilt, it’s likely the capital value may fall a touch but as you intend to buy and hold forever it’s of no concern.

A minimum blended yield of 7% for your Snowball is recommended, as if this is re-invested at a yield of 7% plus this doubles your income in ten years.

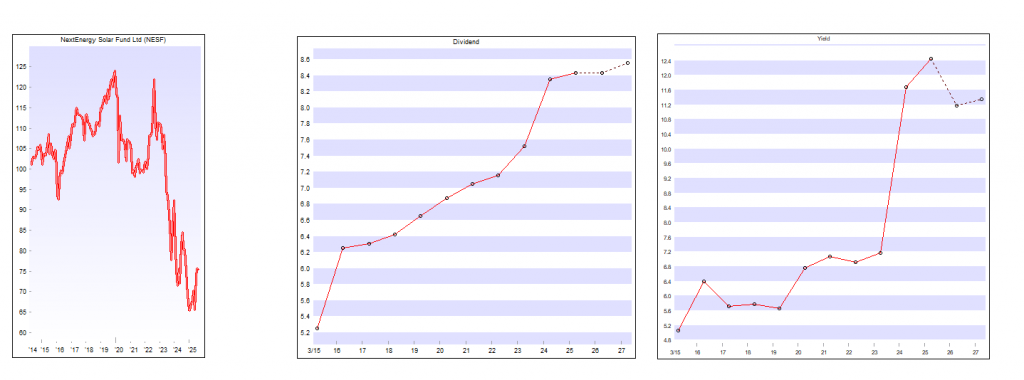

If for comparison purposes only, you pair traded with NESF

The blended yield would be 16.5%, you have reduced the overall risk to your portfolio and achieved a yield of 8%. This could then be re-invested into your portfolio.

Leave a Reply