How much do you need in an ISA to aim for £10,000 a month in passive income?

Millions of us invest for passive income. Here, Dr James Fox explains how much money an investor would need in an ISA to make £120k a year.

Posted by Dr. James Fox

Published 10 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Earning £10,000 a month in passive income is a financial milestone that many UK investors aspire to. Whether it’s to fund an early retirement, achieve financial independence, or simply provide peace of mind, reaching this level of income is possible.

However, it requires careful planning and a well executed strategy. And, of course, it makes sense to do this through a tax-efficient Stocks and Shares ISA.

With its exemption from income and capital gains tax, the ISA’s a powerful tool for UK investors. But generating £120,000 a year in passive income from an ISA alone is a tall order. To reach that level of cash flow without drawing down capital would need a substantial portfolio. What’s more, investors would need an asset allocation designed to yield reliably

So how much?

So how much is “substantial”? The answer depends on several variables. Chief among them is the average yield of the investments held within the ISA.

A portfolio yielding 4% annually would require a value of £3m to produce £120,000 a year in income. At a 6% yield, the required capital falls to £2m. Of course, higher yields often come with greater risks, including income volatility as well as capital erosion.

Now, many readers may have zoned out at £2m or £3m. However, for those starting early enough, reaching these figures is very possible.

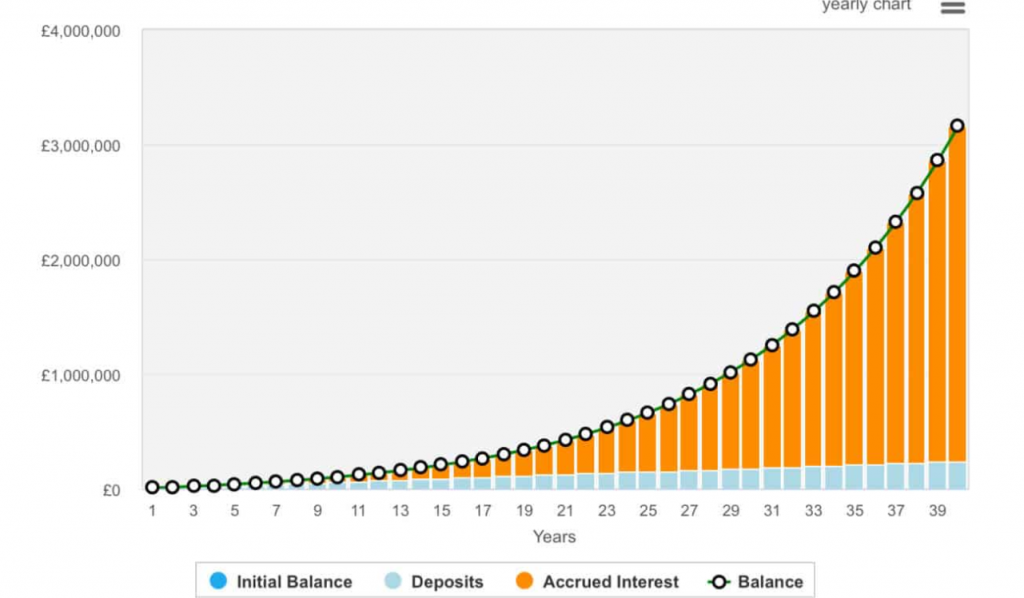

Take the case of investing £500 a month over 40 years with 10% annualised returns. In the first decade, progress can feel modest. After 10 years, the portfolio’s worth just over £100,000.

But compounding begins to accelerate. By year 20, the balance grows to around £380,000, and by year 30 it passes £1.1m. In the final 10 years, growth becomes dramatic: the portfolio adds over £2m, ending above £3.1m by year 40.

Despite contributing just £240,000 in total, over £2.9m comes purely from reinvested gains. This is the exponential nature of compounding. It starts slow, then surges.

Of course, it’s not all plain sailing. There are risks involved with investing, and we can lose as well as gain money. What’s more, 10% may prove to be a challenging target for some investors.

An investment for the long run?

Investors typically want to strive for diversification. One way to do that is by investing in 20-30 individual stocks, another is to focus on in a handful of investment trusts or funds.

Or why Lifestyling is such a bad idea.

Leave a Reply