Realty Income: Declining Rates Make Now The Time To Buy

Aug. 16, 2025 Realty Income Corporation

Summary

- Realty Income stands out for its diversified, reliable cash flow and impressive 50-year operating history, making it a top contrarian pick.

- The company boasts a strong dividend track record with 111 consecutive quarterly increases and a 4.2% annualized yield.

- O’s massive $14 trillion addressable market and S&P 500 dividend aristocrat status offer significant long-term growth potential.

- A key risk is valuation, as reliance on equity funding and limited upside could cap returns near 10%, especially in a downturn.

Realty Income (NYSE:O), or the monthly dividend company, was recently released as our contrarian investment pick based on diverse and reliable cash flow. The company’s earnings, recently released, indicate a continued ability to source valuable transactions, which as we’ll see in this article, make the company a valuable investment as rates are expected to decline.

Realty Income Overview

The company is one of the largest REITs with impressive global operations.

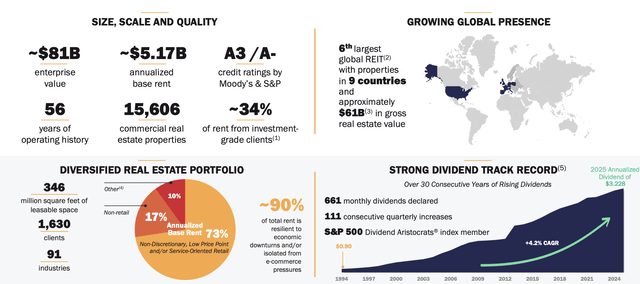

The company has more than 50 years of operating history with a ~$81 billion enterprise value and more than $5 billion in annualized base rent. Versus its market cap, that’s an almost 10% annualized based rent yield. The company’s business is spread across an incredibly high credit rating due to investment grade clients and more than 15 thousand commercial real-estate properties.

The company is known as the monthly dividend company with 111 consecutive quarterly dividend increases and 661 monthly dividends at a 4.2% annualized dividend yield. It’s a strong history of dividends from a diversified history.

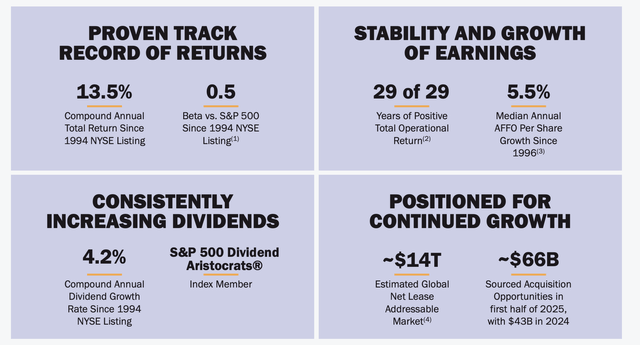

The company has returned 13.5% compounded annually since its NYSE listing with minimal volatility. Realty Income has managed to grow its median annual AFFO by 5.5% driving this, making the company a member of the S&P 500 dividend aristocrats. More importantly, the company has a massive addressable market versus its size.

The company’s estimated addressable market is ~$14 trillion, giving it continued room to grow despite its immense size.

Realty Income 2Q Results

Breaking out the specifics of its 2Q results, the company generated strong results.

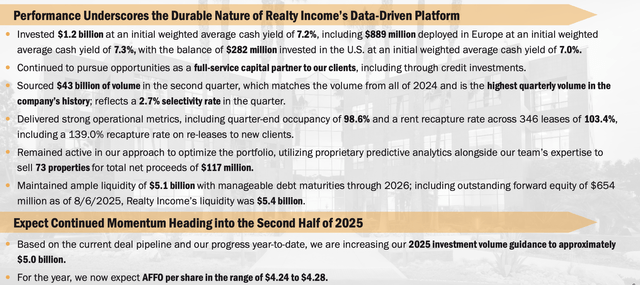

The company invested $1.2 billion in the quarter at an average 7.2% cash yield taking advantage of higher interest rates that enable it to lock in higher returns. Realty Income sourced $43 billion in volume, which shows that, despite its massive scale, it could maintain a 2.7% selectivity rate with 98.6% occupancy.

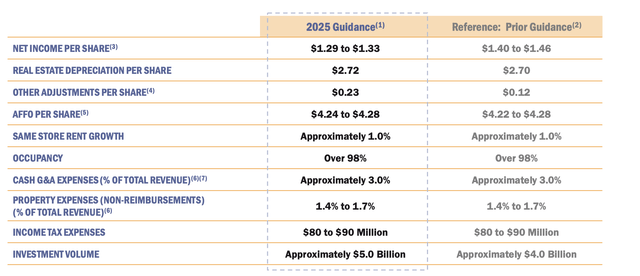

O had a 103.4% rent recapture rate, showing its ability to raise rents with higher inflation rates, and it’s continued to optimize its portfolio. Going into the 2H, the company expects to find additional investments with ~$5 billion in volume and ~$4.26 in AFFO.

Overall, the company’s 2025 guidance is strong versus a $57.8 share price. The company expects 1% same store rent growth with flat AFFO / share and slightly lower net income. Property expenses and income taxes are expected to remain more than manageable while the company is guiding for higher investment volumes.

There is one concern here where the company’s 2024 AFFO was $4.19 / share indicating only 2% YoY growth not enough to support lofty dividend increases.

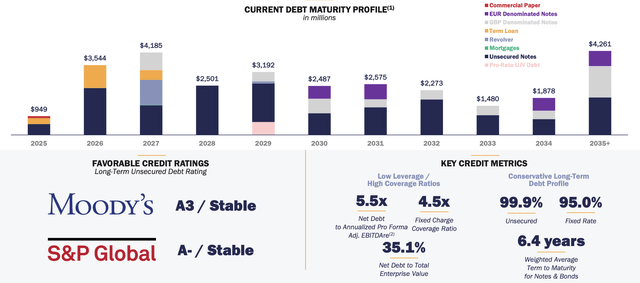

Realty Income Debt

Realty Income has one of the strongest balance sheets in the industry with low-interest rate debt.

The company has 5.5x net debt to annualized pro forma adjusted EBITDA with $28 billion in net debt based on its enterprise value. The company’s debt is 99.9% unsecured and 95% fixed rate, both of which make it manageable with a 6.4 years weighted average term to maturity. With expectations for the FED to decline rates, the company can refinance debt at a lower rate.

The manageable debt load is expected to fund the company’s $5 billion sourcing for 2025 and enable AFFO to continue its growth.

Thesis Risk

The largest risk to our thesis is the company’s valuation. The company has a dividend yield of just under 5.6% and it uses dilutive equity to fund its business. The company expects to be able to achieve dividend growth in the mid single-digit range, but the best-case scenario here is ~10% return. With a downturn, it could be less, making the company a poor investment.

Conclusion

Realty Income is expected to see rates decline enabling the company to refinance its debt at a lower rate while continuing to earn strong returns from properties bought at a higher cap rate. The company has guided for increased acquisitions in 2025 as a result, acquisitions that it can comfortably afford to make. More so despite the size, the company has a large addressable market.

Realty Income is expecting to continue its growth and has an incredibly impressive track record of generating strong cash flow from these assets and using it to fund a multi-decade, growing dividend. Putting that all together makes Realty Income a valuable investment opportunity.

Leave a Reply