The ONE Thing You Must Remember

If I could leave you with just one nugget of investing wisdom today, it would be to NEVER overlook the incredible wealth-building power of dividends.

Few investors realize how important these unglamorous workhorses actually are.

Here’s a perfect example…

If you put $1,000 in the dividend-paying stocks of the S&P 500 back in 1973, you would have had $87,560 by 2023, or 87x your money.

But the same $1,000 in the non-dividend payers would have grown to just $8,430 — 90% less.

That’s why I’m a dividend fan.

The stock market is a fantastic wealth-building machine, but it doesn’t always go straight up!

There have been plenty of 10-year periods where the only money investors made was in dividends.

And that’s what gives us dividend investors such an edge.

When you lock in an 8%+ yield, you’re booking an income stream that’s bigger than the stock market’s long-term average return right off the bat.

Of course you can’t just buy every ticker symbol out there with a flashy yield, or you’ll get burned pretty fast.

So let’s wipe the false promises of mainstream finance from our minds and start thinking the “No Withdrawal” way…

Step 1: Forget “Buy and Hope” Investing

Most half-million-dollar stashes are piled into “America’s ticker” SPY.

The SPDR S&P 500 ETF (SPY) is the most popular symbol in the land. For many 401(K)’s, this is all there is.

And that’s sad for two reasons.

First, SPY yields just 1.2%. That’s $6,000 per year on $500K invested… poverty level stuff.

Second, consider 2022 for a moment (and only a moment, I promise!).

SPY was down nearly 20% that year. That is no bueno, because that $500K would have been reduced to $400K.

The last thing we want to do is lose the money we’re getting in dividends (or more) to losses in the share price. Which is why we must protect our capital at all costs.

Step 2: Ditch 60/40, Too

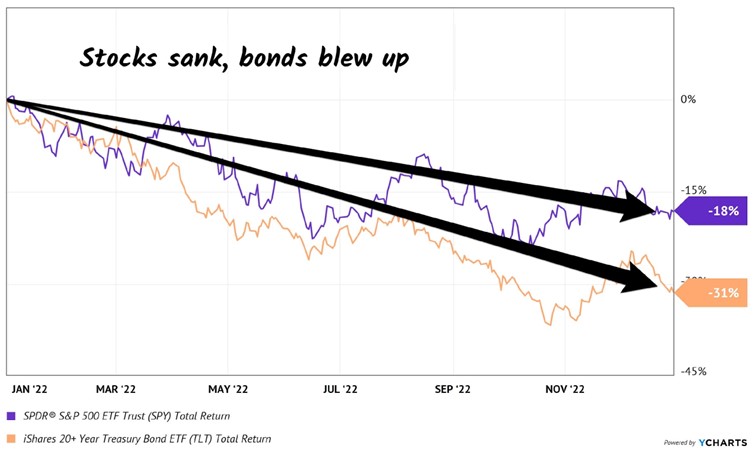

The 60/40 portfolio has been exposed as senseless.

Retirees were sold a bill of goods when promised that a 60% slice of stocks and 40% of bonds would somehow be a “safe mix” that would not drop together.

Oops.

Inflation — plus an aggressive Federal Reserve, plus a (thus far) persistently steady economy — drop-kicked equities and fixed income before they went on a serious bull run in 2023 and 2024.

It just goes to show that bonds are not the haven guaranteed by the 60/40 high priests. They could easily plunge just as hard (or harder) than stocks in the next economic crisis.

Just like they did in 2022 (sorry, we’re only going to spend one more second on that disaster of a year). US Treasuries plunged, which resulted in the iShares 20+ Year Treasury Bond ETF (TLT) getting tagged.

Sure, it still paid its dividend. But even including payouts, the fund was down 31% — worse than the S&P 500. Ouch!

When stocks and bonds are dicey, where do we turn? To a better bet.

A strategy to retire on dividends alone that leaves that beautiful pile of cash untouched.

Contriain Investor

Leave a Reply