Analysis

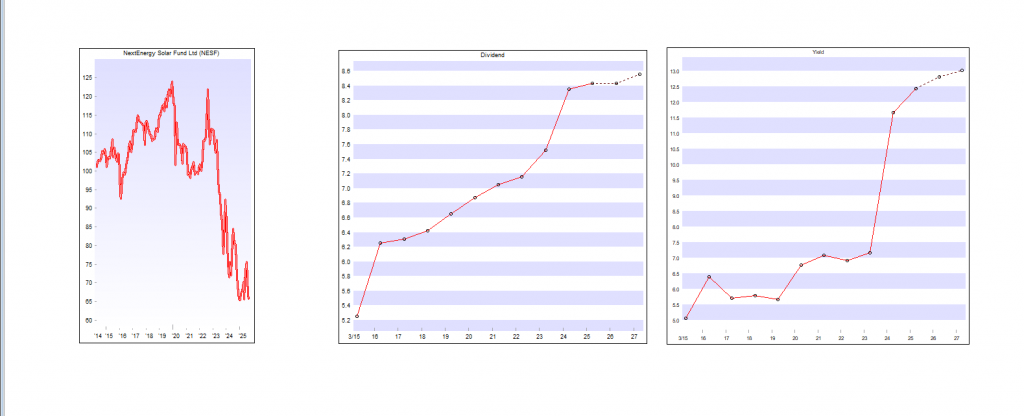

Let’s assume you bought some shares when it was 100p. You could have booked some profit with the intention of buying back if the share price fell but for this analysis we will assume you just held and re-invested the dividends back into your Snowball. Your one share would be worth 65p a loss of capital of 35p and you need to allow for inflation. Your analysis of the share has turned out to be wrong.

But you have earned dividends of 62p, the current dividend is

Dividend:

· Total dividends declared of 2.10p per Ordinary Share for the Q1 period ended 30 June 2025 (30 June 2024: 2.10p), in line with full-year dividend target.

· Full-year dividend target guidance for the year ending 31 March 2026 remains at 8.43p per Ordinary Share (31 March 2025: 8.43p).

· The full year dividend target per Ordinary Share is forecast to be covered in a range of 1.1x – 1.3x by earnings post-debt amortisation.

· Since inception the Company has declared total Ordinary Share dividends of £407m.

· As at 20 August 2025, the Company offers an attractive dividend yield of c.11%.

In 5 years time you will have achieved the holy grail of investing that you will have a share providing income at a zero, zilch, cost. Also you have re-invested the income back into your portfolio which is earning you more income to re-invest into your Snowball.

Firms to exit the FTSE 250 are online retailer Asos, auction market operator Auction Technology Group, Bloomsbury Publishing and housebuilder Crest Nicholson Holdings. Solar investor NextEnergy Solar Fund

Even though your analysis turned out to be wrong but by trading a belt and braces strategy you are still growing your retirement Snowball.

Appreciate the recommendation. Let me try it out. https://20Betforuk.Wordpress.com/