REITs For A Rate-Cut Rebound: My Top 5 Picks

Sep. 25, 2025 4:20 PM ET HST, NHI, XHR, STAG, VICI

Steven Cress, Quant Team

Summary

- The real estate sector and REITs stand to gain from Fed easing.

- Lower mortgage rates are expected to boost homebuying, while reduced financing costs could bolster commercial property values.

- CBRE projects commercial real estate investment volume to increase by 15% in 2025, raising its forecast by 5% after the Fed rate cut.

- According to a CenterSquare investment strategist, institutional investors have been waiting for this type of easing monetary policy environment to deploy assets into real estate.

- SA quant identified five Strong Buy REITs poised to benefit in a rate-cutting cycle, with solid investment fundamentals, FFO generation, and high dividend yields.

- I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.

Is Real Estate Ready For A Rebound?

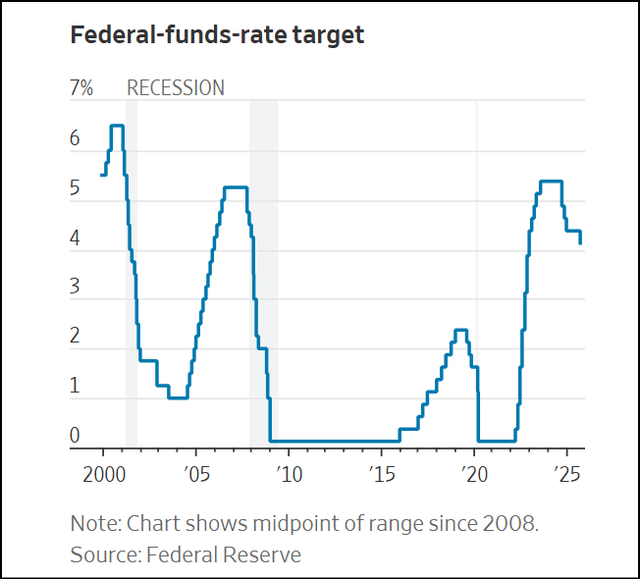

Residential and commercial real estate companies and real estate investment trusts (REITs) could stand to gain from the latest interest rate cutting cycle, which began earlier in September with similar cuts expected for October and February. Lower mortgage rates make houses more affordable and are likely to spur homebuying, while lower borrowing costs could prop up commercial property values, leading to more sales and lending.

In a recent article, I highlighted how the 25 basis point cut may boost some sectors, offering consumers an opportunity to finance at lower rates. The commercial side of real estate may see the benefits of lower rates much more quickly, unlike home mortgages, which do not track the Fed’s moves directly. Much of commercial real estate is financed with shorter-term or floating-rate loans, which are more sensitive to interest rate cuts.

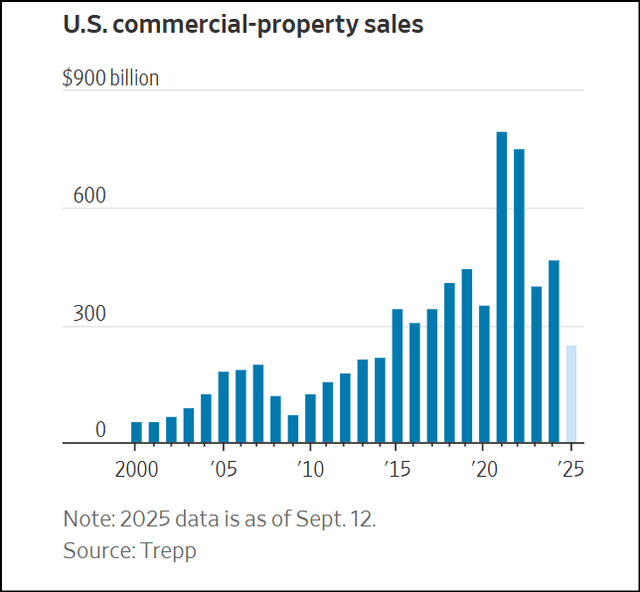

In the wake of the 2022 hikes, commercial property values fell over 20%, sales sank, and banks stopped lending. After the Fed announced the initial cut on September 17, real estate giant CBRE revised its forecast upward, citing lower borrowing costs. CBRE now projects commercial real estate investment volume to increase by about 15% in 2025 – up from its earlier projection of 10%.

Falling short-term rates alone may not be sufficient for a full recovery if the 10Y Treasury yield remains elevated, keeping long-term financing costs high. Add to that risks and uncertainties from tariffs, stubborn inflation, and a softer labor market. That’s why investors should focus on REIT fundamentals – stocks with consistent operating results, reasonable valuations, and reliable dividends.

REITs Primed For A Rate-Cutting Cycle

Although real estate has underperformed the market in the past year, lower interest rates could spur capital inflows. According to CenterSquare investment strategist, Uma Moriarity, institutional investors have been waiting for this type of easing monetary policy environment to deploy assets into real estate. Moriarity also said that, historically, REITs tend to outperform core private real estate once the Fed starts a rate-cutting cycle. In fact, REITs had begun showing momentum ahead of the Fed rate cuts, with the FTSE Nareit All Equity REITs Index rising 3.3% in August.

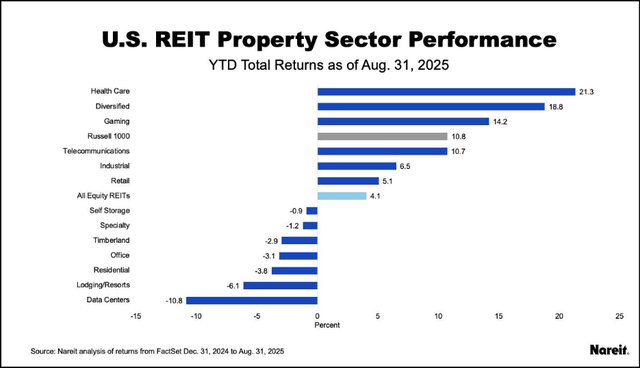

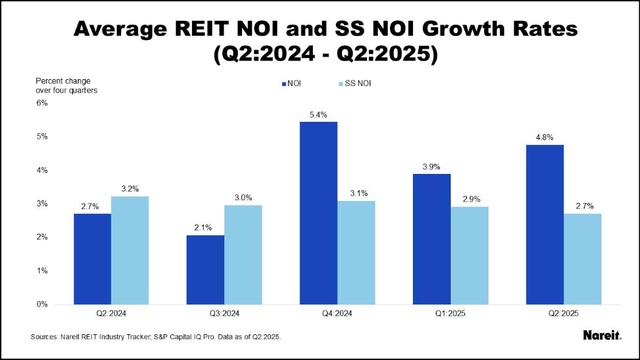

Health care has been the highest performing REIT sector year-to-date, with a total return of 21.3% – followed by diversified and gaming. Despite a rough market, REIT operating performance in Q2 2025 remained resilient, as they continued to deliver year-over-year growth in net operating income (NOI) – led by industrial REITs (+23.6% YoY).

In addition to gaining a foothold in a sector that could benefit from interest rate easing, REITs can be a defensive haven when the market is volatile, due to their stable dividend income, tangible asset backing, and inflation-hedging properties. With these objectives in mind, SA Quant screened for high-yield REITs with exceptional fundamentals and found five poised to perform in a low-rate environment.

Top 5 REITs

SA Quant identified five Strong Buy commercial REITs that own a wide variety of properties, including hotels, casinos, senior housing, and industrial warehouses. The stocks on the list have outstanding collective investment fundamentals, robust FFO generation, and high earnings growth potential. The stocks also offer safe and high-yielding dividends, providing investors with downside protection in a volatile market.

1. Host Hotels & Resorts, Inc. (HST)

- Market Capitalization: $12.10B

- Quant Rating: Strong Buy

- Quant Sector Ranking: (as of 9/25/25): 4 out of 176

- Quant Industry Ranking: (as of 9/25/25): 1 out of 15

- Sector: Real Estate

- Industry: Hotel & Resort REITs

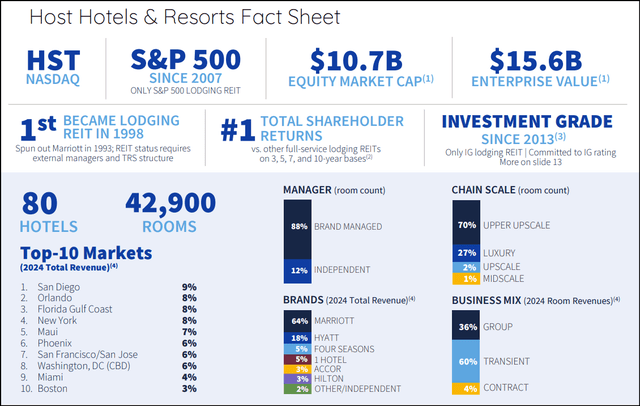

Host Hotels & Resorts, the only S&P 500 lodging REIT, has ridden the post-pandemic leisure and travel rebound to deliver strong growth in revenue, FFO and AFFO – while offering investors stability with a reliable and growing dividend. The top quant-rated Hotel & Resort REIT, HST, has a portfolio of 80 hotels under major brands like Marriott, Hyatt, and the Four Seasons – concentrated in high-demand markets. By consolidating its focus even further on higher-end properties in recent years, Host has benefited from substantial out-of-room revenue from both guests and non-guests.

Higher room rates across the portfolio and greater spending on food, beverage, and services drove Q2 revenue, up 8.2% year-over-year to $1.59B, and helped HST beat earnings for the sixth straight quarter. Healthy transient leisure demand and the continuing recovery in Maui more than offset a decline in group demand, while improvements in room rates offset rising wage expenses. HST lifted full-year EBITDA and revenue guidance, citing outperformance in H125, hotel operational improvements, and expected growth in Maui.

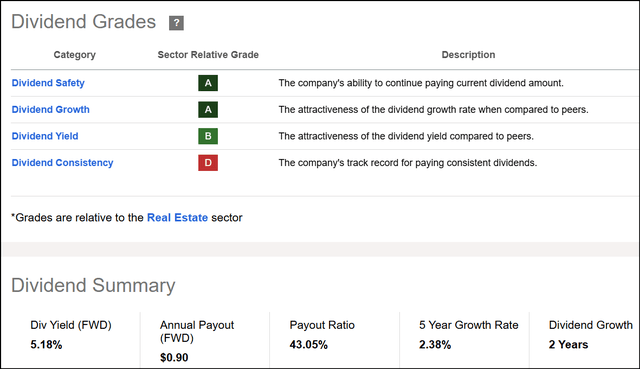

HST’s FFO has surged by a CAGR of ~47% in the past 3 years, driving an A Growth Grade, while exceptional interest and dividend coverage ratios underpin a quality profitability score. HST also offers a stable and rewarding dividend, sporting a yield of 5.18%. Impressive payout ratios support the company’s ‘A’ Dividend Safety Grade while a 3Y CAGR of 115% contributes to a top-notch Dividend Growth Grade. HST’s dividend consistency grade took a hit after the company suspended payouts in mid-2020, preserving cash as it dealt with the fallout from the pandemic. Host’s dividend has grown steadily since it was reinstated in early 2022.

HST is trading at an attractive valuation – with a price-to-FFO of 8.7x – representing a 35% discount to the sector’s 13.4x. HST provides investors with a great opportunity to play the high-end travel boom, backed by premium asset positioning, improving momentum, and a high-quality dividend – all at an attractive price.

2. National Health Investors, Inc. (NHI)

- Market Capitalization: $3.77B

- Quant Rating: Strong Buy

- Quant Sector Ranking: (as of 9/25/25): 7 out of 176

- Quant Industry Ranking: (as of 9/25/25): 1 out of 17

- Sector: Real Estate

- Industry: Health Care REITs

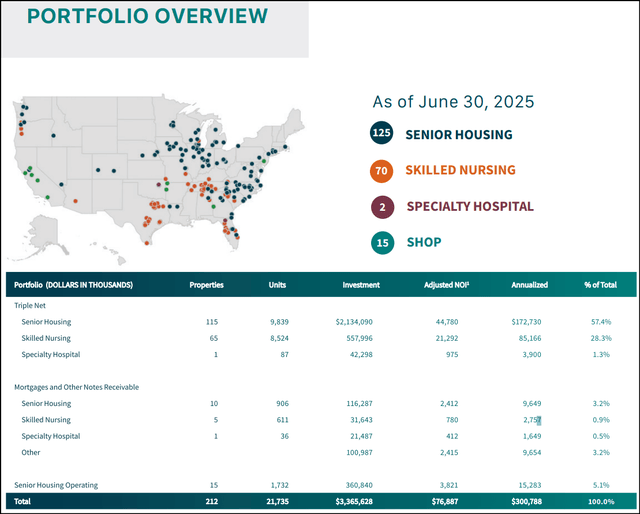

An aging population and surging demand for senior housing have created powerful tailwinds for National Health Investors, Inc. (NHI), SA Quant’s top-rated Health Care REIT. With senior housing representing two-thirds of NOI, National Health Investors is positioned to benefit from long-term demographic trends. The 85+ population growth rate is expected to accelerate to a CAGR of 1.9% by 2030 and 3.5% in the following decade. On the supply side, inventory growth has dropped below 1% while new starts in Q2 2025 were the lowest level ever recorded – and 64% below the historical average.

Boosted by these dynamics, NHI delivered better than expected Q2 results, with NOI surging nearly 30% to $3.8M, primarily due to increased revenue from higher occupancy levels and revenue per occupied room. Excellent year-over-year growth in its Senior Housing Operating Portfolio, or SHOP, and continued collections on deferral repayments also drove outperformance. Looking ahead, NHI said it has $750M in liquidity and capital resources to continue executing on a $350M pipeline – which is nearly entirely focused on senior housing.

Improving momentum in the past 3 months, along with rising earnings and upward EPS revisions, has bolstered NHI’s Strong Buy Quant Rating. Robust AFFO is driving NHI’s ‘A’ Profitability Grade. NHI’s FFO growth has improved in the last 12 months and is projected to rise steadily in each of the next three years, according to consensus estimates.

NHI offers a safe and consistent dividend, yielding 4.63%, with 33 consecutive annual payouts. Growth has lagged, but NHI increased its dividend for the first time in four years – a payout of $0.92 per share will be distributed in Q3. NHI is trading at a premium to the sector with a P/FFO of 16.50x – but positive tailwinds, a safe dividend, and stellar margins, still make it a Strong Buy stock.

3. Xenia Hotels & Resorts, Inc. (XHR)

- Market Capitalization: $1.46B

- Quant Rating: Strong Buy

- Quant Sector Ranking: (as of 9/25/25): 8 out of 176

- Quant Industry Ranking: (as of 9/25/25): 2 out of 15

- Sector: Real Estate

- Industry: Hotel & Resort REITs

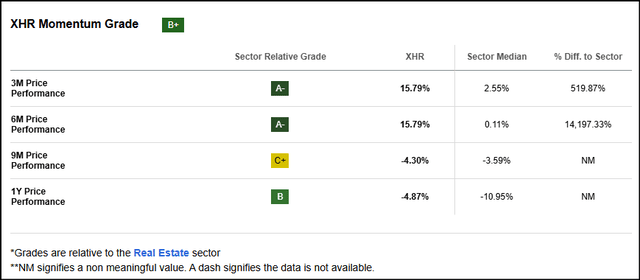

XHR has crushed the real estate sector in the past three months, up more than 15%, boosted by quality financial results across its 30-hotel portfolio and three demand segments, which include Group (~35% of revenue), Corporate Transient (~40%), and Leisure Transient (25%). XHR’s Q2 revenue of $287.58M (+5.4% YoY), beat expectations by $14.23M, and adjusted FFO per share rose 9.6%, resulting from strong group business demand, a recovery in corporate transient, and normalization in leisure.

Xenia’s Q2 performance was driven by sturdy revenue from the recently renovated Grand Hyatt Scottsdale Resort, substantial food and beverage sales portfolio-wide, and outsized gains in its highly-profitable catering business. XHR has delivered amazing FFO growth in the past three years, up by a CAGR of 78% to outperform the sector. And XHR’s outlook is impressive, with Wall Street analysts projecting earnings to grow by 9% in FY25.

Strong reinvestment and FFO dividend coverage ratios, are driving a solid profitably grade. Trading at 8.3x FFO, XHR is at a significant discount to the sector for a ‘B’ Valuation Grade. XHR offers a safe dividend, yielding 3.89%, that has delivered long-term growth. With an attractive price, outstanding growth, and accelerating momentum, XHR is another Strong Buy hotel REIT for your portfolio.

4. STAG Industrial, Inc. (STAG)

- Market Capitalization: $6.52B

- Quant Rating: Strong Buy

- Quant Sector Ranking: (as of 9/25/25): 10 out of 176

- Quant Industry Ranking: (as of 9/25/25): 1 out of 13

- Sector: Real Estate

- Industry: Industrial REITS

#1 among quant-rated Industrial REITs, STAG boasts 600 properties in 41 states – totaling 118.3M square feet – and has seen positive momentum after it beat earnings for the eighth straight quarter in Q2. STAG has delivered substantial growth and profitability in the past year as conditions improve in the medium-sized warehouse market.

STAG has already leased 90.8% of the square feet it expected to lease in 2025, while achieving cash leasing spreads of 24.5% in the second quarter. STAG has seen a recovery in demand and tightening supply as trade tensions dissipate and businesses look to diversify supply chains, which CEO William Cooker elaborated on in the earnings call:

In the first quarter, news related to the global trade war drove significant market volatility. Broadly speaking, today, the theme has shifted to a general desensitization to tariff headlines. We are witnessing businesses continue to grow and make corporate decisions in an uncertain environment, a change to the broad pause seen in the past 12 months. While it’s certainly not business as usual, users cannot delay space decisions in perpetuity, and supply chain diversification remains a priority for many companies.”

STAG has posted steady growth in operating revenue and return on equity, showcases impressive profit margins, and offers a safe and consistent monthly dividend with a yield of 4.30%. The stock is trading in line with the market with a 13.81x P/FFO ratio, but improving earnings growth projections and strong all-around investment fundamentals offer great exposure to a recovering industrial REIT market.

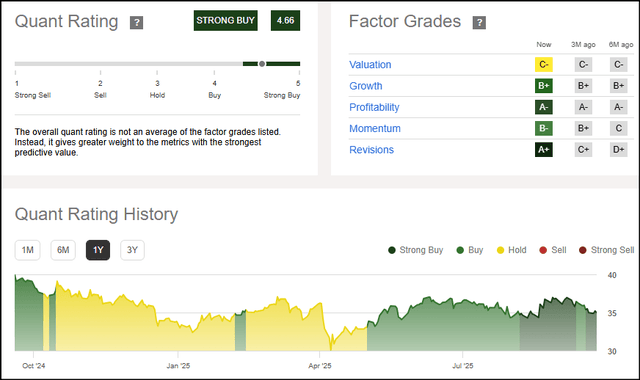

5. VICI Properties Inc. (VICI)

- Market Capitalization: $34.01B

- Quant Rating: Strong Buy

- Quant Sector Ranking: (as of 9/25/25): 11 out of 176

- Quant Industry Ranking: (as of 9/25/25): 1 out of 12

- Sector: Real Estate

- Industry: Other Specialized REITs

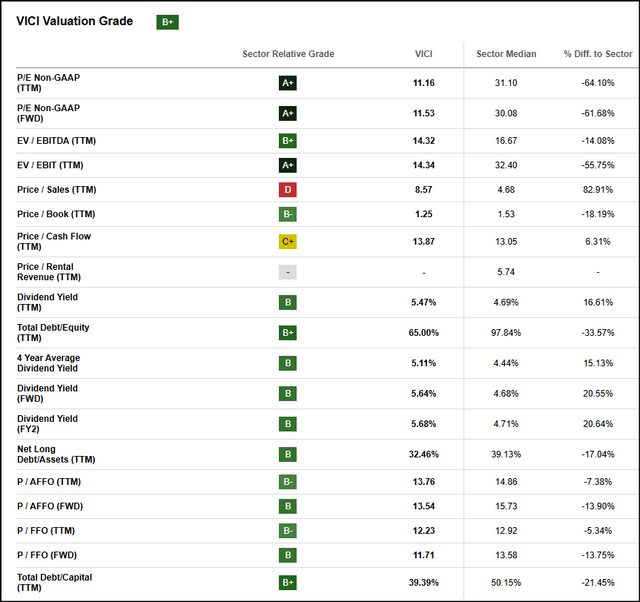

VICI’s stock slid after Las Vegas reported a sharp drop in visitors in July, creating a potential buy-the-dip opportunity. VICI generates significant revenue from the Las Vegas strip – where it owns three iconic hotels – Caesars Palace, MGM Grand, and The Venetian. However, VICI also derives revenue from about 90 other experiential assets in the US and Canada. VICI is now trading at a 12% discount to the sector, at 11.7x FFO, which is attractive given the stock’s exceptional collective investment qualities, high earnings growth upside, and sturdy dividend yield.

Moreover, the rate cut could benefit VICI by lowering refinancing costs, making it even more of a value play, according to SA Analyst Steven Fiorillo:

They have world-class assets that could increase in value as property values increase and rates decline. VICI could also further reduce its carrying costs by refinancing additional debt at lower rates and improving its margins as less capital flows toward interest expenses… As the year progresses, I think that shares of VICI can continue to move higher while rewarding investors with a dividend yield that exceeds risk-free assets.

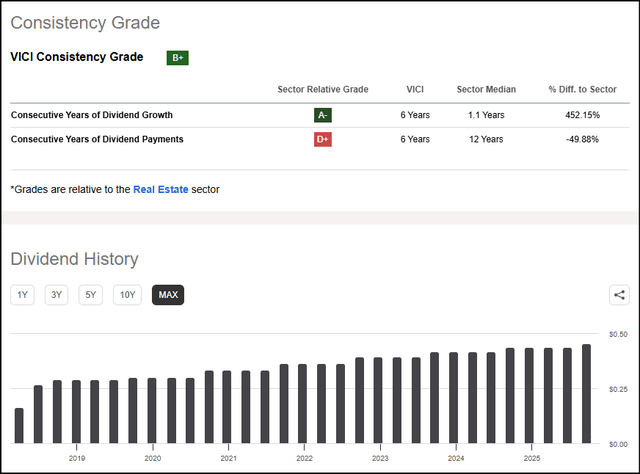

VICI’s FFO margin of nearly 70% is helping fuel its A+ Profitability Grade, while year-over-year and long-term growth in AFFO and FFO are crushing the sector. VICI’s Dividend Scorecard is solid across the board – with B’s in safety, growth, yield and consistency. Showcasing a yield of 5.64%, VICI’s dividend has grown by a CAGR of 7% in the past five years. The gaming REIT has delivered six consecutive years of dividend payments and growth since going public in 2018.

VICI is the final pick on our diverse list of Strong Buy REITs – a great stable of stocks that possess excellent underlying investment fundamentals, dividends you can depend on, and exceptional earnings growth upside relative to the real estate sector.

Conclusion: Top 5 REITs Poised For A Rate-Cut Rebound

The real estate sector stands to gain from interest rate cuts, with lower mortgage rates likely to stimulate homebuying, as lower borrowing costs stabilize commercial property value. REITs tend to perform well during interest-rate cutting cycles, and experts say institutional investors have been waiting for this type of monetary policy environment before deploying assets into real estate. SA Quant identified five commercial REITs with Strong Buy Quant Ratings across a wide range of industries, which have generated strong FFO.

Leave a Reply