I Could Build My Entire Retirement Around These 4 Stocks

Sep. 26, 2025 7:30 AM ET OKE, GTY, VICI, PEP

Leo Nelissen

Investing Group

Summary

- I don’t plan on retiring, but financial independence is crucial. With Social Security’s future uncertain, we must take control of our own retirement planning.

- My strategy focuses on building a core of reliable, high-yield stocks. I avoid risky “sucker yields,” targeting a safe 5-6% from companies with strong, predictable growth.

- I present four dividend stocks that create a foundation of durable income. It allows for stability while leaving room for more aggressive investments to pursue higher returns.

Introduction

The other day, someone told me something like, “Why do you spend so much time discussing retirement investments? You’re never going to retire, anyway!”

It’s a fair question, for a number of reasons. The first one is that, as I have written in a few articles, I am indeed not ever planning on retiring.

Although I have no idea what the future holds when it comes to AI disruption, my health, and other circumstances, I would love to do what Buffett and so many others do, which is work until it’s no longer humanly possible. After all, my work is based on writing research on a computer. I’m not a construction worker or a Texas roughneck. That’s a huge difference.

Even Maurice Greenberg, the 100-year-old who landed on D-Day in France during the Second World War, fought in the Korean War, and became the successor of AIG founder Cornelius Vander Starr, still works. Roughly ten years ago, he made a big comeback with a multi-billion-dollar insurance takeover. He was 90 at the time.

Obviously, I’m not comparing myself to people like Buffett and Greenberg. All I’m saying is that I’m a workaholic. I haven’t had a trip (some call it “vacation”) in more than a decade where I did not spend every day working on a project, article, or similar endeavour.

The other reason I am not a huge fan of talking about my own retirement is motivation. Striving for the goal of financial independence is a great thing, don’t get me wrong. It eases some anxiety, as I will soon be able to stop working if I decide to, technically speaking.

However, on top of the fact that I would do exactly what I am doing right now if I suddenly got really wealthy, I also believe that not having a safety net is better for progress. Personally, I have never been more productive than in the years after I completely wrecked my trading portfolio while being in college. Back then, I traded leveraged bonds. It went really well until it didn’t, and the countermove destroyed my stop losses, leaving me with a hole that took me at least a year to fill.

The good news is that it caused me to rethink my entire strategy and work hard to become a better investor. It led to everything I am doing now.

Ok. That’s enough about me.

The reason I promised readers to focus more on retirement stocks is based on my belief that owning higher-yielding value stocks, in general, is a good idea, and because retirement planning is critical, given increasing pressure on Social Security, as I wrote this month.

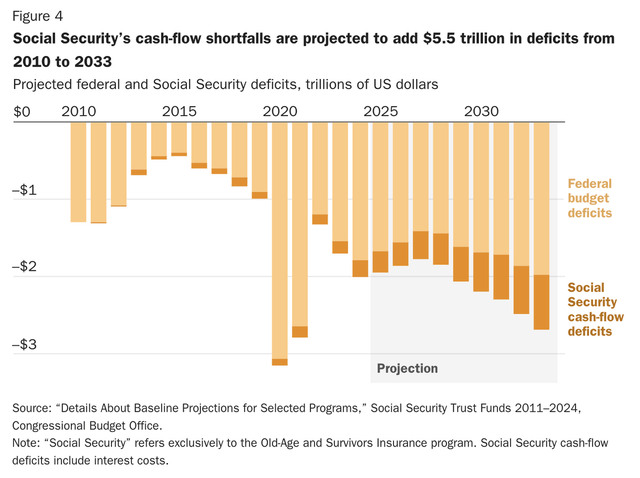

Essentially, Social Security cash flows have become a disaster since the Great Financial Crisis, with increasing deficits and funding requirements, which could lead to cuts down the road and changes like delayed retirements and other regulatory changes.

As the CATO Institute wrote in its warning report, it may be important for people to take more control of their own retirement. As I am someone who is expected to get close to zero from my country’s Social Security and other pension plans, I could not agree more with that.

What if, instead of replacing earnings in old age regardless of need, Social Security was a basic safety net? And what if, instead of relying so heavily on a government program for income in retirement, Americans could own and control more of their own retirement savings, with Social Security acting as a poverty backstop? This reimagined Social Security system would be far from ideal but substantially better than the current unsustainable system. – CATO Institute

In this article, I’ll focus on that and present a few investments that I trust so much, I could make them the core of my retirement portfolio.

So, let’s dive in!

How To Take Control Of Your Own Retirement?

I’m not a financial advisor. And even if I were, I could not give you personal advice, as this article is read by a huge range of different investors. Some are multi-millionaires with second and third homes. Others are barely making ends meet and investing as much as they can to somewhat improve their cash flows. Meanwhile, others have lived paycheck to paycheck their entire lives, while others have enjoyed big tailwinds like inheritances.

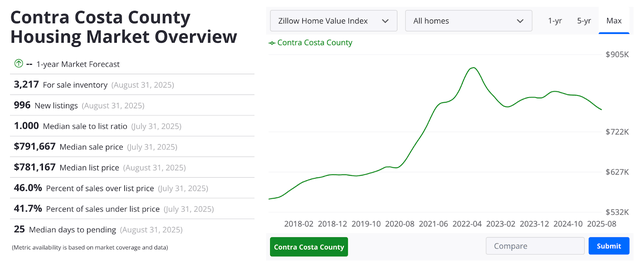

For example, if you inherit a home in Contra Costa County, California, you would likely look at a windfall of close to $800,000, based on the average home price in that region, as we can see below.

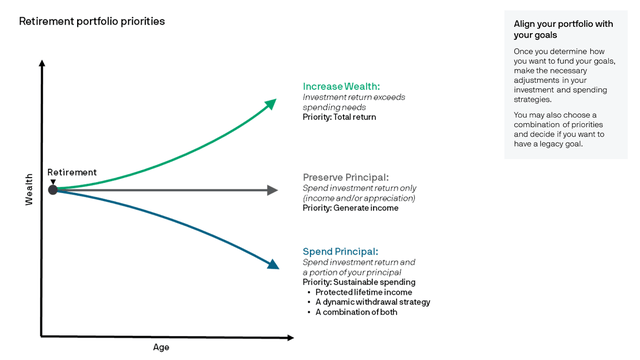

That’s why even during retirement, some can increase their wealth, others manage to keep it steady by generating enough cash flow, while others have to sell assets to cover expenses.

Anyway, my point is that everyone has different needs, which makes this topic so complex.

That’s why Fidelity made a roadmap. It all starts by asking how much money you need.

- What lifestyle do you want to maintain?

- What will your average monthly expenses be?

- What about the risks of unexpected costs?

- Have you thought about health expenditures?

- What about retirement home costs (if needed)?

- Do you have a pension?

- What about 401(k)s?

- What percentage of expenses will be covered by Social Security?

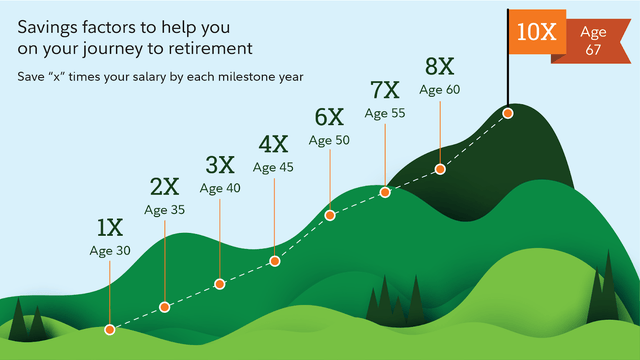

Fidelity says we should try to follow the 10x, which suggests we need to save 10x the salary we expect to make before we start retirement. If you make $80,000 a year, that number is $800,000. If you make $120,000, that number is (you guessed it), $1.2 million.

Now, the tricky part is that we need to incorporate wage growth and inflation. If you’re a 20-year-old college student reading this, you’ll have to factor in close to 50 years of inflation and wage growth. Just imagine what the average income will be in the year 2075 and how high your annual expenses could be. A million dollars by then won’t get you far.

Heck, depending on where you live right now, a million isn’t much either. While a million dollars makes you a king in countries like Albania, a 5-7% yield on that amount makes you lower-middle-class in areas like the San Francisco Bay Area (let’s stick with that example).

Here are some costs to keep in mind (based on Fidelity findings):

- Health expenses (excluding long-term care) for retirees could be north of $170,000. That’s the total. Not per year (obviously). Personally, these costs freak me out the most, as I am currently witnessing just how stressed the healthcare system is getting in nations like the Netherlands, Germany, and other developed places. I can only imagine the premium hikes my insurance will execute if this continues.

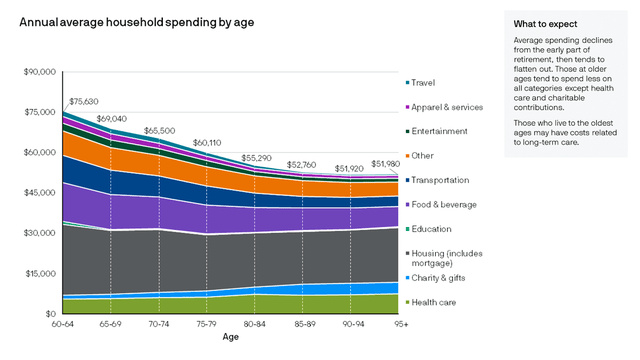

As we can see below, healthcare is one of the few costs that will rise as we get older. Meanwhile, other costs like travel, entertainment, transportation, and food decline.

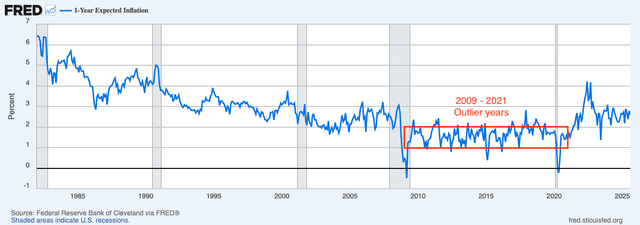

- Another factor is inflation. Between 2009 and 2021 (more or less), inflation averaged less than 2.0%. In addition to paving the road for huge stock market gains, it also made retiring much easier. As I believe in “higher for longer” interest rates and inflation, I think we need to work at least with a base of 3-4% annual inflation.

To show you how big a deal small inflation changes are, let’s use the inflation calculator.

The purchasing power of $100,000 in 2025 equals $122,000 after 10 years based on 2% inflation. A 3% inflation rate brings that number to $134,000. That’s a 10% difference.

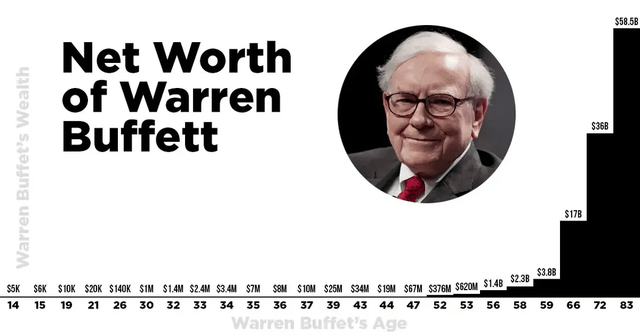

- Longevity is another fascinating topic. Some people may have to fund three decades of retirement. Just imagine what can happen during these years. Think about all the technologies that were invented over the past ten years and how these disrupted markets. The Internet, AI, smartphones, etc. This means we need to buy the right assets that have competitive advantages and inflation protection. Also, if people can afford it, I always suggest that people keep investing for growth even after reaching retirement age. Bear in mind that Buffett generated the overwhelming majority of his wealth after reaching the legal retirement age, as the non-updated chart below shows.

Leave a Reply