Can dividend hero trusts survive the shift to buybacks?

By Dave Baxter

Investors’ Chronicle

Once criticised as a ‘Jurassic Park’ of stock exchanges due to its obsession with dividends, the UK market has changed tack recently. UK-listed companies are boosting returns via an enormous volume of share buybacks, sometimes at the expense of dividends.

This has already had a big effect on how UK equity income trusts operate. Temple Bar (TMPL) addressed this “distributional shift” earlier in the year by changing its dividend policy and increasing its payout using capital reserves. Dunedin Income Growth (DIG) has just followed suit, announcing a dividend increase and saying it would draw on both capital and income reserves to “provide greater investment flexibility”.

With the buyback rush showing no sign of slowing down, there’s reason to suspect we might see more UK income trusts start doing this.

This switch might prove easier for some than others. But certain trusts will be feeling the pressure – for instance those with a long record of increasing their dividends.

The DIG board, for example, referenced its presence in the AIC’s “next generation of dividend heroes” list (trusts with between a decade and 20 years of dividend growth) when announcing its policy change. Plenty of UK income trusts sit in such lists, including the original dividend heroes cohort of those that have upped payouts for 20 consecutive years or more.

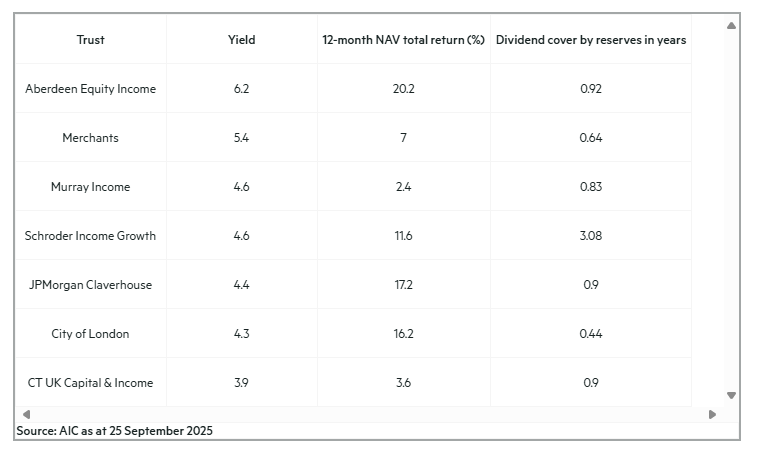

Among these, City of London (CTY) has increased its dividend for 59 consecutive years, with JPMorgan Claverhouse (JCH) and Murray Income (MUT) on 52 years. This list also includes Merchants (MRCH), CT UK Capital & Income (CTUK), Schroder Income Growth (SCF) and Aberdeen Equity Income (AEI).

With buybacks boosting returns, it should theoretically be easy for a trust to use those gains to make up for any lost dividends. Good underlying total returns and a decent level of revenue reserves, where present, will also help trusts switch policies in this way. Conversely, a fund that already has a high dividend might find this harder to sustain or increase.

The data shows a mixed picture on this front. Aberdeen Equity Income, City of London and JPMorgan Claverhouse have enjoyed especially strong net asset value returns over a 12-month period.

That could offset certain challenges, from the Aberdeen fund’s relatively high share price dividend yield of 6.2 per cent to the fact that City of London has limited dividend cover from its revenue reserves. According to AIC data, these would cover less than half a year of its current dividend payouts.

The challenges might be greater still for Murray Income and CT UK Capital & Income, which have some revenue reserves but have struggled in terms of performance, at least recently.

The issue is that trusts that perform badly could find themselves compounding this by selling assets to fund a dividend payment. Meanwhile, running down reserves might leave funds stretched in a crisis that sees companies pause their payouts, as happened in 2020.

If income streams remain less abundant than they once did, shifting to a capital and income payout policy could make trusts look more attractive than open-ended income funds, which simply pay out the dividends they receive. The latter might thus pay out less in future.

But trusts do need to weigh up the costs, and risks, of such a shift.

Leave a Reply