Aberdeen Asian Income Fund Limited (the “Company”)

15 July 2025

Declaration of Second Interim Dividend

Highlights

· Annualised dividend yield of 6.8%.

· Second quarterly interim dividend of 3.84p per share.

The Board has declared a second quarterly interim dividend of 3.84p per share for the year ended 31 December 2025, which will be paid on 22 August 2025 to shareholders on the register at the close of business on 25 July 2025. The ex-dividend date is 24 July 2025.

Based on a share price of 223p on 30 June 2025, and taking into account the first interim dividend already paid, this equates to an annualised dividend yield of 6.8%.

This is the second dividend payment announced by the Company following the introduction of the enhanced dividend policy earlier this year, to broaden the appeal of the Company’s shares to a wider range of investors and to reflect the sustained investor appetite for yield in the current interest rate environment.

The Company offers the option for shareholders to invest their dividend in a Dividend Reinvestment Plan (“DRIP”), which is managed by the Company’s Registrar, Computershare Investor Services PLC. The deadline for elections under the DRIP is 1 August 2025.

Note:

The Company’s dividend policy, as announced on 16 January 2025, is to set the dividend at 1.5625% per quarter of the Company’s net asset value (“NAV”), equating to approximately 6.25% of NAV per annum. The dividend is calculated using the Company’s NAV on the last business day of the preceding financial quarter (i.e. the end of March, June, September and December). The second quarterly interim dividend of 3.84p per share is based on 1.5625% of the Company’s NAV of 246.02p per share as at 30 June 2025

Chairman’s Statement

Building on our strengths: enhanced team, attractive yield and strong results driving shareholder value

This has been an exciting period for our Company. We strengthened our investment team with the appointment of an additional highly experienced lead portfolio manager, bringing fresh insight to complement our existing expertise. Our enhanced dividend policy – delivering one of the most compelling yields in the sector – is already attracting more income seeking investors. Together with a robust share price performance, these developments further reinforce our long term track record and investment appeal.

Investment Management Team

During the period, we were pleased to welcome Isaac Thong as our lead manager, working alongside Eric Chan. Isaac has joined Aberdeen’s Asia Pacific Equities team as Senior Investment Director, based in Singapore, and is responsible for the day-to-day portfolio management of the Company. He also leads the Asian Income portfolio construction group within Aberdeen which includes responsibility for the Company’s portfolio.

With over 15 years’ experience investing in Asian equities, Isaac brings a wealth of knowledge and expertise that will enable the investment team to continue finding companies that will deliver sustainable growth, consistent income and attractive returns for our shareholders.

Performance

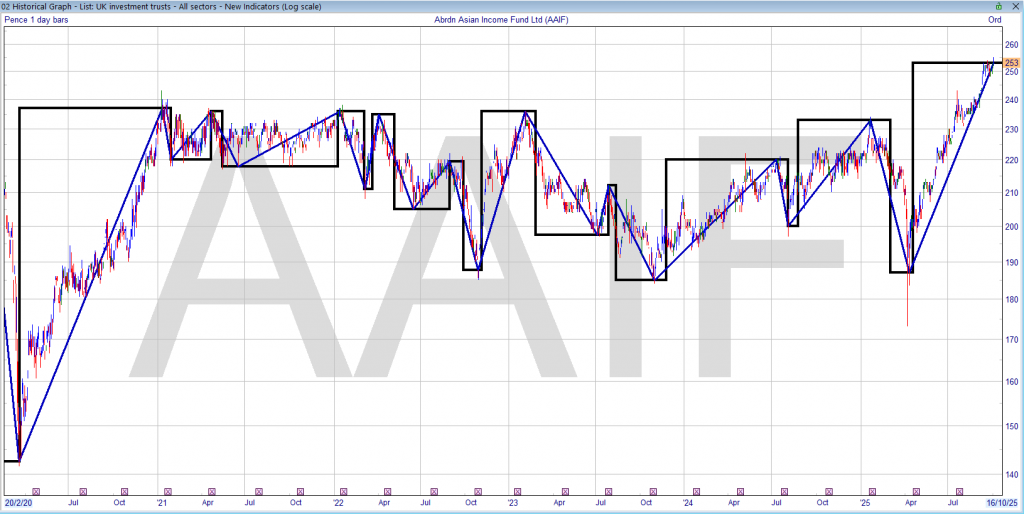

It is pleasing to report a share price total return of 6.3% for the six months to 30 June 2025 and a narrowing of the discount of the share price to the net asset value (“NAV”) per share from 12.5% to 9.3%.

The NAV total return for the period was 2.2%, compared to a total return of 4.5% from the MSCI AC Asia Pacific ex Japan Index (the “Index”).

The NAV underperformance for the period under review was due primarily to the portfolio’s underweight exposure to Chinese internet stocks. Historically, the Company has had little or no China internet exposure because these companies did not pay a dividend, which worked well previously but has had an impact on performance this year.

Encouragingly, the Company continues to outperform the Index over three and five years in both NAV and share price total return terms. These long-term absolute and positive returns for investors have been achieved without compromising on quality, reflecting the Investment Manager’s disciplined investment approach. The Investment Manager has recently implemented a refined strategy of balancing income and growth across key Asian markets. This has resulted in a rise in the portfolio’s weighted average return on equity, profit margins and yield.

13/08/2025

Leave a Reply