City of London Investment Trust (CTY)

Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by City of London Investment Trust (CTY). The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

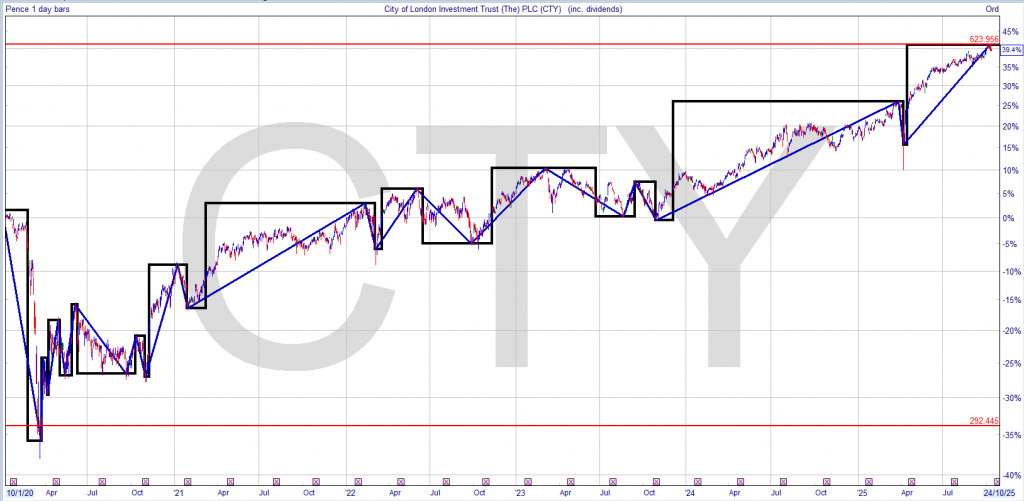

A strong year of stock picking puts CTY well ahead of the benchmark.

Overview

City of London Investment Trust (CTY) aims to deliver income and capital growth. Job Curtis has an impressive tenure of 34 years managing the trust, giving him a depth of experience rarely matched. In particular, the last financial year illustrated the benefits of his active, stock-picking approach. That said, this is a cautious investment strategy that is arguably well suited to extending CTY’s unrivalled 59 year run of progressive dividend increases.

Job seeks to spread risks – both in terms of capital and income generation – across the portfolio. This has protected CTY against many sector-specific issues that have arisen over the years, but also in our view complements Job’s valuation-based investment framework, which favours quality companies, and sometimes has a contrarian tilt towards identifying new ideas. Job aims to balance any lower yielders in the portfolio by also investing in steady, highly resilient dividend payers with strong balance sheets. As we highlight in the Portfolio section, this means that CTY is exposed to a range of different types of companies, with varying growth and income characteristics.

Behind the headline-grabbing Dividend Hero moniker, CTY continues to deliver on a NAV total return basis too. CTY has delivered outperformance of the benchmark over one, three, five and ten years.

CTY’s dividend represents a yield of 4.25%. Whilst the dividend increase last year of 3.4% was a shade behind that of UK CPI at 3.6%, the board has stated that it understands the importance of growing the dividend in real terms through the economic cycle and long term. CTY has delivered real dividend growth over ten and twenty years, as we discuss in the Dividend section.

Analyst’s View

CTY has established itself as the leading trust in the UK Equity Income sector, a result not only of its long history of dividend increases over the past 59 years, but also because it has delivered good total returns to shareholders too. As a result, it has won investors’ confidence over time, issuing shares and growing organically so that it now dominates the UK Equity Income sector in terms of size, meaning good liquidity for investors and low Charges.

CTY’s 2025 dividend equates to a dividend yield of 4.25%. Not only is this attractive in absolute terms, so too is the fact that shareholders can derive an element of reassurance that comes with knowing CTY has a 59-year track record of delivering consecutive annual dividend increases. However, this is no UK domestic play – the majority of CTY’s portfolio revenues are derived overseas. Job sees the UK equities he owns as ‘global growth at a discount’. Job expects takeovers of UK companies to continue, highlighting the value available in the UK market.

CTY also provides reassurance in another way – the share price has tended to move in a relatively narrow band with regard to the NAV. As we discuss in the Discount section, a subtle change in wording means the board has underlined its commitment to try to protect shareholders from the discount widening out. As well as its other attractions, the tight discount has been fundamental to allowing CTY to grow organically in the past through share issuance. With this move, shareholders can continue to have confidence in continued good liquidity, and that the share price should follow the NAV. In our view, CTY appears well placed to continue its leadership within the UK Equity Income sector.

Bull

- Very low OCF of 0.36%

- Consistency and experience of manager who has delivered long-term outperformance of the FTSE All-Share Index in capital and income terms

- Track record of 59 years of progressive dividend increases

Bear

- Cautious approach means that NAV can underperform in some market conditions

- Income track record highly attractive, so manager might risk long-term capital growth in trying to maintain it

- Structural gearing can exacerbate the downside

Portfolio

CTY’s investment objective is closely reflected by the investment process and attitude to risk of the managers, Job Curtis and David Smith. CTY is set up to deliver long term capital growth, and equally long-term growth in dividends. Now in his 35th year of managing CTY, Job has decades of experience to look back on to inform his investment decisions. Fundamentally, this is an active stock-picking approach, and Job has plenty of latitude to pick UK stocks across the market-capitalisation spectrum, as well as up to 20% overseas, in order to deliver on the trust’s objectives. As we discuss in the Performance section, Job and, since 2021, David, as deputy fund manager, have a good track record in delivering over and above the benchmark returns, whilst also building on CTY’s unrivalled 59 years of dividend growth. In particular, the last financial year to 30/06/25 (which CTY has recently reported on) saw Job and David deliver significant outperformance of the benchmark, largely driven by stock picking.

Job’s active approach is set within his philosophy, which sees him aiming to spread risks – both in terms of capital and income generation – across the portfolio. This has protected CTY against many sector-specific issues that have arisen over the years, but also in our view complements Job’s valuation-based investment framework, which favours quality companies, and sometimes has a contrarian tilt towards identifying new ideas. Of course, the prospective dividend yield and growth of that dividend is a key determinant for Job when selecting investments. Holding a company that doesn’t pay a dividend is relatively rare, but Job does hold a number of companies that pay a relatively low dividend yield but, in his view, have strong or resilient growth characteristics. Job aims to balance any lower yielders by also investing in steady, highly resilient dividend payers with strong balance sheets.

The managers break down the portfolio into companies with different features, which we show in the graph below, once again illustrating the fact that CTY is exposed to a range of different types of companies, with varying growth and income characteristics.

PORTFOLIO OVERVIEW

Source: Janus Henderson

Over the last few years, the number of individual stocks has been gently reducing (numbering 77 as at 31/08/25), with a greater proportion of stocks featuring from the FTSE 100. This is largely a result of valuations in the UK being at such a discount to international peers, which means that Job’s exposure to overseas stocks is relatively low by historical standards at c. 8% currently (a maximum of 20% is allowed). Job and David sit within Janus Henderson’s global equity income team, which, amongst other advantages, helps give them an understanding of relative valuations on an international basis. That said, far from being exposed to the UK domestic economy, the majority of CTY’s portfolio revenues are derived overseas. Job sees the UK equities he owns as ‘global growth at a discount’. Job expects takeovers of UK companies to continue, highlighting the value available in the UK market.

Job’s fundamental approach to stock picking has seen CTY benefit from the significant recovery in many UK bank share prices. Job has been focussed on the domestic deposit takers such as NatWest, Lloyds and Barclays. NatWest in particular has been a very strong contributor to returns, Job having recognised well before the wider market that it would have a very strong tailwind to returns from hedges taken out during the period of low interest rates rolling over at much higher interest rates. Away from the biggest stocks in the UK market, Job and David have also been active. An example is recent purchase and mid-cap stock TP ICAP, which is the world’s largest inter-dealer broker between investment banks on many products. Job and the team like the fact this world class group converts a high percentage of its profits into cash and is expected to be a good dividend payer. Harbour Energy is a small-cap, also recently purchased, which has increasingly diversified oil and gas production, with around one third in Norway, one third in the UK and one third spread across the rest of the world (including Latin America, North Africa and Germany). The team believe it has plenty of growth ahead of it, being a relatively nimble, independent energy company.

One to consider, the next time the market shakes out.

Leave a Reply