Here’s the Time-Tested Way to Make

15% Per Year From Stocks

There’s an untapped portion of the market few people know about …

It’s filled with stocks that seem “boring” to the uninformed investor…

Companies that rarely get coverage from the mainstream media …

Contrarian investments that are hiding their true potential …

However, if you look below the surface and read between the lines, these “Hidden Yield Stocks” offer intelligent investors the opportunity to deliver 15% total returns per year—no matter what the wider market does.

How?

Well, the answer lies in what I call “The Three Pillars.”

Pillar #1 – Consistent Dividend Hikes

Pillar #2 – Lagging Stock Price

Pillar #3 – Stock Buybacks

Together, these three pillars allow us to identify the stocks that are undervalued … overlooked … recession-resistant … and primed for major growth.

And by investing exclusively in these “Hidden Yield Stocks,” we can enjoy massive upside with very little downside … plus collect regular, reliable income through healthy dividend payouts!

Contrarian Investor

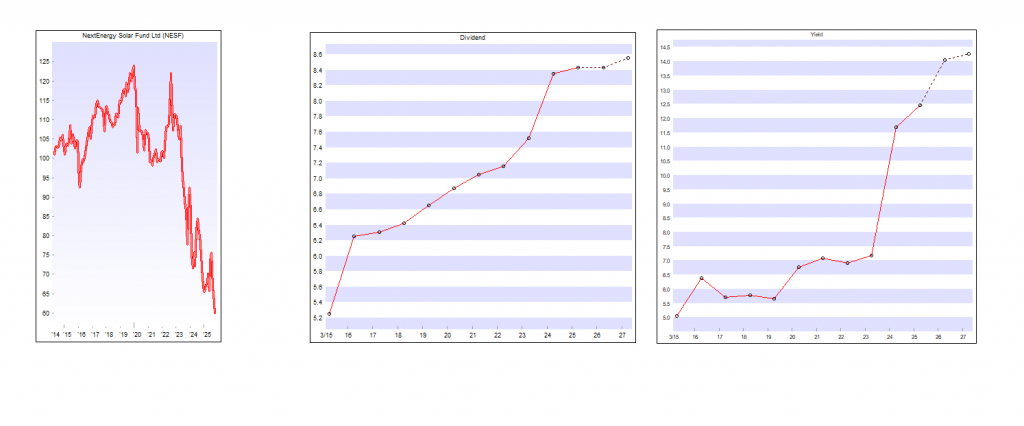

The current yield of NESF, is 14%. Is Mr Market flashing a warning sign, is Mr Market right ?

Sure, chasing high current yields will provide you with instant gratification, but it won’t give you the recession-resistant income … or the 15% year on year returns we want.

Instead, you need to focus on consistent dividend hikes.

In my opinion, selecting companies with a proven track of increasing their dividend payments is one of the safest, most reliable ways to get rich in the stock market. You see, every time a company raises its dividend, you start earning more from your original investment.

For example:

On a $1,000 initial investment, $30 in dividends equals a 3% return. Later, if the dividends go up to $40 a year, you are effectively earning 4% on your initial $1,000 investment.

As this trend continues, you could easily be earning 10%, 15%, even 20% per year just from rising dividends, as your initial investment never changes.

Contrarian Investor

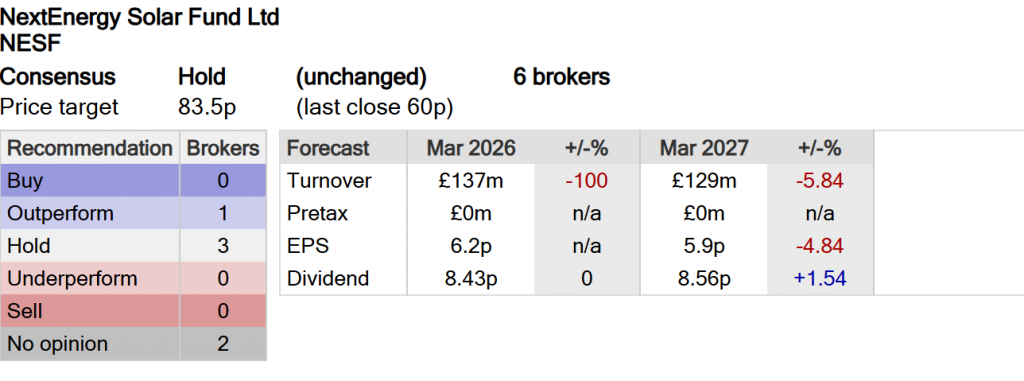

Here’s a deeper look to help you decide:

📈 Current Price & Movement

- Price: 60.0 GBp

- Change: +0.4 GBp (+0.67%)

This modest uptick suggests some short-term stability, but it’s not a strong momentum signal on its own.

☀️ Fund Focus - NESF invests in solar photovoltaic assets, primarily in the UK, with some international exposure.

- It targets long-term income generation through government-backed subsidies and power purchase agreements.

💰 Income Potential - NESF is known for high dividend yields, often exceeding 6–7%, making it attractive for income-focused investors.

- Dividends are typically paid quarterly, and the fund aims to maintain or grow payouts over time.

🧱 Risk Profile - Interest rate sensitivity: As a yield-focused fund, NESF may face pressure if UK interest rates rise further.

- Inflation-linked revenues: Many of its contracts are inflation-linked, offering some protection.

- NAV discount: Like many listed infrastructure funds, NESF may trade at a discount to NAV, which can be an opportunity or a red flag depending on market sentiment.

🔍 Considerations Before Buying - Peer comparison: How does NESF stack up against other renewable infrastructure funds like Bluefield Solar (BSIF) or Foresight Solar (FSFL)?

- NAV trends and dividend cover: Check recent reports to assess sustainability of payouts.

- Market outlook: If you believe in the long-term resilience of UK solar and infrastructure income, NESF could be a compelling hold.

- CoPilot

Pillar #1 – Consistent Dividend Hikes

Pillar #2 – Lagging Stock Price

If you include dividends the NAV if flatlining, the worry is that it may eat it’s own tail with the dividend payments.

Dividend:

· Total dividends declared of 2.10p per Ordinary Share for the Q1 period ended 30 June 2025 (30 June 2024: 2.10p), in line with full-year dividend target.

· Full-year dividend target guidance for the year ending 31 March 2026 remains at 8.43p per Ordinary Share (31 March 2025: 8.43p).

· The full year dividend target per Ordinary Share is forecast to be covered in a range of 1.1x – 1.3x by earnings post-debt amortisation.

· Since inception the Company has declared total Ordinary Share dividends of £407m.

· As at 20 August 2025, the Company offers an attractive dividend yield of c.11%

NESF

Pillar #3 – Stock Buybacks

Share Buyback Programme:

· As at 30 June 2025, the Company had purchased 15,621,142 Ordinary Shares for a total consideration of

£11.5m through its up to £20m Share Buyback Programme, producing a total aggregate NAV uplift of 0.5p per Ordinary Share (0.0p during the period). All purchased Ordinary Shares are currently being held in the Company’s treasury account.

Solar investor NextEnergy Solar Fund will leave the 250 index. All changes will take effect from the start of trading on September 22.

IF the dividend isn’t increased or cut and NESF isn’t taken over, you should receive your capital back in around 5 years.

Leave a Reply