With £5,000, here’s how to create a second income from UK property without buy-to-let

Want to earn a second income from UK property but don’t have the money for buy-to-let? Here’s another way to start building a real estate empire!

Posted by Zaven Boyrazian, CFA

Published 19 October

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

Investing in property is a proven and powerful strategy for earning a second income. After all, with tenants paying rent each month, it generates a predictable and recurring source of revenue. That’s one of the main reasons why buy-to-let became so popular in Britain.

Sadly, not everyone has the money to buy rental property, especially now that mortgage rates have shot up. Fortunately, there’s another way – one that doesn’t require going into debt.

Should you buy LondonMetric Property Plc shares today?

In fact, with just £5,000, investors can potentially start earning impressive passive income, overnight. Here’s how.

Earning real estate income

The easiest way to invest in property in 2025 is through a real estate investment trust (REIT). This special type of business owns, manages, and leases a portfolio of properties, collecting rent that’s then paid out to shareholders, typically every three months.

REITs come with a lot of advantages. Since they trade like any other stock, investors can put money in and take money out almost instantly.

At the same time, someone with just a few thousand, or even a couple of hundred pounds, can snap up some shares and begin generating a passive dividend income. And in many cases, the yields offered by REITs are much higher compared to the standard dividend payout of London-listed shares.

Best of all, they can even be held inside a Stocks and Shares ISA, allowing all this income to be tax-free – a massive advantage that traditional buy-to-let doesn’t have.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

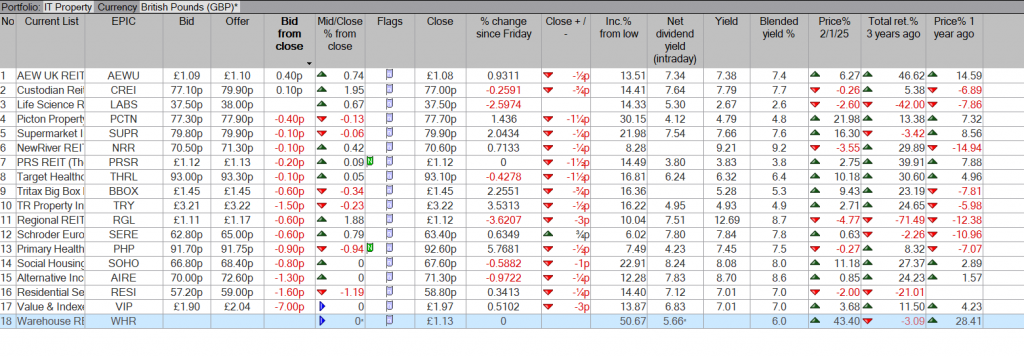

A FTSE 100 REIT with lots of potential

The UK’s flagship index is filled with several REIT stocks. And one that I’ve already added to my income portfolio is LondonMetric Property

Following a series of acquisitions, the firm’s become one of the largest publicly-listed commercial landlords. This expansion ultimately led to the group’s inclusion in the FTSE 100 earlier this year. And its diverse portfolio contains a combination of logistical centres, retail parks, petrol stations, and even healthcare centres, among others.

Intelligently, most of its properties are rented under a triple net lease structure. That means the tenants are ultimately responsible for maintenance, insurance, and taxes. And consequently, LondonMetric benefits from lower operating costs and more predictable cash flows.

In fact, that’s how the REIT has delivered a decade of continuous dividend hikes, generating inflation-linked passive income for shareholders.

Risk versus reward

While I remain quite bullish on this business, there’s no denying there are critical risk factors that investors must carefully consider.

With the bulk of net profits paid out to shareholders, LondonMetric is highly dependent on external financing. As such, the balance sheet’s quite highly leveraged, making the group very sensitive to interest rates. And this exposure’s only amplified by the impact interest rates have on property valuations as well.

So far, the firm generates more than enough cash flow to cover both debt servicing costs and shareholder payouts. However, with several lease renewals on the horizon, cash flows could be adversely impacted if rents are negotiated lower by key tenants.

This risk is why the shares currently offer such a juicy 6.7% yield. Yet for me, the risk is worth the reward.

You ought to be a part of a contest for one of the highest quality websites on the internet.

I most certainly will highly recommend this blog! https://Azurslotusa.Wordpress.com/

Thanks for finally writing about >A second income from UK property.

– Passive Income <Loved it! https://playamoinnz.wordpress.com/

Hi it’s me, I am also visiting this web page on a regular basis, this web site is genuinely pleasant and the

viewers are genuinely sharing nice thoughts. https://22Betus.Wordpress.com/

Hi mates, how is all, and what you want to say on the

topic of this article, in my view its truly awesome for me. https://slotsgeminaustralia.Wordpress.com/

Just desire to say your article is as amazing. The clearness in your post is just excellent and

i can assume you are an expert on this subject. Fine

with your permission let me to grab your RSS

feed to keep up to date with forthcoming post. Thanks a

million and please carry on the gratifying work. https://Slotsgemau.Wordpress.com/

I was suggested this web site by means of my cousin. I am not

certain whether this submit is written by way of him as nobody else understand such specific

approximately my difficulty. You are incredible! Thanks! https://hellspincanada.wordpress.com/

Your way of telling the whole thing in this article is truly nice, all can without difficulty

understand it, Thanks a lot. https://Playamocasinoca.wordpress.com/

Nice post. I was checking continuously this weblog and I’m inspired!

Very helpful information specially the closing phase 🙂 I handle such information much.

I was looking for this certain information for a very lengthy time.

Thanks and best of luck. https://Hellspinau3.Wordpress.com/

It’s a pity you don’t have a donate button! I’d certainly donate to this superb blog!

I guess for now i’ll settle for bookmarking and adding your RSS feed

to my Google account. I look forward to fresh updates and will talk about this website with my Facebook group.

Chat soon! https://nzplayamo.wordpress.com

Terrific work! That is the kind of info that should be shared around the net.

Shame on the seek engines for not positioning this post upper!

Come on over and talk over with my web site . Thanks =) https://22betca.wordpress.com/

I’m not that much of a internet reader to be honest but your blogs really nice, keep it

up! I’ll go ahead and bookmark your website to come back down the road.

Cheers https://tonybet4uk.wordpress.com/