Updated 17 Oct 2025

David Brenchley

Kepler

Disclaimer

This is a non-independent marketing communication commissioned by Schroder Investment Management. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

From China’s silk to Indonesian islands’ spices, the continent of Asia has always been important to the global economy. Early empires tended to look eastward to Asia first; even Christopher Columbus’s discovery of the Americas happened in search of a westward route to India, China, and the Spice Islands.

Today, we’ve lived through decades of growing US exceptionalism that has led to American companies accounting for 63p of every £1 invested in the FTSE All-World Index, as of 30/09/2025.

Yet, Asia’s influence on the global economy has remained and is well highlighted today: Asia accounts for 31% of global GDP, according to the OECD. Despite the US’s dominance of major indices, Asia is also now home to 55% of the world’s listed companies by number and accounts for 27% of global market capitalisation.

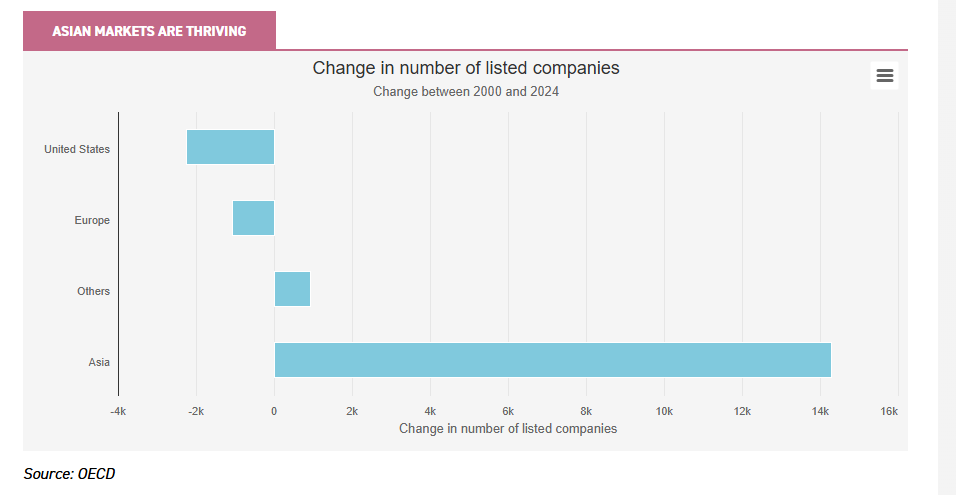

Its public markets are thriving, too, with the number of listed companies in Asia having almost doubled to c. 29,000 between 2000 and 2024. Indeed, while the stock of publicly listed companies in developed markets continued to shrink considerably in the past 25 years, Asian markets have grown, as you can see from the chart below.

Asian markets are thriving

Source: OECD

Despite this, investors are underexposed to Asia, in our view, preferring instead to have either a home bias, by being overweight the UK, or following what worked over the past 15 years, and focusing overly on the US stock market.

Asia is a dynamic and thriving region that remains under-represented, even in world indices. Despite being 27% of total global market capitalisation, Asia accounts for just 12.6% of the FTSE All-World Index, with Japan adding an extra 5.7%.

We believe that there are plenty of compelling reasons, which we will outline below, why Asia deserves a significant allocation in investors’ portfolios.

Why invest in Asia?

A growing region

As demonstrated already, Asia has plenty of momentum. By 2040, the consultancy McKinsey believes that Asia could contribute 42% of global GDP, be home to 60% of the Fortune Global 500 companies, and account for 55% of the world’s total workforce.

In addition, populations around the world are ageing rapidly, but the problem is generally much less acute in Asia as a whole than in Western countries. Indeed, McKinsey expects Asia to be home to more than half the population aged 18 to 24 and account for two-thirds of the global middle class by 2030.

McKinsey sees Asia’s new consumer class as “wealthier, more digitally savvy and as having a penchant for luxury goods”. Given this, Asian firms have a large and growing consumer base that is increasingly seeking out domestic brands for some of their luxuries such as coffee chains, cosmetics brands, and apparel sellers.

Asian companies have also become embedded as key players within areas such as digital services, fintech, healthcare, advanced manufacturing, clean energy, and, most recently, artificial intelligence (AI). Indeed, Asia accounted for 75% of AI patents globally in 2022, according to a report by Stanford University.

These are just some of the attractions driving Asian growth, but there are more from an investment perspective, which we’ll touch on below.

Uncorrelated growth and returns

One clear appeal is Asia’s lower correlation with the West, whether that’s relative to GDP growth rates or stock market performance.

Asian economies have and are expected to grow much faster than their developed counterparts. According to the IMF, the Asia and Pacific region, which includes the main economies of Japan, China and India, is expected to see real GDP growth of 3.9% in 2025. By contrast, North America is expected to see real GDP growth of 1.6% and Europe 1.3% in 2025.

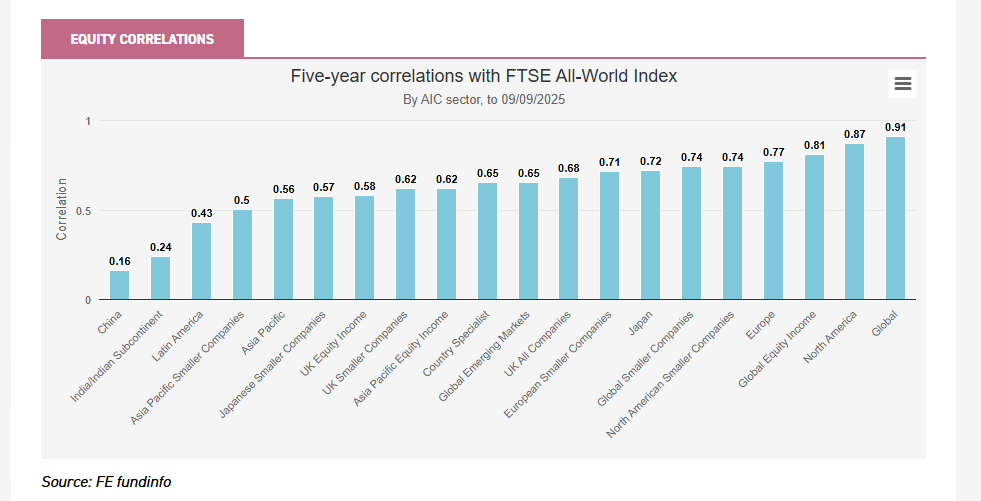

In terms of investments, Asian markets tend to exhibit much lower correlations than developed markets. Indeed, as you can see below, Asia-related investment trust sectors have been less correlated with the FTSE All-World Index in the ten and five years to 09/09/2025, with China/Greater China and India/Indian Subcontinent exhibiting the lowest correlation over both of those timeframes.

Equity correlations

Source: FE fundinfo

Looking for assets that are less correlated with global equities is a good way of achieving diversification within one’s portfolio. That’s especially important at a time when the largest eight American companies account for c. 22% of the (4,220-company-strong) FTSE All-World Index (as at 29/08/2025).

In addition, given that a weaker US dollar is a key aim of the current US administration, getting exposure to other currencies, particularly those in Asia, which should benefit from US interest rate cuts and a weak US dollar, is also important.

Cheap valuations

We briefly touched on the US exceptionalism that has driven global stock markets over the past 15 years, largely leaving most other regions in the dust. Asia is no different.

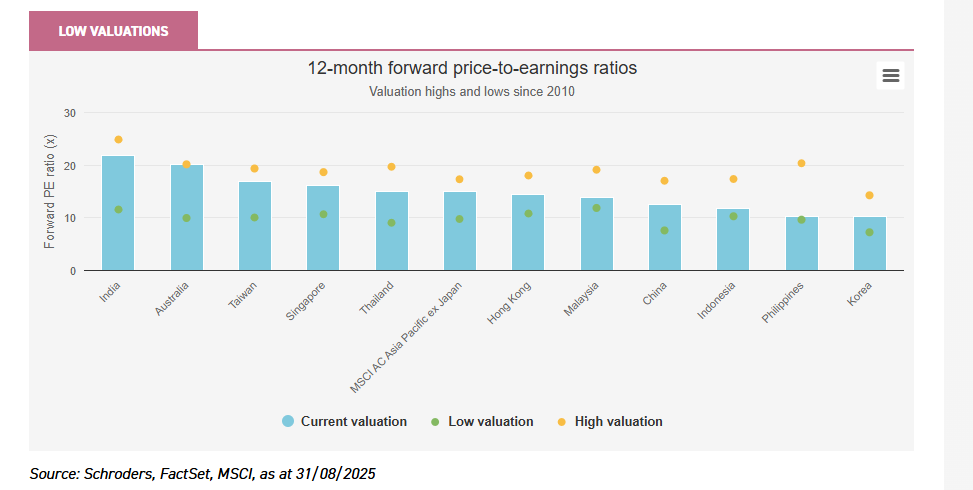

Low valuations

Source: Schroders, FactSet, MSCI, as at 31/08/2025

This extreme divergence has left Asian markets sitting on attractive valuations, both in absolute terms as well as relative to other markets.

Whereas the MSCI USA Index was trading on a forward price-to-earnings (PE) ratio of 23x on 29/08/2025, and a price-to-book (PB) ratio of 5.6x, the MSCI AC Asia Pacific ex Japan Index was on a forward PE of 16x and a PB of 2.1x.

These valuations are in a similar ballpark to the MSCI Europe Index, where the forward PE was 15x and the PB was 2.3x. Japan, by contrast, was slightly more expensive, at 16x on a forward PE ratio, but cheaper, at 1.7x, on a PB ratio.

Long-term outperformance

Despite this recent underperformance and low valuations, over longer timeframes, Asia has performed slightly better than even the US. Between the start of 2001 to 01/09/2025, for instance, the MSCI AC Asia Pacific ex Japan Index has returned over 700%, versus the MSCI USA’s 650% return, in sterling terms.

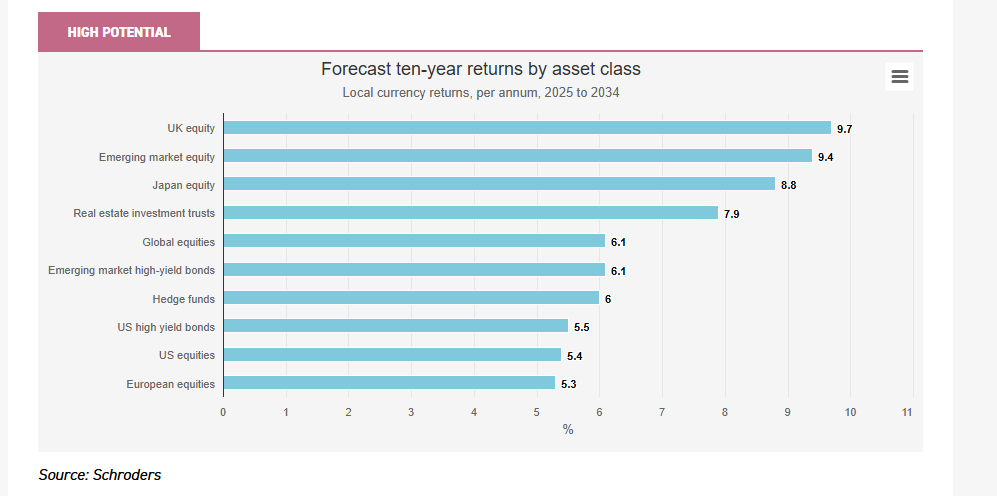

Many experts now believe that the current valuations mean that Asia could re-establish its superior performance versus the US – and other regions – over the next decade or so, as seen below.

Schroders forecasts US equities to return 5.4% per year in local currency terms over the next ten years, whereas emerging markets are expected to return 9.4% and Japan is expected to return 8.8% per year in local currency terms.

High potential

Source: Schroders

Unlocking value in Japan

Corporate reform is emerging as one of the most powerful drivers of Asian equity markets. Governments and regulators are pushing companies to improve transparency, raise governance standards, and put shareholder value at the heart of corporate strategy first. This is unlocking value in markets long held back by opaque structures, low returns on equity, and poor capital allocation.

Japan has led the way, with the Tokyo Stock Exchange and regulators forcing companies to unwind cross-holdings, increase return on equity and improve the independence of the board. The results speak for themselves, with a record ¥20 trillion of share repurchases in 2024 and ¥60 trillion returned to shareholders in dividends.

However, almost half of Japanese companies remain in a net cash position, according to SMBC Nikko, compared to less than 20% in North America and Europe. This has already prompted corporations to go beyond regulatory requirements and proactively deploy capital more efficiently, through US acquisitions, investment in AI capabilities, and returning cash to shareholders.

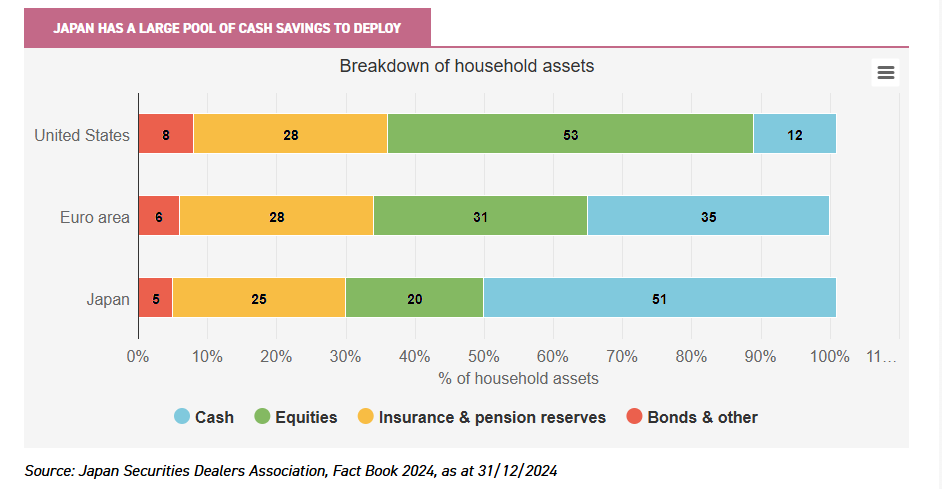

Japan’s economic revival is also being fuelled by shifting household dynamics, with households holding a staggering $14 trillion in financial assets, according to the JSDA (Japan Securities Dealers Association). As the chart below shows, more than half of household assets remain in cash-based holdings, a legacy of the caution towards investing that took root during Japan’s “lost decade”.

Japan has a large pool of cash savings to deploy

Source: Japan Securities Dealers Association, Fact Book 2024, as at 31/12/2024

The expanded NISA (Nippon Individual Savings Account) tax-free investment scheme has already boosted investment inflows by nearly 20% in its first three months, highlighting growing public engagement with asset management.

In addition, the strongest spring wage negotiations (Shuntō) in three decades are increasing disposable income and consumer confidence alike. The redeployment of cash into both consumption and financial assets marks a key step in Japan’s long-awaited transition from a deflationary mindset to sustainable growth and investment.

Corporate governance reform is one of the primary growth drivers identified by Masaki Taketsume, manager of Schroder Japan (SJG). There has been a steady improvement in return on equity, alongside record highs in dividends and share buybacks, but Masaki sees further scope for improvement.

Masaki focuses on company-specific catalysts, such as restructuring, M&A and capital allocation changes to drive returns. This has led to an overweight in small and mid caps, where valuations are more attractive than in larger peers, and in domestically focused companies that are less exposed to global trade and currency swings, and are well-placed to tap into rising consumer spending.

The trust’s returns are testament to the value of an active approach in Japan, delivering an annualised share price total return of 15% over the last five years, beating the 9% return from the TOPIX (as at 31/08/2025). SJG also offers a useful income stream, with a current dividend yield of just under 4%.

Strong income credentials

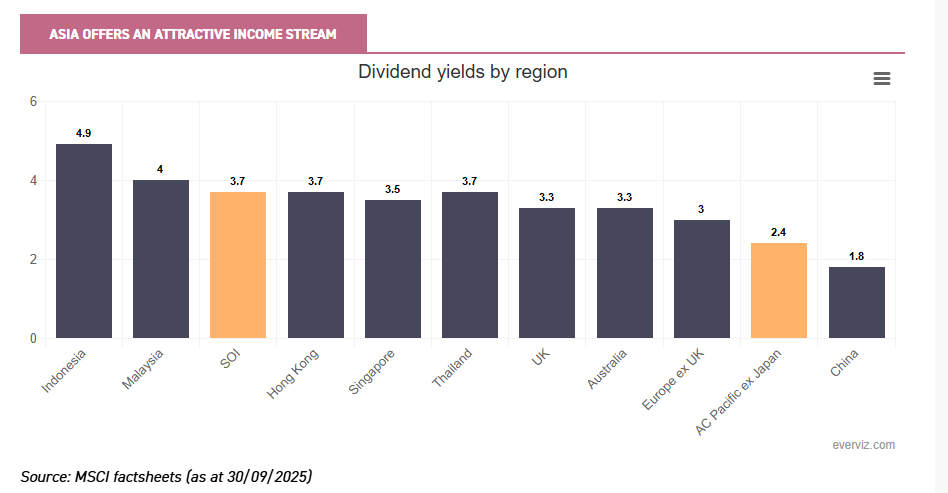

Asia may have flown under the radar for income-seekers, but a thriving dividend culture has put the region on a par with traditional equity markets. As the chart below shows, the yield for the MSCI AC Asia Pacific ex Japan Index isn’t far behind the UK and Europe ex UK, while countries such as Indonesia, Malaysia, and Hong Kong offer even higher payouts.

Asia offers an attractive income stream

Source: MSCI factsheets (as at 30/09/2025)

Asia’s income story is also one of resilience. Payout ratios remain lower than in the UK and Europe, leaving headroom if earnings fall, while net gearing is also lower. Sector exposure is also broad, with financials and information technology accounting for much of the dividend base.

Schroder Oriental Income (SOI) aims to capture the combination of income and growth in Asian equity markets. The trust currently offers a yield of almost 4% and is the highest-yielding Asian fund on the AIC Next Generation of Dividend Heroes list, just one year away from achieving full status with 20 consecutive annual dividend increases.

Manager Richard Sennitt focuses on quality rather than chasing the highest-yielding companies, selecting companies with strong governance and the potential for both income and capital appreciation. This approach generates a high, natural income and avoids reliance on enhanced distribution policies used by some peers.

On the growth side, SOI offers exposure to powerful structural themes, from Taiwan’s world-leading semiconductor industry to the growing role of Singapore and Hong Kong as financial hubs. Its notable underweight to China also offers a differentiated option for investors seeking to limit exposure to the country’s ongoing macroeconomic challenges.

This balanced approach has delivered a ten-year share price return of 170%, reinforcing the trust’s ability to combine a dependable income stream with exposure to Asia’s long-term growth story.

A measured approach

While the income story within Asia is an important and understated point, Asia’s real engine is growth: Asia accounts for 82% of the world’s growth companies by global market capitalisation.

That said, this growth does come with big moves both on the upside and the downside.

While Asia is a predominantly growth market, it can also be volatile. To combat this, Schroder Asian Total Return (ATR) provides investors with a vehicle able to take advantage of the exciting growth opportunities of the Asian market while seeking to protect capital.

Managers Robin Parbrook and King Fuei Lee employ a sophisticated strategy that combines bottom-up stock selection, aimed at identifying high-quality companies able to capture the region’s growth potential, along with a top-down overlay to help mitigate downside risk.

The portfolio is made up of 40 to 70 companies with sound balance sheets, professional management teams, and capital allocation policies that are aligned with the interests of minority shareholders.

As ATR has no formal benchmark, Robin and King Fuei are agnostic to the trust’s reference index, the MSCI AC Asia Pacific ex Japan, particularly when it comes to positioning. Instead, they focus on finding the best-quality franchises in the region that they believe can outperform throughout the cycle, and judging them on their own credentials.

ATR’s hedging strategies, built using an in-house quantitative model, are used to identify risks on a country or regional basis. If any risks are detected, the managers will use derivatives such as index futures and options to provide some downside protection to the overall portfolio.

This tried and tested approach has been proven over the 17 years Robin and King Fuei have been working together on the strategy, which includes 12 years on ATR. Indeed, ATR has outperformed the MSCI AC Asia Pacific ex Japan in seven of the past nine full calendar years, with an average outperformance of 6.6 percentage points. The trust was awarded a Kepler Growth Rating for 2025.

Going for growth

Asia’s diversity presents a wealth of opportunities for active stock pickers able to uncover the most compelling opportunities across the region. Schroder AsiaPacific (SDP) stands out as a core holding for investors looking for pure Asian equity growth, aiming to capture the region’s long-term growth potential with a benchmark-plus mindset.

Given the level of heterogeneity across the region, success requires extensive on-the-ground resources to assess not only the macroeconomic and political backdrop in each country, but also the broader corporate ecosystem, from supply chains to competitive positioning.

The trust benefits from three decades of experience navigating Asian markets across a range of market cycles. Managers Abbas Barkhordar and Richard Sennitt are bottom-up stock pickers but remain mindful of broader macroeconomic and geopolitical dynamics.

SDP provides exposure to a diversified range of local and global drivers, providing resilience across different economic and political backdrops. A core focus is the world-class technology leaders in Taiwan and Korea, with SDP being an early investor in semiconductor giant TSMC and consumer electronics firm Samsung. Another export-focused driver is the China +1 re-shoring of global supply chains into ASEAN countries such as Vietnam and the Philippines.

This is balanced with exposure to domestic trends, including the fast-growing financial services sectors in India and the Philippines, as well as exposure to the companies benefitting from the growth of Singapore and Hong Kong as regional wealth management hubs.

One of the benefits of active management is the ability to tilt the portfolio to the most compelling opportunities. Earlier this year, the managers added exposure during the tariff-driven dips, while trimming positions where AI enthusiasm had pushed valuations above fundamentals. The trust is underweight to China, reflecting structural concerns, as well as being selective in India, given valuations.

Why invest in Asia through investment trusts?

Retail investors often face barriers when trying to access Asian equities directly. Many mainstream UK investment platforms offer limited access beyond developed markets such as Australia, Japan or Korea, while minimum purchase order sizes are high, as are trading costs due to foreign exchange and transaction fees.

Aside from that, doing your own due diligence can be very challenging, as financial reporting requirements tend to be considerably less onerous than in the UK and US, and documents are often not available in English.

Investment trusts democratise access to Asia by providing one-stop shops for diversified exposure to the region. Managers are rarely tied to their benchmark indices, and there are no liquidity issues, so they can provide access to smaller companies within the region, too.

Final thoughts

Columbus may have set out to find an alternative route to Asia, which was then the centre of world trade, but he ended up stumbling across the Americas, part of which, as it would turn out, went on to become the economic powerhouse of the future.

With political risks now dominating the agenda in US discourse and the potential for AI hype to create a monumental bubble in asset prices across the Atlantic, attention may start to turn eastward in search of alternative growth opportunities.

Asia has a thriving and dynamic tech sector, complete with chipmaking capabilities, trading at a much less exorbitant price tag than Silicon Valley, providing a buffer against the excesses of the booming US market and geographic diversification to portfolios.

Schroders’ long-standing presence in Asia underpins its edge in navigating these diverse markets. With over 50 years’ experience in the region and a deeply embedded network of on-the-ground investment teams, the firm combines local insight with global perspective, enabling managers to identify the most compelling opportunities.

These resources underpin a wide range of investment options for investors seeking Asian exposure, from growth-focused SDP to income-oriented SOI. In addition, SJG offers single-country exposure, while ATR provides a risk-managed option for investors. Collectively, they showcase Schroders’ long-standing commitment to helping investors tap into Asia’s evolving opportunities.

Leave a Reply