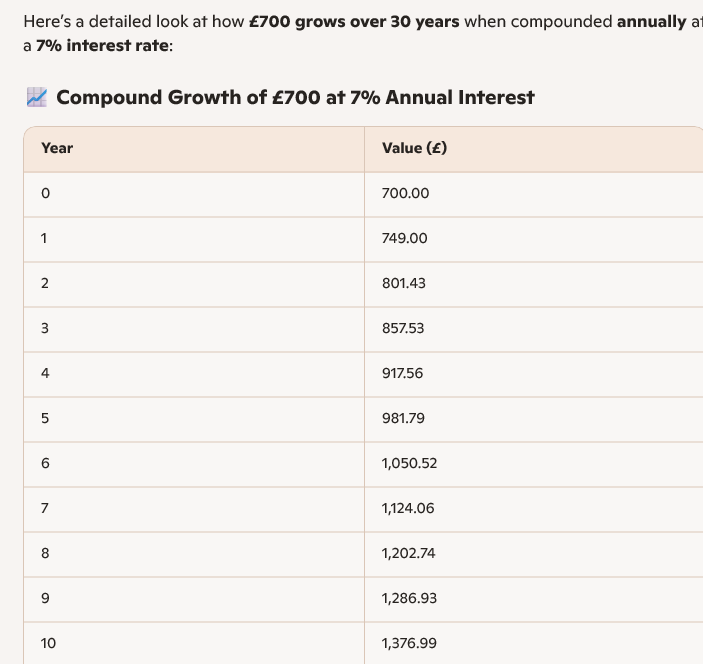

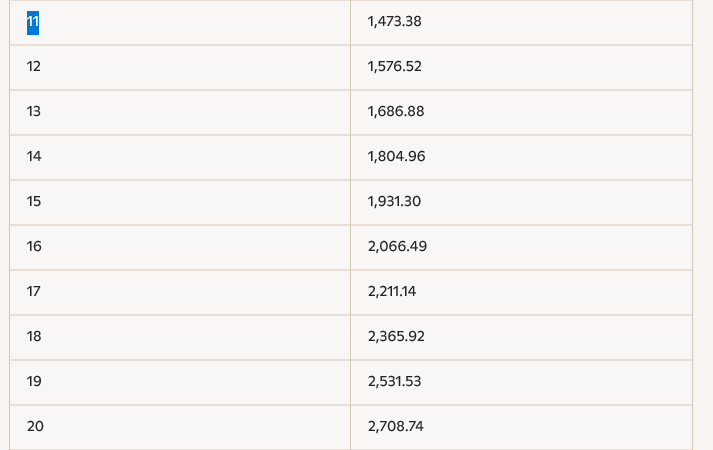

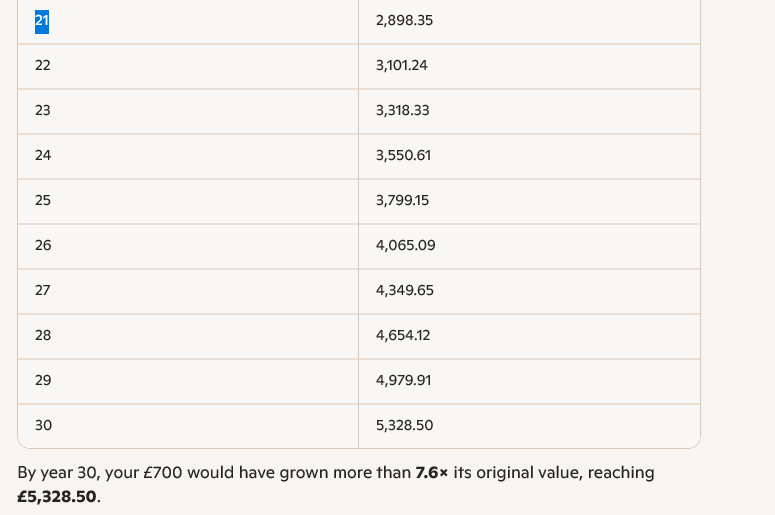

Here’s how the dividend income on a capital investment of 10k grows when compounded annually at 7%, using the formula:

A = P \cdot (1 + r)^t

Where:

- P = 700

- r = 0.07 (7% annual interest)

- t is the number of years

If you have longer to compound

Reaching 53%, you have to allow for inflation and any for any years when the dividend yield is under 7% but you will have years like now when the dividend yield is above 7%. On the capital invested, the dividends should gently increase and you will get the yield on your buying price not the current headline price.

Thank you for sharing this! I really enjoyed reading your perspective.

I enjoyed every paragraph. Thank you for this.